February 2016, Vol. 243, No. 2

Features

Production Rates in Tight Oil Formations Still Rising

Tight oil production in the United States increased from 2007 through April 2015, based on estimates in EIA’s Drilling Productivity Report (DPR), and accounted for more than half of total U.S. oil production in 2015.

Tight oil growth has been driven by increasing initial production rates from tight wells in regions analyzed in the DPR. As drilling techniques and technology improve, producers are able to extract more oil during the initial months of production from new wells.

The average new well in each of these regions produces more oil than previous wells drilled in the same region, a trend that has continued for nine consecutive years. The increasing prevalence of hydraulic fracturing and horizontal drilling, along with improvements in well completions and the ability to drill longer laterals, has greatly improved well productivity.

This trend can be seen in the continued increase in initial production rates since 2007, and it has allowed production in major shale basins to be fairly resilient despite high decline rates common to drilling and producing in tight formations and, since 2014, the declining number of rigs drilling for oil.

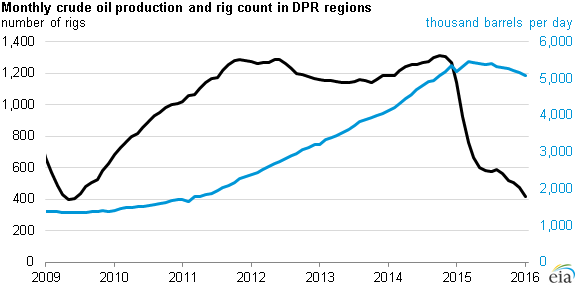

As falling global oil prices led to significant reductions in rig counts and well completions in all DPR regions, remaining rigs are concentrated in high-producing areas. The total number of rigs in DPR regions has fallen from a high of 1,309 rigs in October 2014 to 475 in December 2015, a decrease of 64%, while the production levels in those months have declined by only 8% from their peak in March 2015. Production estimates in DPR regions represent a subset of total U.S. crude oil production. More comprehensive data are available in EIA’s Petroleum Supply Monthly.

High decline rates over the first year or two of production from tight oil plays mean that more new wells are required than in non-tight formations to offset production declines from legacy wells. As the rig count in these regions continues to decline because of low oil prices, there are not enough new wells to overcome the decline from legacy wells. Tight oil production in three of the four most productive regions (Eagle Ford, Bakken, and Niobrara) began to decline during 2015 as rig counts have fallen near or below the relatively low levels during 2009.

Only in the Permian region has the significant reduction in rig count not resulted in lower production. This outcome is because most of the rigs that left the region were vertical rigs, whereas the remaining active horizontal rigs continue to target low-permeability formations similar to those in the Bakken and Eagle Ford.

Additionally, unlike the other regions discussed, the Permian has a large number of non-tight (conventional) wells. Although these wells do not produce as much as horizontal wells, they have slower production decline rates and thus do not need as many new wells each month to compensate for legacy declines. However, the most recent DPR shows the total rig count in the Permian falling below 200 rigs for the first time since 2010, and production declines are likely to occur in the near future.

Principal contributors: Michael Mobilia, Jozef Lieskovsky and Richard Yan, Energy Information Administration

Comments