ONEOK Completes Acquisition of 450-Mile Texas-Louisiana NGL Pipeline System

By Mary Holcomb, Digital Editor

(P&GJ) — ONEOK Inc. has completed its acquisition of a system of natural gas liquids (NGL) pipelines from Easton Energy for approximately $280 million.

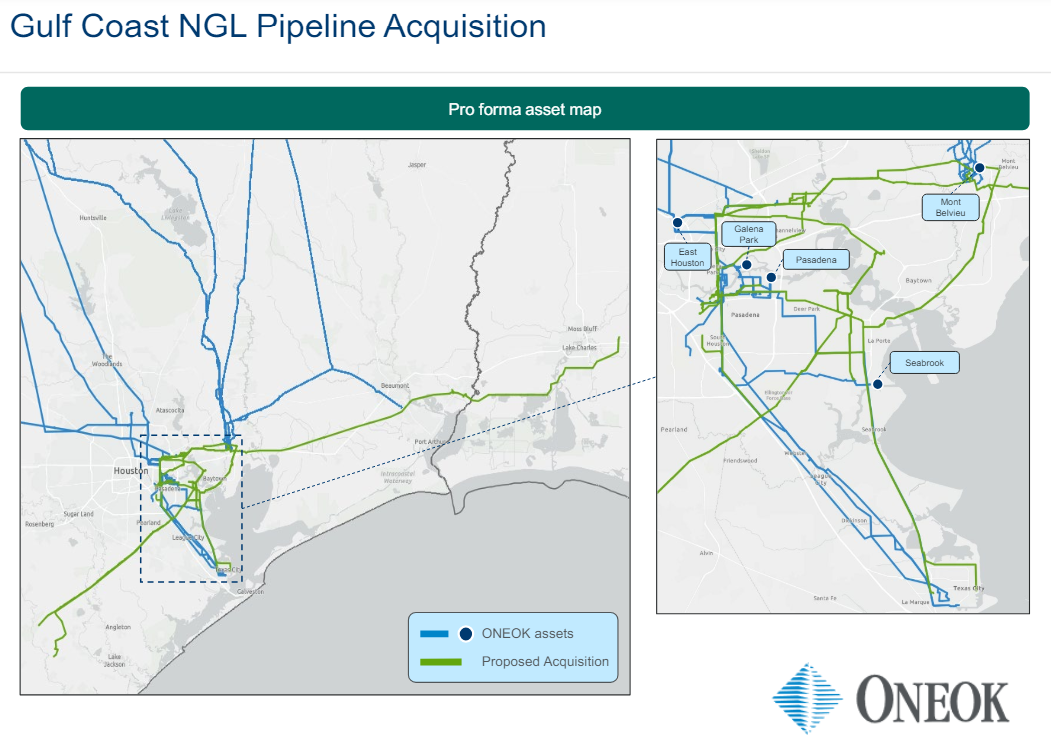

The system comprises of approximately 450 miles of NGL pipelines located in the Texas and Louisiana Gulf Coast market centers for NGLs, refined products and crude oil. These pipelines transport a wide range of liquids products through a portion of its capacity to existing customers.

“These pipelines are a critical piece of the U.S. Gulf Coast NGL and hydrocarbon value chain,” G.R. “Jerry” Cardillo, Easton’s CEO, said in May. “This transaction recognizes value for our customers, shareholders, and our business partners. We will now pivot our focus to our remaining business, our NGL and olefins storage business.”

ONEOK plans to connect the pipelines to ONEOK's Mont Belvieu, Texas, NGL infrastructure and ONEOK's Houston refined products and crude oil infrastructure, accelerating commercial synergies.

"The closing of this strategic acquisition provides immediate earnings, expands our natural gas liquids asset portfolio and accelerates ONEOK's ability to capture commercial synergies related to our recent acquisition of Magellan," said Pierce H. Norton II, ONEOK president and chief executive officer. "These new assets offer significant connectivity between critical Gulf Coast supply and demand centers."

ONEOK plans to connect the pipelines to its Mont Belvieu, Texas, NGL infrastructure and ONEOK's Houston refined products and crude oil infrastructure.

In May 2023, ONEOK agreed to purchase Magellan Midstream Partners in a deal valued at approximately $18.8 billion, inclusive of debt. The acquisition, structured as a cash-and-stock transaction, saw ONEOK offering $25 in cash and 0.6670 shares of its common stock for each outstanding Magellan common unit. This move diversified ONEOK's portfolio from natural gas transportation to include Magellan's refined products and crude oil transportation business, significantly altering its revenue composition.

The acquisition aimed to create a North American midstream infrastructure giant, with a substantial portion of its earnings derived from fee-based sources. ONEOK's CEO, Pierce H. Norton II, expressed optimism about the deal, emphasizing the resultant company's robust balance sheet and financial flexibility. Despite concerns over oversupply in the natural gas market and fluctuating crude prices, the merger was expected to bolster the resilience of the combined entity through diverse commodity cycles.

Financial analysts noted the premium ONEOK paid for Magellan, yet characterized the move as bold, citing the resulting company's formidable scale and diversification. The deal, subject to regulatory approvals, was anticipated to close in the third quarter of 2023, with ONEOK expecting earnings accretion starting in 2024 and continuing through subsequent years, promising enhanced shareholder value. Leading financial advisory firms, including Goldman Sachs and Morgan Stanley, were instrumental in facilitating the transaction.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- U.S. Moves to Block Enterprise Products’ Exports to China Over Security Risk

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- 208-Mile Mississippi-to-Alabama Gas Pipeline Moves Into FERC Review

- U.S. Pipeline Expansion to Add 99 Bcf/d, Mostly for LNG Export, Report Finds

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Kinder Morgan Gas Volumes Climb as Power, LNG Demand Boost Pipeline Business

Comments