February 2014, Vol. 241 No. 2

Features

Overview Of U.S. Oil, Gas Construction Boom

Editor’s note: This is the first in a three part series on the changing face of the oil and gas industry. The initial article deals with the dramatic production increase in recent years, how it has affected prices of both oil and gas, and the effect it will have on energy-driven construction and its related labor market.

In 2008, about 60% of the crude oil produced in the United States came from one of three places: the Gulf of Mexico, Texas and Alaska. Domestic production was on the decline, having decreased about 2% annually on average since 1970. Imports from foreign nations filled the gap, bringing with them significant political and economic implications for the country.

In the five years following, the refinement of hydraulic fracturing technology has allowed the United States to go from an increasingly dependent buyer of foreign oil to the second-leading producer of oil in the world. The technology has also given energy companies the ability to exploit huge natural gas reserves across the country.

While traditionally much of the country’s oil and gas infrastructure lies along the Gulf Coast, shale development is now taking place across the country in states like Pennsylvania, West Virginia, Ohio, Oklahoma, Colorado and North Dakota, increasing production at previously unfathomable rates. Located deep beneath Pennsylvania and West Virginia, the Marcellus Shale has increased natural gas production by six times in just four years. If the Marcellus were its own country, it would be the eighth-largest gas producer in the world. Ten years ago, this was unimaginable.

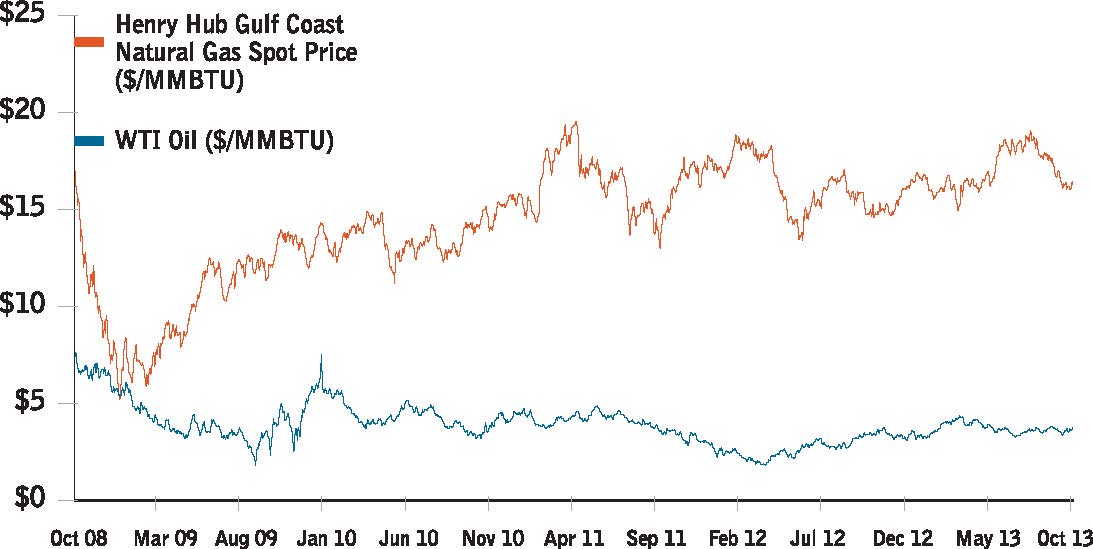

This dramatic production increase has affected prices. The rush to produce natural gas from formations like the Marcellus began to have a significant effect in 2012, when the price of natural gas fell to an all-time low of $1.82 MMBtu on April 20, effectively making it one of the cheapest energy resources in the world.

Oil prices also began to exhibit some peculiar behavior: In early 2011, oil produced in the United States began to trade at a substantial discount to oil produced overseas. With so much oil production in far-off places of the country, surpluses were developing at storage and transportation hubs unable to get to market. As a result, prices declined and refiners rejoiced.

In just five years, the United States has witnessed an energy revolution. Production of oil and gas is increasing, prices are falling, and entrepreneurs nationwide are finding newer and better ways to take advantage of this dynamic. The biggest challenge for all of them comes down to one issue: infrastructure.

Due to infrastructure constraints, domestically produced oil has traded at a discount, and natural gas prices have declined precipitously. There is tremendous profit incentive for companies that can liquefy natural gas and transport it overseas, and for companies that can transport oil from overstocked hubs in the Bakken Shale and other oil-rich areas.

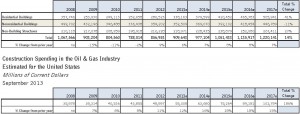

FMI estimates that capital expenditures on oil and gas construction projects in the United States will exceed $55 billion in 2013, up 11% from 2012. This growth will continue at an average of 17% through 2017 as the construction of refineries, petrochemical facilities, pipelines, LNG facilities and related infrastructure projects heats up.

What is not included in these figures is the effect cheaper energy prices will have on industrial spending nationwide. Already, utilities across the country are switching from coal-powered electricity generation to gas, and other energy-intensive industries are examining whether natural gas is a more affordable commodity. All of this will require new investment and new construction.

In all, FMI estimates more than $330 billion will be spent on oil- and gas-related construction during the next four years, nearly double the amount that has been spent in the past four years. As oil and gas producers increase drilling efficiencies and place greater pressure on prices (particularly in natural gas markets), we expect this figure to increase as the United States begins to return to its manufacturing and industrial roots.

Looming Gap: Demand Vs. Labor

The oil and gas sector has experienced an era of intense and accelerated growth over the last few years. Even as many other industries have fallen prey to the economic recession and other negative effects, this particular industry has remained strong and steadfast; that is not expected to change anytime soon. Through 2017, in fact, the rate of growth in oil and gas is projected to be more than twice that of the construction industry as a whole (Table 1).

Table 1: U.S. construction volume put in place and construction spending in the U.S. oil and gas industry.

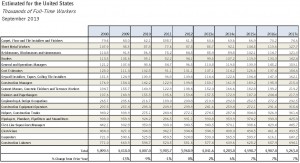

The fact that many construction employees have gravitated to the growing oil and gas sector should come as no surprise. In 2008, just 3.8% of the total construction workforce was engaged in direct oil and gas construction. By 2012, 6.4% – nearly double the 2008 number – of that workforce was engaged in direct oil and gas construction. According to FMI’s estimates, by 2017 nearly 10% of the total U.S. construction workforce will have moved over to this burgeoning segment of the industry (Table 2).

Table 2. Total construction employment demand – all segments.

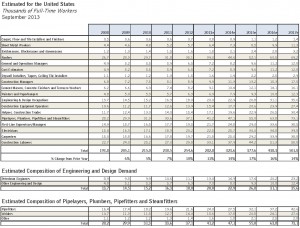

Across the 17 craft categories that FMI tracks, the total number of workers required across all categories within the oil and gas industry was 254,600 in 2012 (Table 3). By 2017 this demand will have approximately doubled, leaving more than 247,000 skilled positions unfilled.

As any top construction firm understands, mitigating shortages through additional hours and workers often leads to limitations and can take a toll on safety, quality and productivity. And while required skill sets are readily transferable in some cases (i.e., roofers, masons, painters and operators), the oil and gas industry will find itself competing with other construction sectors for available talent, while also trying to develop new talent.

Table 3. Total construction employment demand – oil and gas segment.

In other instances, the severity of labor shortages is compounded by required skill sets that are more specific to the oil and gas industry. Petroleum engineers, pipefitters, welders, controls electricians, supervisors and managers, for example, will all be in high demand during the next four years.

One executive of a large global EPC company confirms, “Just like electricity is sold on the spot market when there’s an emergency or a hurricane, the price of labor is going to go sky-high. It’s a basic supply-demand model. The open-shop certified welders right now have pushed the rate to $35 per hour and $70 per diem. That’s the going rate on the Gulf Coast, up from about $28 per hour a year or two ago.”

During the five-year period 2012 to 2017, key shortages will include:

Petroleum engineers: 11,500

Pipefitters: 21,100

Welders: 13,600

Supervisors: 19,000

In each case, the demand for these workers will approach twice the current supply. This will require employers to sharpen their focus in terms of recruiting, training and retaining new talent, as well as developing a long-term comprehensive human resource strategy. Without these and other initiatives in place, firms will risk missing this period of impressive growth and expansion within the industry. The rewards are sure to be substantial for those companies that focus on growing and nurturing their talent pools and challenging, at best, for those firms that take a more languid approach to their human capital.

Growth, of course, is good. However, the oil and gas boom could come at the expense of other construction sectors that are now experiencing recoveries and the growth associated with such revival. It could also affect the oil and gas industry itself. The growth in the sector’s share of total workers, for instance, is taking place despite concurrent double-digit growth in the U.S. residential sector. This fact alone could put constraints on the rebirth of residential construction across the nation as contractors scramble to fill positions.

Authors: Wm. Chris Daum is a senior managing director and officer with FMI Capital Advisors, Inc., FMI Corporation’s registered Investment Banking subsidiary. He oversees the IB teams in Raleigh, NC, Denver, CO and Tampa, FL. Daum may be contacted at 919-785-9264 or cdaum@fminet.com.

Scott Duncan is a vice president with FMI Capital Advisors, Inc. He works with construction industry firms on mergers and acquisitions, valuations and ownership transfer issues. Duncan may be contacted at 303-398-7250 or sduncan@fminet.com.

Sabine Hoover is a senior research consultant with FMI Corporation and has more than 10 years of applied research experience. During the past nine years, she has specialized in market research, focused on the construction industry. Hoover may be contacted at 303-398-7238 or shoover@fminet.com.

FMI is a leading provider of management consulting, investment banking and research to the engineering and construction industry.

Comments