Judge Revokes Drilling Permit for Santos' $3.6 Billion Barossa Gas Project

(Reuters) — Australia's Federal Court on Wednesday ruled in favor of an indigenous group's challenge against a drilling permit for Santos Ltd.'s Barossa gas development, in what Santos called a "disappointing" setback for the $3.6 billion project.

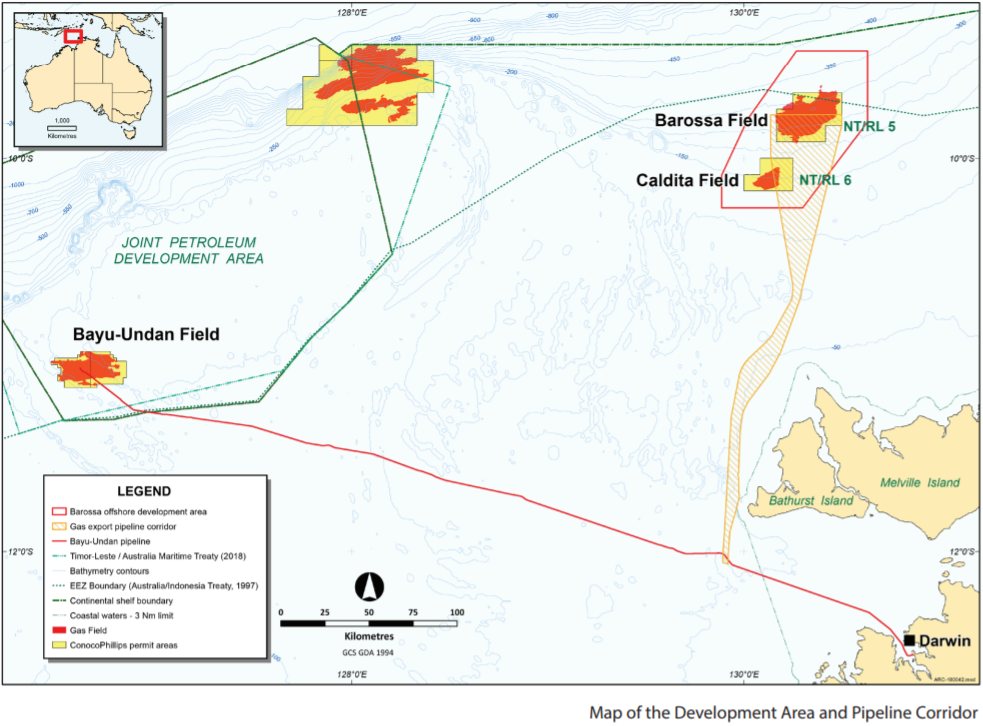

Traditional landowners from the Tiwi Islands led by Dennis Tipakalippa had asked the court in June to overturn drilling approval for the Barossa project near the islands off the northern Australia coastline granted by the industry regulator, the National Offshore Petroleum Safety and Environmental Management Authority (NOPSEMA).

The stakes are high for Santos, which announced plans to seek an expedited appeal soon after the ruling was issued. Barossa is the company's biggest project, and essential for its Darwin LNG plant, which will lose supply from its foundation gas source, the Bayu Undan field, later this year.

"Mr Tipakalippa has established that NOPSEMA ... failed, in accordance with the Regulations, to assess whether the Drilling EP (environment plan) demonstrated that Santos consulted with each person that it was required by the Regulations to consult with," Judge Mordecai Bromberg said in his ruling.

"The acceptance (or permission) given by NOPSEMA was legally invalid. NOPSEMA's decision to accept the Drilling EP must therefore be set aside," he said.

Announcing its plans to appeal, Santos said the decision should be reviewed by the full Federal Court, given the significance of the decision to the company, its international joint venture partners and customers.

Santos' partners in the Barossa project are South Korean energy company SK E&S and Japan's top power generator JERA, a joint venture between Tokyo Electric Power and Chubu Electric Power.

"This is a disappointing outcome," Santos said in a statement to the Australian Stock Exchange, adding that the relevant drilling was to occur at a site in the Timor Sea about 140 km (86 miles) north of the Tiwi Islands.

"Project approval uncertainty is a public policy issue that should be urgently addressed by Australian governments to reduce risk for trade and investment in projects around the country," Santos said.

NOPSEMA said it noted the verdict and was considering the implications of the decision. "It is a matter for Santos to consider what the decision means for the Barossa project," a NOPSEMA spokesperson said in emailed comments.

Tipakalippa, who filed the challenge, said Santos had not properly consulted the traditional owners about the drilling, and told the court that the Barossa project posed a risk to sacred sites and spiritual connection to Sea Country.

"We are so happy and so relieved. We have won. The most important thing for us is to protect our Sea Country," Tipakalippa said in a statement.

Santos, which had agreed to suspend drilling for the project pending the court decision, said it had "engaged with" indigenous representative bodies - the Tiwi Land Council and the Northern Land Council - about the proposed drilling, and the regulator had accepted its efforts to consult with Tiwi islanders.

Santos was on track to start producing gas from Barossa in 2025 to feed its Darwin LNG plant.

"The drilling activities are not on the critical path for the project, and we have headroom in the project cost contingency," Santos said.

Credit Suisse analyst Saul Kavonic said if Santos fails in its appeal and has to submit a new environmental plan, that could impact the overall cost and add months or even more than a year to the project's schedule.

Besides expanding consultations, Kavonic said, there is a risk that the regulator might broaden any review to include other considerations, such as looking at emissions, since the country's carbon emissions targets are tighter now than when the permit was approved.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments