April 2014, Vol. 241 No. 4

Features

UK Production Starts Rose Through 2013

The number of fields which began producing oil and gas in the UK hit its highest level in five years in 2013, as operators focused on development activity. This is according to the latest report into offshore activity from Deloitte, the business advisory firm.

The report, detailing activity across North West Europe over the past year and compiled by Deloitte’s Petroleum Services Group (PSG), found the number of UK fields which started production rose by 44% in 2013 (up from nine in 2012 to 13 in 2013). This figure represents the highest number since 2008, when 16 fields were brought on-stream.

Of the 13 fields brought on-stream last year, 84% were eligible for tax allowances, pointing to a positive industry reaction to government incentives.

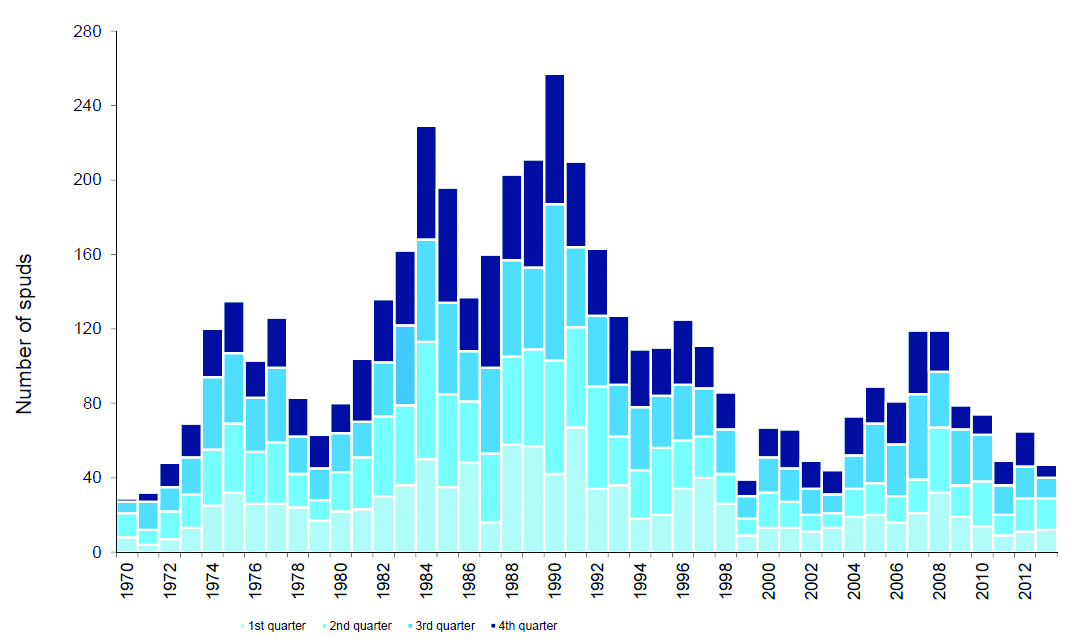

However, a total of only 47 exploration and appraisal wells were drilled on the UK Continental Shelf (UKCS) in 2013, compared with 65 in 2012 – a decrease of 28%. During the same period, the Norwegian Continental Shelf (NCS) saw a 41% increase in drilling activity.

Graham Sadler, managing director of Deloitte’s PSG, said that more needed to be done to encourage drilling on the UKCS, including incentives for exploration activity.

“The North Sea industry is complex and companies operating there have to consider many factors. Despite the high oil price, margins are tight and the drop in drilling during 2013 most likely reflects the increased costs of operating. Staff costs remain high and access to equipment such as rigs, which are limited in number, drives prices upwards.

“Nevertheless, we are seeing evidence that government incentives are helping to stimulate field developments – even historic discoveries – with Chevron’s recent announcement that it will start work on the Alder field, which was discovered in the 1970s.

“Advances in technology have also been vital to the development of this and other historic discoveries. However, incentives and technologies are not the whole picture. Greater overall knowledge and understanding of the North Sea’s complex geology and economics also play an important role in the viability of these older discoveries.”

The UK’s 27th Licensing Round saw record levels of applications and last November the Department of Energy and Climate Change confirmed 219 awards were offered, highlighting positive and continued interest in the North Sea. With the launch of the 28th licensing round on Jan. 24 continued interest is expected in the offshore sector.

Graham Hollis, energy partner at Deloitte in Aberdeen said: “The rise in field start-ups over the last year and increased interest in licensing rounds are positive indicators for the future of the North Sea. But more than ever companies appear to be at a crossroads in their attitude toward it, with optimism and pessimism seemingly present in equal measure.

“We have recently seen a number of announcements of significant – and in some instances all-time high levels of investment in the UKCS. However, several other companies, some of whom have been key players in the UK sector for many years, have announced or are taking steps seeming to indicate the North Sea is no longer a core focus for investment within their global portfolios.

“Any longer-term decline in exploration and appraisal drilling will be of concern and there are measures that seriously need to be considered by industry and government to reinvigorate drilling activity and ensure the longevity of the UKCS.”

For more information, visit www.deloitte.com/petroleumservices. To purchase the full report, visit www.psg.deloitte.com/store.

Editor’s Note:

In 2013 the UK government asked former Wood Group Chairman Sir Ian Wood to report on how to best ensure the longevity of the UK’s oil and gas resources. His interim report (published November 2013) made recommendations including the establishment of a new arm’s-length regulatory body and a shared strategy with commitment from government.

Comments