Cedar LNG Taps Samsung, Black & Veatch for EPC Contract

(P&GJ) — The Haisla Nation and Pembina Pipeline Corp., partners in the development of the proposed Cedar LNG Project (Cedar LNG), announced that Samsung Heavy Industries (SHI) and Black & Veatch have been selected to provide engineering, procurement and construction for the design, fabrication and delivery of the project's floating LNG production unit (FLNG), subject to a Final Investment Decision (FID).

"This is a critical milestone on our path towards a FID for Cedar LNG, the first Indigenous majority-owned LNG project in the world," said Doug Arnell, Cedar LNG Chief Executive Officer. "We have secured world-class FLNG expertise and look forward to working with SHI and Black & Veatch to build an LNG facility with one of the cleanest environmental profiles in the world that will usher in a new era of low carbon, sustainable LNG production."

"Our role in helping Cedar LNG make history on this world-class facility aligns with our commitment to deliver a reliable and resilient global energy supply as a leader in the world's energy transition," said Mario Azar, Black & Veatch Chairman & Chief Executive Officer.

Cedar LNG now has major regulatory approvals, signed memorandums of understanding for long-term liquefaction services for the project's total LNG capacity, and with the achievement of this milestone, the Project is at an advanced stage of planning and development with a FID expected by the end of the first quarter 2024.

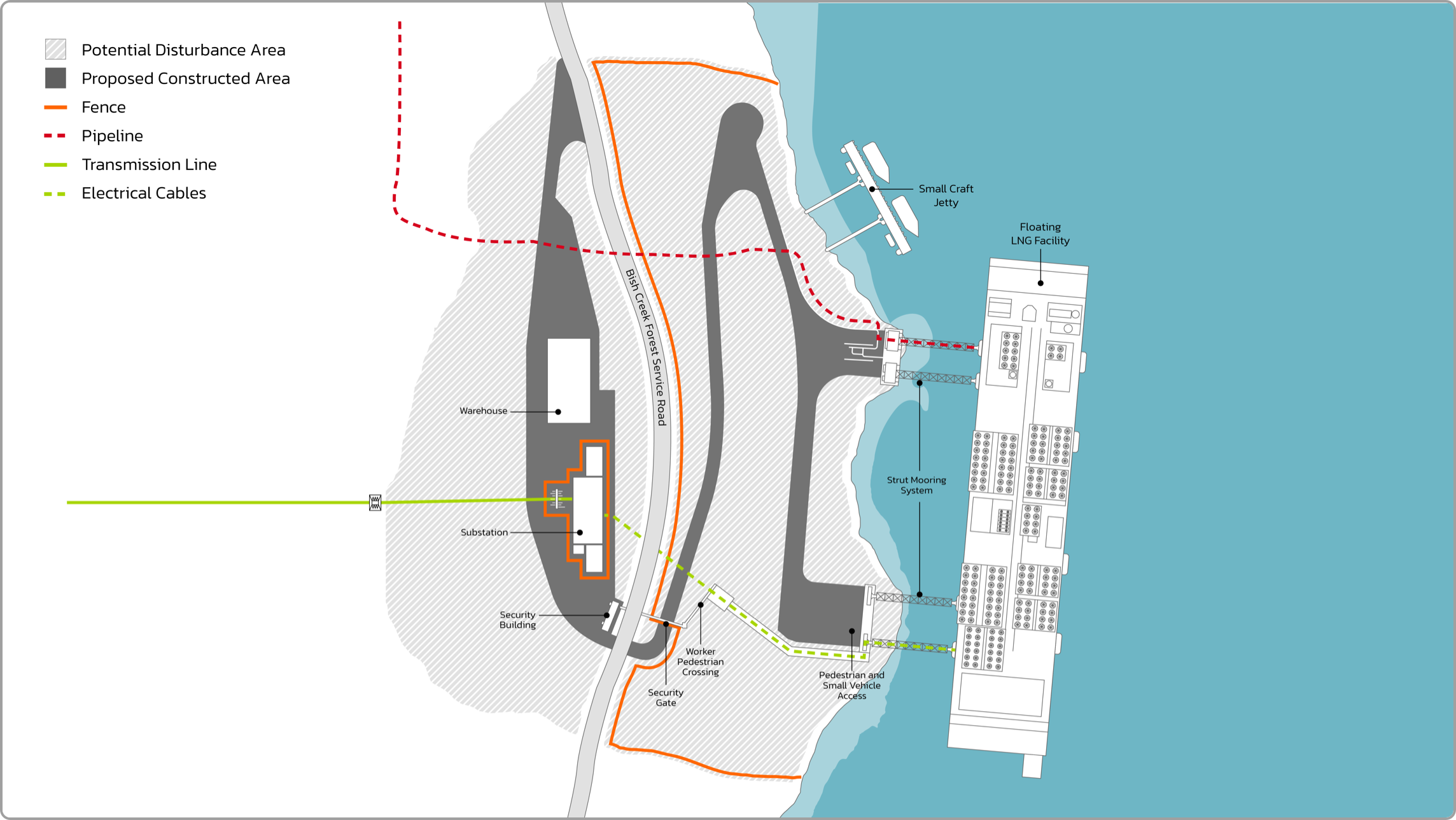

Subject to a positive FID, onshore construction work for the project could commence as early as the second quarter 2024, with the delivery of the FLNG and substantial completion expected in 2028.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments