January 2016, Vol. 243, No. 1

Features

Survey Finds Natural Gas Industry Still Upbeat, Just Less So

While the majority of those in the natural gas industry remain optimistic about growth between now and 2020, the numbers from a Black & Veatch survey clearly indicate that “the exuberance of 2014 is waning.”

According to the 2015 Strategic Directions: U.S. Natural Gas Industry Report, even as demand from the U.S. power sector and export markets continues to increase, formerly bullish expectations for midstream development have been tempered within the industry by new regulatory and non-governmental hurdles.

Overall, almost 82% of the 404 survey respondents said they were “optimistic” or “very optimistic,” but this represented a substantial drop from a year ago when almost 93% expressed enthusiasm about the near future.

On the local distribution company (LDC) front, finding new sources of revenue while managing aging infrastructure remained prominent in the minds of company executives.

“The cross-industry optimism of 2013 and 2014 has been replaced by a bifurcated market in which some producers face existential threats from an extended period of low gas prices and declining arbitrage opportunities for exports,” analysts with Black & Veatch wrote in the annual report.

Conversely, opportunities to expand service in the power sector may create favorable circumstances for midstream companies and LDCs if those providers can deliver access to firm gas supply. Investments in midstream pipeline capacity and local distribution infrastructure improvements are cited as a key factor for optimism among those in an industry that have used favorable conditions to address perennial issues, according to the report.

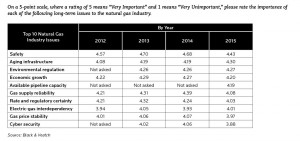

Although safety once again ranked No. 1 as the most important issue faced by the natural gas industry, worries about aging infrastructure climbed significantly higher among causes for concern than at any time in past years.

With a rating of “5” signifying an issue as “very important” to a respondent and “1” meaning the issue is considered “very unimportant,” safety fell slightly from a high of 4.70 in 2013 to 4.43 in 2015. Meanwhile, aging infrastructure rose in importance from 4.19 in both 2013 and 2014 to 4.30 in 2015.

With a rating of “5” signifying an issue as “very important” to a respondent and “1” meaning the issue is considered “very unimportant,” safety fell slightly from a high of 4.70 in 2013 to 4.43 in 2015. Meanwhile, aging infrastructure rose in importance from 4.19 in both 2013 and 2014 to 4.30 in 2015.

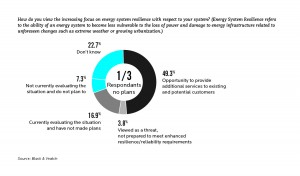

Oddly, with safety and aging infrastructure cited as the top concerns, respectively, the report noted that 30% of respondents said their organization had “no current plan to assess resilience” of their system – or if there was such a plan they were unaware of it.

“I find that point to be almost diametric,” Jeff Meyers, a manager in Black & Veatch’s Oil & Gas management consulting practice, told P&GJ. “That was most striking and we don’t know why it occurred.”

Meyers suggested some of the respondents might have been looking at the term “resilience” as more along the lines of the ability to withstand or bounce back from a natural disaster, such as the East Coast faced with Hurricane Sandy in 2012.

Black & Veatch found perceptions of infrastructure resilience to be mixed, with half of industry respondents seeing the growing focus on system resilience as an opportunity to provide additional services to existing and potential customers. While 17% indicated their company is evaluating its system, only 3.8% viewed the issue as a threat due to possible problems in meeting enhanced resiliency and reliability requirements.

Black & Veatch found perceptions of infrastructure resilience to be mixed, with half of industry respondents seeing the growing focus on system resilience as an opportunity to provide additional services to existing and potential customers. While 17% indicated their company is evaluating its system, only 3.8% viewed the issue as a threat due to possible problems in meeting enhanced resiliency and reliability requirements.

“I think building infrastructure to be more resilient and able to serve customers in a better fashion is seen as an opportunity to provide additional services to customers,” Meyers suggested. “I’m not so sure it’s new customers so much as it is new technology that’s seen as the opportunity.”

Concerning the priority of aging infrastructure – ranked as the No. 2 priority overall by LDCs – over 63% of respondents said their company has an approved capital cost recovery tracker or accelerated infrastructure cost recovery mechanism in place. The percentage has grown from 53% last year and 46% in 2013, indicating a substantial trend.

Regulatory Front

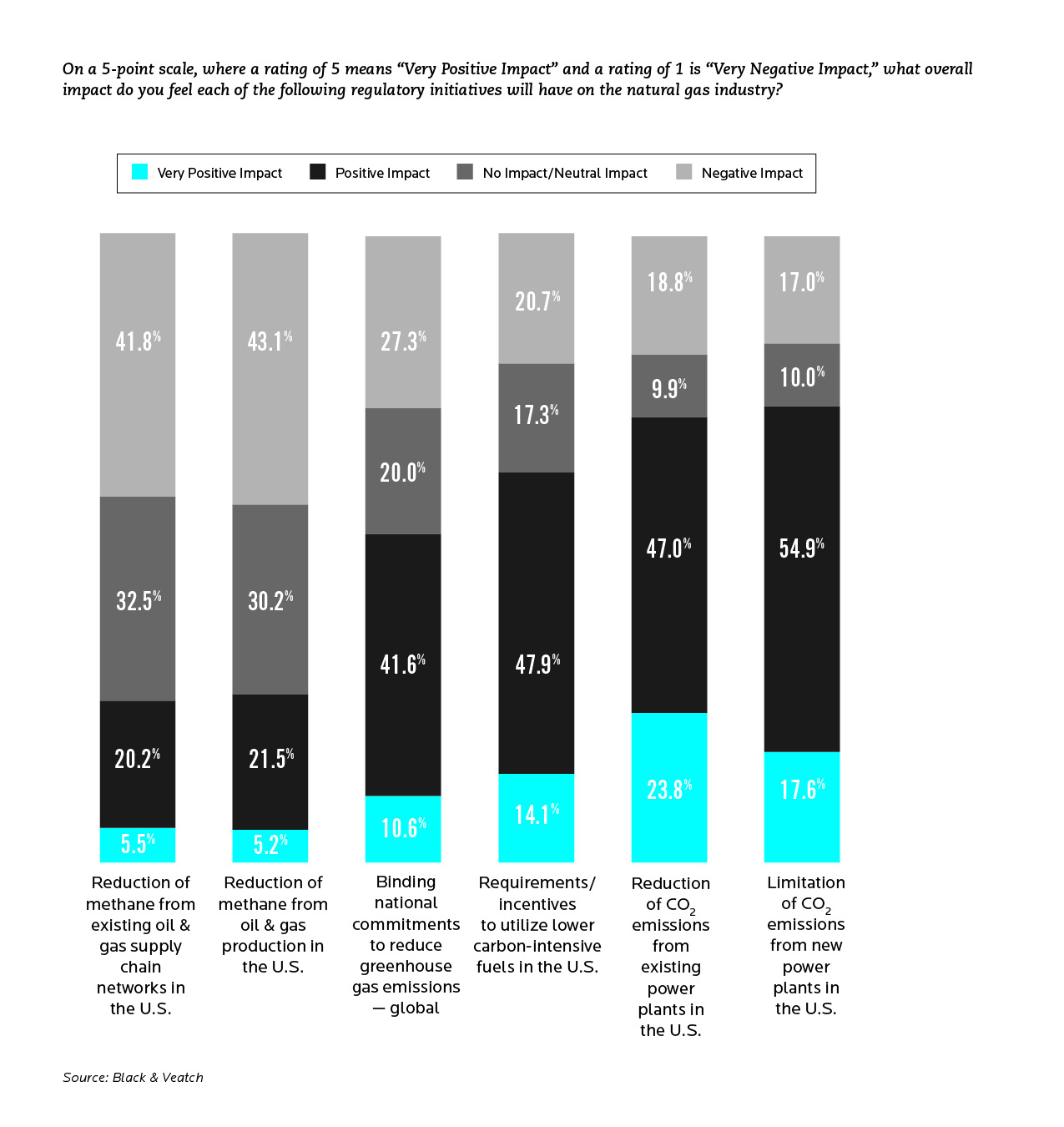

On the regulatory front, the final version of the U.S. Clean Power Plan (CPP) appeared to influence respondents who cited environmental regulation as the third-most significant area of concern with a 4.27 rating vs. 4.26 rating in 2014.

This, in part, was due to the CPP’s focus on renewable energy and carbon dioxide (CO-2) emission limits, which were “at odds with the treatment of natural gas in the draft regulation,” according to the report. (Among midstream companies and LNG importers and exporters, regulatory uncertainty rated as the top area of concern.)

“You talk to the industry, they’ll tell you they’ve done a significant amount in that area,” Rick Porter, a director in Black & Veatch management consulting, told P&GJ. “The EPA proposal will have a negligible effect, though they are a little concerned about the targeting of methane.”

Asked to name the three most significant issues facing the natural gas pipeline industry over the next three to five years, respondents overwhelming named regulatory uncertainty most often (82%), followed by sustained growth in demand (56%), safety and system integrity 48%, sustained growth in production (24%) and cybersecurity (22%).

Although the industry generally relies on trade associations or industry experts to understand regulatory changes, it is still difficult to fully understand the potential ramifications of the emerging EPA and Pipeline and Hazardous Materials Safety Administration (PHMSA) regulatory actions, the report said.

“Pipeline companies used to worry about a predetermined set of regulations, and they knew what to focus on,” Porter said. “There is so much happening at PHMS, EPA and FERC (Federal Energy Regulatory Commission) that the whole horizon has expanded and shifted. I think they don’t know what’s coming out next.”

It came as no surprise that far and away the top overall concern among regulatory practices was “procedures that reduce the time required to receive authorization to construct pipeline projects.” Three-quarters (76%) of respondents cited this concern vs. 75.5% in 2014.

Cited as the second-most significant concern was whether regulators could help pipelines “promote stable cash flow,” which jumped nearly 18% (to 48% in 2015 from 30.6% in 2014). Porter said one reason for this might be that in the past large, one-time costs, such as dealing with the aftermath of hurricanes, were prominent on respondents’ minds, whereas now, companies are looking more at ongoing modernization costs.

“Given the magnitude of the cost, this is probably the driving force in that one,” he said.

The third concern among regulatory worries was “allowing shippers to enter into contracts for bundled pipeline services,” cited by 38% of respondents, up from 28.6% last year.

The report also examined how industry players are managing their way through the current low-price environment while continuing to look for growth opportunities. The consultants found that while many North American producers struggle with the twin dilemmas of oversupply and the inability to provide gas to constrained markets, some companies are adjusting their existing business models.

Atlanta-based power company Southern Company was cited as an example of a company that is looking to acquisitions as a means to expand pipeline capacity. With interstate pipeline investment also increasing, these strategies, nonetheless, face the waiting times and limits on capital recovery posed by regulation.

Not surprisingly, as extended favorable pricing of natural gas vs. other energy sources continues to feed the demand for capacity and deliverability to consumers, respondents named mainlines (59.2%) and laterals (52.1%) as the types of infrastructure most needed.

Among North American respondents, New England was identified as the region most in need of incremental delivery capacity (59.8%), followed by the Mid-Atlantic (35.4%) and Southeast (31.8%). Outside the United States, Mexico was identified as most needing capacity (30.1%), followed by Canada (12.5). In comparison to the 2014 findings, however, these results showed less urgency on the part of respondents in every major market area – down nearly 18 percentage points for New England and 14 points for the Mid-Atlantic.

“It may be that respondents perceived ‘incremental’ as something in addition to the various major projects that have already been announced,” the report said, in partial explanation. “Or, it may be that the announcement of numerous pipeline projects has calmed the anxiety of the industry as attention is focused on securing regulatory approvals for the proposed projects.”

Among key findings:

- Overall, over 80% of the industry viewed the outlook for the North American natural gas industry as positive.

- By a wide margin (85%), respondents expect the power sector to see material increases in gas consumption as a source of fuel generation.

- Regulatory uncertainty was cited by 82% of respondents as a medium-term concern for pipelines.

- Well over half (60%) of LDCs are either expanding or have plans to launch natural gas expansion programs.

- Two-thirds of LDCs see distributed energy resources powered by natural gas as an opportunity for future growth.

The survey for the report was conducted between July 23 and Aug.19 with the online questionnaire completed by 404 participants identifying themselves as natural gas utility/service providers or natural gas industry providers. The margin for error of the findings is 4.8%.

To obtain the survey, visit www.bv.com/reports.

Written by Michael Reed, Managing Editor

Comments