January 2016, Vol. 243, No. 1

Features

P&GJ’s 2016 Worldwide Construction Report

P&GJ’s 2016 survey figures indicate 94,799 miles of pipelines are planned and under construction worldwide. Of these, 49,848 miles represent projects in the engineering and design phase; 44,951 miles are in various stages of construction.

Following is a list of new and planned pipeline miles in the seven basic regional groups (see area map). North America 34,122; South/Central America and Caribbean 5,085; Africa 6,528 ; Asia Pacific 29,759; Former Soviet Union and Eastern Europe 11,191; Middle East 4,929; and Western Europe and European Union 31,116. For information on these and other pipeline projects, see P&GJ’s sister publication, Pipeline News.

Pipeline Outlook

Now in its 8th edition, the World Onshore Pipelines Market Forecast 2015-2019 from Douglas-Westwood (DW), considers the prospects for the onshore pipelines construction business and values the future markets through 2019 by key component, region, pipeline type and diameter.

DW expects onshore pipeline expenditure to grow modestly to $220 billion from 2015-19, an increase of 14% compared with $193 billion over the preceding five-year period.

The report suggests North America and Asia remain the highest volume markets, accounting for 45% of global Capex. However, fastest growth is anticipated in the Middle East. In total, DW expects almost 192,000 miles of line pipe to be installed. This represents an increase of 11% compared to the previous five-year period.

United States

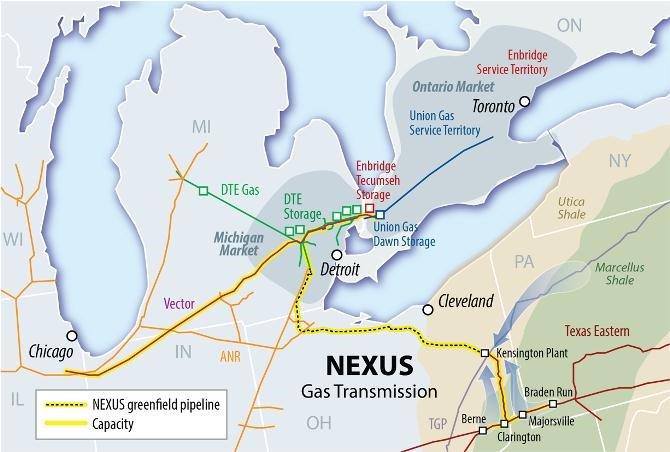

Natural gas production is forecast to rise by 44% by 2040; however, production is unlikely to come from traditional supply areas. Historic supplies from the Gulf of Mexico have decreased 46% over the past five years. The new gas that will replace supplies from the Gulf primarily originate from the Marcellus and Utica shale formations, where pipelines – such as the 250-mile NEXUS Gas Transmission LLC system that will be constructed in Ohio and Michigan by Fluor Corp.

DTE Energy Co. and Spectra Energy Partners, LP, are lead developers of the NEXUS project that is expected to cost $2 billion and deliver incremental production from the Utica and Marcellus plays to meet growing demand for gas by distribution and end-use markets in the Upper Midwest and Canada. Construction is anticipated to begin in early 2017.

The U.S. accounts for several planned projects as well. Already before the Federal Energy Regulatory Commission is an application for the 711-mile Energy Transfer Partners’ Rover Pipeline to move 3.25 Bcf/d of Utica/Marcellus gas to similar markets as the NEXUS Pipeline.

Additionally, the Rover project will include a pipeline segment from the Midwest Hub in Defiance County, OH through Michigan to an interconnection with Vector Pipeline, enabling deliveries to additional points in Michigan and to the Union Gas Dawn Hub in Ontario, Canada.

Energy Transfer Partners LP and Regency Energy Partners have awarded contracts for construction of the 533-mile, 24- and 30-inch Lone Star NGL pipeline from the Permian Basin to Mont Belvieu, TX. The pipeline accommodates Lone Star’s contracted NGL transportation volumes that will soon exceed the company’s existing 290,000-bpd capacity from the Permian Basin.

Pumpco Inc. won a contract for spreads 1-3 and Strike Construction won a contract for spreads 4-7. The facilities are expected to be operational by mid-year and first-quarter 2017, respectively.

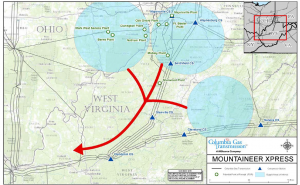

Columbia Pipeline Group, a unit of NiSource Inc., plans two projects to transport natural gas from Marcellus and Utica production areas to markets served by its Columbia Gas Transmission and Columbia Gulf Transmission pipeline systems. The Mountaineer Xpress (MXP) Project calls for 165 miles of various diameter pipeline, three new compressor stations, modifications to three existing compressor stations and a regulating station.

The project would provide an additional 2.7 Bcf/d of firm transportation service from the Marcellus and Utica production areas to markets on the Columbia Gas Transmission system, including markets in western West Virginia, TCO Pool, and mutually agreeable points.

Columbia Pipeline Group’s Leach XPress project involves construction of 160 miles of natural gas pipeline and compression facilities in southeastern Ohio and West Virginia’s northern panhandle. The roughly $1.4 billion investment will transport of 1.5 Bcf/d of gas from the heart of the Appalachian supply basin.

Tennessee Gas Pipeline Co., a Kinder Morgan company, has filed an application with FERC for its proposed Northeast Energy Direct Project (NED). The anticipated in-service date is Nov. 1, 2018.

Four U.S. companies – Dominion, Piedmont Natural Gas, Duke Energy and AGL Resources formed Atlantic Coast Pipeline, LLC to build and own the proposed 564-mile Atlantic Coast Pipeline. The interstate gas transmission pipeline is expected to begin service in late 2018.

Canada

Not surprisingly, the hot topic throughout North America and Canada in particular, is President Obama’s rejection of TransCanada’s Keystone XL pipeline to ship crude oil and diluted bitumen from Alberta’s oil stands to refineries in the U.S. The first three phases of the project have been built. The fourth phase, Keystone XL, calling for a 1,179-mile, 36-inch pipeline to move oil sands from Hardisty, Canada to Steele City, NB and allow product to be shipped to Texas refineries on the Gulf Coast became a political fight for much of the Obama presidency.

Canada still accounts for several new and planned projects, many involving TransCanada. TransCanada was selected by Shell Canada Ltd. and its joint venture partners in the LNG Canada project to develop the 404-mile Coastal GasLine Pipeline to deliver gas from the Montney region near Dawson Creek, B.C. to LNG Canada’s proposed liquefied natural gas facility near Kitimat, The project involves construction with 48-inch pipe along and as many as three meter stations and a compressor station. Initial capacity would be 2-3 Bcf/d.

TransCanada was selected by Progress Energy Canada Ltd. to design, build, own and operate a 560-mile pipeline in northern British Columbia. The Prince Rupert Gas Transmission Project will deliver gas from a point near the District of Hudson’s Hope to the proposed Pacific NorthWest LNG facility on Lelu Island, near Prince Rupert. The project, calling for 485 miles of land pipeline and 68 miles of marine pipeline, will connect production in the Montney fields of northeastern B.C. with the proposed PNW LNG facility on Lelu Island.

Once all approvals are received, right-of-way clearing, with startup of pipeline construction activities will follow shortly.

Mexico

Mexico accounts for several pipeline projects already online or coming online in 2016, namely the Northwest Pipeline 22 System, the Chihuahua Pipeline System and the Los Ramones Pipeline System, which have a total capacity of 4.8 Bcf/d.

The following five recently authorized projects have completion dates well into 2017: Waha to San Elizario pipeline (1.35 Bcf/d); Waha to Presidilo pipeline (1.35 Bcf/d; El Encino pipeline (1.135 Bcf/d; El Encino to La Laguna pipeline (1.35 Bcf/d); and Ramal Tula (0.485 Bcf/d).

These five systems will cost $2.2 billion and will be completed in phases. Mexico will use the resulting imports to initially displace LNG imports at Altamira and eventually at Manzanillo.

TransCanada will build, own and operate the Tuxpan-Tula Pipeline. Construction is supported by a 25-year natural gas transportation service contract with the Comisión Federal de Electricidad (CFE), Mexico’s state-owned power company.

TransCanada expects to invest US$500 million in the 36-inch pipeline and anticipates an in-service date in late 2017. The 155-mile pipeline will have contracted capacity of 886 MMcf/d. Construction should start this year.

South/Central America & Caribbean

Fluor Corp.’s Brazil unit is part of a consortium awarded a contract by Parnaíba Gás Natural (PGN) for engineering, procurement and construction of a natural gas field development project in the state of Maranhão, Brazil. The consortium will construct an 8.5 MMcf/d gathering system in the Gavião Branco field as well as a pipeline to transport the gas to an existing production and treatment facility at the Gavião Real field.

Tipiel S.A., Technip’s subsidiary in Colombia, won a contract by the Consorcio Constructor Ductos del Sura for a pipeline to transport gas from the Camisea field to southern Peru. The project consists of 1,055 miles of 32-inch pipeline.

Technip won a contract from Libra Oil & Gas BV, a consortium of Petrobras Netherland BV (40%) and partners: Shell (20%), Total (20%), CNOOC (10%) and CNPC (10%). The project includes the supply of flexible pipes for the Libra field, located in the Santos Basin pre-salt area, Brazil. Libra is Brazil’s biggest oil field to date and is expected to produce about 1.4 MMbp/d by 2021. Delivery is scheduled to start later this year.

In the Caribbean, BP Trinidad and Tobago LLC awarded Technip an engineering, procurement, installation, and commissioning contract for development of the Juniper project off the southeast coast of Trinidad. Offshore installation is scheduled later this year.

Western Europe & European Union

The word from UK Energy and Climate Change Secretary Amber Rudd is the government’s energy policy will see natural gas playing a central role in future power generation which should increase local pipeline activity. To develop a cleaner, more secure energy network, Rudd said she will consult on closing coal-fired power stations by 2025.

Singapore’s Sembcorp Marine won a $1 billion contract from Maersk Oil to build facilities for the Culzean field in the U.K. North Sea. SMOE Pte Ltd, a Sembcorp Marine unit, will build the central processing facility, two connecting bridges, wellhead platform and utilities and living quarters. The facility will be installed at a depth of 90 meters 145 miles east of Aberdeen in the central North Sea. The field can potentially provide 5% of the UK’s gas consumption by 2020-21.

Subsea 7 will construct a 22-inch, 20-mile gas export pipeline for the project that will connect to the Central Area Transmission System (CATS) and a 2.2-mile pipe-in-pipe for transportation of the condensate to the in-field floating, storage and offloading facility (FSO). Offshore operations should start in 2017.

In Norway, the Norwegian Petroleum Directorate granted startup consents for the Edvard Grieg oil pipeline and the Utsira High gas pipeline, which will serve the Edvard Grieg and Ivar Aasen fields in the North Sea. Startup of the Edvard Grieg field came near year-end 2015; startup of Ivar Aasen field is scheduled in 2016.

Middle East

Spurred by lower prices and ample supply, Middle East natural gas demand is projected to grow through 2040, said International Energy Agency’s World Energy Outlook 2015. Moreover, the IEA projects global demand for gas will rise 1.4% a year to 182 Tcf in 2040, up 50% from 120 Tcf in 2014.

One major gas project in the Middle East is the Pars Oil and Gas Company’s South Pars field where underwater pipelay operations for Phases 20 and 21 began in July. The field is on the Iranian border with Qatar in the Persian Gulf, covering 3,745 square miles, of which 1,429 miles are in Iran’s territorial waters in the Persian Gulf and 2,317 miles are in Qatar’s territorial waters.

Once the 65-mile pipelines for Phases 20 and 21 are completed, platforms for the two phases will be installed. South Pars, divided into 29 development phases, holds an estimated 1,412 Tcf of natural gas, or 21% of the world’s total reserves, and 50 billion bbls of condensate.

In Pakistan, a unit of Russian state company Rostec plans to build a 685-mile gas pipeline to connect Karachi with the provincial capital of Lahore. The Rostec unit, RT Global Resources, will build the $2.5 billion pipeline with capacity of up to 12.4 Bcma of gas. Construction is expected to take 42 months, with the pipeline reaching full capacity in 2020.

Former Soviet Union & Eastern Europe

Russia continues its focus toward exports with several pipelines planned and being constructed. Following cancellation of the South Stream pipeline in December 2014, Gazprom and the Turkish Botas Petroleum Pipeline Corp. signed a memorandum of understanding to build the $20 billion Turkish Stream Pipeline. The goal is to provide security of supplies to Turkey and European countries and bypass Ukraine. However, the project is being delayed by Russia in retaliation for Turkey’s shooting down of a Russian fighter jet in November.

The 56-mile offshore portion of the pipeline would cross the Black Sea. Length of the Turkish onshore section would be 112 miles. Capacity of the four strings total 63 Bcma, with 47 Bcma to be supplied to the Turkish-Greek border.

The region includes several projects involving exports to China. Construction reportedly started in mid-2015 on the Power of Siberia transmission system to provide Russian gas access to China, a new market for Gazprom. The system will convey gas from Irkutsk and Yakutia production centers to consumers in the Far East and China. Total length will comprise 2,485 miles with design capacity of 61 Bcma. Startup of direct supplies to China is scheduled in 2019.

Officials say construction of the Power of Siberia–2 Pipeline that will deliver another 30 Bcma of gas to China will start soon.

Gazprom, BASF, E.ON, ENGIE, OMV and Shell signed a Shareholders Agreement last year to construct the Nord Stream 2 gas pipeline system with capacity of 55 Bcma of gas from Russia to Germany across the Baltic Sea.

Trans Adriatic Pipeline AG (TAP) awarded a contract to Technip for a 540-mile pipeline to transport gas from the giant Shah Deniz II field in Azerbaijan to Europe. The pipeline will connect with the Trans Anatolian Pipeline at the Turkish-Greek border at Kipoi, cross Greece and Albania and the Adriatic Sea, before coming ashore in southern Italy.

Once in operation, the pipeline will open a new route for gas from the Caspian region. It is designed to transport 10 Bcma with potential expansion to 20 Bcma. Completion is scheduled in 2020.

Situated at the Arctic port of Sabetta in the north of Russia and near an estimated 22 Tcm of reserves, the massive Yamal LNG project is one of the few Russian gas export projects not operated by Gazprom. Novatek, Total, and CNPC jointly own the Yamal LNG export project, which has an anticipated construction cost of $27 billion and will eventually supply 16.5 mtpa of LNG to European and East Asian markets, especially China. First exports are scheduled in 2017.

Africa

Despite civil unrest in several African countries, pipelines are being planned and constructed. Ethiopia and Djibouti signed an agreement for a 550-km oil pipeline stretching across both countries. The pipeline will be managed by U.S.-based African infrastructure development company Black Rhino. The project is expected to be completed in three years.

Technip and Heerema Marine Contractors are working for to Total E&P Angola on the Kaombo project off Angola in depths up to 2,000 meters. The project consists of the engineering, procurement, fabrication, transport and installation of: 18 rigid risers, large buoyancy tanks, flexible top riser jumpers and riser base spools and 186 miles of rigid pipe-in-pipe production and single-0pipe injection pipelines. Offshore installation activities are scheduled for 2016 and 2017 with project completion in 2018.

Penspen will do a feasibility study on the Kampala-Kigali segment of the 487-mile Eldoret-Kampala-Kigali pipeline. An initiative of the Kenyan, Ugandan and Rwandan governments, completion is due next year.

Asia Pacific/Australia

Though Asia’s growth has disappointed, the region is projected to grow at a steady 5.4% in the short term, remaining the global growth leader. China National Petroleum Corp.’s third West-to-East natural gas pipeline is nearing completion and will run from Horgos in western Xinjiang to Fuzhou in Fujian. Its total length is 4,584 miles, including 3,240 miles of trunkline and eight branches. The project includes three gas storages and an LNG plant. The pipeline will be supplied with gas from central Asia.

CNPC has proposed fourth and fifth West-to-East gas pipelines and reports indicate the projects are in the planning stages. Both are expected to have capacity of 45 Bcma. China began construction of its eastern route on the Power of Siberia project that will transport 38 Bcma of gas from Russia. The pipeline is to become fully operational in 2018 and will link with the Chinese gas infrastructure already in place. The Russian portion of the project should become operational in 2017.

India’s Oil and Natural Gas Corp. has a $6.51 billion program to develop oil and gas fields. Reports indicate ONGC allocated $3.77 billion to develop six projects on the east and west coasts while spending $2.73 billion to redevelop the Mumbai High fields and the Heera-South Heera fields in the western offshore region.

ONGC’s largest project is the western offshore Daman field, costing $949 million to develop with production targeted at 977 Bcf by 2034-35.

In Australia, the Northern Territory Government announced plans to build and operate the North East Gas Interconnector (NEGI), connecting the Territory’s vast gas fields to the east coast market. The 387-mile pipeline will link Tennant Creek in the Territory to Mt. Isa in Queensland and cost $800 million. McConnell Dowell is construction contractor. Work includes the pipeline, two compressor stations and treatment facilities. The cost is expected to exceed $300 million.

LNG remains a strong focus in Australia, accounting for five operating developments and another five under construction. Australia has over $160 billion of LNG projects under construction and more are under consideration.

Written by Rita Tubb, Executive Editor

Literature Cited:

Natural Gas Supply Association’s 2015-2016 Winter Outlook Presentation and Energy Ventures Analysis Report.

Editor’s Note: To purchase the World Onshore Pipelines Market Forecast 2015-2019 from Douglas-Westwood , visit www.douglas-westwood.com.

Comments