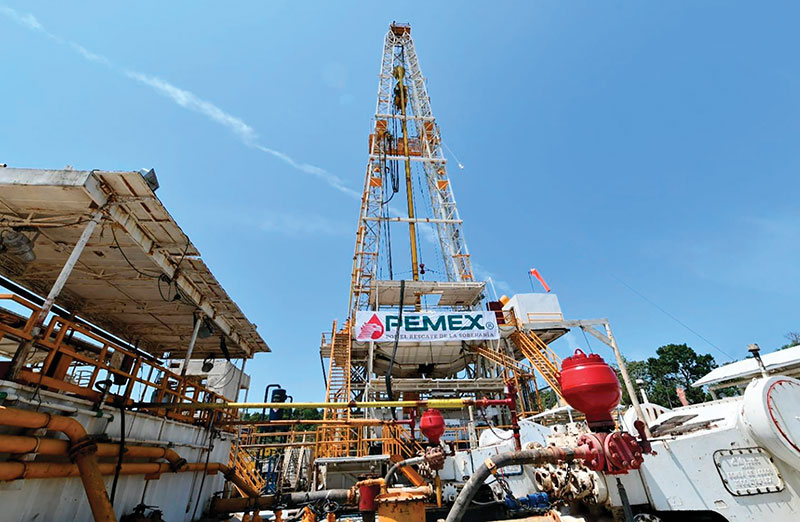

Pemex Oil Production Drops as Lopez Obrador Exits Presidency

(Reuters) — Crude output by Pemex fell in August as Mexico's national oil company failed to reduce fuel imports in line with company targets, while overall falling well short of the lofty energy trade goals of the country's outgoing president.

While locally produced petroleum product volumes rose during the month, gasoline and diesel import volumes were still much higher than Pemex's own output as its new oil refinery showed only meager production during its first couple of months online.

President Andres Manuel Lopez Obrador, who will leave office next week, pledged at the start of his term six years ago to stop exporting crude oil and instead expand domestic refining in a bid to end a long-standing dependence on foreign gasoline and diesel imports, mostly from U.S. suppliers.

But Pemex's liquids production, crude plus condensate, fell by about 6% in August compared with the same month last year to settle at 1.77 million barrels per day (bpd), according to company data published late on Wednesday.

Crude output by itself stood at just under 1.5 million bpd in August, which for months has slid to a new low not seen in more than four decades.

Pemex has blamed the production fall on the natural aging of its top-producing fields.

Meanwhile, the company's refined product output totaled 1.02 million bpd in August, up 15% compared with same period last year, including 290,100 bpd of gasoline and 188,200 bpd of diesel.

But motor fuel output was dwarfed by production of nearly 306,000 bpd of fuel oil, a highly contaminating product Pemex produces in large part due to its inability to more efficiently process its heavy crude oil.

Meanwhile, August imports of gasoline totaled 416,700 bpd and 142,000 bpd of diesel.

Lopez Obrador has often described his nationalistic Pemex strategy as "rescuing our sovereignty," a policy that also sought to mostly sideline foreign or private producers while funneling tens of billions of dollars in government support to the heavily indebted state-owned company.

A few months ago, Lopez Obrador admitted that Mexico will not be able to end crude exports by the end of his term as promised; in August, crude exports reached 730,000 bpd. Instead, he said, that should happen next year under the leadership of his successor and close ally, President-elect Claudia Sheinbaum.

While petroleum product imports have dipped by around 16% overall during his term, compared with Lopez Obrador's first full year in office in 2019, they will almost certainly remain stubbornly above the expectations the company's chief executive set out just a few months ago.

In July, CEO Octavio Romero said fuel imports in September would dip to about 52,000 bpd.

Romero, a confidant of the president going back decades, has also promised optimistic production and processing targets for the country's newest, largest oil refinery, which have failed to materialize.

The Olmeca refinery, with a crude processing capacity of 340,000 bpd, produced only 28,400 bpd of gasoline and 1,100 bpd of diesel in August.

Romero had said around the start of the month that the facility, located on Mexico's Gulf coast, would produce 175,000 bpd of gasoline and 130,000 of diesel in August while reaching its full processing capacity.

After two months online, its crude processing reached about a quarter of its capacity, or about 84,100 bpd.

Related News

Related News

- Enbridge Plans 86-Mile Pipeline Expansion, Bringing 850 Workers to Northern B.C.

- Intensity, Rainbow Energy to Build 344-Mile Gas Pipeline Across North Dakota

- Energy Transfer to Build $5.3 Billion Permian Gas Pipeline to Supply Southwest

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- A Systematic Approach To Ensuring Pipeline Integrity

- 275-Mile Texas-to-Oklahoma Gas Pipeline Enters Open Season

- LNG Canada Start-Up Fails to Lift Gas Prices Amid Supply Glut

- Strike Pioneers First-of-Its-Kind Pipe-in-Pipe Installation on Gulf Coast with Enbridge

- Enbridge Sees High Demand to Expand 593-Mile Canada-to-U.S. Gulf Oil Pipeline

Comments