April 2021, Vol. 248, No. 4

Features

Canada Looks to Future Beyond Keystone XL, COVID-19

By Jeff Awalt, Executive Editor

With production curtailments lifted and a post-COVID-19 upturn in sight, Canadian oil production is on the rise, prompting concerns that output from Alberta’s oil sands could again exceed takeaway capacity within a few years, even if current pipeline construction is completed.

The apparent demise of Keystone XL has shaken Canada’s energy industry and provincial governments to their core, costing jobs, investments and future income in Canada and the U.S. alike. But Canada will bear the overwhelming brunt of U.S. President Joe Biden’s decision on his first day in office to block the pipeline’s construction.

Its loss makes other Canadian pipeline projects all the more important.

“One of the things we had to cope with because of not having enough capacity to reach markets for the oil was that our storage filled up and differentials blew out to the extent that it was uneconomic to produce, and the provincial government of Alberta curtailed production. It was a disastrous situation,” said Chris Bloomer, president and CEO of the Canadian Energy Pipeline Association (CEPA).

“Now that things are moving forward, that production is coming back. So, all the other ways to access the market without Keystone XL are going to start reaching capacity fairly quickly, and that’s going to put us back, in the very near term, into a situation where we’re capacity-constrained,” Bloomer said. “You don’t build pipelines ‘just in time.’ They take a long time, obviously.”

Among recent indicators, Canadian Natural Resources, Canada’s biggest oil producer, beat analysts’ estimates for fourth-quarter earnings and forecast in early March that it would have much stronger cash flow in 2021. The company projected free cash flow this year of US$3.87 billion (C$4.9 billion) to US$4.26 billion (C$5.4 billion), compared with only US$546.3 million (C$692 million) in 2020.

Canada’s four largest pipeline construction projects are still in the works, and odds favor their completion, but each continues to face challenges.

Trans Mountain

The Trans Mountain Expansion Project (TMX) has overcome a series of legal hurdles and appears to be on track for completion by the end of 2022, albeit at a much higher price than originally expected.

Estimates have risen to US$9.95 billion (C$12.6 billion) from US$5.84 billion (C$7.4 billion) for the former Kinder Morgan project, which was purchased by the Canadian government in 2018 for US$3.55 billion (C$4.5 billion). Construction has continued in spite of the higher labor, steel and land costs that contributed to the new estimate.

TMX is essentially a twinning of the existing 715-mile (1,150-km) pipeline originating near Edmonton, Alberta, and extending to Burnaby, British Columbia. It includes more than 600 miles (980 km) of new 36-inch (914-mm) pipe and 120 miles (193 km) of reactivated pipeline, along with 12 new pump stations and 19 new storage tanks at existing terminals.

The expansion project will increase nominal capacity of the system to 890,000 bpd, from 300,000 bpd. The expected in-service date is December 2022.

Since operation began in 1953, the capacity of the Trans Mountain system has been increased numerous times, with the initial expansion in 1957. The most recent expansion project took place in 2006-2008 and included the construction of 13 new pump stations, modifications to existing stations and 100 miles (160 km) of new pipe between Hinton, Alberta, and Hargreaves, British Columbia.

Two 2020 court rulings helped break bottlenecks that had stalled its further expansion projects in recent years.

First, the Supreme Court of Canada ruled that the federal government has primary jurisdiction over pipelines across provinces, ending an effort by British Columbia to halt expansion and block crude oil delivery from Alberta to the Pacific coast. This followed a positive ruling by the British Columbia Court of Appeal that the province does not have the right to impose environmental laws that could stop the expansion.

Then, another challenge to Trans Mountain was defeated when Canada’s Federal Court of Appeal ruled that Ottawa carried out “reasonable” and “meaningful” consultations with indigenous peoples affected by the project’s construction before approving the pipeline for a second time. In that case, the court said that, while the federal government has a constitutional duty to consult with indigenous people, that does not mean they have the power to veto a project.

The rulings were long-awaited victories for the pipeline industry, according to the CEPA, which intervened on behalf of Trans Mountain and the industry.

One big question remains: What will happen with Trans Mountain’s ownership after construction is complete?

“The government of Canada is building it because Kinder Morgan could not tolerate the regulatory uncertainty and the costs along with that, so the federal government bought the project,” Bloomer said. “They are building it, but they have said they will sell it and get out of that business, as well they should.”

Some analysts have speculated that Enbridge, Brookfield or others could step in as buyers, but it is expected to have at least partial indigenous ownership, if not 100%.

“Over the next year, as the execution risk keeps coming down and it’s closer to completion, I think you’re going to see a fair bit of activity around who’s going to own Trans Mountain,” Bloomer said.

Line 5

The Enbridge Line 5 tunnel project hit the radar in a big way during the U.S. election cycle and it continues to fight for its survival, but Canada’s leaders have pledged to complete the system upgrades and dismissed any comparisons with the ill-fated Keystone XL.

“It was another odd piece of political grandstanding and symbolism, because shutting that down would create extreme harm to both the U.S. Midwest and southern Ontario,” Bloomer said.

That potential harm would be twofold: First, the Enbridge system provides about 70% of Canada’s capacity to the U.S. Midwest, and the loss of Line 5 would dramatically reduce the ability to move its crude. Second, after crossing into the United States, Line 5 swings back into Canada and provides crude oil to Ontario and Quebec. If it were to shut down, there would be a shortage of crude supply to one of Canada’s most populated regions, impacting the energy and employment needs of Ontario, Alberta, and Quebec, as well as northern U.S. states.

The tunnel project was approved by Michigan’s former Gov. Rick Snyder, but his successor has taken aim at the project from the start of her term. In November 2020, current Gov. Gretchen Whitmer told Enbridge that the 1953 easement that allows it to operate in the Straits is being revoked. She ordered Line 5 to be shut down by May 2021, accusing Calgary-based Enbridge of violating terms of the deal that allows the line to traverse the bottom of the Straits of Mackinac. Enbridge filled a federal lawsuit to block the governor’s order.

Canada’s natural resources minister, Seamus O’Regan, vowed in early March that the federal government will not let Michigan shut down the Line 5 pipeline.

“We are fighting for Line 5 on every front and we are confident in that fight,” O’Regan said. “We are preparing to invoke whatever measures we need to in order to make sure that Line 5 remains operational. The operation of Line 5 is non-negotiable.”

The Enbridge Inc. pipeline carries an estimated 540,000 barrels of light crude oil, light synthetic crude and natural gas liquids (NGLs), which are refined into propane, supplying 65% of propane demand in Michigan’s Upper Peninsula and 55% of Michigan’s statewide demand.

As it travels under the Straits of Mackinac, Line 5 diverges into two, 20-inch (508-mm), parallel pipelines that start underground onshore, taper deep underwater and cross the Straits for 4.5 miles (7.2 km). Opponents of the pipeline have raised the specter of an oil spill in this area of powerful, rapidly changing currents, despite Line 5’s long-standing history of safe operations.

“Built in 1953 by the Bechtel Corporation to meet extraordinary design and construction standards, the Line 5 Straits of Mackinac crossing remains in excellent condition and has never experienced a leak in more than 65 years of operation,” Enbridge said. “The Line 5 crossing features an exceptional and incredibly durable enamel coating, and pipe walls that are three times as thick – a minimum of 0.812 inches – as those of a typical pipeline.”

Line 3

Enbridge’s Line 3 replacement project – the largest in company history – will provide much-needed incremental capacity to support Canadian crude oil production growth and refinery demand in Canada and the United States.

Enbridge has begun commercial operation of the Canadian section of its Line 3 pipeline while continuing to work through the Minnesota regulatory process for the U.S. portion of the $9 billion replacement project.

Line fill of the 665-mile (1,070-km) Canadian segment of the Line 3 replacement pipeline was completed in mid-November 2019, and the replacement pipeline, which connects to the existing U.S. Line 3 at the Manitoba-U.S. border, started moving oil the following month.

It will run at about half its rated capacity of 760,000 bpd until the U.S. portion receives final approval and is constructed and brought onstream, Enbridge spokesman David Coll said.

Enbridge has operated Line 3 since 1968, with the Canadian portion of the pipeline stretching from Hardisty, Alberta, to Gretna, Manitoba, and the U.S. portion delivering oil to Superior, Wis. Plans to replace the aging pipeline have been in the making since 2013.

Enbridge had hoped to bring the U.S. segment online last year, but the timing remains uncertain, because Minnesota utility regulators ordered further study on the potential impact of oil spills on the Lake Superior watershed.

Coastal GasLink

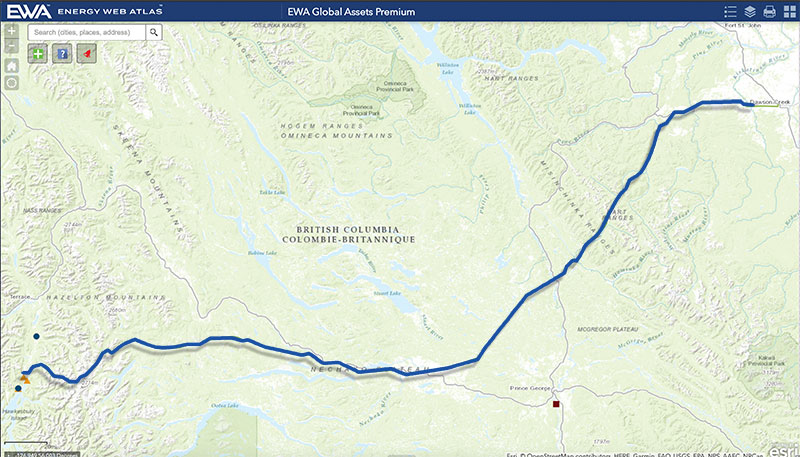

The Coastal GasLink project involves the construction and operation of a 48-inch (1,219-mm), 416-mile (670-km) pipeline from near the community of Groundbirch, in northeastern British Columbia, to the liquefied natural gas (LNG) Canada Export Terminal now under construction near Kitimat. From there, the LNG will be exported to Asian markets, helping to reduce emissions by replacing high-carbon coal.

TC Energy is building the project in partnership with LNG Canada, Kogas, Mitsubishi, PetroChina and Petronas. The pipeline will be built to move 2.1 Bcf/d (59 MMcm/d) of natural gas with the potential for delivery of up to 5 Bcf/d (142 MMcm/d), dependent on the number of compressor and meter facilities constructed.

Coastal GasLink selected four prime contractors to construct the pipeline – Surerus Murphy Joint Venture, SA Energy Group, Macro Spiecapag Joint Venture and Pacific Atlantic Pipeline Construction Inc.

Preliminary construction began in 2019, with clearing, development of access roads, site preparation for laydown areas and workforce accommodations after final routing was approved in May. In-service is expected in 2023.

Despite its importance, the construction of the Coastal GasLink project seemed to be flying below radar in comparison with other projects – that is, until indigenous and climate activists across Canada took up the cause of Wet’suwet’en hereditary chiefs, who opposed the natural gas line, leading to some of the most disruptive protests that Canada has ever faced over pipeline construction.

Protesters in Canada blocked train lines, Vancouver’s port entrance and at least one highway in February after police dismantled a rail barricade in southern Ontario and arrested 10 indigenous protesters. As the demonstrations continued, CN Rail – the nation’s largest rail line – shut down its western freight routes and temporarily laid off 1,000 employees as the government struggled to resolve the matter.

After three days of talks, indigenous affairs ministers from British Columbia and Prime Minister Justin Trudeau’s government reached an agreement that would address future land rights disputes while allowing pipeline construction to resume.

Capital Issues

Despite recent progress after a months-long pandemic stall, says Jackie Forrest, executive director of Calgary’s Arc Energy Institute, the outlook for production growth and new pipeline construction has weakened, in part, because regulatory and other risks simply have made capital harder to come by.

“I think it’s going to be very difficult for private capital to back these projects,” Forrest said, citing Trans Mountain and Keystone XL as prominent examples.

“With TMX, Kinder Morgan wasn’t willing to continue to back that project because it was deemed too risky for them to put any more capital in, and so the federal government had to step in,” she said. “And, again, with Keystone, the Alberta government had to step in because putting any additional capital into that project was deemed too risky for the private company.”

The dwindling availability of capital has also been a headwind facing oil and gas producers, which could limit demand for additional pipeline takeaway capacity, at least in the short term. Financing challenges have also spurred a surge of mergers and acquisitions, and that trend may continue in upstream and midstream markets alike, despite the recent recovery in oil prices.

“Even though you might be doing well, it’s very hard for smaller companies to get the attention of the capital markets, so I think you will see more consolidation,” Forrest said. “It is painful in the short term, because it usually results in job losses, but in the long term it should create a more resilient industry with more ability to attract capital.”

Recent deals have been primarily equity-based acquisitions involving little or no cash. For instance, Cenovus Energy in January closed its acquisition of Husky Energy in an all-stock deal valued at $2.9 billion, creating Canada’s No. 3 oil and gas producer.

Other Canadian mergers and acquisitions activity since the start of fourth-quarter 2020 includes:

- Whitecap Resources’ acquisition of Torc Oil and Gas for US$703 million

- The US$542 million acquisition of Petrogas Energy by AltaGas Idemitsu

- Tourmaline Oil’s US$108 million acquisition of Modern Resources

- Jupiter Resources’ US $478 million acquisition of Tourmaline

It’s not only smaller players who are feeling the pinch. After reporting its first annual loss in at least 40 years, ExxonMobil – which last year announced up to 300 job cuts in Canada – revised its worldwide reserves on Dec. 31 and erased 98% of the company’s Canadian oil-sands crude from its books. It noted in a regulatory filing, however, that it could bring the reserves back under certain conditions.

“Among the factors that could result in portions of these amounts being recognized again as proved reserves at some point in the future are a recovery in the SEC [Securities Exchange Commission] price basis, cost reductions, operating efficiencies and increases in planned capital spending,” the Irving, Texas-based oil major said.

In the midstream sector, Brookfield Infrastructure launched a rare hostile bid in February to buy Canada’s Inter Pipeline for C$7.08 billion ($5.62 billion). It had offered more, under the condition that Inter Pipeline agree to negotiate, but Inter turned Brookfield down and started looking for other options.

Inter Pipeline’s assets include more than 4,300 miles (7,000 km) of oil pipelines, 5 million barrels of oil storage in western Canada and NGL processing plants.

Expanding Exports

The Coastal GasLink and LNG Canada projects are spawning new markets for Canadian natural gas. In addition to growing LNG exports, Canada’s western gas provides an opportunity to produce NGLs at relatively low cost, prompting development of midstream infrastructure expansion to capitalize on the resource.

In fact, it was a direct result of these circumstances that helped lead to Brookfield’s unsolicited bid for Inter Pipeline. That’s because Inter had committed to the development of a petrochemical plant that would source these NGLs, a project that encountered cost overruns and made it both more attractive and vulnerable to the takeover bid.

In addition to the expanding LNG exports to Asia, Canadian natural gas producers also are in a position to boost net gas exports to the United States.

In recent years, Canadian firms were hurt by the cheap gas produced as a byproduct of U.S. shale oil production. Now, Canadian producers have bounced back faster than U.S. shale firms, giving them an opportunity to recover some market share.

Canada’s net gas exports leapt 31% year-over-year in January to 6.3 Bcf/d (178 MMcm/d), the biggest monthly increase since March 2018, according to Refinitiv.

LNG Canada – a joint venture of Shell, Petronas, PetroChina, Mitsubishi and Kogas – represents one of the largest energy investments in the history of Canada and is its first significant LNG export facility to receive a final investment decision.

TMX also will provide greater capacity for crude oil exports from Canada’s west coast. It includes the construction of three new berths at the Westridge Marine Terminal in British Columbia, where tanker traffic is projected to increase to 34 per month, from one per month.

Energy Transition

Among other key trends impacting the midstream industry in Canada are a commitment to achieve net-zero emissions by 2050 and the development of a national hydrogen strategy, which was released by the government in December.

The Alberta government also has put out a task force document to develop a hydrogen infrastructure road map, including a plan to build a hydrogen hub – the largest hydrocarbon processing center in Canada – in a complex near Edmonton, known as Alberta’s Industrial Heartland.

“So far, there hasn’t been a lot of federal government money spent – only about $1.5 billion that has been put into what they’re calling a net-zero fuel fund, and hydrogen could take some of that. So that’s very small if you compare it with Europe,” Forrest, of Arc Energy, said. “In Canada, it’s at the stage where people are building awareness and understanding and looking at the opportunities. I do expect some government money will be going into hydrogen. It just hasn’t been announced yet.

Canada is especially well-situated to produce and distribute hydrogen, said Bloomer, noting its established pipeline network along with resources such as Quebec’s hydropower and Alberta’s gas resources, which can be used to produce hydrogen. It is also seeing investment in the areas of carbon capture and underground storage, notably Wolf Midstream, whose Carbon Business Unit constructed and operates the Alberta Carbon Trunk Line system – the world’s newest integrated large-scale carbon capture, utilization and storage (CCUS) system.

These trends, Bloomer emphasized, should be on everyone’s radar, inside and outside of Canada.

“Back before COVID and the U.S. election, I gave a presentation in Houston about the Canadian scene and emphasized at the time that what’s happening in Canada from a political policy transition and net-zero perspective is going to come to the U.S., and you have to look at Canada to see where that’s going,” CEPA’s Bloomer said.

“You know, it may evolve a little differently, but that’s the trend,” he said. “And you have to join in and ride that wave, because it’s coming, and you’ll drown if you don’t. – P&GJ

Comments