January 2016, Vol. 243, No. 1

Features

Changing Contract Expiration Dates to Alter Crude Futures Comparisons

A change to the North Sea Brent crude oil futures contract will change the way prices for Brent futures are compared to futures prices for West Texas Intermediate (WTI) crude oil, according to a new report by Energy Information Administration (EIA).

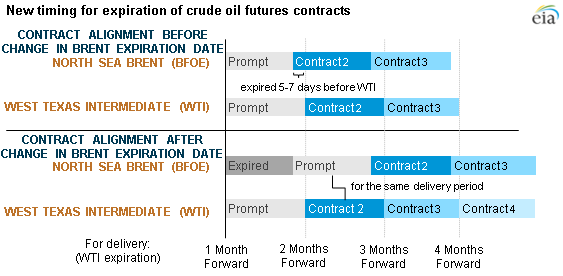

Beginning Jan. 29, the Brent contract will expire, or rollover to the next month, about two to three weeks before expiration of the WTI contract for delivery in the same month. Prior to the change, the Brent contract rollover was only five to seven days ahead of the WTI rollover.

With earlier expiration dates for the Brent contract, the prompt month prices for Brent and WTI represent the same delivery period on fewer days each month. For example, on Monday, Feb. 1, the prompt Brent contract will represent crude oil deliveries in April, while the prompt WTI contract will represent deliveries in March. The mismatch will continue for most of the month until the WTI contract for March delivery expires on Feb. 22.

Crude oil futures contracts allow crude to be bought and sold for delivery at specific dates in the future, allowing market participants to lock in a price today for the future delivery of a barrel of oil. One of the roles of futures markets is price discovery, or price determination in a marketplace of buyers and sellers.

Two of the most important crude oil futures benchmarks are Brent, which trades on the Intercontinental Exchange (ICE) in London, and West Texas Intermediate (WTI), which trades on the New York Mercantile Exchange (Nymex) in New York.

Both futures contracts have an underlying physical crude oil trade basis: cargoes of North Sea Brent, Forties, Oseberg, Ekofisk (BFOE) crude oils for the Brent contract and crude oil deliveries to the crude oil storage hub of Cushing, OK for WTI. The changing of the expiration date of the Brent futures contract is intended to better align the timing of when BFOE cargoes are bought, sold, and loaded onto tankers.

The difference between Brent and WTI prices, the Brent-WTI spread, is an indicator of global oil flows and market dynamics. Historically, the prompt month (the most immediate delivery) contracts for both Brent and WTI were for the same delivery month, for example, March Brent v. March WTI, except for the five-to-seven-day period between the rollover dates of the contracts.

When the delivery dates for the prompt month contracts are aligned, the spread between the two prompt contracts reflects the economics of importing crude oil to the U.S. Gulf Coast vs. shipping it from Cushing by pipeline.

With the earlier expiration dates for Brent contracts now being implemented, the two prompt contracts will reflect the same delivery month much less frequently. In fact, delivery dates are more likely to be aligned by comparing the Brent prompt month futures contract with the WTI futures contract two months ahead.

Alignment of delivery dates is especially important when there is a difference between the price of near-term and longer-dated deliveries of crude oil futures. When near-term deliveries are priced above longer-term deliveries, the market is said to be in “backwardation.” The reverse situation is known as “contango.” Accurately comparing the two futures contracts for similar delivery dates avoids introducing artificial backwardation or contango to the Brent-WTI spread.

EIA’s January Market Prices and Uncertainty Report (MPUR), a supplement to the Short-Term Energy Outlook (STEO), discussed the effect of changing expiration on the Brent contract’s open interest for February and March futures. Future EIA analysis and publications will discuss the Brent-WTI futures spreads using contracts with the most relevant alignment of delivery dates.

Principal contributors: Mason Hamilton, Jeff Barron, Energy Information Administration

Comments