May 2025, Vol. 252, No. 5

Features

North Dakota’s Bakken Basin Set for Midstream Comeback, Experts Say

By Richard McDonough, U.S. Correspondent

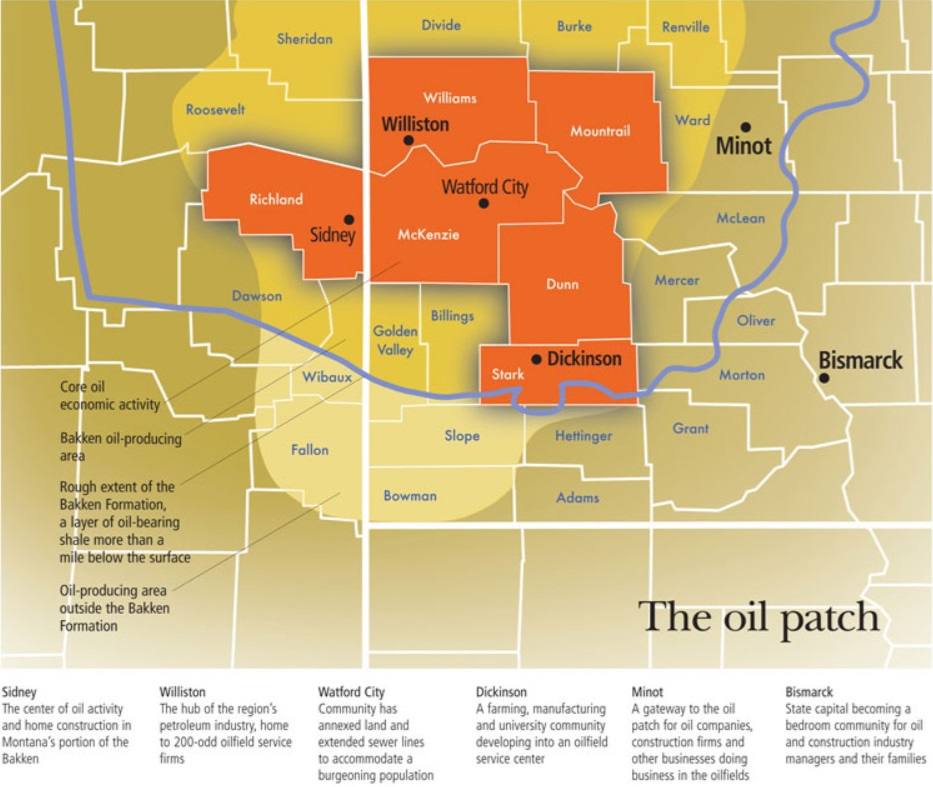

(P&GJ) — The Bakken formation has seen its ups and downs during the past 15-plus years. Today, leaders in the oil and gas industry see growth in the region.

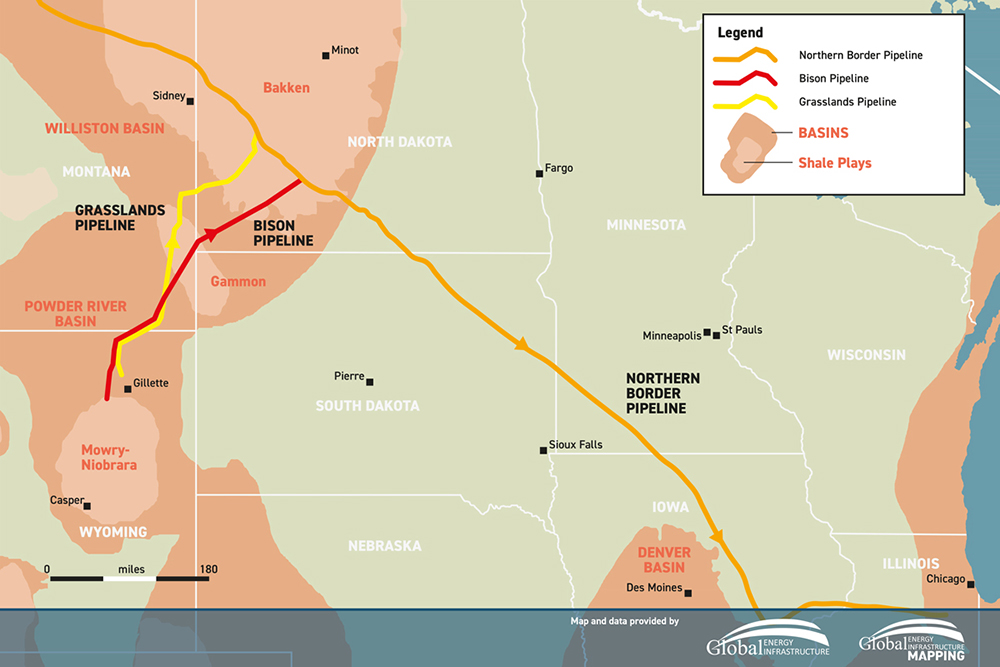

Expansion of the existing pipeline network is underway, with miles of potential pipelines under consideration. North Dakota has 30,000-plus miles of pipelines, primarily for gathering as well as the transmission phase. The growth in pipeline construction peaked in 2012, according to the state.

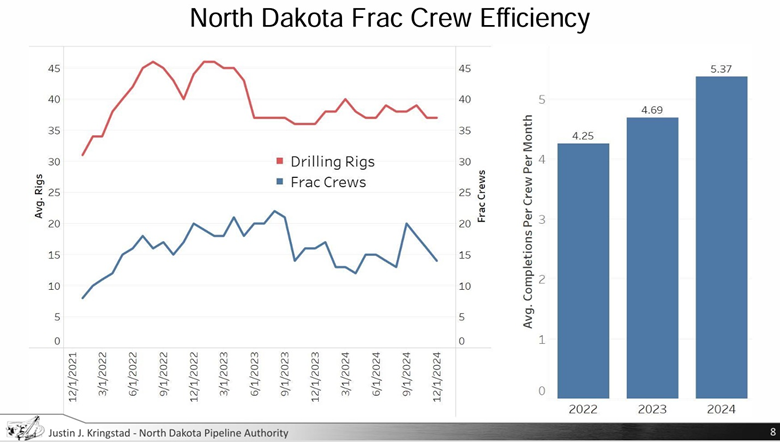

“The slowdown that you see, while it seems dramatic, falls right in line with the number of rigs and drilling activity and the concentration of drilling activity,” said Justin Kringstad, director of the North Dakota Pipeline Authority. “The way that operators were performing their drilling strategies in those early years is much different than [the way] they’re performing today with their infill strategies, and so we’re seeing a smaller number of miles of pipe, but more strategic miles of pipe as far as pipe diameter, compression and the ability to move product.”

“We want to be north of 80 well completions per month to really at least keep production stabilized when it comes to oil,” he added.

Kringstad said for years the focus had been on the drilling rig count, but the count he is most concerned with now is the frack crew count. He believes 14 is the “bare minimum” needed to keep production stabilized.

“If we get above 14, assuming some 3-mile lateral and coming up some four-mile lateral development, that’s really the sweet spot to get production back on a growth trend,” Kringstad said.

He explained that transport by pipeline has supplanted much of what was once transported by rail from the Bakken region.

“We’re in a new dynamic,” said Kringstad. “A number of years ago, we were highly talking about crude by rail movements. We’ve seen that level off over the last number of years — typically now trending around two trains per day on average leaving North Dakota.”

That number is down from the peak of 10 to 12 loaded rail trains leaving the region on any given day now, with trains primarily going to the West Coast.

“We’re still in a very good position today for crude oil movements with the elective use of rail to reach the markets that we can’t get to by pipeline,” Kringstad said. “So, things look very, very positive assuming all systems stay in service — that there’s no retirements, outages or anything unexpected there.”

With anticipated continued growth in the energy sector in the Bakken region, pipelines may be able to help mitigate challenges likely to come in the next few years.

Map: Global Energy Infrastructure

Regarding natural gas production in North Dakota, the processing outlook appears strong in the near term. Hess has announced an expansion in 2027, but going forward, there appears to be a shortfall in statewide gas processing.

“We find ourselves in this chicken-or-egg scenario,” Kringstad said. “You need both transmission and processing, along with gathering compression — all of these things need to come together. If we don’t have a transmission solution, all the gas processing in the world will be for naught, if you have no place to move the gas from that gas plant to.”

Kringstad foresees a need for expanded pipeline capacity in several parts of the state. The Northern Border system — the primary means of moving natural gas out of the region — currently uses 80% to 90% of that pipeline, which is filled with Bakken natural gas. The other mix comes from Canada. At 90%, the remaining 10% is held by Canadian producers that have transport capacity on the Northern Border pipeline.

“Our base case says we start to run into problems in early 2027; the low case scenario would say out in the 2029 time-frame,” Kringstad said. “We run into problems where we’re out of capacity even with one of the other projects, notably the Bakken xPress.”

East of Bismarck, with the Alliance Pipeline, is an area of need for expansion to areas of North Dakota that are either underserved or unserved.

Planning for additional pipelines involves both commitments from private sector businesses as well as strong support from governmental entities. Kringstad indicated that North Dakota is well-positioned with both.

“No one wants to build the last gas pipeline,” he said. “They don’t want to build the last pipeline that may or may not have full utilization, and so there’s a tremendous amount of risk that the developers try to alleviate through these commitments.”

North Dakota has committed up to $30 million annually to potentially be used to fill any gaps in funding for new pipelines in the state. The funds provide a tool that could be used alongside private sector funding to build new pipelines in North Dakota.

Federal Reserve

“Two changes in the past 10 years have affected the Bakken,” said Joseph Mahon, Regional Economist at the Federal Reserve Bank of Minneapolis. “Both technology and the infrastructure have changed. Producers have determined that production can remain at a certain level even without additional rigs.”

The transport of the oil produced in the Bakken has also changed. At first, a great deal of the oil was shipped by rail, but that has given way to pipeline transportation. Additionally, the Covid pandemic affected production in the region.

“There was a drop-off again in the Bakken,” said Mahon. “There’s been some recovery, but not like the surge in growth that occurred before the pandemic. Production has plateaued since then.”

The cost of capital has increased, too. Although drilling rig count grew slightly in recent years, there has been little exploration activity. Additionally, access to the available workforce during the past 15 years has also hampered growth in the region.

“The Bakken was one of the few areas of the country that had plentiful jobs available in the years after the Great Recession,” Mahon said. “At that time, the Bakken was able to grow by pulling in labor from around the country. Today, the labor market is tight in much of the nation. It’s a limiting factor here.”

EIA View

The U.S. Energy Information Administration (EIA) projects that crude oil prices will generally decline from mid-2025 through the end of 2026, as growth in global oil production outpaces growth in oil demand. The current forecast calls for the Brent price to average $74/bbl this year and $66/bbl in 2026.

These expectations take into account the completion of the Wahpeton Expansion Project (21 MMcf/d) in 2024, as well as FERC approval to begin construction of Northern Border Pipeline Company’s Bison Xpress expansion project (300 MMcf/d), which runs from North Dakota to Wyoming. The EIA noted that the indicated target in-service date for this pipeline is February 2026.

In a report issued on Oct. 31, 2024, the EIA detailed that the share of natural gas produced relative to crude oil has historically been relatively low, averaging only 1.2 Mcf/b (16% of total production) in 2014. However, the gas-to-oil ratio (GOR) increased to 2.9 Mcf/b (33%) in 2024, with average gross natural gas production increasing 186%, compared with 2014, while crude oil production increased just 14%.

The Short-Term Energy Outlook, released by the EIA on Jan 14, included projections for 3.3 billion cubic feet of natural gas to be produced per day (Bcf/d) in the Bakken region in 2025. This compares to 2.8 Bcf/d of natural gas, 3.1 Bcf/d of natural gas in 2023, and 3.3 Bcf/d produced in 2024.

The EIA also included in that Energy Outlook its projection for 1.25 MMbpd of oil to be produced in the Bakken region in 2025. This compares to 1.08 MMbpd of oil produced in 2022, 1.21 MMbpd oil produced in 2023 and 1.23 MMbpd of oil produced in 2024.

Petroleum Council View

Prior to the drop in oil production, due to the COVID-19 pandemic, oil production was approaching 1.5 MMbpd, according to the North Dakota Petroleum Council. The years since have seen some recovery.

“Completion technology continues to improve in the Bakken, three-mi lateral wells have expanded the core area of the play, and the productivity of those wells continues to improve,” said Ron Ness, president of the North Dakota Petroleum Council.

He explained that the oil industry in North Dakota has a tremendous impact on the state overall, with oil taxes paying more than 50% of all the taxes paid in the state.

Pipelines help carry the bulk of the oil produced in the Bakken region to several different markets.

“The Dakota Access Pipeline is the largest market, carrying oil to midcontinent refineries and the Louisiana Gulf Coast markets,” Ness said. “Other markets include Great Lakes area refiners and niche markets reached by rail throughout the United States. The majority of Bakken oil is transported by pipeline, with some oil moving at markets warrant via rail.”

Ness said the council anticipates a push for research and investment into enhanced oil recovery. Oil operators continue to improve efficiency and oil recovery techniques.

“Expanding this next phase of development using CO2 and natural gas to enhance recovery is the breakthrough North Dakota policymakers are looking to stimulate with research partnerships,” Ness said.

Federal policies on energy production, now under review in Washington, D.C., have affected the Bakken region, according to Ness.

“Burdensome, duplicative and costly federal regulations pose a significant risk to the industry’s ability to maintain oil production as development and operational costs are inflated,” he said. “We continue to see natural gas production grow in North Dakota. There are numerous value-added industry projects across the state utilizing natural gas being permitted and planned.”

Gas-to-Liquids

One of those value-added projects in the Bakken region is a gas-to-liquids (GTL) facility planned by Cerilon of Calgary, Alberta, Canada. It is scheduled to be the first large-scale, natural-gas-fed GTL facility to be built in North America, according to the company.

In late December 2024, the North Dakota Department of Environmental Quality issued a North Dakota Pollutant Discharge Elimination System Permit for Cerilon GTL North Dakota. The company noted that this was the final major permit required for the project.

“We’ve designed the project with a focus on minimizing impacts on both the community and the environment, and [we] have worked hard to meet the state’s high expectations,” said Ron Opperman, CEO of Cerilon GTL. “Receiving this final major permit means we’ve successfully delivered on a project design that meets or exceeds these expectations. In addition to producing valuable products, the project will also contribute to energy security in North Dakota by reducing reliance on energy imports.”

Some specific details on this energy development:

“The facility will also include carbon capture and sequestration, making this nominally 24,000 barrel-per-day facility the first of its kind in the world,” said Rochelle Harding, director of Sustainability & Engagement at Cerilon. “This innovative facility will transform natural gas into unique, high-performance synthetic products, including industry-leading Group III+ base oils, ultra-low sulfur diesel and naphtha.”

Harding indicated that direct customers are most likely to be large energy and lubricant companies.

She highlighted several aspects of this planned energy project.

“There is a surplus of natural gas in North Dakota and a strong market for lower-carbon energy products,” said Harding. “This project will create superior quality products. GTL-derived products are higher quality and burn more efficiently than their crude oil-based counterparts.”

WBI Energy

One of the major players in the Bakken region and beyond is WBI Energy. The company reported that it has the capability to transport more than 2 Bcf/d from the Bakken region and currently owns and operates more than 3,800 miles of natural gas transmission and storage pipelines located in North Dakota, as well as in four other states.

The newest pipeline of WBI Energy began operations in December of 2024 — the Wahpeton Expansion Project. This pipeline included the construction of approximately 60 mi of new pipeline, serving the North Dakota cities of Wahpeton and Kindred, according to the company.

“Bringing the Wahpeton Expansion Project online in late 2024 marked the culmination of an almost three-year process of design, regulatory applications and approvals and construction, as well as collaboration with landowners and other stakeholders,” said Mark Snider, spokesperson for WBI Energy. He added:

This milestone project will help fuel growth to communities and businesses in the region. It also reflects the customers’ confidence in WBI Energy to continue providing safe and reliable transportation of a valuable resource that improves our region’s economy and way of life.

Further expansion of its pipeline operations is planned.

The initial design of the project includes 375 miles of new 30-inch and 24-inch high-pressure steel pipeline compression and various measurement and interconnection facilities. WBI Energy recently completed a non-binding open season to gauge interest in a pipeline from the Bakken region to serve new power generation, industrial and local distribution company demand in central and eastern North Dakota.

“Based on this initial design, the project could have a capacity of up to 760,000 cf/d,” Snider added. “The final design of the project will ultimately depend on the results of the open season and any subsequent binding open season(s). The first phase of the project has a targeted in-service date of late 2028, and the second phase has a target date in late 2029.”

Snider explained that WBI Energy considers a number of items as it identifies potential routes for pipeline rights-of-way.

Author: Richard McDonough writes about energy infrastructure-related issues in the United States, including the column The Nuacht of Pipelines. He can be reached at newsaboutamerica@gmx.us.

Comments