August 2018, Vol. 245, No. 8

Features

2018 Midyear International Update: Pipeline Construction & Market Trends

Global Infrastructure Expands with Rising Production, Demand

By Jeff Awalt, Executive Editor

Global energy trends and forecasts entering the second half of 2018 continue to support a generally bullish outlook for oil and gas production and infrastructure construction to meet growing demand and evolving patterns of interregional trade.

An improved world economy is expected to underpin solid increases in the trade of both crude oil and natural gas, and upstream market conditions are the best in recent years, but the exploration and production sector has continued to spend cautiously and focus on efficiency through its ongoing recovery from a downturn.

Consulting firm Wood Mackenzie projects there will be about 30 final investment decisions (FID) this year on oil and gas projects worldwide, but noted that operators remain focused on less capital-intensive projects with quicker returns, as they did in 2017, when FIDs doubled amid falling costs and rising prices. “The big question is whether the (upstream) industry is actually spending enough,” said WoodMac’s Research Director, Angus Rodger. “We cannot just have lots and lots of small projects forever. It will not sustain the industry.”

The International Energy Agency (IEA) reported in July that total energy spending declined globally for the third consecutive year in 2017, but it also highlighted the positive impact of E&P cost efficiencies in areas that may contribute to pipeline infrastructure expansion. Higher prices and operational improvements, for example, have put the U.S. shale sector on track to achieve positive free cash flow in 2018 for the first time ever.

Market Trends

Crude Oil

Global oil demand got an early boost from cold weather in the northern hemisphere and grew an average 1.5 MMbpd in the first half of 2018, according to IEA, which predicts a more modest 1.3 MMbpd growth rate in the second half. In 2019, the growth rate should remain steady at 1.4 MMbpd, but with a predicted slowdown in China, which together with India accounts for nearly 50% of worldwide demand, IEA projects the global rate will fall to about 1 MMbpd in 2023.

While there is no peak oil demand in sight, IEA said, there are signs of substitution of oil by other energy sources in various countries. It cited China as a prime example, due to its intensifying efforts to improve air quality in cities through more stringent fuel efficiency and emissions regulations.

Natural Gas

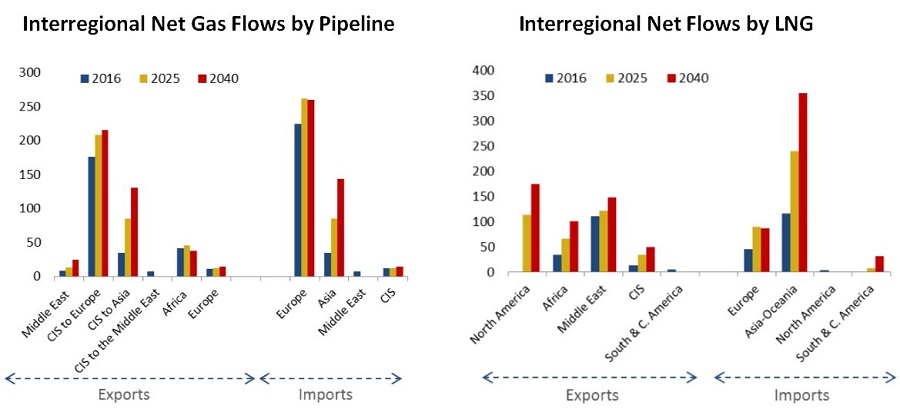

Natural gas is a primary beneficiary of the shift to cleaner fuels, and growing demand from developing countries is contributing to a transformation of world energy markets. In its latest medium- and long-term outlook, released in July, Cedigaz predicts that interregional (long-distance) natural gas trade will grow by 3.1% per year – more than twice the 1.4% rate in overall demand growth for natural gas worldwide.

Chinese gas demand is predicted to grow by 60% from 2017 to 2023, overtaking Japan as the world’s largest gas importer as early as 2019 and account for 37% of projected global demand growth over the next five years.

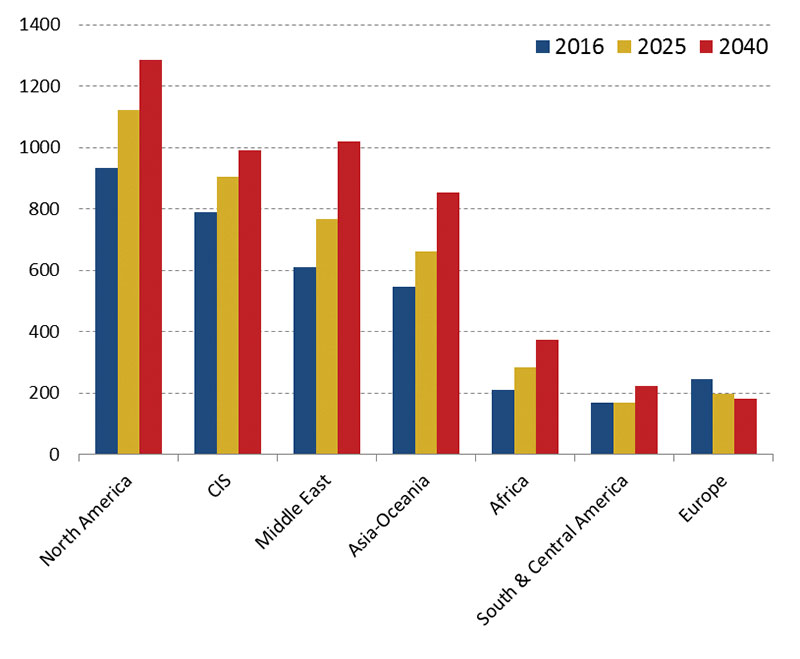

The expansion of global gas supply will be driven by unconventional gas in North America and Asia, as well as conventional gas in Russia and the Middle East, according to Cedigaz, with the largest regional production gains expected in the Middle East (+411 Bcm), North America (+352 Bcm) and Asia-Oceania (+305 Bcm).

LNG will take an increasingly larger share in global gas trade, with the United States leading gas production growth and emerging Asian markets leading the growth in demand.

Infrastructure

The total number of new onshore pipeline miles installed globally this year is forecast to rise by 13%, according to Westwood Global Energy’s 2018 World Onshore Pipelines Market Forecast. In addition, Westwood adds: “An increasing population of aging pipelines and stringent repair and maintenance regulations in regions such as North America and Western Europe will continue to act as stable long-term drivers for operational expenditure, which the firm expects to increase 17% during 2018-2022.”

An earlier Westwood forecast called for global installations to exceed 171,500 miles and total onshore pipeline capital expenditures to increase about 5% through 2021 to $203 billion, compared with $194 billion in the preceding five years, with North America and Asia accounting for 53% of global spending over the forecast period.

In addition to the growth of onshore pipeline projects, a number of subsea projects are proposed or underway, including installations related to offshore discoveries as well as major projects in the Baltic, Black and Mediterranean seas.

Higher LNG demand also is contributing to infrastructure development, including liquefaction facilities, shipping terminals and pipelines. A wave of LNG export projects is expected to increase liquefaction capacity by 30% by 2023, with U.S. output accounting for nearly three-quarters of the projected total growth in LNG imports over the next five years, followed by Australia and Russia, according to IEA.

LNG production may temporarily surpass global demand as liquefaction plants now under construction come online by 2020, but Cedigaz Chief Economist Armelle Lecarpentier said that delays in a second wave of LNG supply investments bring a risk of increasingly tight markets after 2020. In a hopeful note, WoodMac’s Rodger said his firm sees “a lot of big LNG projects out there that are competing to be sanctioned” in 2019.

Regional Updates

Africa

The Zohr natural gas field, which Eni discovered offshore Egypt scarcely three years ago, started up a third production unit in May to bring total installed capacity to 1.2 Bcf and production to approximately 200,000 boe/d. With its close proximity to Zohr and Cyprus’ Aphrodite gas field, along with an established pipeline system and two idle liquefaction plants standing, Egypt sees an opportunity to become an LNG export hub to Europe.

Egypt and Cyprus have already announced plans for a pipeline connecting the Aphrodite gas field with Egypt’s LNG facilities at an estimated cost of $800 million to $1 billion. At a joint press conference in May with his Egyptian counterpart, Cyprus Energy Minister Yiorgos Lakkotrypis said a final agreement on the pipeline would be signed as quickly as possible but did not specify a timeframe.

The Nigerian National Petroleum Corporation (NNPC) said it will start building the largest natural gas pipeline in its nation’s history, following agreements that include financing for two of three sections of the Ajaokuta-Kaduna-Kano (AKK) pipeline. NNPC hopes to complete the project by first half of 2020 at an expected cost of more than $2.8 billion. The 614 km (381-mile), 40-inch AKK pipeline is designed to provide connectivity between eastern and western sections of Nigeria to supply natural gas for power generation and industrial development in key commercial centers in its central and northern regions.

Offshore Angola, Total is nearing completion of the company’s first floating production, storage and offloading (FPSO) unit to be converted from an oil tanker. The Kaombo Norte unit is the first of two FPSOs at the site, each designed to process up to 115,000 bpd of crude oil. Technip and Heerema Marine Contractors led engineering, procurement, fabrication, transport and installation of infrastructure for the ultra-deepwater Kaombo development, including 186 miles (300 km) of rigid pipe-in-pipe production and single-pipe injection pipelines.

Asia & Oceania

China is the leader in world energy demand, and its policies mandating a shift from coal to cleaner energy sources have boosted demand for gas and LNG imports while setting a course to more than double its pipeline infrastructure during the next seven years to nearly 150,000 miles. China’s National Development and Reform Commission said it plans to add about 80,000 miles to its current 69,600 by 2025. After expansion, natural gas pipelines will account for 76,400 miles, or 51% of the system.

Gazprom announced in June that 83% of its Power of Siberia gas pipeline is complete, and construction is on track to begin delivering natural gas to China with completion in 2019. The 1,864-mile Power of Siberia will transport gas from the Irkutsk and Yakutia gas production centers to consumers in Russia’s Far East and to China via its eastern route, with 38 Bcm to be transported annually. Construction of the Power of Siberia began in 2014 and has involved construction of extensive gas processing infrastructure in Russia’s Far East.

Since the new Russia-China oil supply agreement took effect at the start of the year, an extension of the East Siberia-Pacific Ocean (ESPO) oil pipeline between Russia and China started operating and PetroChina’s largest refinery has almost doubled the amount of Russian pipeline crude oil that it is processing. The 410,000 bpd PetroChina refinery in the northeast port city Dalian will process 260,000 bpd of Russian pipeline crude oil in 2018, up by 85-90% compared to 2017, Reuters reported. The Russian pipeline crude replaces seaborne shipments from the Russian Far East and crude oil shipments from the Middle East.

On offshore India’s southeastern coast, McDermott International and Larsen & Toubro completed engineering, procurement, construction and installation for development of the Oil and Natural Gas Corporation (ONGC) Vashishta and S1 gas fields. The project included 58 miles of 14-inch dual rigid pipelines, extending from the shallow water shore line to a maximum water depth of 2,300 feet.

Russia & CIS Countries

Russia is projected to remain the world’s largest energy exporter as it continues to focus on oil production and increased natural gas exports through major pipeline expansions to Europe and Asia.

Gazprom appears poised for construction of the Nord Stream 2 pipeline despite U.S. sanctions and opposition from European countries concerned about growing reliance on Russian gas. Germany, Finland, Sweden and Russia have all approved the project, leaving only Denmark undecided. Its prime minister said Denmark could block or delay construction of the pipeline in Danish territorial waters for security reasons.

Gazprom says the project will continue without a cost increase even if Denmark rejects it. Nord Stream 2 is scheduled to start flowing natural gas from Russia’s Baltic coast to Germany by 2019, running alongside the first Nord Stream pipeline, which was completed in 2011. It will render existing pipelines obsolete, including several pipelines that run through Ukraine, which stands to lose about $2 billion in annual transit revenues if gas is diverted away.

Pipelaying operations resumed in June for the second string of Gazprom’s TurkStream offshore gas pipeline, as it progresses toward Turkey. Construction of the twin 32-inch pipelines began in May 2017, and the first string of the offshore section was completed in April with a total of 722 miles of pipes laid along the two strings. After re-entering the Black Sea in June, the pipeline head of the second string was recovered from a depth of 2,170 meters. Each of TurkStream’s twin pipelines have an annual throughput capacity of 15.75 Bcm. The first string of TurkStream is intended for Turkish consumers, while the second string will deliver gas to southern and southeastern Europe.

Construction has commenced on the Afghan section of the Turkmenistan, Afghanistan, Pakistan and India (TAPI) gas pipeline. The 1,130-mile project will deliver gas from Turkmenistan to Pakistan and India. In a rare announcement, the Afghan Taliban said it will support and protect the pipeline in areas under its control. Uzbekistan announced plans to join the $8 billion project. TAPI reportedly received an investment from Saudi Arabia as it began construction on the difficult Afghan section, which runs abreast of the 346-mile Kandahar-Herat highway.

Western Europe

With growing gas demand and declining oil and gas production, Europe has become a key battleground for global natural gas and LNG market share.

In a sign of further weakening, the Dutch government in late June revised its 2018 production forecast downward for the Groningen natural gas field to 19-20 Bcm from an earlier projection of 21.6 Bcm, compared with 24 Bcm last year. The government announced in March that it plans to stop all production in Groningen by 2030 due to the risk of earthquakes.

Russian expansion has motivated some countries to seek supply diversity. The Finnish government, for example, authorized state-owned Baltic Connector Oy to start construction this year on the Balticconnector natural gas pipeline and announced it will open wholesale and retail gas markets to competition in synch with project completion in 2019-2020.

Saipem’s pipe laying vessel, Castorone, began installing Norway’s longest and largest pipeline to Equinor’s Johan Sverdrup oil field. The 176-mile, 36-inch pipeline is being pulled through a pre-drilled hole at the bottom of the Fensfjorden. It will be capable of transporting up to 660,000 bpd to Equinor’s Mongstad terminal. At its deepest point, the pipeline will be 1,762 feet below the sea. The Johan Sverdrup oil field, located 87 miles west of Stavanger, is being developed in two phases. Phase 1 is projected to be completed in late 2019 with production capacity estimated at 440,000 bpd. Phase 2 is projected to be completed in 2022, expanding the field’s production capacity to 660,000 bpd.

State-owned Bulgaria Energy Holding (BEH) reached a preliminary agreement with the European Investment Bank in June to finance construction of a natural gas pipeline with Greece. The proposed 113-mile gas link is expected to begin transporting gas from Azeri to Bulgaria in 2020, as well as some liquified gas from terminals in Greece. According to ICGB, the project company for the gas link, BEH is receiving preferential financing through a government-backed guarantee of $128 million. BEH holds a 50% stake in ICGB. Greece’s DEPA state energy firm and Italy’s Edison each hold 25%.

Middle East

The Middle East accounts for 34% of the world's crude oil production, 45% of oil exports and 48% of proved reserves, but oil-producing countries in the region are turning to natural gas for domestic use, while Israel looks to become natural gas exporter.

The leaders of Israel, Cyprus and Greece said they plan to sign an agreement by year-end to move forward on the proposed East Med Pipeline, with Israeli Prime Minister Benjamin Netanyahu describing the project as a serious endeavor of great importance to Europe. Israeli Energy Minister Yuval Steinitz said Israel expects a decision to move ahead with construction of the 1,243-mile pipeline by early 2019. The estimated $7 billion East Med would cross from Israel and Cyprus into Greece and Italy in deep waters with an expected capacity of 9-12 Bcm annually. Project owners are IGI Poseidon, a joint venture between Greece’s natural gas firm DEPA, and Italian energy group Edison.

Energean Oil & Gas said it has approved development of the $1.6 billion Karish & Tanin Project offshore Israel, which includes an FPSO with capacity to treat 800 MMscf/d natural gas and liquids storage capacity of 800,000 barrels. A 56-mile gas pipeline will connect the FPSO to the Israel’s domestic sales gas grid operated by INGL, the country’s national gas transmission company. Energean plans to begin operating Karish & Tanin in the first quarter of 2021 and expects to transport 2.15 Tcf of gas over a period of 16 years.

Jordan and Iraq agreed to a framework for construction of a 1,044-mile, twin oil and gas pipeline from Basra to Aqaba. When completed the project would move 1 MMbpd of oil and 258 MMcf/d of gas it destination. The pipelines would eliminate exposure to terrorist activity at border crossings which have forced Jordan to find more expensive sources for most of its 134,000-bpd demand.

South & Central America

Despite having the world's No. 2 shale gas reserves, Argentina is still a net energy importer, but there are signs of change under a business-friendly administration. Government incentives to develop and create markets for the Vaca Muerta shale and Austral Basin are starting to pay off. Transportadora de Gas del Sur S.A. (TGS) committed to an initial $250 million project to add gas transportation infrastructure in the Vaca Muerta during 2018-2019, including a conditioning plant and a 57-mile, 36-inch gas pipeline that will cross 16 hydrocarbon areas with initial capacity of 37 MMcm/d, expandable to 56 MMcm/d.

Argentina is expected to start exporting natural gas to neighboring Chile by the end of 2018. Existing agreements limited gas and electricity exports allowed gas and electricity exports only in emergency situations and required equivalent re-imports within a year. A recent agreement removing export restrictions could mark a turning point in energy trade in the region. P&GJ

Comments