April 2018, Vol.245, No.4

Features

Energy Regulatory Outlook Stresses Need for Modernization

By Charlie Sanchez, John Lucker and Paul Campbell, Deloitte & Touche LLP

Gas pipeline companies across both the distribution and transmission segments of the industry are having to refresh multiple facets of their approaches to asset management.

The surge in activities can generally be characterized as a much-needed modernization effort that has one major catalyzing force – regulatory mandates precipitated by a confluence of serious events, political pressures, and pragmatic industry imperatives.

The tipping point for regulators arrived a few short years ago as they witnessed aging infrastructure turning into catastrophic failures. System failures – such as the San Bruno and East Harlem gas explosions, and the Porter Ranch gas leak near Los Angeles – resulted in loss of life, damage to property, environmental harm, increased scrutiny and escalated mandates by industry regulators. According to the Pipeline & Hazardous Materials Safety Administration (PHMSA) under the Department of Transportation, the following statistics have characterized the circumstances in the recent several years:

"From 1998 through 2017, there were a significant number of incidents across various pipeline types with a number of fatalities, injuries and a significant amount of property damage. Specifically as stated in records kept by the agency, the U.S. had 808 serious incidents across Distribution, Transmission and Other System Types, resulting in 307 deaths and 1,267 injuries."

Those regulatory jurisdictions with the most direct and significant impacts have led the charge in enforcement of new safety protocols, encompassing federal, state and local regulators.

As examples, the public utility commission in California has been among the most active in prescribing mandatory changes. California’s SB 1371 program requires targeted pipeline and infrastructure replacement programs for improving public safety and methane emissions.

The California Public Utility Commission has also prescribed the use of empirical data to prioritize asset replacement, a major step forward in modernizing the approach around asset risk management. Other recent examples include the issuance of an order by the Kansas Corporation Commission to expedite replacement of aging pipe over the next four years in what they have termed an accelerated replacement program (ARP).

Following a gas pipeline explosion in Colorado in 2017, the Colorado Oil and Gas Conservation Commission ordered tests that showed failures on 0.35% of the approximately 120,000 lines in close proximity to populated areas, with 13,000 lines returning uncertain results. This has set in motion a rewrite of flow line regulations by the Colorado Oil and Gas Conservation Commission.

In most cases, the guidance has come after events that dominated media coverage in each respective jurisdiction – events where fatalities and subsequent financial, legal and regulatory consequences took place. A search across the industry reveals similar formal or informal activities, often without clear guidance of what will be required to achieve abstracted goals around safety and modernization.

Taken in isolation, the increasing frequency of these events due to the age and often problematic materials used for the infrastructure justifies the increase in attention to this important operational area.

Natural gas pipeline incidents over the last 20 years have remained steady despite continued improvements in safety practices. Yet, the challenges facing the industry are deeper and more extensive than just aging pipes. Rapid growth in customer demand is straining the pipeline network while an aging workforce is departing with the institutional knowledge and technical experience currently depended upon to manage inherent infrastructure risks.

There is also a growing concern that the current software applications used to prioritize and perform maintenance and triage replacement of these pipelines and their components are becoming obsolete. Asset managers in the pipeline industry recognize these long-standing and visible challenges, but budgeting limitations have largely kept programs focused more tactically.

A review of the current guidance provided by regulators establishes a setting of three general themes. The first is that safety must prevail above all else. This is not necessarily a new focus and yet, there is a revolution in defining this guidance to asset intensive companies.

It is this revolution that features prominently in the second theme within the guidance, which is that many new behaviors and outcomes will be needed to achieve increased transparency and modernization of asset management programs.

Short of making it a mandate, descriptions of what modernization consists of describes attributes of protocols like those found in the ISO 55000 standards. Since the issuance of this protocol by the International Organizations for Standardization in January of 2014, strong guideposts have been set for many to direct their asset management program modernization, even those who are not seeking official certification.

The third of the themes within the regulatory guidance and pronouncements, which is strongly featured in the ISO 55000 standards, is the specific call out for the need to improve the use of data. Along with this requirement comes a dependence on the modernization of systems, their related data governance processes and procedures, and the use of analytics to help drive toward risk-based predictions.

The expectation is that this would help reduce reactive approaches and would enable experts to have more data and insights at their disposal when making decisions. All of these prescriptive items amount to one important narrative oriented toward driving empirical fact-based decisions that focus on safety and span the entire asset management lifecycle. Many organizations have already begun to consider these essential goals, although a dedicated effort to overhaul the entire program remains the exception rather than the rule. Clearly more attention should be quickly focused on these important changes.

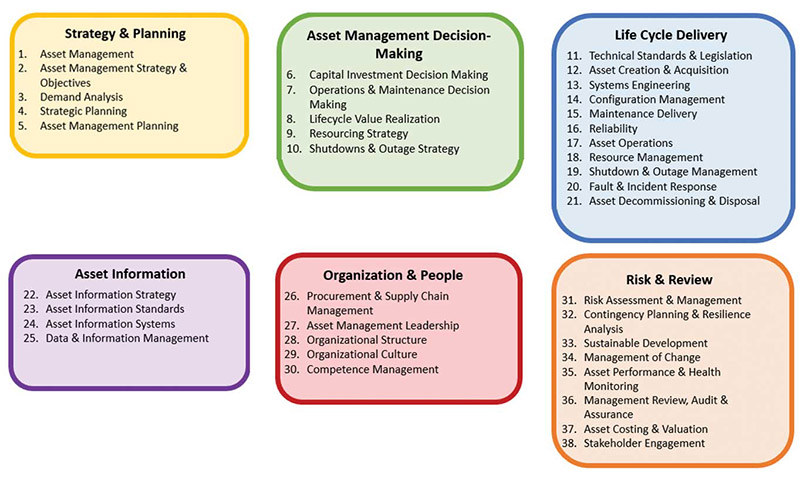

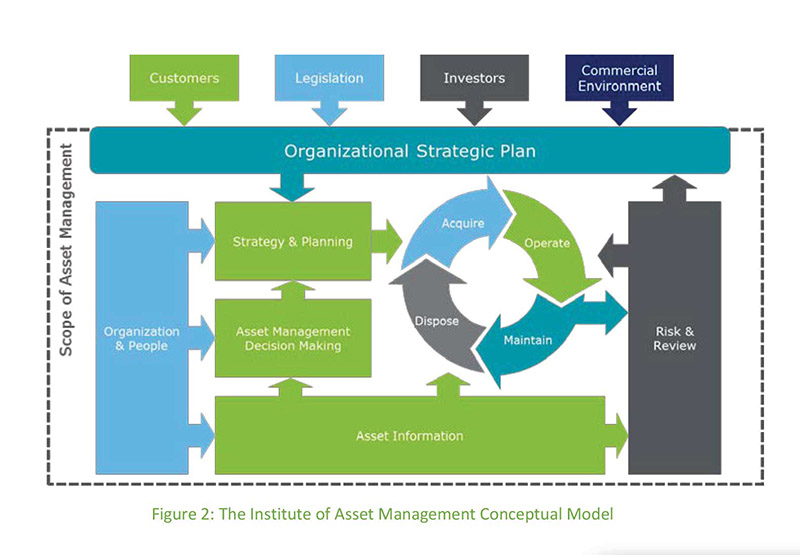

When organizations begin to view asset management in the consolidated terms defined by leading practices, the relationship across the various activities performed starts to become more about realizing the full value of each asset. This is a highlight of how the Institute of Asset Management (IAM), the international professional body for asset management professionals, conceptualizes the ISO 55000 standards usage. This may seem incongruent with the shifting focus towards safety, but when asset health becomes more visible, so do other life-extending insights. Transparency across the entire asset lifecycle helps bring precision to decision-making during the acquisition, operation, maintenance and disposal phases as shown in Figure 2. Once the total expenditures across the lifecycle of assets become better understood, asset managers can move away from the reactive behaviors that relegate their activities to merely maintaining these items.

Using the ISO 55000 standard as a basis for how to accomplish all or portions of these needed changes, the focus shifts to an integrated view of the various contributors across the asset lifecycle.

As an illustration of these interconnections you can see in Figure 2, the IAM Conceptual Model, the logical relationships between various moving parts of a robust asset management program.

Within this are competing priorities for short-term operations and long-term capital programs, one of the important dividing lines that exists natively among factions of the asset management team. In this model, a more prominent role is featured to consider the influence from legislators, customers, investors and other external contributors and stakeholders within the strategic vision of the organization.

The role of technology, both computing and asset-based advancements, are where we have witnessed the biggest shift occurring within the natural gas pipeline industry. Companies are discovering that small investments in both mature and nascent digital/analytical innovation areas often bring significant insights with a multitude of additional peripheral and exponential benefits.

The library of buzzwords that characterize these opportunities includes a mix of familiar concepts (e.g., big data analytic approaches for risk modeling and root cause analysis, sensor data) and potentially some unfamiliar items (e.g., predictive maintenance, industrial internet of things or IIOT, unstructured data analytics, data visualization, cognitive machine learning, wearables, RFIDs, virtual/augmented reality, drones).

The first steps, though, are more foundational and frequently involve common real-world challenges including grappling with legacy systems that capture data ineffectively, disparate sources (including appending with externally available inputs) and poor quality of information and related historical documentation. Based on a number of direct experiences, the path to harnessing this data is often much shorter than organizations would anticipate, especially as the philosophy has shifted from force fitting specific data into a rigid model.

Techniques can vary widely and depending on the appetite for innovation, can include more ambitious elements related to increasingly plentiful sensor data or cognitive computing techniques. These more aspirational methods may include variants on sophisticated algorithmic approaches such as survival analysis, random forest techniques and other ensemble (multiple methods aggregated into a grouped result) modeling methodologies that can refine insights significantly.

Today, these approaches are no longer just lofty aspirations. Still, there is a lot to gain by some of the more easily understood methods and approaches. In one use case, a multi-variate regression analysis leveraging basic asset data, event-related information, and external data about environmental conditions produced impactful findings that presented new insights to help drive decisions.

In that case study, the flagging of the worst 1% of assets needing repair were predicted 1000% more accurately than average and the worst 10% of assets were identified 490% better than average. These types of improvements are common and make up the basis for what regulators expect as an appending element to the professional judgement of asset management experts.

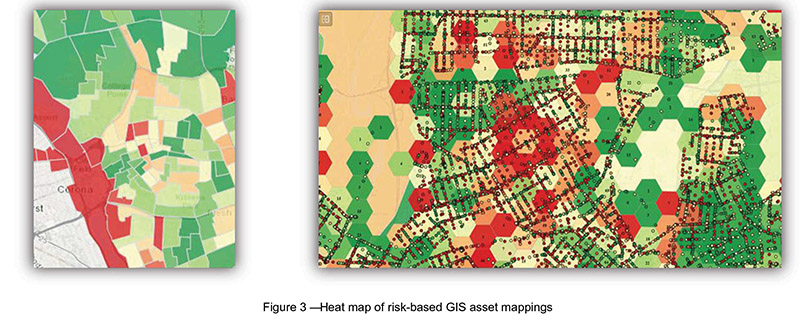

As other organizations begin to produce these types of risk and consequence scores, including related probabilities and consequences at the component, sub-system, system and geospatial levels, these expectations will likely just continue to grow. When made operational through a visualization layer that plots the GIS data (Figure 3) pinpointing risk-based priorities on mobile devices in real time, the storyline becomes difficult to debate.

Beyond these key features, there are other operational and hard technology innovations that are being leveraged to improve the circumstances including in-line robots/smart pigs and automated leak detection tools as well as enablers that allow for advanced control operations, such as automated or remote shut-off valves. These are not mutually exclusive items and data from these types of innovations can be used to further enhance the insights provided through advanced analytics.

Regardless of the uncertainties of when specific regulators will impose changes that mandate the updates for the protocols, systems, and analytical methodologies, there is limited uncertainty that this trend will continue and many have already taken proactive measures in preparation for stricter expectations.

Realistically, there are spending limitations on what can be done to replace the items that are determined to pose the highest risk and difficult decisions will need to be made on what items will be high-ranked and which will be managed through other maintenance protocols.

The use of advanced and predictive analytics are tools that can help justify how these choices are made and later explained to regulators. Their use will not preclude the need for experts – instead they will arm these individuals with the robust empirical observations needed to avoid simply trusting instinct and helping to overcome many common biases and behavioral economic factors widely discussed in management literature.

Done in the context of the wider lens provided by the guidance of the International Organization for Standards 55000 issuance, the Institute for Asset Management’s conceptual model, or related leading practices, the multitude of objectives that can benefit from these modernization efforts include:

- continuous monitoring of asset and process performance

- performing of root cause failure analysis

- prediction and resolution of prioritized needs

- alignment of investments with strategic objectives

- optimization of life-cycle costs for assets

- analysis and planning for asset life expectancy. P&GJ

Authors:

Charlie Sanchez leads Deloitte & Touche’s Operational Risk Services. With more than 18 years of experience. His recent focus on asset portfolio optimization.

John Lucker is an advisory principal with Deloitte & Touche, who specializes in global advanced analytics and modeling, and analytics.

Paul Campbell leads Deloitte & Touche’s energy Regulatory and Risk Consulting services for the Governance, Regulatory & Risk Strategies practice. He has more than 20 years of experience.

Comments