October 2020, Vol. 247, No. 10

Features

Despite Recent Setbacks, Midstream Shows Confidence

The cancellation of Atlantic Coast Pipeline and the court order to shut down Dakota Access Pipeline will have a lasting impact on the midstream sector, signaling ongoing legal and regulatory challenges and making it harder to raise capital for large projects, a Pipeline & Gas Journal survey indicates.

The survey of nearly 500 readers drew responses from mostly managers, engineers and executives at companies throughout the midstream industry. Just over a quarter of respondents were at engineering firms, while 19% were in operations and 17% in construction. Others included service and maintenance, consulting and local distribution companies.

Nearly 54% were at companies with more than 200 employees, while 26% had fewer than 20. The rest were spread fairly evenly across the mid-range.

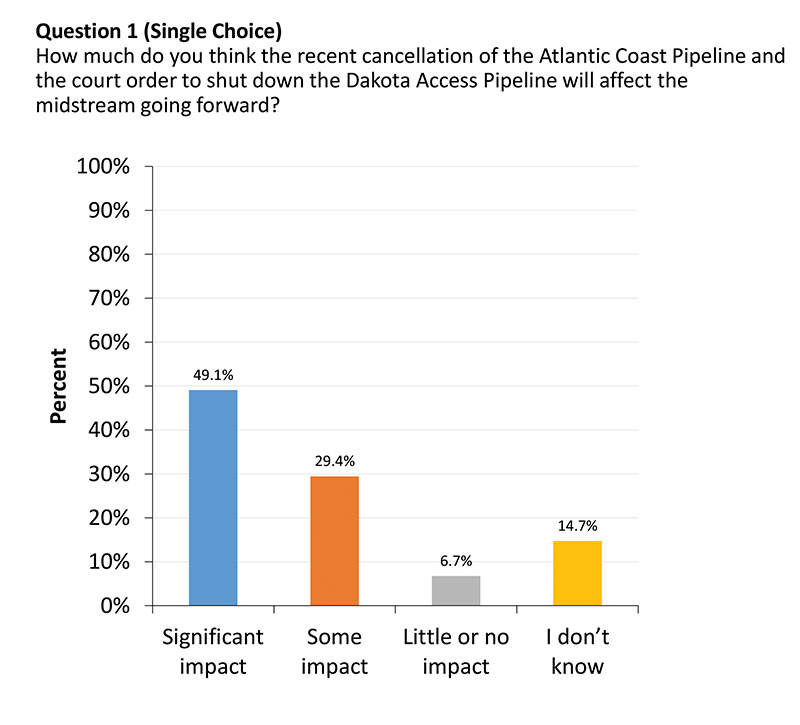

Asked about the cancellation of Atlantic Coast and the court order against Dakota Access, 49% said they believe there will be a significant impact on the midstream going forward, and 29% said there would be some impact. Just under 7% expected little or no impact, with the remainder undecided.

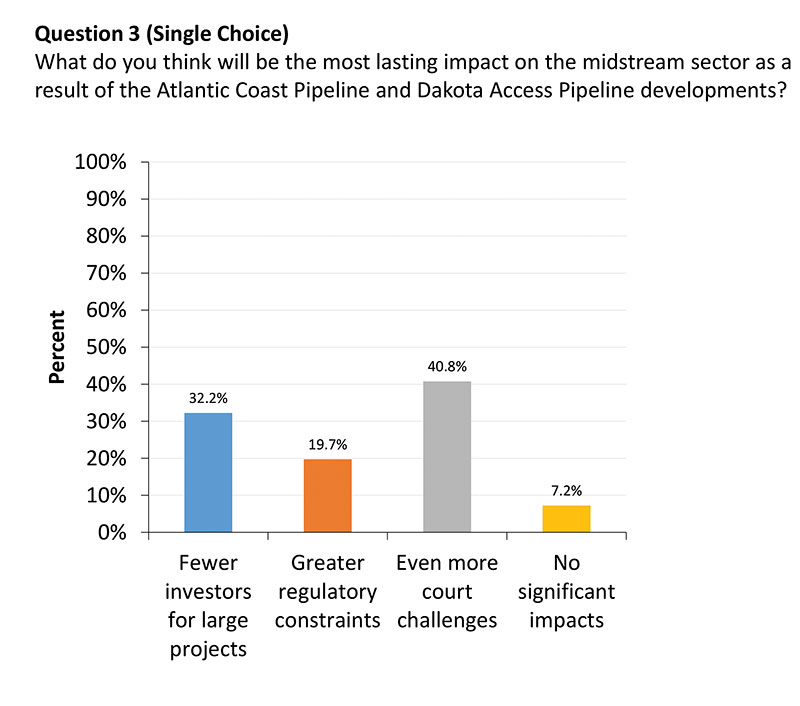

More than 40% said they think the most lasting impact on the midstream sector will be even more court challenges, followed by fewer investors for large projects (32%) and greater regulatory constraints (20%).

Business Impact

While most see a significant industry impact in the future, they were generally more optimistic about the outlook for their own companies.

About half, 49%, expected the developments to result in capital spending reductions at their companies of less than 10%. However, 22% of respondents felt they would result in a 25% or greater reduction in capex. The remainder expected spending would be reduced by about 15-20%.

About 37% said they believe the financial ill-effects on their companies would last only a year or less. The majority, however, think the impact on their businesses will last longer. About 40% predicted their businesses would be affected for two years, 8% expect three years and 15% believe the impact will continue for more than three years.

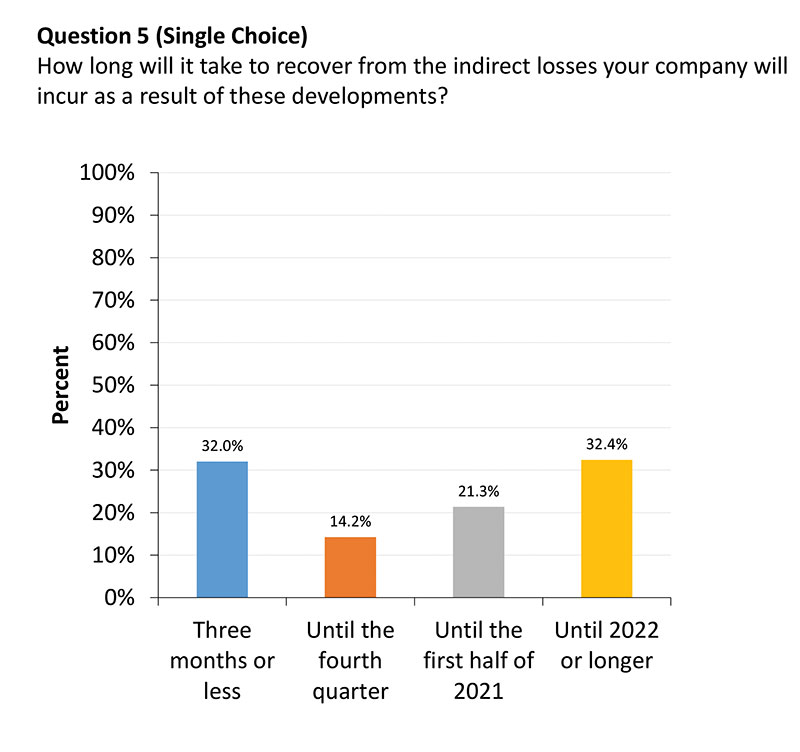

They were even more upbeat when asked how long it would take their companies to recoup business it loses as a direct result of the Atlantic Coast cancellation and Dakota Access developments. Nearly half – 48% – expected to regain losses by the end of this year, while 25% said it would take until the first half of 2021, and 27% projected their recovery would take until 2022 or longer.

Company Responses

At least some of the optimism reflected in the survey may be fueled by a belief that the adjustments companies are making will cushion the impact of a lingering pandemic, reduced oil and gas prices and project construction cutbacks.

“The low price of oil and gas has had a more significant impact on our business than the coronavirus/health issue,” one respondent wrote.

Some of the readers who work at construction companies said they are pursuing more projects outside of oil and gas to help tide them over, including municipal utilities and other public infrastructure. Others said they are shifting from large pipelines to smaller construction, maintenance and replacement projects.

Companies in some areas, such as inspection services, report they are as busy as ever. Still others are shifting toward more fabrication and equipment rentals, and toward natural gas instead of oil projects. Meanwhile, those who believe they already have the right customer bases are sticking with tried and true approaches.

“We cover construction from new capital projects to small maintenance, so we will continue to pursue the same business plan,” one respondent wrote.

Coronavirus Effects

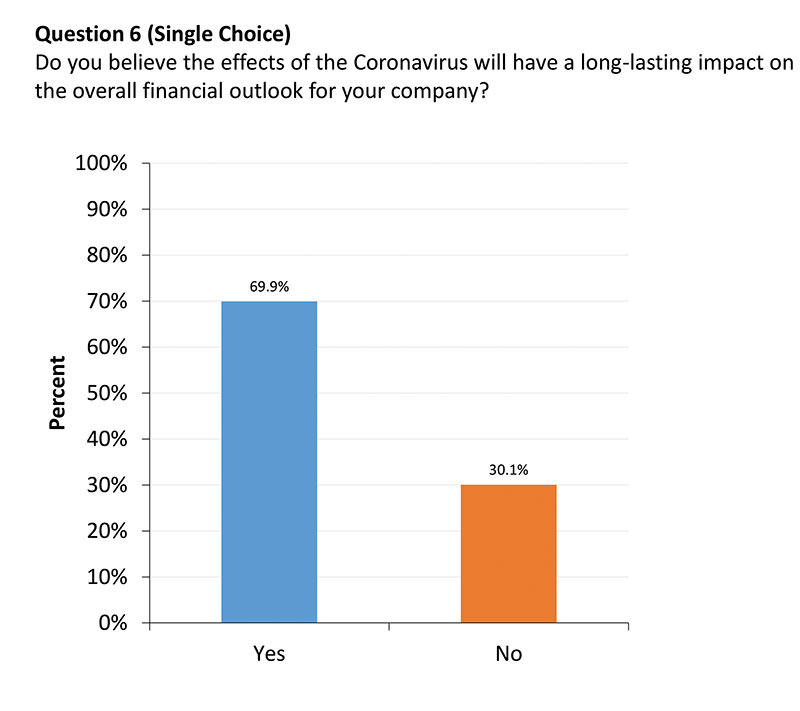

More than half of P&GJ readers responding to the survey (53%) said their companies have implemented workforce reductions as a result of pandemic-related shutdowns, and 70% of respondents believe the COVID-19 crisis will have a long-lasting impact on the overall financial outlook for their companies.

A majority of midstream and related companies said their productivity has also been negatively impacted by the pandemic.

Forty-seven percent reported “some” negative impact on productivity, and 28% said their companies have suffered a “significant” negative impact. On the other hand, 19% reported very little impact, and a surprising 6% think their net productivity has actually increased during the shutdowns.

Supply chain has been a major business concern since the start of the COVID-19 crisis, and midstream companies are seeing varying degrees of impact in this area. About 45% reported a small amount of supply chain disruptions, and 23% said they have seen disruptions to a noticeable extent.

One respondent cited three causes of delays: “not enough warehouse personnel to pick and ship the item, not enough employees to build that piece of equipment that I ordered or downstream parts from other suppliers, or … the manufacturer has not reopened to bring its workers back.”

However, only 5% reported significant disruptions, and 26% said they haven’t noticed any change in supply availability.

The majority of readers responding to the survey believe the coronavirus impact on their businesses will linger, including 40% who think it will persist for two years and 23% who believe it will last three years or longer. Others believe it won’t last nearly that long, with 37% predicting the negative financial impact of the pandemic on their companies will last only one year or less.

Remote Work

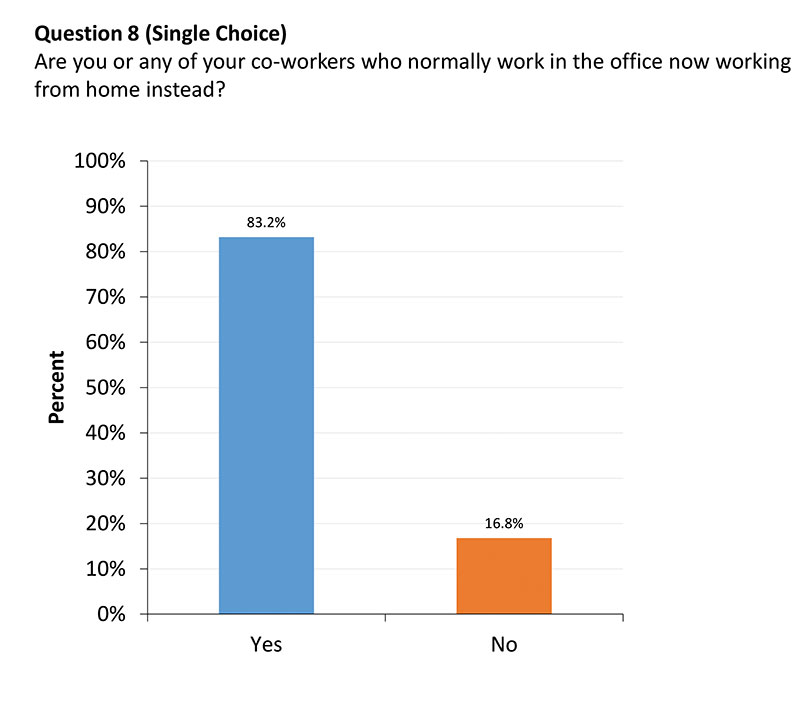

A whopping 83% of survey respondents said that either they or some of their coworkers who normally work in an office are now working from home.

When asked what percentage of their staffs were affected, 32% of P&GJ readers responded that all or almost all were working from home, and 25% said between half and three-quarters of their workforces were working remotely.

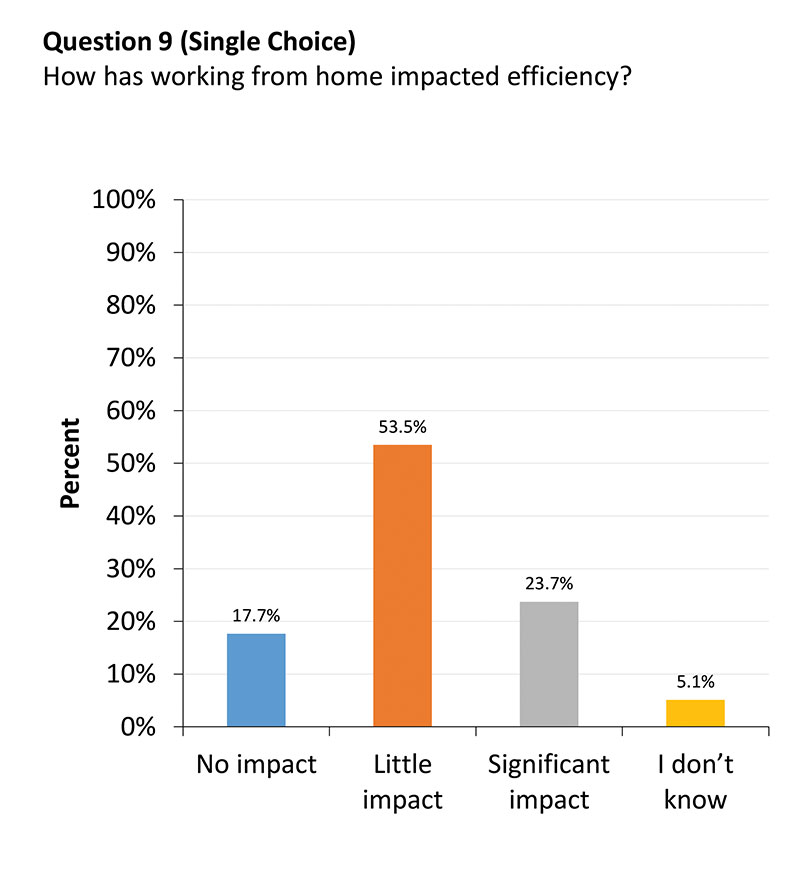

Of those, 71% said the shift toward remote work has had little or no impact on efficiency (18% no impact, 54% little impact). However, 24% said that the shift toward working from home had significantly impacted their efficiency.

“We haven’t lost any business, but it’s harder to find new projects with people working remotely, not traveling as much, etc.,” one respondent wrote.

Comments