June 2018, Vol. 245, No. 6

Features

Russia’s Gas Pipeline Network Revised

By Nicholas Newman, Contributing Editor

Russia’s Gazprom, in which the government holds a controlling stake, is responsible for about 11% of global gas output. In 2016, it extracted 419.1 Bcm of natural and associated gas, 15.9 million tons of gas condensate and 268.9 Bboe (39.3 million tons of oil).

Gazprom is a vertically integrated energy company focused on geological exploration, production, transportation and storage upstream, along with downstream processing and sales of gas, gas condensate and oil, and the sale of gas as a vehicle fuel. The company is also involved in the generation and marketing of heat and electric power.

Russia’s gas trunk transmission system is the most extensive in the world, linking gas fields in the Urals, Central Siberia and Russian Far East, with domestic customers and further afield in Europe, Turkey and China. In 2017, Gazprom’s sales reached $103.9 billion.

During the years 2005-2016, Gazprom spent over $4.62 billion in expanding the gas network. During this period, more than 28,000 kilometers (17,400 miles) of gas pipelines were built, and the gas penetration level in Russia increased from 53.3% to 67.2%, with the increase from 60% to 70.9% in urban areas and from 34.8% to 57.1% in rural areas.

Unified System

Gazprom owns and operates the Unified Gas System of Russia (UGS), which at 171,400 kilometers, is the world’s longest domestic gas trunk transmission system serving not only its own fields, but also those of independents such as Rosneft, Novatek, Urals Energy Public Company ltd and the Imperial Energy Corporation PLC.

Gazprom operates 253 compressor stations to carry gas over long distances, as well as more than 20 underground natural gas storage facilities. These impressive credentials mask the fact that the bulk of the transmission pipelines are old and in need of costly replacement.

“Around 50% of the Russian trunk pipeline system is over 30 years old,” said Jack Sharples, an Oxford Institute fellow for Energy Studies. “A further 27.5% is 20 to 30 years old. This leaves around 22.5% of the system being 20 years old or less.”

Western Projects

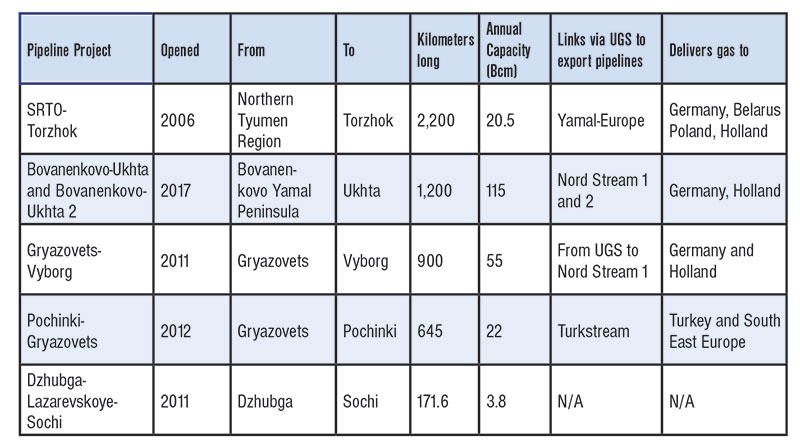

In order to improve gas transmission capacity and reliability to European markets, Gazprom has invested in several pipeline construction projects (Table 1). In 2006, in north western Siberia, the SRTO-Torzhok and the Bovanenkovo-Ukhta and Bovanenkovo-Ukhta 2 pipelines came on stream to link up with the UGS to supply major markets in the Moscow and St, Petersburg regions, as well as connecting up with export pipelines delivering gas to the Baltic States, Eastern and Western Europe.

Further west, Gazprom built the Gryazovets-Vyborg pipeline designed to connect the UGS to Nordstream 1, the major direct export pipeline to Germany.

In addition, the company recently made the Pochinki-Gryazovets interconnector, which at present moves gas from central Russia to the Northern, part of the UGS bidirectional. Once Turk Stream is completed in 2019, the flow of gas will be changed to allow Yamal gas to be sent south to the start of the Turk Stream pipeline at Anapa across the Black Sea to European Turkey for delivery to Istanbul and other south eastern European markets.

Further south, Gazprom has extended the UGS to serve various Russian Black Sea resorts including Sochi, by constructing the nation’s first offshore gas pipeline, the Dzhubga-Lazarevskoye-Sochi. In 2014, this pipeline was used to meet the power and heating needs of contestants at the 2014 Winter Olympics.

Pipelines to Europe

At least half of Gazprom’s 639.9 Bcm gas output in 2017 was exported with Europe accounting for the lion’s share. In 2017, Gazprom-owned pipelines supplied 193.9 Bcm, or 40%, of Europe’s, according to Financial Times.

By 2019, Gazprom expects to complete two more major pipeline connections with Europe. First, it will double the capacity of its 55 Bcm a year Nordstream 1, which connects its domestic network directly to Germany with Nordstream 2 running in parallel. Secondly, it will complete construction of the mostly subsea, 31.5 Bcm per year Turk Stream pipeline linking Russia directly to Turkey and south eastern Europe (Figure 1).

The $55 billion 4,000-km Power of Siberia natural gas pipeline, the fruit of Gazprom’s $400 billion contract signed in May 2014 with China National Petroleum. The Power of Siberia gas trunk line will transport gas from the Irkutsk and Yakutia gas production centres to consumers in Russia’s Far East and China (Figure 2).

In September 2014, Gazprom started construction of Power of Siberia’s first section running some 2,200 kilometers from the Chayandinskoye field (Yakutia) to Blagoveshchensk (Chinese border). The second phase of the project will include the construction of a section stretching for about 800 kilometers from the Kovyktinskoye field (Irkutsk Region) to the Chayandinskoye field. The third stage provides for expanding gas transmission capacities between the Chayandinskoye field and Blagoveshchensk.

As of March 2018, Gazprom reports some 75.5% is complete, and Gazprom added, it could start supplying China’s CNPC with natural gas in December 2019. Once operational, Russia could send up to 300 Bcm of natural gas a year to China alone, overtaking the European market in terms of volume if not profitability.

Along the Pacific coastline, Gazprom is involved in several interesting projects. Since 2011, on the isolated Kamchatka Peninsula, it has developed gas fields and gas network delivering 175 Mcm of gas per year to serve settlements in this remote region.

Further south on the island of Sakhalin, it has worked since 2009, with various partners to exploit the gas fields of the region, by operating an integrated pipeline network and LNG export plant with an output of 9.6 mtpa of LNG. On the mainland, near the city of Vladivostok, Gazprom has plans to build a 3.6-million-ton LNG export plant, due to be fully operational in 2020.

Third-Party Access

Gazprom is sole owner of virtually all of Russia’s trunk natural gas pipelines, the UGS and export pipelines. A crack in its monopoly was opened by the 1999 Law on Gas Supply which requires owners of gas systems to allow third-party non-discriminatory access and in exports of LNG from Yamal.

According to Sharples, “The government will not allow other companies to own and operate pipelines, but it is pressing ahead with the implementation of third-party access to that system, including for Gazprom’s competitors [the largest being Novatek and Rosneft].”

The Novatek-led $27 billion Yamal LNG export plant, a 16.5 mtpa project, above the Arctic Circle has allowed it direct access to gas markets without the use of Gazprom pipelines.

During the past year, the U.S. and E.U. have tightened economic, financial and technology transfer sanctions on Russia – particularly its energy sector. However, the effect of the ban on technology transfers to Gazprom is likely to be minimal when it comes to pipeline construction. Local suppliers, leading builder CJSC Stroytransgaz, pipe-maker TMK Group a pipe-maker and coating provider Bt Svap LLC have experience building pipelines in remote locations and difficult environments, such as the high Arctic.

Likewise, Gazprom can bypass western financial restrictions by seeking funding from the state, China and Saudi Arabia to support its program of upgrades and new projects. P&GJ

Comments