Algeria's Sonatrach, Britain's Grain LNG Sign 10-Year LNG Deal

(Reuters) — Grain LNG said on Wednesday it had signed a 10-year deal with Sonatrach to extend the Algerian company's long-term storage and redelivery capacity at Europe's largest liquefied natural gas (LNG) import terminal beyond January 2029.

The agreement is for 125 gigawatt hours per day (GWh/d) of import capacity, equivalent to 3 million metric tons per annum (mtpa) of LNG and is the first to be announced under Grain LNG's competitive auction process which was launched in September for 9 mtpa of existing capacity.

This was designed for parties who want to acquire a substantial stake in the terminal at a reduced cost and with shorter contract lengths when compared to new-build projects.

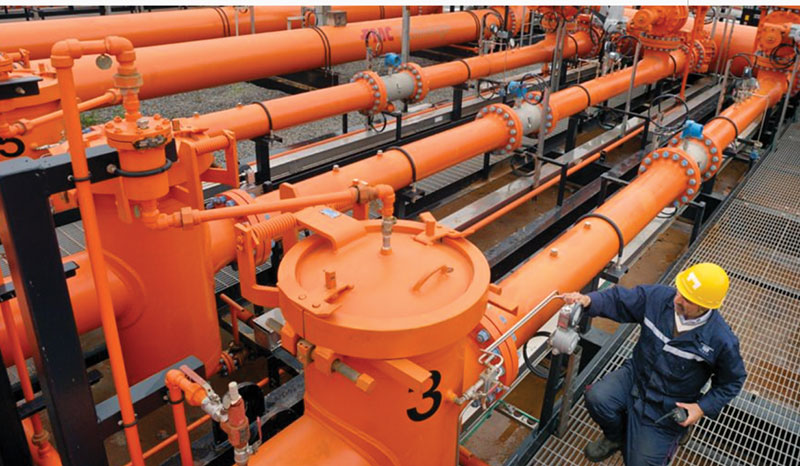

Located on the Isle of Grain in Kent, National Grid's Grain terminal is currently being expanded to store and deliver enough gas to meet up to 33% of British gas demand.

"This agreement ensures that Grain will continue to have a diverse supplier base within the Atlantic Basin," said Katie Jackson, President of National Grid Ventures.

"LNG imports play a critical role in making sure the UK has the gas it needs, when it needs it, providing a flexible and reliable supply of gas to heat peoples’ homes and to complement the growth of renewable generation," she added.

The agreement helps line up Sonatrach’s long term marketing strategy by diversifying its LNG markets, said Mayouf Belgacem, Executive Vice President of Sonatrach.

Related News

Related News

- Kinder Morgan Proposes 290-Mile Gas Pipeline Expansion Spanning Three States

- Valero Plans to Shut California Refinery, Takes $1.1 Billion Hit

- Three Killed, Two Injured in Accident at LNG Construction Site in Texas

- Tallgrass to Build New Permian-to-Rockies Pipeline, Targets 2028 Startup with 2.4 Bcf Capacity

- TC Energy Approves $900 Million Northwoods Pipeline Expansion for U.S. Midwest

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- Enbridge Adds Turboexpanders at Pipeline Sites to Power Data Centers in Canada, Pennsylvania

- Great Basin Gas Expansion Draws Strong Shipper Demand in Northern Nevada

- US Poised to Become Net Exporter of Crude Oil in 2023

- EIG’s MidOcean Energy Acquires 20% Stake in Peru LNG, Including 254-Mile Pipeline

Comments