January 2016, Vol. 243, No. 1

Features

Mexico: An Expanding Market for Infrastructure, but Dependent on Reforms

A consultant in his native Mexico, Arturo Palacios is more than willing to share his considerable views on what’s going on in his nation, but he also suggests that anyone in the U.S. energy sector wanting to do business south of the border should do their homework.

He can suggest websites, government agencies, industry associations, companies and consultants, all of which can provide public information relevant to understanding Mexico’s latest national effort to open up its rich energy sector to more foreign investment.

High among his suggested information sources is Petroleos Mexicanos (Pemex), the Mexican government-owned oil/natural gas company that is central to the nation’s ongoing reform program. Pemex itself is being reformed from the inside out, according to Palacios, who has been watching the state-owned energy giant for years as part of his work at Mexico City-based Rodriguez Davalos Abogado.

While a steady decline in Mexico’s oil production in recent years and the aggressive agenda of the current president have been major drivers for the Energy Reform that began in 2014, the state of Pemex and its need for fundamental change also are driving the latest push that has been endorsed and enshrined by the national Congress. In essence, if Mexico is going to succeed in its long-sought efforts to bring in more foreign investors in its energy industry, look for an entirely new brand of Pemex to emerge in the months and years to come.

Informed sources like the U.S. Energy Information Administration (EIA) say energy is a really big deal in Mexico, but Palacios noted for a recent gas industry conference in Los Angeles that hydrocarbons overall represent less than 7% of Mexico’s gross domestic product. Nevertheless, Pemex provides about 35% of the national government’s revenues. That is a big deal, indeed.

“Pemex is taxed on the sales of oil, not on profits,” Palacios told the audience at the LDC Gas Forum Rockies & the West conference last fall. “Sixty percent of those sales are paid in taxes to the federal government, leaving 40% of all income to cover the costs of the national energy company’s operations. It is different than any other country in the world, and is a model that worked at one time, but it is no longer sustainable.”

While remaining a state-owned company in coming years, Pemex now has to be operated as a private company, said Palacios, noting that to implement the national government’s mandated market Reforms “it is recognized that Pemex has to change into a productive, state-owned company.” Losses that have been covered in the past by the government won’t be starting in 2016. “It will have a separate budget and will have to live within it.”

As Mexico’s energy sector seeks to attract more private sector partners on both sides of its U.S. border, Pemex will be seeking to remake itself into an attractive, flexible and well-managed partner for the private sector. As such, Palacios noted that the newly developing Pemex will be able to acquire/own interests in other companies, enter private sector alliances/partnerships, issue financial guarantees/credit instruments, and sign contracts under commercial law in Mexico. This freedom and flexibility was not possible in the past pre-reform era.

“Private investors – either Mexican or foreign companies – now are allowed to participate in every aspect and activity involving oil and natural gas,” Palacios said. “Before the Reforms, only natural gas pipelines and storage projects were open to private companies.”

Last summer, a UK-based consultant with Douglas-Westwood (DW) in London reiterated that Mexico’s energy sector was “entering a new era” with the national government seeking to kick start the nation’s lagging offshore development in the Gulf of Mexico. DW expects the level of drilling to ramp up substantially in the next few years into 2020, but production still may be relatively anemic at an annual compound rate of less than 1% (0.3%).

“Despite low oil prices, the government has remained committed to auctioning its offshore blocks, keen to drive international investment,” said DW’s Iva Brkic.

Compliance risks and corruption remain major issues south of the border, according to a New York City-based communications consultant familiar with a PricewaterhouseCoopers (PwC) analysis of 12 recent corruption-settlement cases processed over the past 15 years. About two-thirds of the bribes paid to government officials were made by business partners, according to PwC’s analysis.

As a result, the New York consultant stresses four key points for companies wanting to do energy business there:

- Effective anti-corruption programs must be supported by the highest levels of management, including boards of directors and their audit committees.

- Companies in Mexico should document periodic risk assessments as part of efforts to identify bribery risks.

- About 92% of the bribery cases included payments to some kind of business partners and 72% of those cases involved legitimate business partners representing companies in front of Mexican authorities.

- Employees of companies moving into Mexico need training and knowledge on the nature of corruption and anti-corruption laws.

Consider the environment in late 2015: Mexico is a significant oil exporter, the third-largest in the Americas, but the nation also is a net importer of refined petroleum products.

“Mexico’s largest trading partner is the United States, which is the destination for most of its crude oil exports, and the source of most of its refined product imports,” said the authors of a U.S. EIA report on Mexico released last fall.

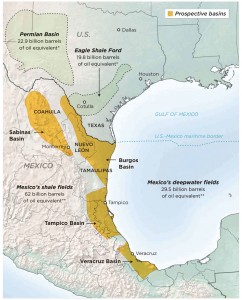

Reserves in Mexico are cited cautiously by the EIA, attributing them to industry trade publications. Nevertheless, at the end of 2014, there were supposedly nearly 10 billion barrels of proved oil reserves and up to 17 Tcf of natural gas reserves. There are no international oil pipeline connections; most exports are shipped by tanker. Mexico has six refineries with a collective capacity of 1.54 MMbpd, the EIA analysis showed.

Last fall, Mexico revealed plans for spending close to $10 billion by 2019 to construct up to 12 natural gas pipelines, totaling collectively about 3,100 miles of gas infrastructure for the nation’s pipeline network. The buildout relates mostly to a longstanding national goal to switch from oil to gas-fired electric generation through an initiative of Comision Federal de Electricidad (CFE). Some of the projects are already under development; others plan to hold bidding processes.

“The projects are promoted by Pemex and CFE to strengthen the natural gas transmission network,” said Palacios, adding that overall there are projects totaling 12,000 miles of pipelines and $30 billion in investment. “A second effort to upgrade the infrastructure was announced last June [2015] involving 24 new bidding processes covering both gas transmission and power generation.”

He cited five gas pipeline projects underway in 2015 totaling about 1,500 miles, nearly 8 Bcf/d of capacity and $11.62 billion.

“Power generation through these infrastructure projects will fundamentally increase gas demand in Mexico,” said Palacios, and since it will take several years for the Reforms to boost Mexico’s own domestic production of oil and gas, in the next few years the nation will depend on ever-increasing imports of gas from the United States.

Among the projects in play is a $3 billion, 500-mile undersea pipeline proposed from South Texas to Tuxpan in the state of Veracruz. It is another project aimed at serving new and converted power-generation plants in the states of Tamaulipas and Veracruz. In total, new pipelines are now scheduled to cross 16 of Mexico’s 31 states. In 2015, CFE listed up to 12 separate proposed pipelines on its website.

While noting the restructuring in Mexico’s power sector at CFE was “more complex” and less clear in 2015, Palacios said the most important change ongoing in oil and gas is clearly the need to transform Pemex into a profitable business entity.

“Pemex’s business plan includes associations with various private companies, particularly U.S. companies, to assure operating efficiencies,” he said. The “balance and strength” should come from the partnerships with private companies, he thinks. This will continue to manifest itself in U.S. exports to Mexico and investment in its transportation buildout.

“As it applies to the oil sector, the newly enacted Energy Reforms allow for greater outside investment in E&P [exploration and production] and other activities in the natural gas sector,” EIA said in its September 2015 report. “The Reforms allow for new E&P contract models – licenses, production-sharing, profit-sharing and service contracts. Pemex will remain state-owned but will be given more budgetary and administrative autonomy and will have to compete for bids with other firms. New and expanded regulatory authorities are also being contemplated, including a new environmental agency, Agencia de Seguridad, Energia y Ambiente [ASEA].”

California-based Sempra Energy’s CEO Debra Reed told financial analysts’ conference call listeners in November that Mexico presents a “wonderful growth platform” for Sempra’s Mexico City-based IEnova unit for which a successful initial public offering fetched over $1 billion in 2014. Reed saw “layers of opportunity” south of the border where Sempra has been active with LNG and numerous distribution/transmission pipeline projects during the past 10 years. She pledged at the time to be actively involved in bidding on $6 billion of new Mexican pipeline projects in 2016.

“Now some of the [onshore] oil properties are beginning to be taken over and produced, and we see some great opportunities to do liquids pipelines that will have takeaway capacity from some of the Pemex properties now being developed,” Reed told analysts. “There is also potentially gathering and processing infrastructure to be developed in the area.”

Reed added a shout-out for Sempra’s existing pipeline assets already in place in Mexico as being potential added investment opportunities in upgrades and expansions. “With the great pipeline backbone that we have, we can also increase capacity by adding industrial customers and we’re working on that pretty vigorously,” she said, agreeing that “there are a wealth of opportunities in Mexico.”

Sempra companies began projects in Mexico over 20 years ago when the Mexican government first opened downstream natural gas segments to private investment. Before the more recent Reforms, Pemex kept a monopoly on gas exploration, but the government did allow private-sector participation in non-associated gas E&P activities. When it opened the downstream to private companies in 1995, they were restricted to one function (transportation, storage or distribution), which a regulatory agency was established to oversee, Comision Reguladora de Energia (CRE).

As EIA pointed out in its latest overview and analysis of Mexico’s energy marketplace, there has always been a national energy secretary in Mexico, Secretaria de Energia (SENER), and a general hydrocarbons agency, Comision Nacional de Hidrocarburos (CNH). “The Reforms also call for expanding the regulatory authorities of SENER and CNH, along with creating a new environmental protection agency [cited earlier, ASEA],” EIA’s report noted.

Coming off recent years of modest declines in Mexico’s domestic, dry natural gas production, the relative higher prices for oil than gas have historically kept Pemex officials favoring oil development over gas. For the most recent full year of statistics, 2014, 147 MMcf of gas was vented and flared, amounting to nearly 30% of the nation’s total gas production. In 2014, over two-thirds of Mexican production was associated with oil.

EIA said Mexico is beginning to explore and produce shale gas which is an extension of the Eagle Ford play extending southward from Texas. The first Mexican shale gas was produced in 2011 in northern Mexico, and later that year the federal government announced a significant discovery in the same area. Pemex reportedly has been pursuing 10 test wells since early 2014.

“Although Pemex has allocated a small share of its budget to shale gas development, the sector is unlikely to grow rapidly without improvement in Pemex’s financial situation, technical abilities, and terms for investors,” stated EIA’s analysis, noting the new Reforms could bring in foreign firms to pursue shale development.

When private investment was allowed in the downstream gas sector, Mexico was divided into distribution regions and new local pipeline systems were created, but these are concentrated in the major population centers. Palacios pointed out that only about 10% of the nation geographically has natural gas service.

“There are several states with no gas pipelines,” he said, noting that 90% of the country is ripe for further gas infrastructure development. A wider gas pipeline network in Mexico will only become a reality after the first of the national market and regulatory Reforms are completed, Palacios thinks. “Until then, the gas distribution transportation in the country will remain limited.”

Ultimately, Palacios sees the energy market in Mexico as being big enough to support many different U.S.-based companies. In the initial bidding for projects, mainly large, well-established companies will compete, he thinks, but by what he called the second stage, there will be many opportunities for small- and medium-sized businesses. “These other companies eventually will find the right niche,” he said.

“We’re a nation of 110 million people and the 13th-largest economy in the world, so there is enough business for everybody.”

By Richard Nemec, Contributing Editor and West Coast correspondent in Los Angeles. He can be reached at: rnemec@ca.rr.com.

Comments