December 2011, Vol. 238 No. 12

Features

Issues Facing U.S. Shale Gas Exports To Japan

This article explores the feasibility of exporting shale gas – in the form of LNG – from the U.S. to Japan and Korea considering the break-even gas prices and the liquefaction and transportation costs versus prevailing spot and long-term contract prices of LNG in Japan. Potential risks also are discussed.

Japan has limited energy resources and its energy self-sufficiency, even after inclusion of nuclear power, barely amounts to 16%. This is the main reason why Japan is heavily dependent on imported energy to maintain its economic growth. Following the oil shocks of the ’70s and ’80s, Japan gradually veered away from initial oil dependence of almost 80% to reach current levels of 43% in terms of primary energy supply.

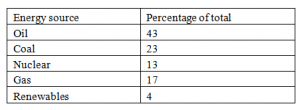

While making this transition, importing natural gas from neighboring countries would have been the perfect solution except that there were no nearby sources – barring Russia – to be tapped. In the ’70s and ’80s, given the cold war conditions and Sakhalin yet to be developed, Japan obviously tilted toward importing LNG from faraway countries. Japan’s energy supply mix for 2009 is presented in Table 1. LNG imports constituted almost 91% of the total gas supply.

Table 1: Energy Supply Mix of Japan, 2009.

Today, Japan is the largest global LNG importer. Japan’s LNG import was 3.18 Tcf (65.2 million metric tons) in 2009.It is expected to reach 3.75 Tcf in 2016 and 4 Tcf in 2035. Despite a declining population (resulting in an aging work force) in Japan and meteoritic rise in LNG consumption in merging economies, Japan’s share of LNG import will still be 35% of the Pacific market and 16% of the world market by 2015. In fact, there is a distinct possibility that due to the disasters at the Fukushima I Nuclear power plant, Japan will opt for increasing its LNG import. This presents a unique opportunity for gas producers to sell more LNG to Japan.

Japan’s LNG Import Sources

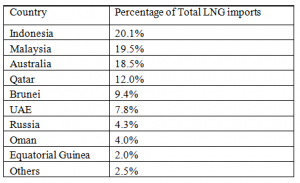

Japan imports most of its LNG from a select group of countries in Asia, Australia and Africa. Table 2 shows Japan’s import by country in 2009.

Table 2: Japan’s LNG Imports by country, 2009.

As can be noted from Table 2, Indonesia, Malaysia and Australia each supply close to 20% of Japan’s LNG imports. Japan is intent on diversifying the sources of LNG imports to get better control on LNG prices and attain reliability of supply in case of adverse weather/geopolitical events in any particular region of the globe.

Japan would obviously seek reliable suppliers with which it has had a long relationship who have enough spare capacity and stable political situation. Energy price and the necessity of upfront investments will be the other variables taken into consideration.

The main contenders to supply LNG to Japan are Qatar, Australia, Malaysia and Russia. Out of these, Russia’s contribution would definitely increase from 4.3% to a higher percentage when the Sakhalin-II LNG plant reaches its peak production (Mitsui and Mitsubishi together have a 22.5% share in Sakhalin-II and intend to supply Japan with an extra of 200,000 metric tons in the near future). In reality, reliability of Russian supply will always remain a big question.

Malaysia could be an eager exporter, but it already supplies almost 20% of Japan’s requirement. Therefore, Japan might think of exploring other markets. Australia’s case is similar to that of Malaysia. In the case of Qatar, all the parameters appear to be satisfied except for the concern regarding long-term political stability in the Persian Gulf region. It makes sense, therefore, for Japan to review the possibility of importing U.S. natural gas. In fact, officials from TEPCO Trading Corp. and Chubu Electric Power Co. have already shown interest in importing LNG from U.S. producers.

At this stage it is worthwhile to consider several factors that would govern the feasibility of exporting U.S. LNG to Japan and other Far East countries. Some of these factors discussed in this study are: 1) U.S. natural gas spare capacity, 2) U.S. liquefaction facilities and their locations, 3) benefits of LNG export to the U.S. economy, 4) financial feasibility of U.S. LNG export, 5) mutual trust factor in dealing with Asian clients, 6) LNG project finance, and 7) possible impacts of regulatory changes on hydraulic fracturing and other risks for U.S. LNG development.

U.S. Spare Capacity

At first, U.S. natural gas spare capacity needs to be discussed. Daily consumption in the U.S. is approximately 62.4 Bcf/d while the “technically recoverable” gas resource total is estimated at 2,170 Tcf of which 687 Tcf is attributed to shale gas. If these results are combined with the Department of Energy’s latest determination of proved gas reserves, the U.S. has enough natural gas for the next hundred years. It should be noted that spare capacity, in a capitalistic system, does not necessarily mean domestic production minus domestic consumption. In an open market, a commodity will chase the highest price quoted for it globally.

A review finds that none of the large basins responsible for boosting U.S. natural gas production is close to the West Coast. Nor is there a facility on the West Coast for gas liquefaction. Geographically, the Gulf of Mexico is the next coast line closest to the Far East. Eagle Ford, Barnett, Woodford, Haynesville and Fayetteville shale gas basins are all located in states bordering the Gulf Coast.

Forecast gas production from Eagle Ford shale, which is closest to the Gulf Coast, is provided in Table 3. Figure 1 shows the predicted growth curves in some of the other prominent shale basins. These basins are easily accessible to both the liquefaction facilities proposed on the Gulf of Mexico coast. A rapidly rising production trend is evident from these forecast data, which indicates that sufficient quantities of LNG could be exported if a reasonable net margin is assured to the producers.

Table 3: Forecast gas production from Eagle Ford Shale.

LNG Facilities

Let us examine the facilities through which natural gas could be sent to Japan and Korea. As discussed above, several prolific shale gas producing basins are close to the U.S. Gulf coast and therefore it would make sense to examine existing/proposed LNG terminals on the Gulf Coast and associated liquefaction capacities.

Freeport LNG and Macquarie Energy have planned to jointly develop four liquefaction trains each with a capacity of 330 MMcf/d at Freeport LNG’s existing LNG import terminal on Quintana Island, 70 miles south of Houston. Following government approval, the start-up is expected in early 2015. Macquarie is contributing toward the development costs of the project. The project is planned to draw shale gas from the Barnett, Haynesville, Eagle Ford and Marcellus basins.

Cheniere Energy’s Sabine Pass liquefaction project is being designed to permit up to four modular LNG trains – each with an average processing capacity of 466 MMcf/d. The initial project phase is anticipated to include two modular trains with the capacity to process on average 1.2 Bcf/d of pipeline-quality natural gas. Subject to regulatory approvals and long-term customer contracts, LNG export is expected to commence as early as 2015. Time and cost required to develop the project is anticipated to be materially lessened by Sabine Pass LNG’s existing large acreage and infrastructure.

These proposed export terminals will be located in one of the largest gas-producing regions in the world, near two large natural gas trading hubs – the Houston Ship Channel and Katy – with access to the extensive U.S. pipeline network. Moreover, with the opening of the Panama Canal to LNG ships in 2014, cargoes being exported out of Freeport/Cheniere will have a much shorter and quicker access to the Far East, prime area for LNG demand.

Benefits Of LNG Exports

It is worthwhile to review the expected direct and indirect benefits of LNG export. Fully built out, the Freeport LNG liquefaction project will require more than $2 billion of direct investment and will create more than 1,000 construction jobs over a two- to three-year construction period. Altos Management Partners has predicted that the incremental natural gas exploration and production required to supply this project would create 17,000-21,000 jobs and spur companies to spend $2.7 billion a year on salaries, as well as exploration and production.

In terms of direct benefits of the Sabine Pass Liquefaction project, the craft labor payrolls alone during Stage 1 and 2 constructions are expected to be $400 million and $360 million, respectively, with total wages amounting to $1 billion over a six-year period. On completion, approximately 170-250 full-time positions will be required to maintain and operate the project. Indirect benefits will include effects of increased gas production resulting from the ability to export domestic supplies and generation of even more economic activity as businesses and workers spend money. Indirect benefits will most probably be somewhat higher than those estimated for the Freeport LNG project as capacity of the Sabine Pass project is almost 30% higher.

LNG Export Economics

A preliminary review of the economics of U.S. LNG export is warranted. Such a review will scrutinize the conventional thinking that the disconnect between crude-linked LNG and North American gas is the driver which encourages U.S. producers to push for LNG exports. Toward that end, some calculations can be made to establish the cost of supplying LNG to Japan and Korea.

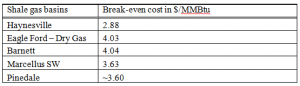

Table 4: Break-even costs at various Shale gas basins.

Table 4 shows the break-even prices of shale gas for four major shale gas basins. Now, at a minimum, by adding cost of transportation to a gas liquefaction facility, liquefaction cost, shipping cost, and storage and regasification cost, one can calculate the cost of natural gas at the point of unloading in Japan/Korea:

1) Delivery cost to liquefaction facility: Based on a typical maximum system-wide base rate for firm and interruptible transportation service of $0.20/MMBtu plus a 3% fuel and lost and unaccounted for (LAUF) gas charge, the total variable cost per unit for transportation from processing plant to a liquefaction facility 300 miles away can be estimated at $0.32/MMBtu.

2) Liquefaction cost: Some authors see a generic liquefaction cost of U.S.$1.09/MMBtu. In 2010, Cheniere Energy said it would charge between $1.40-1.75/MMBtu for liquefaction, although according to Pan EurAsian, an adviser to the LNG industry, it appears to be $1 too high. ICF calculated liquefaction cost at $2.09/Mcf for a LNG plant in Russian Far East. For the present study, an average of the Cheniere fees, $1.58/MMBtu, has been considered.

3) LNG Shipping cost: According to Brito and Hartley (2007), the unit costs of LNG shipping have been reduced by 40% during 1997–2007. Based on the market developments in the last few years, LNG shipping costs could further stabilize due to several reasons: (a) availability of a large number of LNG carriers, (b) new technology which allows for reliquefying boil-off gas and thereby offers more cargo to buyers, and (c) development of new generation of LNG carriers which will increase cargo capacity. Some authors see an LNG shipping rate of U.S.$0.61/MMBtu while others considers a minimum shipping cost of $0.28/MMBtu. Another indicates a shipping cost of U.S.$0.89/Mcf from Russian Far East to the North American West Coast, which has been used in calculations here.

4) Storage and Regasification cost: One author suggests regasification could add U.S.$0.30/MMBtu to the price of imported LNG while another points to a regasification cost of $0.38/Mcf. A minimum storage and regasification cost of $0.20/MMBtu is considered in another piece of literature.

If the cost of transporting the gas to a liquefaction facility, liquefaction cost, LNG shipping cost and storage and regasification cost are added to an average break-even cost of U.S.$4 (Table 4), the cost of natural gas post-regasification at a Japanese/Korean LNG facility will be ~$7.17/MMBtu. This value is somewhat higher than PFC Energy’s estimate of $5.55/MMBtu (it includes a storage and regasification cost of $0.38/MMBtu added by this author) for Western Canada natural gas delivered through Kitimat to Japan. The PFC estimate suggests a netback for the producer-owners of Kitimat of $2.93-7.23/MMBtu based on Japan Crude Cocktail (JCC) indexation and $60-80/bbl crude oil .

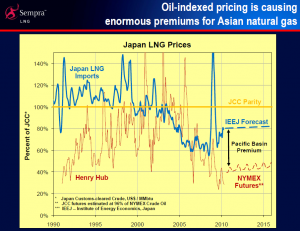

At this point, a review of JCC prices in the near future is warranted. Japan imports most of its crude oil from the countries around the Persian Gulf. Oman crude oil futures at the Dubai Mercantile Exchange range between $103.09 and $97.70/bbl during the period August 2011 to December 2016 (this futures contract is used as a benchmark for Saudi Arabia, Iran, Iraq, the UAE, Qatar and Kuwait crude sold in the Asia-Pacific market). NYMEX WTI futures range from a minimum of $91.16 to a maximum of $102.29 between August 2011 and December 2019. Brent oil is trading almost $14 above WTI and is expected to do so for the next several years. Given such expectations for future crude oil prices, the $7.17/MMBtu cost of LNG FOB Japan post-regasification as calculated above should provide any LNG exporter a significant net margin. A slide from a Sempra LNG presentation (Figure 2) shows the Pacific Basin Premium, caused by oil-index pricing, as a percentage of JCC.

Figure 2: Pacific basin premium due to oil-index pricing.

Examples of recently signed LNG contracts clearly indicate that at break-even prices of natural gas shown in Table 4, there will be sufficient margin for U.S. producers to supply LNG to Japan/Korea/China. In fact, Japanese import prices averaged $9.04 per million Btu last year, more than double the average $3.50 per million Btu available to producers in Western Canada, according to data compiled by Bloomberg. In February 2011, China’s CNOOC was in the market for one tanker for March delivery and was bidding around $10/MMBtu. In mid-Feb 2011, Darwin LNG awarded seven cargoes loading from late March through June for up to $9.30/MMBtu on a FOB basis. Platts Japan/Korea Marker (JKM), the benchmark daily assessment of the spot price for cargoes of LNG delivered ex-ship into Japan or Korea, for April 2011 was $10.95/MMBtu.

Discussions made above are based on LNG prices being linked to JCC indexation. But what if LNG prices are delinked from JCC? According to Daniel Muthman of E.ON Ruhrgas, most LNG long-term contracts are now priced at dollar-per-MMBtu rate that is 14-15% of the dollar-per-barrel oil price. There are rumors Australia’s Gorgon project and ExxonMobil-led Papua New Guinea project sold their planned output under long-term contracts indexed to oil at 14-15%.

Mutual Trust Factor

Japan and other Asian nations have been known to place a great deal of importance on mutual trust developed over a long period of time. In this context, it could be pointed out that while Conoco/Marathon’s Kenai LNG plant in Alaska is scheduled to close soon, it has supplied LNG to Japan since 1969. Therefore, U.S. companies such as ConocoPhillips and Marathon have established a long-term relationship with Japan. The Kenai LNG plant is closing down due to a lack of long-term natural gas availability.

Project Finance

As part of this study, potential sources of project financing need to be considered because LNG projects are extremely expensive. LNG project developers should consider an assortment of capital sources to reduce their overall weighted cost of capital. Funding sources include equity capital markets, long-term debt, ECA (Export Credit Agency)/multi-lateral, commercial bank loans, equipment financiers, government funding and trade players.

Greenfield LNG development is often structured close to 75% debt and 25% equity. Commercial banks and ECAs carry the debt load. For example, Qatar Gas II upstream and Liquefaction Trains I & II were structured at 70% debt and 30% equity. Four senior debt tranches: a commercial bank facility comprised of 36 banks ($3.6 billion), Islamic financing ($530 million), two export credit agency facilities – the U.S. Export-Import Bank ($405 million and its Italian counterpart Servizi Assicurativi del Commercio Estero ($400 million and ExxonMobil Sponsor loan ($1.9 billion as mirror facilities) were assembled.

The Freeport liquefaction project in the U.S. Gulf Coast will require more than $2 billion of direct investment and plans to liquefy and export 1.3 Bcf/d of natural gas from Port Freeport on Quintana Island near Freeport, TX.

For the PNG LNG project in Papua New Guinea, operated by ExxonMobil, $5.5 billion is planned to be funded from equity contributions from the partners. Out of the remainder $14 billion in project financing, $8.3 billion will originate from export credit agencies, $1.95 billion from uncovered commitments from a syndicate of 17 commercial banks, and $3.75 billion as co-lending from ExxonMobil.

Sometimes oil andgas firms may consider to “buy-in” at a later stage such as Total’s $4 billion deal for a 12% stake in Novatek which includes 20% of the Russian independent’s Yamal LNG plant. Loans can also be availed from interested private equity firms.

To ensure smooth LNG supplies, Japan’s policy has been to diversify the LNG supplier base and take shares in different LNG projects. To this end, Japanese government institutions have provided financing and incentives. In the past, Japanese financial support has taken various forms such as overseas investment loans, untied loans, import loans and direct loans. In certain cases Japan government has assisted through Overseas Government Cooperation Funds, credit guarantees from Japan National Oil Co., and investment and trade insurance from the Ministry of International Trade and Industry (MITI). For example, MITI has a 4.7% stake in the ExxonMobil-led Papua New Guinea LNG project. Another example is Japan Bank for International Cooperation’s (JBIC) loan agreement of $1 billion with Woodside Petroleum Limited in Australia.

Environmental And Other Risks

Concerns over environmental impacts of hydraulic fracturing on drinking water supplies may prevent production of shale gas in certain parts of the U.S., thereby affecting the chances of the U.S. becoming a natural gas exporter.

In Maryland companion bills in the House and Senate are planning to put a moratorium on issuing permits for shale gas drilling until August 2013, giving time for environmental concerns to be addressed. New York placed a six-month moratorium in December 2010 on the issuing of permits until concerns could be addressed. On March 1, 2011 the Pennsylvania governor lifted the moratorium on Marcellus shale gas drilling in state forest areas.

The Environmental Protection Agency (EPA) has proposed a new study to 1) investigate the fracturing process and 2) determine whether drilling techniques pose a risk to drinking and underground water. EPA has submitted its draft study plan on hydraulic fracturing for review to its Science Advisory Board (SAB). Following this review, during which stakeholders and the public can provide comments, EPA will revise the study plan. A preliminary report is scheduled for release by the end of 2012 with a complete report to be released in 2014.

Other real risks for LNG development in the U.S. may arise due to over-supply of LNG, potential carbon tax imposition, wide-scale shale gas discovery in China and Europe and de-linkage from JCC indexation.

The fast ramp-up in LNG production in Qatar and Australia has the potential to create a LNG glut in global markets. Within five years, Australian exports are planned to exceed 50 million tpa from current levels of less than 20 million tpa, ranking it just behind Qatar. Although Australian LNG producers are particularly vulnerable to a carbon tax because they already have higher costs than most LNG projects globally with costs between $6-8/MMBtu (most non-Australian projects cost less than $6/MMBtu, according to the Australian Petroleum Production & Exploration Association data), the increase in LNG production could really materialize, at least initially, which in return would create intense competition in catering to the demands from Japan, Korea, China and India.

Risks to U.S. gas exports may also occur due to the incentives being offered to the drillers by the China. If China becomes self-sufficient in unconventional gas, it would reduce imports of LNG (China buys 269.4 Bcf/year of LNG from exporters in Australia, Indonesia and Malaysia) and create a glut in global LNG markets.

De-linkage of LNG prices from JCC may be detrimental to U.S. gas exports. In this regard, energy executives attending the CERA week in Houston in March 2011 predicted that despite increasing influence of western spot prices in short- to mid-term LNG contracts, long-term LNG contracts will continue to be linked to oil prices, perhaps with adjustments in the face of any ongoing gas glut. Only large volumes of Russian LNG export to the Far East can cause a major shift in the LNG pricing formula by reduction of the JCC slope and re-instatement of the S-curves. However, the Russians are unlikely to oversupply the Far East market and would rather strive toward a strategy of balancing their gas export to Europe with that in the Far East. At the same time Japan would be extra careful not to get overly dependent on Russian supplies.

Permitting delays and any postponement in constructing liquefaction facilities on the Gulf Coast could lead to U.S. losing out the LNG race to Australia, Qatar and Malaysia.

Conclusion

This preliminary study shows that conditions are opportune for the U.S. to export LNG to Japan as well as Korea and China. The job creation prospects of such export and U.S. administration’s focus on low-carbon fuels would definitely act as boosting factors for such export plans. Of course there are regulatory risks involved which could severely restrict shale gas production and derail hopes for export. Moreover, the liquefaction facilities on the Gulf of Mexico are yet to be financed and constructed. Exports of large quantities of LNG from Russia, Qatar and Australia could be impediments as well.

Regardless, given the fact that Japan, Korea and China would most likely diversify their source of energy supplies and are among the largest importers of LNG globally obviously means that U.S. LNG can play a significant role in the Far East in the near future. The incidents in the Japanese nuclear sector also point toward increased LNG imports. Finally, exporting attractively priced gas as LNG from the U.S. will help undoubtedly support continued domestic production, balance global market dynamics and offer global buyers a stable, attractively priced fuel supply alternative.

(Author’s note: This article is an excerpt from a presentation that contains additional text, footnotes and references. The presentation, with references, is held by the author.)

Author

D.K. Das is employed at UniversalPegasus International, an EPC firm headquartered in Houston that provides services to the global energy sector. He earned his M.S. degree from the University of British Columbia and his M.B.A. degree from the University of Chicago Graduate School of Business. He can be reached at dkdas@pegasus-international.com

Comments