August 2018, Vol. 245, No. 8

Features

Italian Energy Hub Seen as Key to EU Goals

By Nicholas Newman, Contributing Editor

European energy policy is largely determined by Brussels and implemented by individual member states, but integral to improving European energy security are joint plans to turn Italy into Southern Europe’s energy hub.

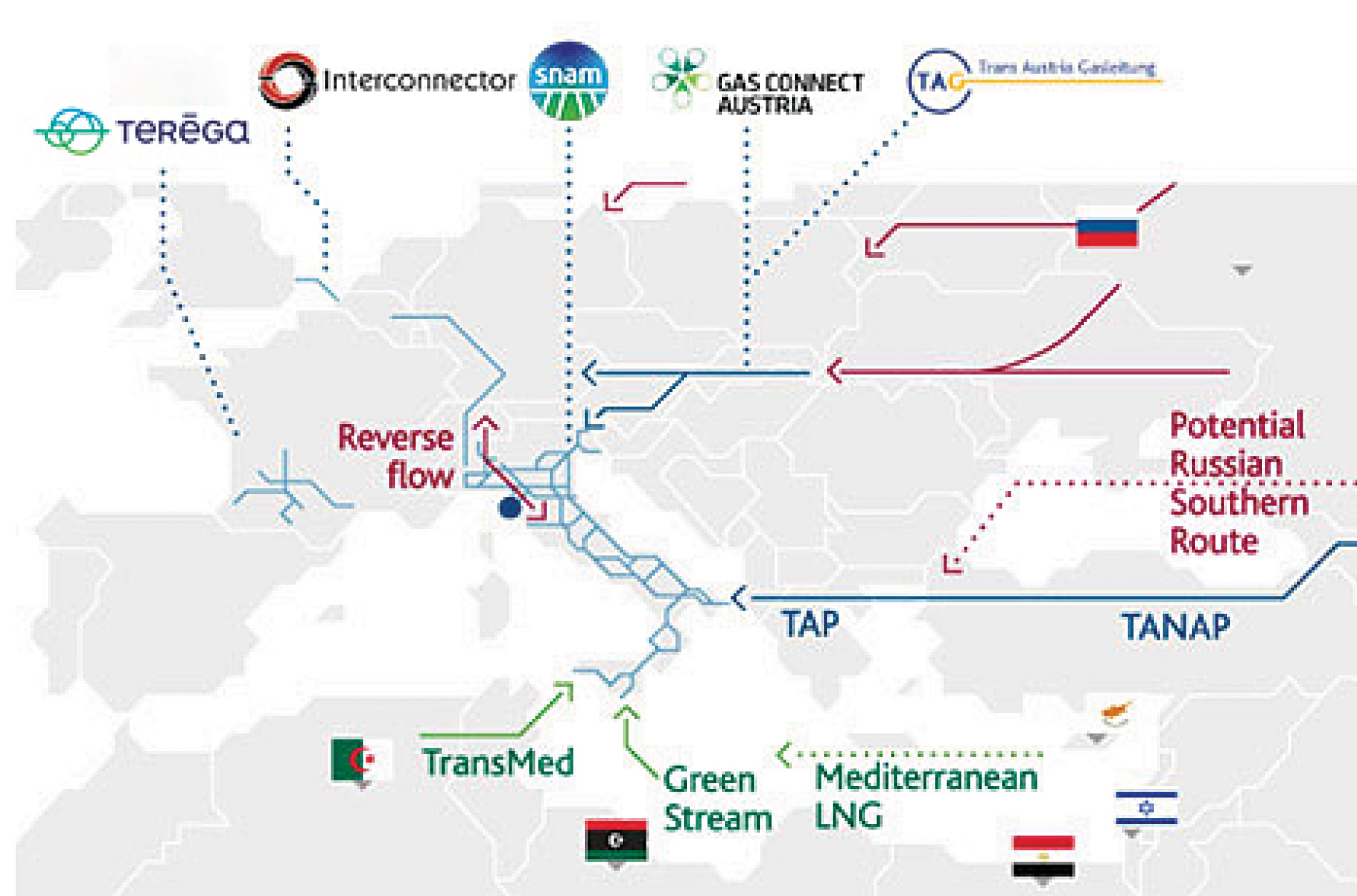

It would be fed by pipeline natural gas from North Africa and Caspian Sea gas fields, LNG by tanker from the Middle East, and ultimately from the Eastern Mediterranean for onward despatch to markets in Central Europe and the Balkans.

To contribute to the EU environmental program, gas will replace coal after 2025 in power generation and act as a vital tool to balance the grid as output from renewable supplies increases. Moreover, both the EU and Italian government encourage the use of LNG in heavy goods vehicles and shipping.

Italy’s partially privatized gas transmission system operator, Società Nazionale Metanodotti (SNAM), is crucial to meet domestic and Europe’s long-term economic, energy and environmental ambitions.

SNAM is responsible for transmission and distribution of natural gas throughout Italy, as well as construction of pipelines. With a market capitalisation of $16.3 billion (€13.9 billion) and an operating income of ($1.53 billion (€1.3 billion) in December 2016 it is roughly equivalent in size to Spain’s Enagas and the U.K.’s National Grid.

SNAM subsidiaries operate in Austria (TAG and GCA), France (Teréga) and the United Kingdom (Interconnector UK). SNAM is one of the main shareholders of the Trans Adriatic Pipeline (TAP) and is, therefore, the company most involved in projects for the creation of the Energy Union.

With little in the way of fossil fuels of its own, Italy is reliant on natural gas imports for about 90% of its needs and is highly dependent on Russia, Algeria and Libya. Second to crude oil, natural gas currently provides about 36% of Italy’s primary energy needs and LNG just 2%.

To boost and diversify supplies of gas, Italy has built three LNG import facilities providing easy access to gas fields in Egypt, Israel, the U.S. and Qatar and is involved in the construction of the Trans Adriatic Pipeline (TAP) to gain direct access to gas fields in the Caspian Sea (Figure 1).

Arrival of Biomethane

To boost its green credentials and increase gas supplies, SNAM injected biomethane, supplied by Montello SpA, an Italian and European leader in bio-waste recovery and recycle, into its national gas pipeline network last year.

Montello, a pioneer of biomethane produced exclusively from bio-waste, produces about 32 Mcm of biomethane a year, enough for about 640 million km traveled by “bio-vehicles.” The plant recovers wet organic waste, produced by 6 million inhabitants (equal to 60% of the whole Lombardy region), does not produce emissions and is the first Italian “carbon negative” plant.

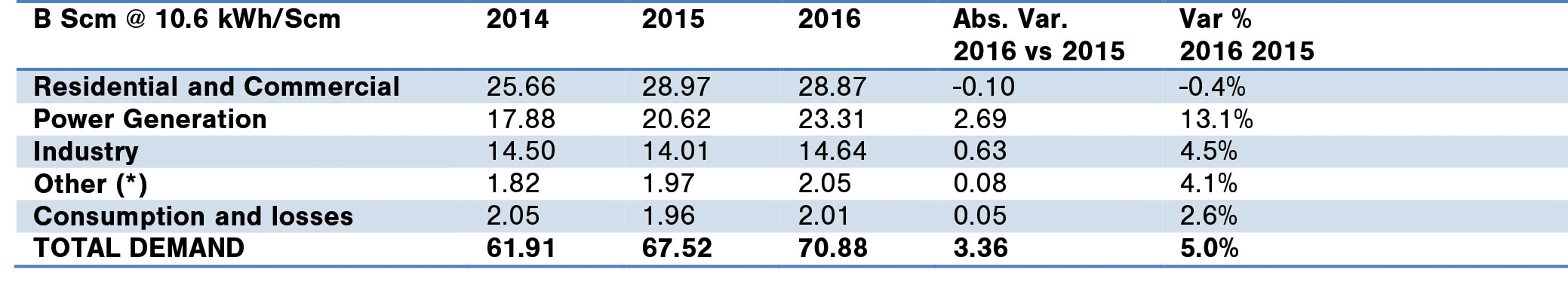

Italy’s domestic demand for gas was 70.9 Bcm in 2016 and is forecast to grow by 5% a year mainly due to rising demand from power generation and industry (Table 1).

Domestic Gas Network

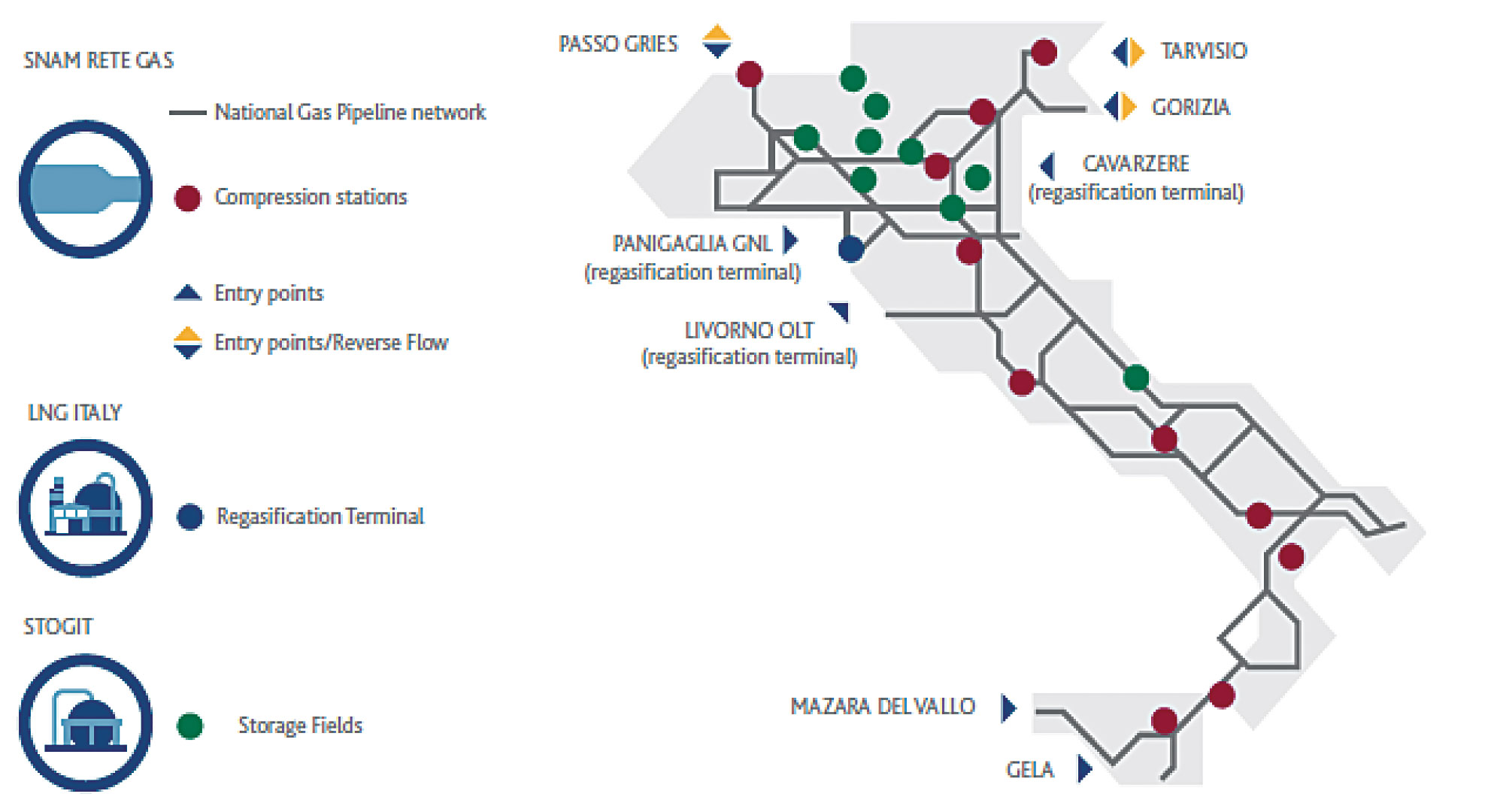

SNAM’s gas pipeline network of 32,508 km serves all the major cities and towns of the mainland as well as Sicily but excludes the island of Sardinia. The network is connected with cross-border underwater pipeline networks to North African neighbors, Tunisia and Libya and by overland pipelines to the Alpine states of Switzerland and Austria.

In addition, the domestic network is linked to three LNG import terminals, two on the Adriatic Coast and one on the Tyrrhenian Sea coast.

SNAM supplies more than 7,000 re-delivery points that supply gas to city distribution networks, industrial customers and gas-fired power stations. It operates eleven compressor stations and nine gas storage facilities in depleted natural gas fields (Bordolano, Brugherio, Cortemaggiore, Fiume Treste, Minerbio, Ripalta, Sabbioncello, Sergnano and Settala) with a total capacity 16.5 Bcm.

SNAM is one of the largest gas storage operators in Europe, which allows the company to buy and store plenty of low-priced gas during summer in time for the rise in winter demand (Figure 2).

Domestic Investment

In the five years ending in 2021, SNAM will invest $6.1 billion (€5.2 billion) of which $5.4 million (€4.6 billion) will go toward developing domestic transportation network and completing Sardinia’s north-south gas pipeline connecting Porto Torres to the southern city of Cagliari.

Sardinia’s 600-km grid will be served by a micro-LNG import terminal at Santa Giusta from this year which should cut customer’s bills and also provide bunkering facilities for LNG vessels. SNAM will spend 704.6 million (€600 million) on its storage and regasification facilities and upgrades to 650 km of pipes. A further $422.7 (€360 billion) will go toward improving energy efficiency and reducing emissions by 10%.

In keeping with European efforts to substitute gas for diesel in trucks and commercial vehicles, SNAM awarded Baker Hughes with a commission worth €80million to construct 19 micro-liquefaction LNG plants dedicated to supplying 140,000 tons a year of LNG to the commercial transport sector.

The adoption of gas in this form is likely to reduce greenhouse gas emissions by 30%, reports the European Commission. In June 2018, SNAM announced a similar plan for supplying shipping with LNG as part of the European Commission’s Gainn4Sea program.

International Pipelines

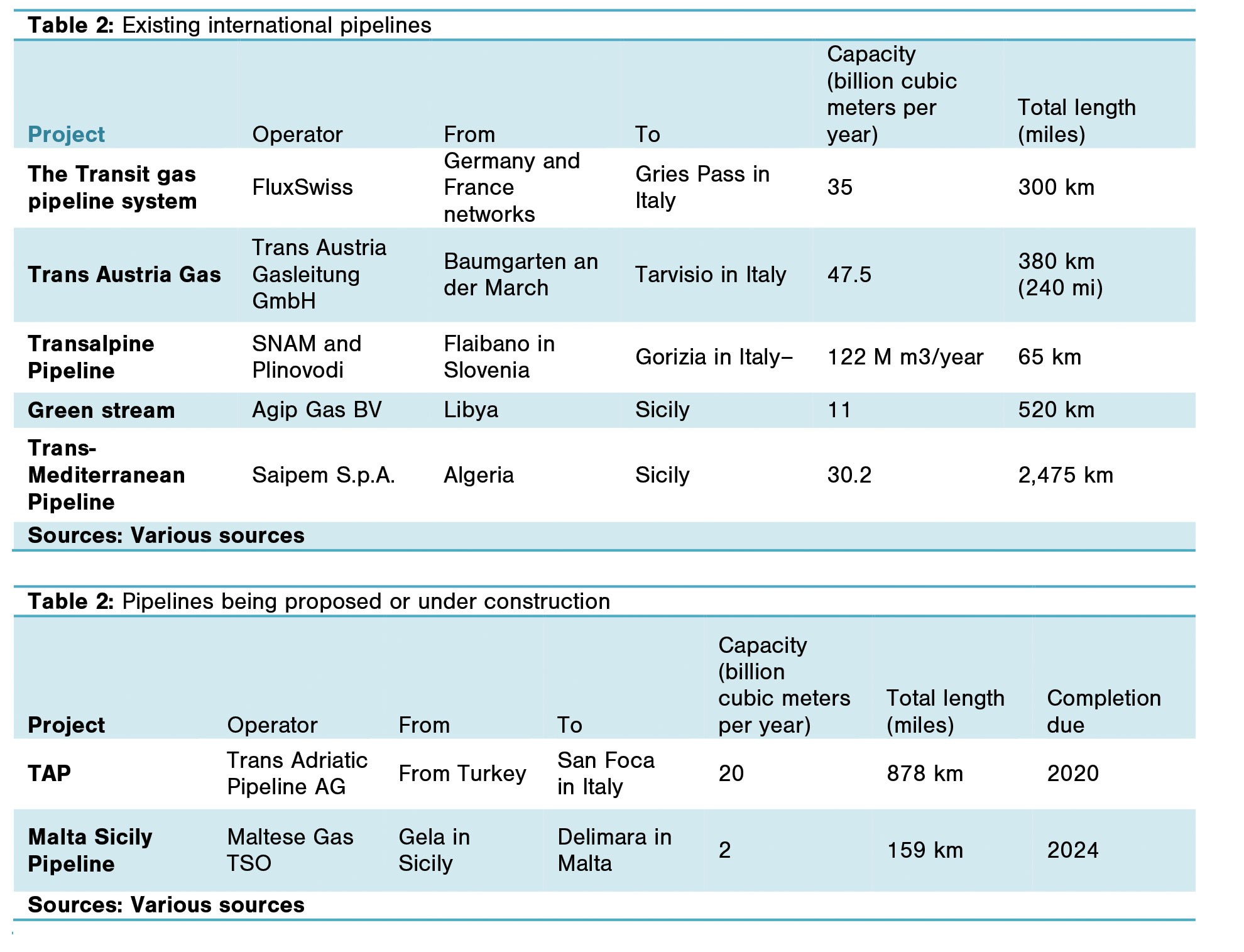

SNAM transports North African natural gas delivered by subsea pipelines through its domestic network and via bi-directional Alpine pipelines linking Italy with the North Sea and Siberian gas fields. Table 2 provides an overview of existing cross-border pipelines.

However, to significantly improve gas supplies for European power generators, industry and consumers, the cross-border TAP and the Malta-Sicily pipelines are being developed.

Trans Adriatic Pipeline (TAP): The TAP pipeline, currently under construction by an international consortium, is designed to provide Southern Italy with up to 10 Bcm of gas from BP’s Shah Deniz 2 gas field in the Caspian Sea via Turkey, Greece and Albania.

The need for diversifying sources of gas supplies was amply demonstrated by the impact of the Baumgarten depot explosion in December 2017, which forced Italy to declare a state of emergency as wholesale day-ahead price surged 97% to a record high of $54.95 (€47) per megawatt hour for few days.

Malta-Sicily Pipeline: The $348.1 million (€322 million) Malta-Sicily (mostly sub-sea) gas pipeline connecting Malta with Italy’s gas grid has completed all the approval stages. With a deadline in August, tenders to undertake (a ) a preliminary marine route survey between Delimara and Gela Sicily, (b) Environmental Impact Assessment studies in both Malta and Italy and (c) front-end engineering design studies, were issued in July.

The pipeline, to be operational by 2024, will connect Malta to the Trans-European Gas Network and will displace the unsightly tanker anchored in Malta’s Marsaxlokk Bay, which is providing LNG to the Delimara power station. Half co-financed through EU funding, this pipeline is designed to meet not only Malta’s domestic needs for four decades but also satisfy demand for LNG ship-bunkering needs from vessels refuelling on the island.

In sum, SNAM is integral to the European Union’s aim of improving energy security by becoming a hub for piped gas and LNG brought by tanker for onward transmission to southern and central Europe. SNAMs innovatory establishment of national micro-LNG plants to substitute diesel in road and heavy oil in marine transport provides additional support for European efforts to shift toward a low carbon future. P&GJ

Comments