Security of Supply Concerns Prompt Arctic Barents Sea Gas Pipeline Rethink in Norway

(Reuters) — Building a pipeline to transport gas produced in the Arctic Barents Sea could be worth re-examining due to an increased focus on supply security and Norway exporting more of its gas to Europe, gas infrastructure operator Gassco said on Monday.

In March, Norway's oil and energy ministry asked Gassco to evaluate various alternatives to increase gas transport options from the southern Barents Sea. At present, gas produced in the region can only be exported via Equinor's Hammerfest LNG plant.

"The increased focus on security of supply and deliveries of Norwegian gas to Europe in light of the energy situation is strengthening the necessity of Norwegian gas as part of the energy mix going forward," Gassco said on Monday.

The Nordic country is Europe's largest gas supplier following a drop in Russian flows.

Interest from energy companies in exploring the Barents Sea for oil and gas has in recent years been muted due to high costs and limited opportunities to export the gas to markets.

A 2021 study carried out by Gassco concluded it was not sufficiently beneficial for Norwegian society to expand exports.

Based on current resource assumptions for the Snoehvit field that feeds Hammerfest LNG, the plant would be fully utilized until 2040, Gassco said on Monday.

This extended to 2050 when including potential new production from identified resources, but new fields to be developed would need export capacity before then, it added.

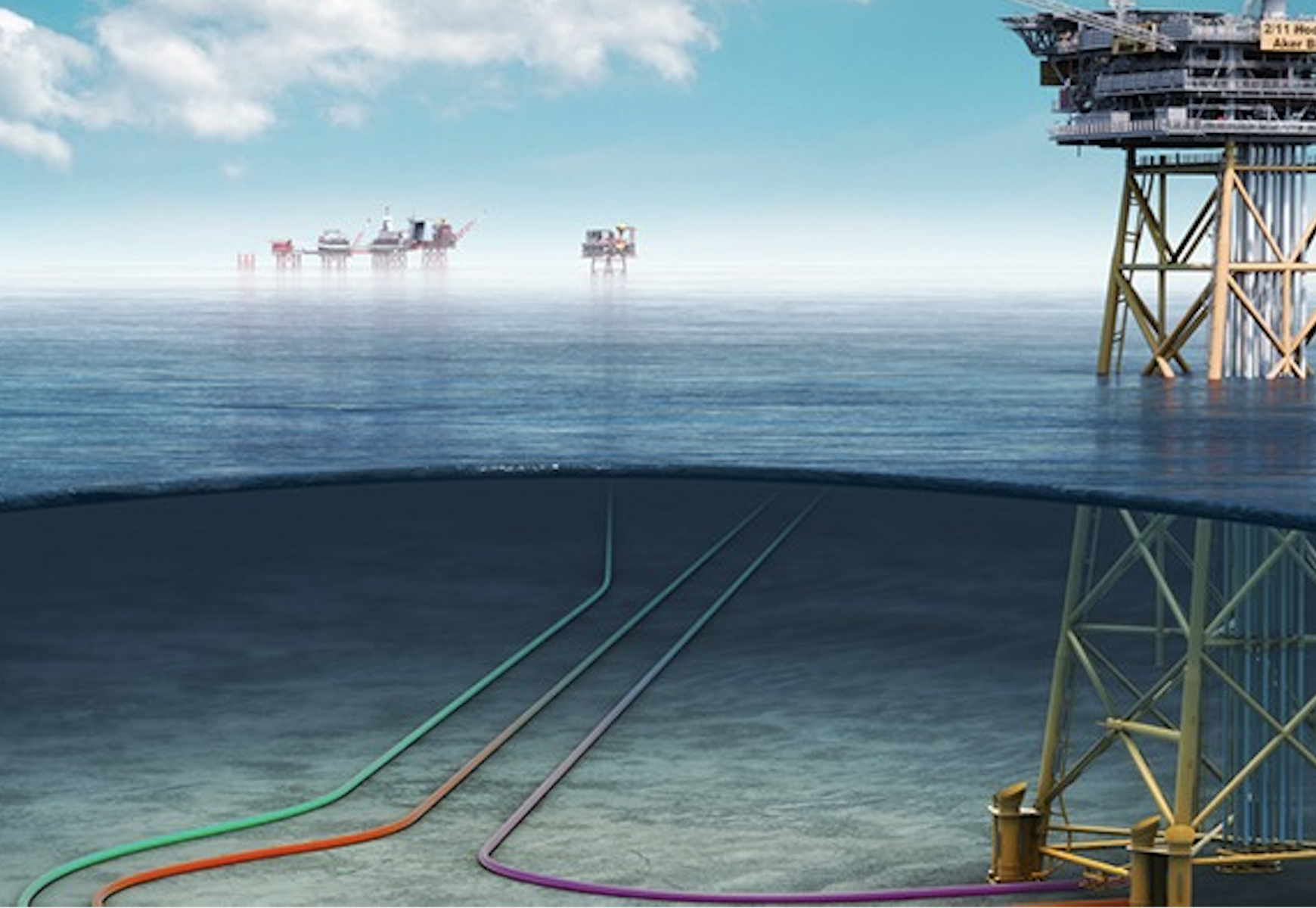

Gassco evaluated three options: expanding LNG capacity, converting gas to carbon-free ammonia, which would then be shipped to customers, as well as building a processing plant including carbon capture and a pipeline that connects to the existing infrastructure.

Its report now forms the basis for Gassco's dialogue with relevant companies about next steps and further studies on cost and profitability.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments