POET's U.S. Midwest Ethanol Plants to Join Summit Carbon Pipeline Project

(Reuters) — POET LLC, the world's largest ethanol producer, on Monday said it will partner with Summit Carbon Solutions to capture carbon dioxide emissions at 17 of POET's U.S. Midwest ethanol plants as part of Summit's multi-state pipeline project.

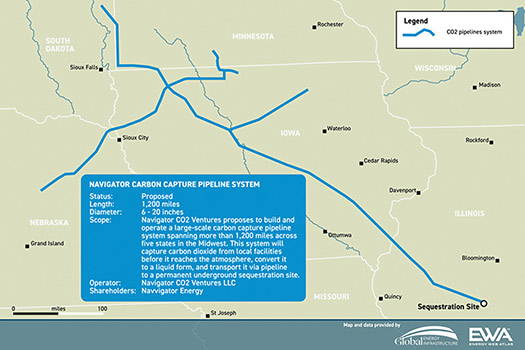

POET previously partnered with another carbon pipeline project proposed by Navigator CO2 Ventures to use carbon capture and storage (CCS) to slash the emissions of its ethanol production and help meet its climate goals.

Navigator canceled its project in October, citing a challenging state regulatory environment.

"As the world seeks low-carbon energy solutions, carbon capture ensures that age-based biofuels will remain competitive for decades to come," POET founder and CEO Jeff Broin said in a statement.

Summit will capture and store 4.7 million metric tons of CO2 from 12 POET plants in Iowa and five plants in South Dakota, the companies said in a statement.

That's in addition to the 18 million metric tons of CO2 Summit already plans to capture at 33 biofuel plants across its proposed 2,000-mile (3218 km), five-state route.

The Summit project has faced opposition from landowners along its route, who fear potential carbon dioxide leaks, damage to their farmland or that their land will be taken under eminent domain to build the pipeline.

South Dakota state regulators denied the company's first application in September, citing safety concerns and the landowner opposition. Summit plans to refile its application.

North Dakota, where Summit aims to store its captured carbon, also denied the project's initial permit application in August citing potential harm to humans and the environment.

The company is awaiting a permit decision from state utility regulators in Iowa.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- Court Ruling Allows MVP’s $500 Million Southgate Pipeline Extension to Proceed

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments