November 2017, Vol. 244, No. 11

Features

Fall Will Be Busy Season for Pipeline Projects

Fall is traditionally a time when many gas pipeline projects are put in-service, as the construction that can be done in key spring and summer windows (to avoid impacts on protected animals and plants) are completed.

This year is no exception, as an update of the PointLogic Energy gas pipeline data base indicates nearly three dozen projects are on track for in-service from Sept. 1 through the end of the year. Overall, PointLogic has identified and confirmed with developers 32 projects in North America that are on track for in-service by year’s end.

Combined, these projects will be able to transport about 14.1 Bcf/d of natural gas. However, that volume should not be taken to represent a net increase in capacity because many of the projects are inter-related, and so their deliveries are linked rather than additive.

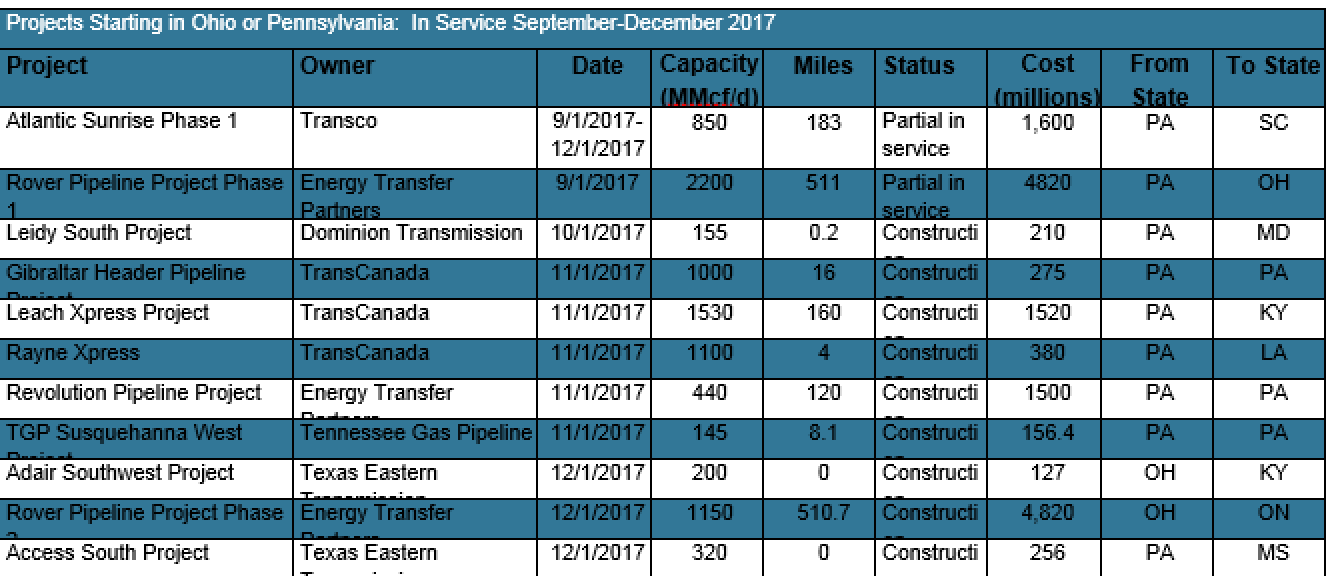

If there is a theme to the projects, it could be summed up as: Appalachia. Eleven of the 32 projects originate in Pennsylvania or Ohio, indicating that they either target Marcellus gas directly or are moving Marcellus and Utica gas that already was on pipelines (see table).

In the past year, outflow capacity from the Marcellus and Utica has been increased by about 2.5 Bcf/d. This latest round of expansions (going into early 2018) will add another 2.5 Bcf/d, or more.

In thinking about moving gas out of Appalachia, three prominent projects are reaching in-service this fall (and in two cases, have already achieved partial in-service): Rover Pipeline, Atlantic Sunrise, and Leach XPress/Rayne XPress.

Rover Pipeline is the biggest project coming online this fall – and probably the one with the highest profile. Developed by Energy Transfer Partners, (ETP), Rover is designed to move gas from West Virginia, Pennsylvania and Ohio to markets in the Midwest and Canada. When all of its phases are in-service, it will provide new takeaway for up to 3.25 Bcf/d of Marcellus and Utica gas.

Rover Phase I, Part A went into service Sept. 1, all in Ohio. According to PointLogic’s tracking service, volumes already are approaching 700 MMcf/d (see graph).

Taking gas off Rover are the Trunkline Backhaul and Panhandle Backhaul projects, each of which are in partial in-service, too. At full operation, they will have capacity of 750 MMcf/d each. Panhandle takes Marcellus and Utica gas Rover at the newly constructed interconnect with PEPL near Defiance, OH into ETP’s Trunkline Gas Pipeline at PEPL’s existing Tuscola compressor station interconnect in Douglas County, IL. The Trunkline project itself did not involve any new pipeline installations, but instead a series of additional compressors that raised the volumes that could be moved through existing lines.

The remainder of Rover Phase I is on track for in-service by November and Phase II for December, says ETP. The early impact of Rover Phase 1a has been modest strengthening of prices at the Dominion South hub.

Atlantic Sunrise, a Transco project, is coming online in phases, like Rover. This three-phase, $3 billion project ultimately will move up to 1.7 Bcf/d of gas from Appalachia to the South and Gulf Coast. Part of Phase I (call it Phase IA), came in-service Sept. 1, authorized by FERC for volumes of up to 400 MMcf/d.

The impact of Atlantic Sunrise Phase IA can be seen even in the first weeks of the first phase in operation. A good estimate of the flows supported by Atlantic Sunrise, Phase IA can be found by using PointLogic’s data on flows through Maryland because the project is originating in Pennsylvania and moving south through Maryland to further destinations. For the month of August, flows averaged 1.471 MMcf/d, but for the period of Sept. 1-13, they averaged 1.798 MMc/d, or a gain of 327 MMcf/d.

When Atlantic Sunrise Phase I is complete in November, it will support 850 MMcf/d of new gas flow.

The third major project affecting Appalachia production that is due for in-service this fall is actually a pair of projects, Rayne XPress and Leach XPress, both on track for Nov. 1 in-service.

Leach XPress is a Columbia Gas project (Columbia Gas has since been purchased by TransCanada) that will have capacity to move 1.5 Bcf/d of gas from Pennsylvania to Kentucky, where it will connect with the existing TCO pipe. From there, up to 1.1 Bcf/d of gas can flow on Rayne XPress, moving south to the Louisiana Gulf through an interconnect with Texas Eastern and onto a Columbia Gulf Transmission pipeline (see map). As with Trunkline Backhaul, the Rayne XPress project is mostly increased compression, as it entails only 4 miles of new pipeline.

These projects, in combination, will significantly reduce spreads between the Gulf (Henry Hub) and the Northeast, as Northeast producers see more outlets for their gas, and Gulf consumers, including LNG operators, have more options from which to procure gas.

Demand-Driven Projects

While moving gas out of Appalachia is the biggest story of the fall, several other projects are using gas from the producing areas for more localized needs. Many of the projects coming into service later this year (and in 2018 and 2019) are driven by demand for specific markets.

Many of these can be thought of as moving gas within the Northeast, rather than moving it out of the region, and they are serving a range of demand matters, such as new gas-fired power plants and growing market share for natural gas home heating as it replaces heating oil or propane. Projects include:

- Collierville Expansion Project a 200 MMcf/d project in Tennessee, which is designed for the Tennessee Valley Authority’s gas-fired power operations.

- New Market, a 112 MMcf/d Dominion project, which will feed a power plant in New York state, as well as growing demand from LDCs serving New York customers who are switching from fuel oil and propane.

- Virginia Southside Expansion, a 250 MMcf/d project in Virginia.

- Northern Lights 2017 Expansion, a 77 MMcf/d project in Minnesota.

- Continent to Coast Expansion Project, a 210 MMcf/d project to serve New England, being developed by Trans-Canada subsidiary Portland Natural Gas Transmission.

The Garden State Expansion project, a Transco (Williams) project, is designed to increase deliveries in New Jersey, specifically to provide more system reliability by creating a parallel loop to towns on the New Jersey shore. Phase 1 of the project came in-service on Sept. 8, and Phase 2 will come in-service next year. The vulnerability of the towns became evident during Superstorm Sandy.

While small individually, these types of local, demand-oriented projects represent important incremental demand for gas production and support for an increasingly flexible gas infrastructure.

Exports

In addition to the localized projects, several other projects are designed to feed LNG exports or petrochemicals operations, in both cases aiming for export markets as the biggest growth opportunities.

Rayne XPress, noted above, will be delivering into networks in the Gulf that serve both LNG and petrochemical and industrial operations. In addition, Leidy South, which goes from Pennsylvania to Maryland, will deliver up to 155 MMcf/d to the Cove Point LNG facility that is aiming for commissioning volumes this fall. This will be the country’s second large LNG export facility, after Cheniere’s Sabine Pass.

The same can be said for a trio of related projects, all developed by TETCO (now owned by Enbridge): Access South, Adair Southwest and Lebanon Extension. Access South will move up to 320 MMcf/d from Pennsylvania to Mississippi. Lebanon Extension is a scant 2 miles in length, serving as a link to Access South, and came in-service in August. Adair, picks up another 200 Bcf/d and moves it further down to the Gulf.

The gas pipeline story this year has been Mexico exports, as numerous projects came in-service to deliver gas along the U.S.-Mexico border, or move gas more deeply within the country to serve end users. Additional, more Mexico-inspired projects are due online this fall, including IEnova’s 1.5 Bcf/d El Encino-La Laguna Pipeline, a domestic Mexico project.

U.S. exports to Mexico averaged 4.1 Bcf/d this summer, a seasonal record and 0.2 Bcf/d greater than summer 2016. Through the end of summer 2018, PointLogic projects that export capacity to Mexico could increase to 11 Bcf/d. Utilization of that capacity will be highly dependent on the expansion of Mexico’s power fleet and its ability to expand and transport capacity across pipelines in-country as well.

From a demand perspective, the most striking conclusion one can draw is that exports are key to the majority of proposed capacity that will allow gas production in the continental U.S. to grow.

Comments