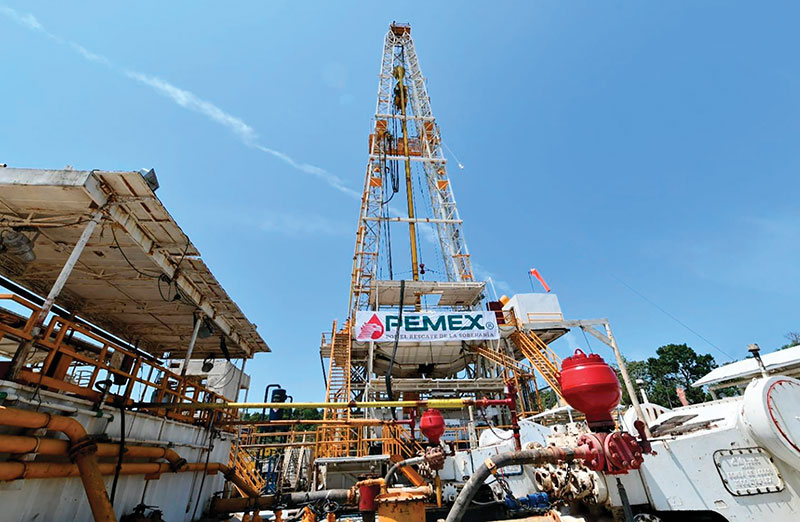

Mexico's New Government to Encourage Pemex Partnerships with Private Oil Firms, Sources Say

(Reuters) — Mexico's incoming government will encourage state oil producer Pemex to seek equity partnerships with private oil companies, a model out of favor with the current president, in a bid to boost reserves amid towering debt, according to four sources familiar with the matter.

These partnerships would be similar to past Pemex joint ventures with private oil producers, also known as farm-outs, that Mexico pursued through an energy reform enacted a decade ago. That reform allowed the oil regulator to approve private and foreign oil companies to partner with Pemex on exploration and production, a common practice in the international oil industry.

President Andres Manuel López Obrador stymied that reform, however, canceling auctions for Pemex tie-ups as well as for private producers to win blocks and operate them on their own.

Mexico's oil sector is a potential sticking point between incoming President Claudia Sheinbaum, who takes office on Oct. 1, and her mentor and current President López Obrador.

Neither Pemex nor Sheinbaum's team responded to requests for comment.

Sheinbaum, a scientist who worked on climate issues, is expected to push for more renewable energy but it has been unclear what she plans to do with Pemex, which faces stagnating production, dwindling reserves and massive debt.

Mexico, the 11th-largest oil producer, saw its proven oil reserves fall last year to 5.98 billion barrels from 6.12 billion barrels the year before, while crude production has declined to nearly 1.5 million barrels per day from a peak of 3.4 million bpd two decades ago.

To help make Pemex more agile in finding partners, three sources said the new government plans to give the Pemex board decision-making powers over potential partners, removing the oil regulator CNH from the process.

Farm-out deals allow partners to share the risks and rewards of oil projects. The main current Pemex example is the Trion field, which two of the sources said the government was studying as a possible blueprint.

Trion, an ultra-deep field in the Gulf of Mexico, is a partnership between Australia's Woodside Energy, with a 60% operating stake, and Pemex, which owns 40%. The project is expected to begin production in 2028.

Pemex has debt of almost $100 billion, owes suppliers a further $20 billion and has about $3.6 billion in cash, leaving it little room for investment.

The sources did not say whether partnerships with specific companies, or on specific fields, had been discussed.

"The idea is to expand exploration to more areas," said one of the sources on condition of anonymity as they are not authorized to speak publicly.

The current administration has favored contracts in which Pemex pays companies for their services but does not give them stakes in projects.

A greater role for the Pemex board over partnerships would coincide with a possible scrapping of the oil regulator altogether, if a constitutional reform promoted by López Obrador and supported by Sheinbaum is approved.

One of the sources said Mexico's Hydrocarbons Law could also be amended to give more power to choose partners to Pemex's board.

Related News

Related News

- Trump Aims to Revive 1,200-Mile Keystone XL Pipeline Despite Major Challenges

- ONEOK Agrees to Sell Interstate Gas Pipelines to DT Midstream for $1.2 Billion

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- Boardwalk Approves 110-Mile, 1.16 Bcf/d Mississippi Kosci Junction Pipeline Project

- Kinder Morgan Approves $1.4 Billion Mississippi Crossing Project to Boost Southeast Gas Supply

- Tullow Oil on Track to Deliver $600 Million Free Cash Flow Over Next 2 Years

- GOP Lawmakers Slam New York for Blocking $500 Million Pipeline Project

- Enbridge Should Rethink Old, Troubled Line 5 Pipeline, IEEFA Says

- Energy Transfer Reaches FID on $2.7 Billion, 2.2 Bcf/d Permian Pipeline

- Polish Pipeline Operator Offers Firm Capacity to Transport Gas to Ukraine in 2025

Comments