DT Midstream Successfully Completes Phase 1 LEAP Expansion Ahead of Schedule

(P&GJ) — DT Midstream Inc. has announced the successful early commissioning of its LEAP phase 1 expansion, increasing capacity from 1.0 Bcf/d to 1.3 Bcf/d, surpassing its planned Q4 2023 in-service date and staying within budget.

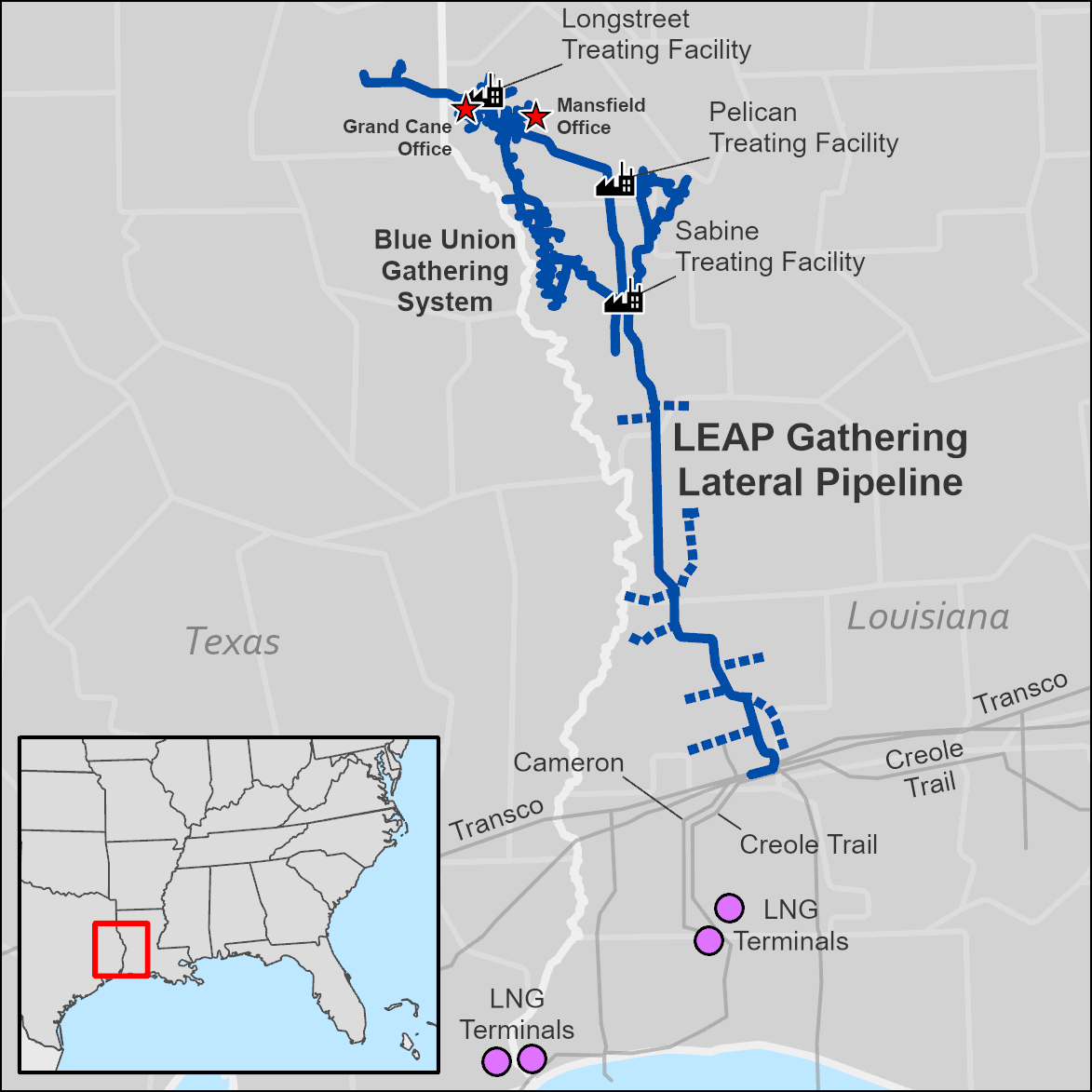

The LEAP Gathering Lateral Pipeline is a 155-mile high-pressure lateral pipeline that gathers gas along a spine-like system from Haynesville shale area producers and redelivers gas to interstate pipelines that provide access to petrochemical and refining facilities, power plants and LNG export facilities.

The pipeline's phase 2 and phase 3 expansions are also progressing on schedule, with anticipated in-service dates of Q1 2024 and Q3 2024, respectively. This multi-phased project will ultimately elevate LEAP's total capacity to 1.9 Bcf/d, offering flexibility for future expansions up to 3 Bcf/d.

LEAP currently establishes connectivity between Haynesville production and burgeoning Gulf Coast markets, which are projected to witness growth of more than 8 Bcf/d by 2030. Presently, LEAP customers enjoy access to various operational or under-construction LNG terminals, including Sabine Pass, Cameron, Calcasieu Pass, Plaquemines, and Golden Pass through interconnections with Creole Trail, Cameron Interstate Pipeline, Texas Eastern, and Transco.

David Slater, President and CEO of DT Midstream, commented, "Achieving the early in-service of the LEAP expansion project marks a significant milestone in granting our customers 'wellhead to water' access to premium LNG markets. We take pride in supporting U.S. LNG exports globally, especially during times when energy security and affordability are of utmost importance."

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

- Enbridge Sells $511 Million Stake in Westcoast Pipeline to Indigenous Alliance

Comments