TotalEnergies Faces Second Lawsuit Over Uganda Oil Projects

(Reuters) — Five activist groups have sued French oil major TotalEnergies for a second time over its projects in Uganda and Tanzania in a Paris civil court, they said on Tuesday, after an earlier fast-track attempt was dismissed in February.

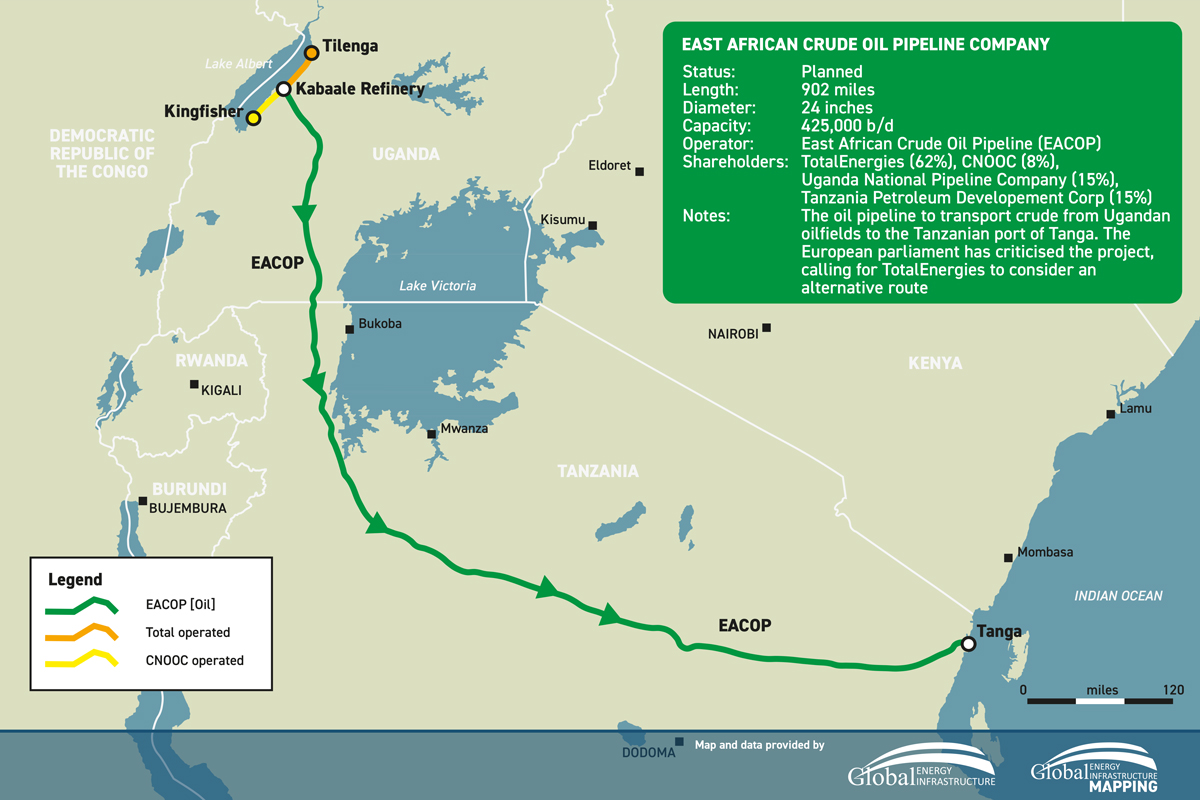

The French and Ugandan groups, led by Friends of the Earth France, accuse the energy company of failing to protect people and the environment from its Tilenga oil development and the $3.5 billion East African Crude Oil Pipeline (EACOP).

Their lawsuit makes use of a 2017 French "duty of vigilance" law requiring large companies to identify risks in their global operations and supply chains, and detail strategies to prevent them.

"TotalEnergies considers that its vigilance plan is implemented effectively and has ensured that its subsidiaries in Uganda and Tanzania have applied the appropriate action plans so as to respect the rights of local communities and biodiversity," the company said in an emailed comment.

"We look forward to a debate on the merits in court."

The company holds a 62% stake in EACOP, which will run 1,443 kilometers (897 miles) from Uganda’s Lake Albert oilfields to the port of Tanga in Tanzania, with the capacity to send up to 246,000 barrels of crude per day out to world markets as early as 2025.

The first suit sought — and failed — to halt the projects by judicial order under a special fast-track process, with the judge finding that TotalEnergies' so-called vigilance plan was legally adequate.

The judgment added however that only a detailed investigation in a standard-speed trial could examine whether the company's actions on the ground were in line with its duty to prevent identifiable harms.

This latest legal attempt instead seeks reparations for those who claim they have already been harmed as a result of the project construction.

Allegations run from lack of timely payment for land on which the pipeline will be built, to damaged houses from flooding during construction of oil processing facilities.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

Comments