February 2015, Vol. 242, No. 2

Features

Energy Forecast Predicts Rising Gas, Oil Demand As Global Middle Class Grows

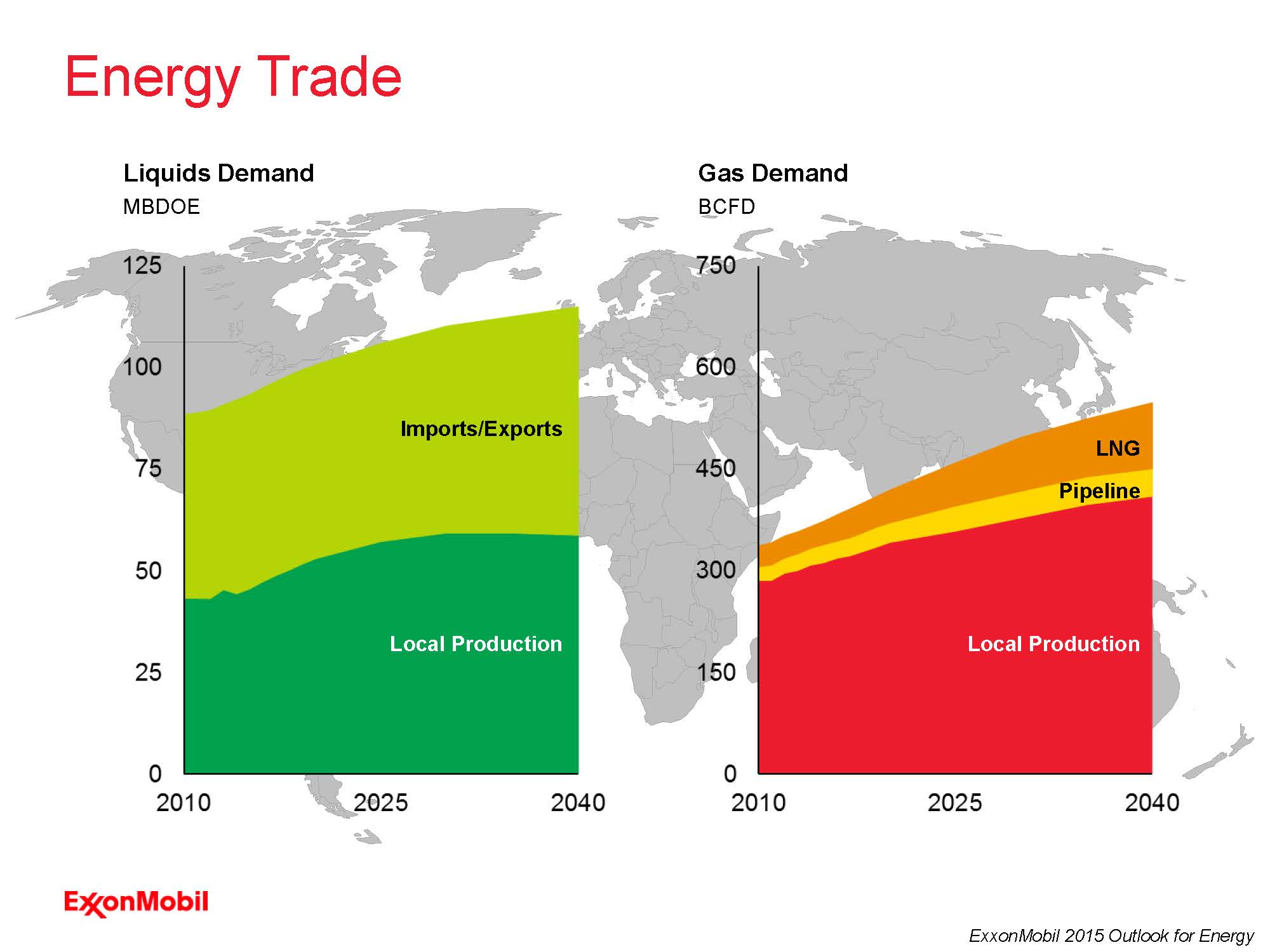

ExxonMobil’s 2015 energy forecast posits natural gas as the fuel with the most demand growth between now and 2040, overtaking coal as the second most popular energy source with a 65% gain vs. its 2010 levels. By the end of the period, the report predicted more than 125 Bcf/d will be shipped by LNG or inter-regional pipeline.

Bill Colton, vice president of corporate strategic planning for ExxonMobil, presented the report Dec. 9. He said the transport of energy is crucial to the forecast’s predictions of progress.

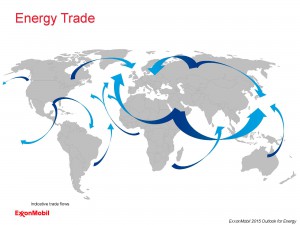

“If energy is the lifeblood of the world economy, then surely free trade is the circulatory system that keeps things flowing in a healthy way,” Colton said. And net energy moved is only part of the picture. “Even regions that are fairly well balanced will have significant imports and exports just to optimize their own energy system.”

Colton said most gas exports would be accomplished via LNG shipments, which will triple, flowing to Asia and Europe from the Middle East and Russia.

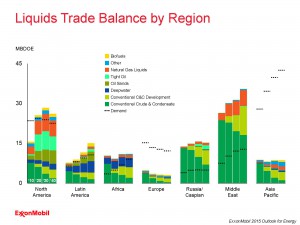

Most energy trade overall will follow these routes, as European and Asian production will fall far short of demand. North America is expected to produce enough liquids and gas to become a net exporter, while Latin America will produce slightly more liquids than it requires. Exports from Africa will go down as local demand rises. Russia will remain the world’s most abundant producer of gas, and oil surpluses will come from the Middle East and Russia.

A non-dominant but significant trade of transport North American fuels to South America, Europe and Asia is also projected.

Colton emphasized regardless of prices oil is expected to remain the most used source of energy, based on its energy density. Renewables are expected to gain significantly in market share, but their present small footprint means even large percentage gains will not affect demand for other fuels significantly.

Growth in energy demand is projected at 35% by 2040, led by a rapidly expanding global middle class. Colton said China, India and ten “key growth” countries – Mexico, Brazil, Nigeria, South Africa, Egypt, Turkey, Saudi Arabia, Iran, Thailand and Indonesia– will effectively embody all energy demand growth. China is expected to equal the OECD in electricity generation by 2040.

The growth in demand will be mainly seen in increased power generation as standards of living go up worldwide. Citing figures from the Brookings Institution, the report predicts that by 2030 an additional 3 billion people will join the 2 billion considered as middle-class worldwide today.

The expectations in the report largely mirrored ExxonMobil’s previous predictions for the period. Asked about a study published in Nature in December, in which a team of researchers from the University of Texas at Austin calculate a lower level of recoverable gas reserves in the major U.S. shale plays than previously predicted, Colton dismissed the idea that the supply forecasts in recent years had been inaccurate.

“We’ve looked at [the study], and based on our experience, we see a big underestimation of the role that technology plays. We frankly just disagree,” Colton said. “Our own experience in operating our wells here in North America is that we see increased productivity over time, producing more from a single pad just figuring out the way the rocks are performing and then adjusting as we go. Our experience, as well as the experience of the development of technology in this area, really doesn’t support [those conclusions]. It’s a vast, increasing technological play for the industry.”

Comments