Wood Mackenzie: North American RNG Market Could Reach 4 Bcf/d by 2050

(P&GJ) — The North American renewable natural gas (RNG) market is poised for significant expansion, potentially growing tenfold to reach 4 Bcf/d by 2050, driven by new government incentives for the transportation sector, according to a new report from Wood Mackenzie.

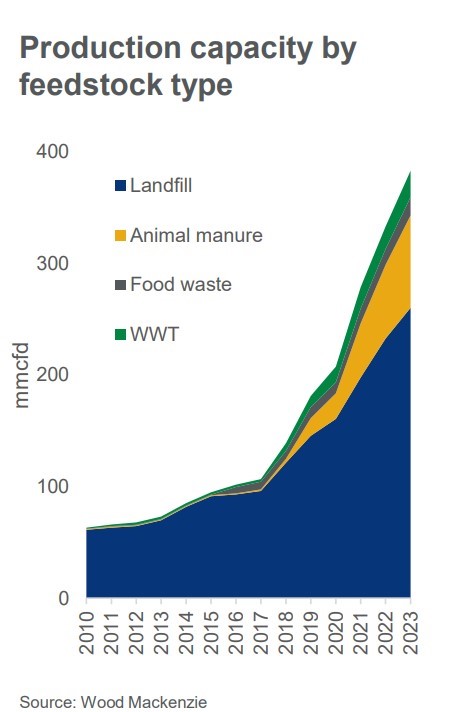

In 2022 alone, the market experienced remarkable growth, with the addition of 60 MMcf/d of new production capacity, showcasing the increasing prominence of RNG, also known as biomethane.

According to the report “North American renewable natural gas state of the market” the number of RNG projects has doubled in the last five years and 66 future projects were announced in 2022. In total, the North American market size sits at 385 MMcf/d, with states such as Texas (62 MMcf/d), California (33 MMcf/d), Pennsylvania (33 MMcf/d), leading the way.

Activity has been spurred by recent mandates and incentives aimed at lowering greenhouse gas emissions, most notably through investment tax credits (ITC) in the Inflation Reduction Act for RNG development and low-carbon fuel programs in the EPA’s Renewable Fuel Standard program.

“RNG has become more popular as it can have five times lower carbon intensity than natural gas projects and helps reduce emissions considerably when used for transportation fuel,” said Natalia Patterson, senior research analyst with Wood Mackenzie. “More than half of RNG production is estimated to be consumed as fuel for natural gas vehicles.”

Landfills make up the largest portion of the capacity by feedstock through methane emissions, but animal waste projects are on the rise, followed by food waste and wastewater treatment projects.

Despite the recent growth, the RNG market currently only makes up 0.5% of the North American natural gas market. Yet with continued policy support and technology development, Wood Mackenzie projects it will growth to 3% of the market by 2050, for a total of 4 billion cubic feet per day.

“There are opportunities for new policy framework to drive more activity in the sector, but we will also need to see voluntary efforts as well, particularly from the industrial sector as more firms commit to low carbon initiatives,” said Patterson. “The growth in the industrial sector would have the potential to dwarf traditional RNG demand in the transportation sector.”

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments