August 2015, Vol. 242, No. 8

Features

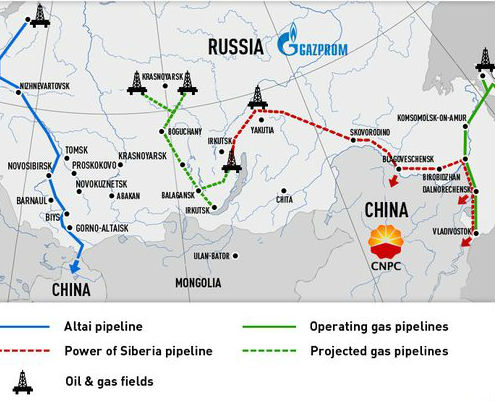

World News: China and Russia Begin Work On Power of Serbia Pipeline

Russia’s Gazprom and China National Petroleum Corporation (CNPC) have confirmed that construction is underway on the 4,000-km Power of Serbia Pipeline that will deliver up to 38 Bcma of gas to China.

The first joint of pipe for the Chinese sector of the project was recently welded near the city of Heibe in the northern Heilongjiang Province bordering Russia, according to CNPC. Russia started building its section of the 2,500-mile eastern route last year. The pipeline is due to become fully operational in late 2017.

Costs for the gas production and transmission facilities in Russia are estimated at $55 billion. Gazprom head Aleksey Miller said work will begin soon on a second Power of Serbia Pipeline, which will be completed in 2018.

KBR Awarded Eurasian FLNG FEED Contract

Lloyds Energy awarded a near-shore floating LNG front end engineering design (FEED) contract to KBR. KBR will provide integrated topsides and hull engineering design services for a nominal 2.5 mtpa floating natural gas liquefaction plant (FLNG). Start-up of the facilities is expected in 2019.

All LNG-processing facilities, together with the associated utilities and power generation, will be located on the FLNG barges, which will be moored at the end of a new single jetty, about 3.5 km long. LNG storage will be in the barge hulls and loading will be by a separate LNG carrier berth at the end of the jetty.

Lloyds Energy is assessing a range of potential near-shore FLNG locations but has not yet designated a specific location in the Eurasian area for the FLNG contracted to KBR.

“Because of KBR’s strong position within the LNG market, the company can satisfy the needs of our LNG customers, regardless of the phase of the project,” said Stuart Bradie, KBR president and CEOm, noting that KBR is responsible for one-third of the world’s operating LNG capacity across a range of locations in Africa, Asia, the Middle East and Australia.

Converting Wind Power to Hydrogen for Natural Gas Pipelines

Siemens will start an energy project to convert wind power into hydrogen for re-use as a general fuel or in natural gas pipelines, according to Reuters. Siemens’ electrolysis plant in Mainz is based on Proton Exchange Membrane (PEM) technology, which allows the capture and storage of electricity into hydrogen.

It said the plant can process up to 6 MW of electricity, making it the biggest PEM installation of its kind worldwide and able to supply 2,000 fuel cell cars. PEM technology, which is capable of responding to fluctuations in power production within milliseconds, has been tested successfully by another Siemens partner, utility RWE.

The plant is a collaboration between Siemens, the Mainz energy utility, industrial gases company Linde, and the Rhein-Main University of Applied Sciences. Energy storage is needed by power grids in Germany as they become increasingly vulnerable to gaps in output, as a result of the closure of nuclear reactors and increasing reliance on intermittent green energy such as wind or solar power.

Linde will be responsible for cleaning, compressing, storing and dispensing the hydrogen. It can be fed to industrial uses, or fill tanker trucks to go to hydrogen-based car filling stations, or into the gas pipeline network.

Upstream Projects Remain Strong in Kazakhstan

While Kazakhstan and Azerbaijan have added over 1 MMbpd to the world’s oil supply since 2005, the two countries are diverging in their ability to grow production and influence global supply, reports consulting firm GlobalData.

Anna Belova, GlobalData’s senior upstream analyst covering the former Soviet Union, said both countries have centered their growth strategy on giant offshore fields in the Caspian Sea. However, while the Kashagan field in Kazakhstan has yet to move into uninterrupted full-field development, the Azeri-Chirag-Guneshli (ACG) project in Azerbaijan has already achieved its peak production and is declining.

“While ACG is expected to decline in the near-to-midterm, the operator’s commitment to development and injection well drilling will ensure maximum reserve recovery under the contractual terms,” said Belova. “With Shah Deniz 2 expansion scheduled for first gas in 2018, additional condensate volumes will partially offset the overall crude decline forecast for Azerbaijan in the midterm.”

In Kazakhstan, the giant offshore Kashagan project is expected to start commercial flows in late 2017, following the resolution of leakages in pipelines due to produced fluids’ high sulfur content. By 2020, Kashagan is expected to add about 400,000 bpd of crude to Kazakhstan’s production.

Belova said reserve replacement over the past decade has been driven in both countries by discoveries and extensions at the aforementioned giant fields.

“Smaller fields that do not require involvement of major international companies are essential to developing domestic industry and local service companies, as well as strengthening Azerbaijan and Kazakhstan’s national oil companies,” she said.

Changes to Kazakh licensing encourage exploration in the country, while the Velikoye discovery just across the border in Russia, with estimated recoverable reserves of over 2 Bbbls, shows the exploration potential in the region.

Chinese NOCs Consider Options Amid Gas Supply Glut

Only 12 months ago, the Chinese gas market looked set to continue its relentless pace of growth, which averaged over 15% annual during the previous decade, according to Wood Mackenzie.

Now, according to a report by that company, as a result of a range of underlying factors – including weaker economic growth, low oil prices, mild weather and high domestic gas prices – demand growth for 2014 reached just over 5%. Consequently, the outlook for domestic investment and production is challenging.

Wood Mackenzie said while production growth continues, changes are looming with NOCs expected to curtail domestic output from some projects by as much as 25 Bcm between 2015-17, compared to earlier Wood Mackenzie forecasts.

The analysts expect the NOCs to pursue several options, including maximizing contracted LNG volumes to sell into the domestic market, particularly as term and spot prices look competitive against regulated city gate tariffs due to low oil price.

PetroChina is expected to manage overall volumes of pipeline imports using take-or-pay provisions, with the potential for spot volumes above take-or-pay during periods of peak demand. NOCs are expected to restrict some domestic investment in more expensive developments and defer investment until demand recovery.

Even so, the report said China will be unable to absorb all contracted LNG and some volumes will need to be re-sold into an already over-supplied Pacific market.

Comments