June 2020, Vol. 247, No. 6

Features

Pipelines Critical to Equatorial Guinea’s Ambitious Gas Plan

By Shem Oirere, Energy Writer

The coronavirus (COVID-19) outbreak is expected to have far-reaching implications on Africa’s oil and gas projects, many of them that had already been billed as next drivers of growth for the region’s hydrocarbons pipeline sector.

However, one country in Africa could rest easy, at least momentarily, as a key upstream investor in a major gas monetization project proceeds despite the company substantially reducing its 2020 capital expenditure globally.

Houston-based hydrocarbon explorer Noble Energy, formerly Noble Affiliates, said it has made significant reductions in its earlier projected 2020 capital expenditure by $550 million. “In light of the recent commodity price downturn, we are sharply reducing capital expenditures,” said David L. Stover, Noble Energy’s chairman and CEO in a mid-March statement to shareholders.

He said the deferring of activity until commodity prices recover “protects our investment returns, maintains free cash flow and strengthens the balance sheet.”

An estimated two-thirds of the reduced capital expenditure is to be channeled to the Alen gas monetization development project in Equatorial Guinea as Noble projects its new 2020 capital expenditure to between $1 billion and $1.3 billion.

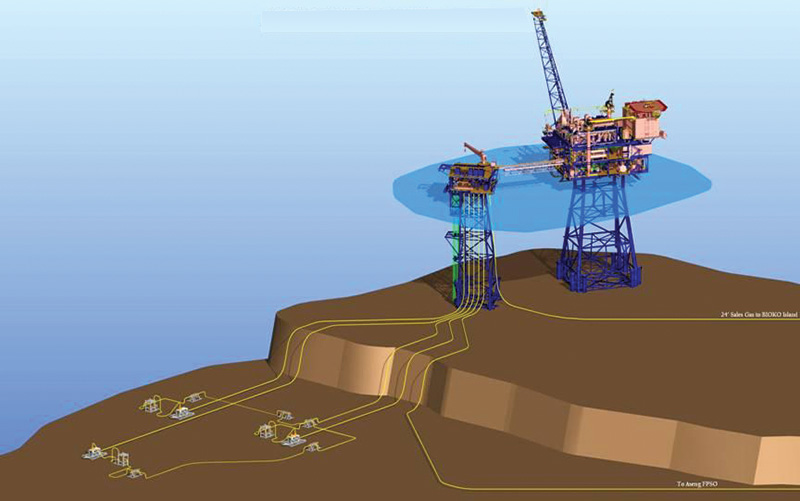

Noble Energy has discovered 3 Tcf (85 Bcm) of gross natural gas resources in Equatorial Guinea’s offshore pipeline market in the Douala basin in Block O. The launch of the Aseng field development, which is located on Block I in water depths of 1,000 feet (304.8 meters), is under a contract awarded to Technip.

Technip’s contract entails engineering, supply, installation and pre-commissioning of the 18.6 miles (30 km) of flexible pipe system, comprising one flexible riser, two flexible flowlines, and three jumpers. The five subsea wells at the Aseng field are connected to a Noble Energy-chartered floating production, storage and offloading vessel (FPSO).

The two flowlines pipe liquid condensate for processing from the Alen fields in Block O to the Aseng FPSO, nearly 15 miles (24 km) to the south in Block I. The Aseng FPSO is operated by GEPsing, a joint venture between Compania Nacional de Petroleo de Guinea Ecuatorial and SBM Offshore.

Elsewhere, the natural gas produced from the Alen field is re-injected to help increase pressure in the reservoir and support targeted production levels, in addition to inducing flow of additional hydrocarbons.

“Noble Energy is continuing to move the Alen gas monetization project in Equatorial Guinea forward for first production in early 2021,” added Noble. At least 80% of the reduction is in the U.S., while at the international level, Noble said, it “has identified approximately $100 million in capital reductions coming from major project execution, deferral of noncritical spend into future years and the exploration program.”

In November 2019, Noble Energy had contracted Italian multinational oilfield services company Saipem SpA for the offshore installation of a 24-inch (609.6-mm) pipeline. The 43-mile (70-km) pipeline is capable of handling 950 MMcf (26.90 MMcm) of natural gas equivalent per day (MMcfe/d) and is to transport all natural gas processed through the Alen platform to the single-train Equatorial Guinea Liquefied Natural Gas project located on the northwest side of Bioko Island at Punta Europa.

Noble previously picked Luxembourg-based global manufacturer of steel pipes Tenaris SA for a tender to manufacture 20,000 tons of concrete-lined pipes at its Confab welded pipe mill located in Pindamonhangaba, Brazil, for the Alen gas monetization project.

Cronus Technology will supply the pipeline lead and provide oversight services of the front-end engineering design (FEED). “Detailed design of the subsea pipeline system, procurement of rigid and flexible pipe, pipeline route and hazard survey, SURF installation contracting and installation campaign for the infield and export pipeline systems” will be provided as well, said Cronus.

Cronus said the Alen gas field’s infield pipeline system comprises three tie-back flowlines consisting of a combination of flexible and rigid line pipe. The export system consists of a condensate pipeline from the wellhead platform, terminating with a flexible riser to an existing FPSO.

More investments in Equatorial Guinea pipeline industry was expected when the country, currently the third oil producer in Africa, declared 2020 the year of investment in its upstream sector. Unfortunately, this declaration coincided with the outbreak of COVID-19.

For Noble Energy and the Alen gas development project, the greatest challenge in the coming months amid COVID-19 remains balancing between the decision to proceed with the pipeline works and adherence with the World Health Organization’s (WHO’s) safety and social distancing regulations to protect personnel from infection.

Although Noble Energy reiterated its desire to push ahead with the Alen gas monetization project in Equatorial Guinea, with an initial production date of early 2021, the project’s lead pipeline contractor, Saipem, has remained, on the other hand, cautious because of the likely impact of COVID-19 on oil and gas projects in the near term.

Saipem cites the example of the shift toward a low oil price regime in recent weeks, which predicts “could substantially affect future investment decisions by oil companies.”

“Saipem operates mainly as a global solutions provider in engineering and construction, as well as drilling, and it is exposed to the future clients’ investment decisions in various segments, ranging from oil, gas, renewables and infrastructure,” said Chairman Francesco Caio and CEO Stefano Cao in a statement to shareholders in early April. “The ongoing Coronavirus pandemic makes the current market scenario highly uncertain: from financial markets to the real economy, with impacts that cannot be foreseen at the moment and could potentially significantly impact the group’s future commercial and operating activities,” they said.

Noble Energy has been a top contributor to the shaping of Equatorial Guinea’s pipeline market with its Alen gas development project, which involves a condensate field in Block O in 230 feet (70 meters) of water off the east coast of the country’s Bioko Island.

Equatorial Guinea, which has 1.1 billion barrels and 1.34 Tcf of proven oil and gas reserves, respectively, is committed to turning its Punta Europa LNG facility into West Africa’s gas processing hub by linking it through pipelines to offshore gas fields within the country and, in the future, in Nigeria, Cameroon and São Tomé.

Equatorial Guinea’s Ministry of Mines and Hydrocarbons, led by Gabriel Obiang Lima, has reached out to the three neighboring natural gas reserve holders to consider utilizing the Punta Europa gas processing facility instead of investing in separate standalone similar plants.

Separately, growth of Equatorial Guinea’s pipeline industry is also expected to be supported by scheduled or unscheduled pipe repairs and replacements as happened with the Marathon Oil-owned Alba C Riser Repair project.

Marathon’s affiliate, Marathon Equatorial Guinea Production Ltd (MEGPL), carried out repair works at its Alba C platform at the Alba Block in the Gulf of Guinea. The platform has two 12-inch (304.8-mm) pipelines, identified as North and South, that run from Alba C platform to Alba B2 platform for product separation.

Two of the existing 12-inch Hyper 12% Cr risers, which were installed on Alba C in 2003, are said to have begun experiencing cracking and coating degradation. Cronus Technology was subcontracted to perform FEED and detailed design for two new risers and tie-ins on the Alba C platform.

With increasing oil and gas discoveries in Equatorial Guinea’s offshore space and an anticipated ramping up of production, installation, repairs and replacement of subsea pipeline systems are expected to remain key drivers in growth of the country’s pipeline industry.

Comments