EIA Forecasts 20 Bcf/d Boost for U.S. LNG Export Terminals with New Pipelines

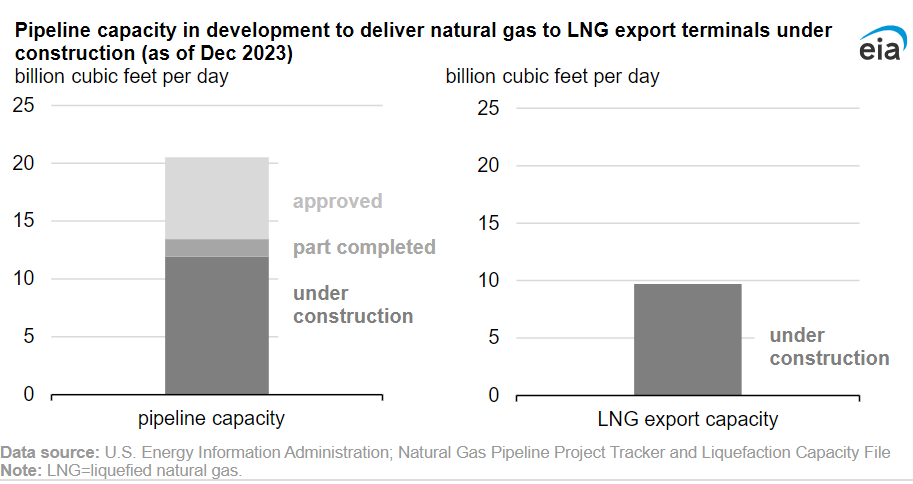

(P&GJ) — More than 20.0 billion cubic feet per day (Bcf/d) of natural gas pipeline capacity is under construction, partly completed, or approved to deliver natural gas to five U.S. liquefied natural gas (LNG) export terminals that are currently under construction, according to U.S. Energy Information Administration’s Natural Gas Pipeline Project Tracker.

Some of the new pipeline capacity is under the jurisdiction of the Federal Energy Regulatory Commission, and some is under the jurisdiction of the Railroad Commission of Texas. About 13.5 Bcf/d of pipeline capacity is currently under construction, and each new LNG terminal—Plaquemines in Louisiana and Golden Pass, Port Arthur, Corpus Christi Stage III, and Rio Grande in Texas—has one or more pipelines being developed.

Southeast Texas Projects

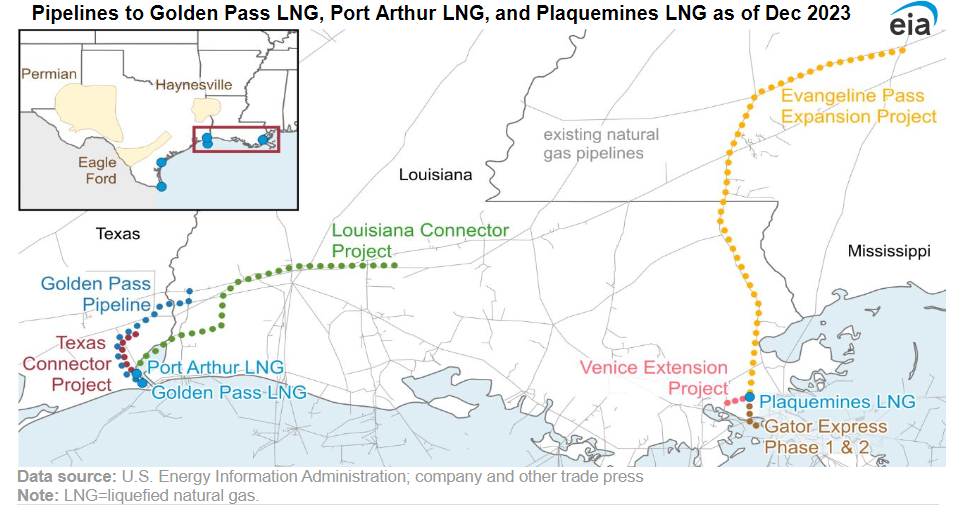

Golden Pass Pipeline: Golden Pass Pipeline, LLC, is expanding the existing 69-mile pipeline that originates northeast of Starks, Louisiana, to enable deliveries of 2.5 Bcf/d of natural gas to the Golden Pass LNG terminal in Jefferson County, Texas. The pipeline was originally built in 2010 to transport imported natural gas to interconnected interstate pipelines and northern U.S. markets. Golden Pass Pipeline is changing the primary flow of the pipeline to flow south and adding connections to nearby natural gas supply sources.

Louisiana Connector Project and Texas Connector Project: Port Arthur Pipeline Company plans to construct two pipelines, each with a capacity of 2.0 Bcf/d, to deliver natural gas to the Port Arthur LNG export terminal in Jefferson County, Texas. When completed, the 72-mile Louisiana Connector Project will deliver natural gas through pipeline interconnections in Louisiana and Texas, and the 34-mile Texas Connector Project will extend from interconnections in Texas to the export terminal.

Louisiana Projects

Gator Express Pipeline: Venture Global Gator Express is constructing two pipelines, each with approximately 2.0 Bcf/d capacity, to deliver natural gas from pipeline interconnections to the Plaquemines LNG export terminal located about 20 miles south of New Orleans, Louisiana. Phase 1 of the project includes a 15-mile pipeline, and Phase 2 includes a 12-mile pipeline.

Evangeline Pass Expansion Project: Tennessee Gas Pipeline Company plans to construct this 13-mile pipeline with capacity of 1.1 Bcf/d. The pipeline is designed to deliver natural gas to the Plaquemines LNG export terminal from a Southern Natural Gas Company interconnection in Mississippi to a new interconnection with the Gator Express Pipeline in Louisiana.

Venice Extension Project: Texas Eastern Transmission is constructing this three-mile pipeline with 1.3 Bcf/d capacity, which will replace an existing segment of its pipeline system, to accommodate natural gas deliveries to the Plaquemines LNG export terminal.

South Texas Projects

ADCC Pipeline: WhiteWater Midstream is constructing this 39-mile pipeline with capacity of 1.7 Bcf/d. The pipeline is slated to deliver natural gas to the Corpus Christi Stage III project. This pipeline originates at the end of the Whistler Pipeline near the Agua Dulce hub in Nueces County, Texas, in the Eagle Ford production region.

Corpus Christi Stage III Pipeline: Cheniere Corpus Christi Pipeline is constructing this 21-mile pipeline with 1.5 Bcf/d capacity. The pipeline is co-located with the existing 2.8 Bcf/d pipeline and is slated to deliver natural gas from pipeline interconnections to the Corpus Christi Stage III project.

Rio Bravo Pipeline: Rio Bravo Pipeline Company is constructing two 138-mile pipelines with a combined capacity of 4.5 Bcf/d to deliver natural gas from the Agua Dulce supply area to the Rio Grande LNG terminal in Brownsville, Texas.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- Cheniere Seeks FERC Approval to Expand Sabine Pass LNG Facility

- Heath Consultants Exits Locate Business to Expand Methane Leak Detection Portfolio

Comments