S.Korean Court Dismisses Plea to Block Loans to Fund Deep-Sea Gas Pipeline in Australia

(Reuters) — A South Korean court has dismissed an application from a group of Indigenous Australians to block South Korean export credit agencies from funding a deep-sea gas pipeline for the $3.6 billion Barossa gas project off northern Australia.

People from the Tiwi Islands and Larrakia Traditional Owners in March sought an injunction from the Seoul Central District Court to block Export-Import Bank of Korea (KEXIM) and Korea Trade Insurance Corp. (K-Sure) from providing loans for the Barossa pipeline.

The Seoul Central District Court on Friday dismissed the application to block loans to the project, the court's record showed.

"We are disappointed in yet another timid decision by the South Korean court around environmental cases. The South Korean court has historically been very timid about environmental cases and cross-border issues. The ball is now in the court of Australian regulatory bodies," said Ha Jiyeon, a Seoul-based lawyer with a climate group familiar with the case.

"We plan to review various factors such as necessity of LNG imports as well as environmental factors to support the project," KEXIM told Reuters.

K-Sure was not immediately available for comment.

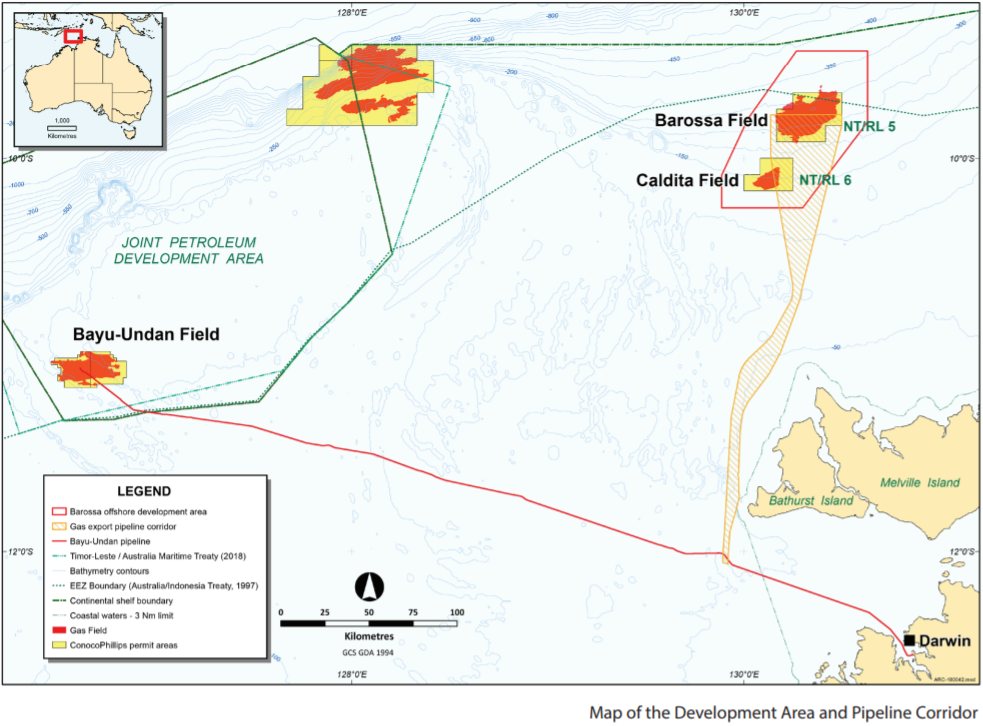

The indigenous groups had said they were not properly consulted on the Barossa project and the planned 260-km (162-mile) pipeline that will connect offshore gas facilities to an existing pipeline that runs to Darwin.

KEXIM and K-Sure are considering loans and loan guarantees that could be worth around $700 million.

Australia's Santos Ltd., operator of the Barossa development, due to produce first gas in 2025, declined to comment on the case. Partners in the project include private South Korean energy company SK E&S.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments