October 2020, Vol. 247, No. 10

Features

U.S. Northeast: Taking a Fresh Look at an Old Region

By Richard Nemec, Contributing Editor

Just a week before Labor Day in the heart of the Marcellus Shale’s unconventional natural gas bonanza, Pennsylvania state officials were predicting another quarter of declining production, the first back-to-back quarterly declines and lowest year-over-year growth in three years.

This outcome pre-pandemic was unexpected, but when the numbers crunchers uncovered a 49.7% decline in gas prices between the start of 2019 and the end of this year’s second quarter, the falloff in output was inevitable.

A few days earlier, the Northeast was treated to a rare regulatory victory when another part of the Pennsylvania commonwealth government moved to allow the resumption of the Energy Transfer LP (ET) underground drilling for its Sunoco Pipeline LP unit’s Mariner East 2 Pipeline across all of southern Pennsylvania.

A state environmental hearing board judge agreed with the company that state environmental regulators had overreacted to a construction-related water discharge. Through August, the $3 billion Sunoco project had experienced significant setbacks, including other spills, sinkholes and a year-long regulatory fight over an explosion on an additional ET pipeline in the state.

At issue was Sunoco’s challenge of a state regulatory directive to suspend work on horizontal directional drilling (HDD) in Chester County, Pa., that is needed to complete parts of what has become an embattled Mariner East pipeline system to carry Marcellus Shale supplies to a processing facility near Philadelphia. The stakes were high for the Northeast region’s energy future.

A prolonged construction stoppage at the site in West Whiteland Township represented “a significant risk of adverse consequences at this work location,” including a potential complete loss of the HDD of a 2,800-foot (853-meter) borehole, and the continued discharge of groundwater through the existing pilot hole, according to Sunoco’s legal appeal to the Pennsylvania Environmental Hearing Board. The pipeline was challenging a violation notice from the State Department of Environmental Protection (DEP).

Whether it is fingerprints or footprints, natural gas infrastructure has left its mark all over the Northeast in recent times, fueled by the Appalachian gas boom and roaring demand in what constitutes a heavily populated region of America. Pundits, regulators and operators all agree that supply and demand growth both have outpaced pipeline development at times, and the recent history is littered with canceled efforts and investment write-offs.

“The U.S. power sector’s shift to natural gas over the past few years has been a boon to gas producers across the Lower 48, especially in the Northeast,” RBN Energy’s Housley Carr, a respected energy analyst, wrote on his blog in mid-August. “Scores of new gas-fired power plants have been built there during the shale era, and a number of coal-fired, oil-fired and nuclear plants have been taken offline. New England is a case in point; gas-fired power now accounts for about half of the installed generating capacity in the six-state region (Connecticut, Rhode Island, Massachusetts, Vermont, New Hampshire and Maine) – three times what it was 20 years ago.”

Natural gas demand is projected to be down by about 3% this year, and after setting records last year, production is slated to drop about 4% for 2020, according to the Northeast Gas Association (NGA).

On the national level, the U.S. Energy Information Administration (EIA) predicts that production should start turning upward again in the second quarter of next year. “Demand this summer was strong from the power generation sector as hot and humid weather impacted the region, and notably in July gas fueled 63% of the electric demand throughout New England,” said NGA spokesperson Stephen Leahy.

NGA projections call for “continued steady growth” for natural gas, “steady state” for oil as a backup power plant fuel and continued decline for coal in the nine-state Northeast’s power generation mix. In the heating sector, gas fuels 59% of the homes in the region; oil is 21%; and electricity has 16% of the heating load.

RBN’s Carr and many other analysts examining the Northeast conclude the midstream sector is working feverishly to keep pace with growth, but it hasn’t succeeded in keeping up with either the growth in gas-fired generation or the Marcellus/Utica shale plays’ production growth over the past decade and longer.

Carr, et al. cite as evidence the fact that the same five major gas pipeline networks are still serving the Northeast:

- Tennessee Gas Pipeline (TGP) and Algonquin Gas Transmission (AGT) from the south

- Iroquois Gas Transmission (IGT) from the west through New York state

- Maritimes & Northeast Pipeline (MNP) along with Portland Natural Gas Transmission (PNGT) from Canada, through New Brunswick and Quebec, respectively

“In recent years, infrastructure growth in the region has been fairly steady, but generally at a lower rate since 2015,” said NGA’s Leahy. “In the first months of 2020, when nationally about 5 Bcf/d (142 MMcm/d) of new pipeline capacity came online, the Northeast saw less than 500 MMcf/d (14 MMcm/d) in additions. The spring of 2020 also witnessed the withdrawal of several major proposed projects, which was disappointing news for the Northeast; incremental growth seems the most likely path for new infrastructure additions in the region in 2021.”

Along with the five steadfast transmission pipelines, the Northeast has two liquefied natural gas (LNG) import terminals in the Boston, Mass., area – Excelerate Energy’s Northeast Gateway Deepwater Port and Exelon Generation’s Everett terminal. LNG provides fuel for Exelon’s 1,400-MW, gas-fired Mystic power plant as well as supplies to gas utilities. There is also the Canaport LNG import terminal up in New Brunswick, from which regasified LNG can be piped down MNP into New England.

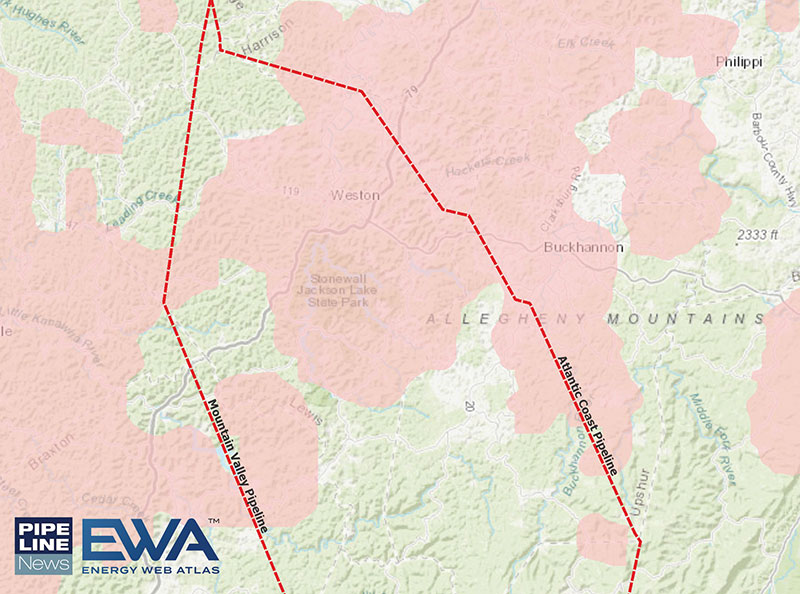

In this mix, some of the analysts focusing closely on the Northeast see several major infrastructure projects reaching fruition in 2021, such as Mountain Valley Pipeline (MVP) early in the year and Mountain Valley Southgate late in 2021. (Early in September, MVP received a key environmental OK from the U.S. Fish and Wildlife Service.)

The final completion of Mountain Valley mainline equates to 2 Bcf/d (57 MMcm/d) of takeaway from southwest Appalachia. However, analysts at Colorado-based BTU Analytics LLC do not see the project spurring added production because of the dampened demand outlook for the Atlantic Seaboard.

Other infrastructure scheduled to come online next year include PennEast Phase 1, Adelphia Gateway and Transco’s Leidy South expansion. In August, Leidy received authorization from the Federal Energy Regulatory Commission (FERC), and Williams Companies officials were expecting to start construction in 2021.

At about the same time, PennEast received updated environmental assessments from FERC, although it was not exempt from potential regulatory and legal delays in the months ahead. Adelphia was working through state permits in Pennsylvania before seeking FERC’s permission to proceed.

“Infrastructure is the key to connecting markets around the country to our region’s natural gas abundance,” said David Spigelmyer, president of the Marcellus Shale Coalition. “Even if pipeline access is artificially blocked, demand for clean, affordable and reliable energy still exists. Without added capacity, we face higher costs, reliability challenges and reliance on older, less-efficient power generation technologies that have significantly greater emissions.”

Nevertheless, Spigelmyer is concerned about various “headwinds” facing Appalachian region gas producers, some of which are due in large part to the COVID-19 pandemic and others caused by political roadblocks, particularly in New York state where Gov. Andrew Cuomo’s administration has repeatedly blocked new and expanded gas pipeline access. The state’s path to a Green New Deal is unattainable if new pipeline capacity additions are blocked, he argues.

“[Cuomo’s] path to greater renewable energy use is unattainable because every renewable energy source requires a baseload electricity backup, something that we have quickly learned from the recent failed California experiment, and as noted recently by the head of the Wind Energy Association,” he said. “Natural gas is the clean energy partner that makes renewable energy possible.”

A second analyst at RBN Energy, Rick Smead, cited another challenge for the midstream pipelines tied to the number of 10-year contracts from the start of the U.S. shale boom that now are rolling off and must be renegotiated with suppliers at a very difficult time for the producers and other shippers.

“For pipeline owners, this is happening at the worst possible time; the market is in turmoil and facing ongoing uncertainty as gas production is down, demand from LNG exports is in flux, and regional supply/demand dynamics are shifting,” Smead wrote just before Labor Day.

Smead acknowledged that the Rockies Express Pipeline’s primary owner Tallgrass Energy has re-signed most of its shippers at lower rates “that recognize the lower value of only needing to get supplies to the Midwest, but other pipeline corridors may face new dilemmas.” He said the bottom line is that everything in the market is in flux, “and all pipelines are physically static.”

At the end of summer, Northeast production was projected to remain flat until late next year when growth is expected to return in a post-pandemic world. U.S. LNG demand is not expected to rebound until 2022 at the earliest. Like general gas demand, LNG could start to move upward in late 2021, and with it drilling and well completion activity is expected to pick up.

Noting that Northeast producers are “somewhat isolated” from the impacts of sustained low associated gas production, BTU Analytics’ energy analyst Anna Lenzmeier expects that “the Northeast region will benefit from the decline in associated gas production as demand rebounds.” Lenzmeier said the higher gas pricing has the potential “to put downward pressure on power demand across the country, but Northeast power demand is expected to average just slightly lower than 2020, driven by new gas-fired power plants coming online.”

While low gas and power prices could persist, infrastructure investment is expected to continue to be “robust,” according to Ryan Wobbrock, a senior credit officer at Moody’s Investors Service in New York. “Power transmission and distribution in the Northeast could be attractive targets since they have a long runway for investment and would benefit from electrification efforts and offshore wind development longer term, Wobbrock said.

Wobbrock sees supply/demand in the region staying in check, thanks mostly to the regional independent grid operator. Nuclear plants will continue to be an issue with one facility in New York state, Indian Point 3, closing with its replacement being a new gas-fired plant, despite the state’s aggressive push to lower greenhouse gas (GHG) emissions.

Separately, the region’s only multiunit nuclear generating station, Millstone in Connecticut, has been awarded a multiyear power purchase agreement to ensure its “economic life,” according to Wobbrock.

“The decarbonization transition will continue despite some headwinds,” Wobbrock said. “Green investment is often seen as a good source of jobs and economic stimulus. For local gas distribution companies and transmission pipelines, renewable natural gas [RNG] is having an uptake, and eventually hydrogen gas could help support infrastructure’s prolonged life, even with the aggressive GHG emissions reductions.”

From a policy perspective, NGA’s Leahy said Northeast states are emphasizing a transition to clean energy, but he thinks that includes natural gas. “It remains the key energy source for the region for both the building and power sectors in 2021 and for many years beyond that,” he said. “The fundamentals are looking fairly positive for gas once we get past the immediate effects of the pandemic on overall economic demand.”

Leahy cited the announcement in August of a multiyear joint national undertaking, the Low-Carbon Resources Initiative, as an international collaborative involving U.S. natural gas and electric utilities, and two industry research centers on a $100 million effort to develop alternatives to natural gas.

Researchers at the Gas Technology Institute (GTI) and the Electric Power Research Institute (EPRI) are leading the effort to bring several early-stage technologies to commercial scale by 2030. EPRI has committed $10 million to the project.

In the current climate change-driven push for electrification and decarbonization, a group of utilities last November helped the two industry think tanks to sign a memorandum of understanding. The initiative’s 18 primary utility supporters include the nation’s largest gas-only distributor, Southern California Gas Co. (SoCalGas), along with Duke Energy Corp. and Consolidated Edison Inc.

BTU Analytics’ Lenzmeier envisions some cautions about future fossil fuel investment, predicting it will involve “smaller, brownfield expansions” more likely being built than greenfield projects, and neither type project have strong chances when they cross state lines. She cites the original PennEast project as an example. It garnered all of its needed permits in Pennsylvania only to be eventually stopped by New Jersey regulators.

“Pipeline infrastructure investment will be led next year by the expected in-service of Mountain Valley Pipeline in early 2021 and the planned completion of Mountain Valley Southgate in late 2021,” Lenzmeier said. “These projects will access downstream demand centers, and PennEast has an interconnection with Adelphia Gateway that directly supplies demand consumers, so these projects are expected to spur incremental production growth from Northeast Pennsylvania.”

Lenzmeier thinks small fossil fuel projects will more likely be successful than greenfield projects, and interstate projects are likely to be more difficult because of varying policies regarding fossil fuels these days.

NGA’s Leahy sees the prospects for new energy investment in the region as challenging, while Moody’s Wobbrock said hold on a moment. “Infrastructure investment will continue to be robust to modernize transmission and distribution [automated valves and meters, etc.],” Wobbrock said. He thinks transmission and distribution could be attractive targets for investment since they have a long runway for investments and would benefit from electrification efforts and from offshore wind development. Nevertheless, Leahy sees challenges for all energy resources, from fossil fuels to renewables.

“The uncertainty regarding the economic recovery and the cost implications of delayed timelines raise general cautions,” Leahy said. “The decision by Dominion [Energy Inc.] to sell its natural gas transmission and storage businesses is interesting as was the decision of [billionaire Warren Buffet’s] Berkshire Hathaway to acquire them.”

In most cases, there is more consensus than disagreement on the short-term outlook in the Northeast. Increasing gas-fired generation is a given, while where the decarbonization and electrification movement will go is uncertain at best. Marcellus Shale Coalition’s Spigelmyer sees the dry gas boom in parts of Pennsylvania as a catalyst for a revival of manufacturing across the Appalachian region.

“Locally produced gas gives a competitive advantage for manufacturers to invest domestically, create jobs and expand operations,” Spigelmyer said. He cites the U.S. Shell Oil unit that is building a petrochemical manufacturing facility in Beaver County, Pa., creating more than 7,000 construction jobs. “In New York, particularly its southern tier, we would expect to see similar manufacturing growth opportunities.”

Analysts contacted for this update see technology continuing to drive the future during the current slowdown in investment, permitting and construction. The advent of RNG leading to more hydrogen use in clean alternatives is receiving more serious examination these days by both industry and government researchers. Another source indicated that he believes today’s increasing emphasis on low-carbon technologies offers the “possibility of new breakthroughs that can help us achieve affordable, reliable and lower emission energy systems that will benefit the whole economy.”

Technology on the production side for about 15 years now has carried the U.S. energy revolution, as one analyst points out. So, the next 15 years may see more technology disruptions on the demand side. Technology-driven disruptions are likely in offshore wind, fuel cells and batteries, all with repercussions for natural gas infrastructure longer term.

“With ongoing capital constraints combined with an industry-wide commitment to producing energy in cleaner and more responsible ways than ever before, we are seeing longer laterals [in unconventional drilling] that reduce surface disturbance, new technologies to capture and eliminate emissions, and major advancements in water recycling and reuse,” said Marcellus Shale Coalition’s Spigelmyer, reminding anyone who will listen that advances in hydraulic fracturing and horizontal drilling are what made the United States the world’s leading oil/gas producer pre-pandemic.

Ultimately, the Northeast region could play a big part in making sure the U.S. global energy dominance continues once some sort of normalcy returns.

Richard Nemec is a regular contributor and West Coast correspondent for P&GJ. He is based in Los Angeles. He can be reached at rnemec@ca.rr.com.

Comments