March 2012, Vol. 239 No. 3

Projects

Williams Partners Acquiring Footholds In Marcellus Liquids, Utica Shale

Williams Partners announced March 19 that it will acquire Caiman Eastern Midstream LLC in the natural gas liquids-rich portion of the Marcellus Shale for approximately $2.5 billion.

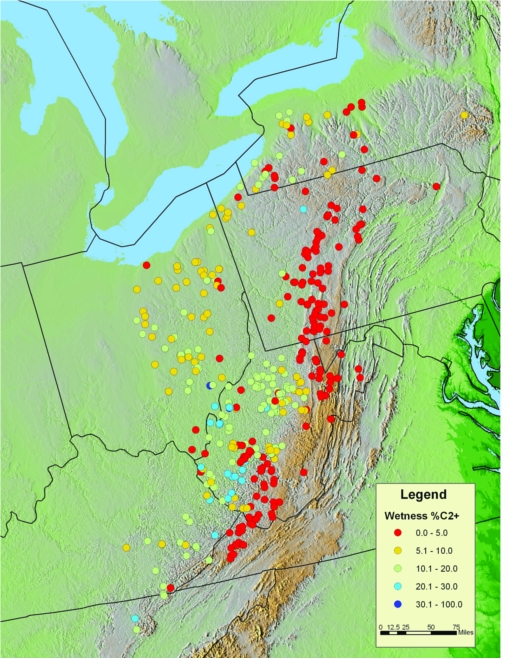

Caiman Eastern Midstream is an independent gathering and processing business located in northern West Virginia, southwestern Pennsylvania and eastern Ohio, which owns a gathering system, two processing facilities and a fractionator. Expansions to the gathering system, processing facilities and fractionator are currently under construction. An ethane pipeline is also planned.

The assets are anchored by long-term contracted commitments, including 236,000 dedicated gathering acres from 10 producers in West Virginia, Ohio and Pennsylvania.

Williams Partners expects significant growth in gathering volumes and NGL production from these assets. There is an estimated 300 trillion cubic feet (Tcfe) of natural gas in place within a 35-mile radius of the system, and a significant amount remains undedicated. Williams Partners expects the Caiman system to gather more than 2 billion cubic feet per day (Bcf/d) and produce approximately 300,000 barrels per day (bbl/d) of NGLs and condensate by 2020.

Joint Venture to Develop Utica Shale Infrastructure

Williams Partners has also announced a new joint venture with Caiman Energy to develop midstream infrastructure in the NGL- and oil-rich areas of the Utica Shale, primarily in Ohio and northwest Pennsylvania.

“These new assets, anchored by long-term agreements with a diverse set of customers, give us a major presence in the liquids-rich portion of the Marcellus Shale,” said Alan Armstrong, CEO of Williams. “We expect significant long-term growth potential because the liquids-rich gas makes this area the most economical and top-performing play for producers in North America.

“It’s also just adjacent to the rich gas and oil-producing portions of the Utica Shale, where we’re planning on developing new infrastructure with Caiman. Our goal is to be the leading gathering, processing and transportation solution provider for producers in the Marcellus Shale.”

Williams intends to make an additional investment in Williams Partners of approximately $1 billion to facilitate the acquisition. Williams intends to purchase approximately 16.3 million Williams Partners limited-partner units at a price equal to the price of the units Williams Partners will issue to Caiman. Williams has also agreed to temporarily waive the general partner incentive distributions through 2013 with respect to the limited-partner units to be issued to Caiman and Williams. Williams estimates the foregone IDRs would have yielded approximately $26 million in 2012 and $42 million in 2013.

The partnership expects to complete the acquisition in the second quarter of 2012.

Comments