May 2021, Vol. 248, No. 5

Features

Saudi Aramco Seeks $7.5 Billion Loan for Pipeline Investors

By Nicholas Newman, Contributing Editor

In late 2019, struggling Saudi Aramco (Aramco), the world’s largest oil company, completed the biggest initial public offering of shares to raise $25.6 billion, with additional shares sold, bringing the total raised to a hefty $29.4 billion.

Now, Aramco is negotiating with potential investors to raise a loan of at least $7.5 billion to monetize its oil pipelines infrastructure, reported a financial news outlet.

Saudi Arabia holds 16% of the world’s proven oil reserves and has the largest crude oil output of as much as 13 MMbpd. The country also holds substantial reserves of gas, estimated at 233.8 Tcf (6.621 Tcm) at the end of 2018, which is also under Aramco’s control.

Aramco remains a national oil company, with the Saudi government owning 98%. Until recently, Aramco had little in the way of corporate debt.

However, as a result of the crash in oil prices, the effect of COVID-19 on oil demand and the transition to renewables, the company’s value and its revenue have both fallen. As a result, Aramco is urgently seeking new sources of capital to protect its annual dividend payments of $75 billion, much of which goes to fund the government’s expenditure.

Crucially, the Saudi government needs oil prices of at least $67.90 a barrel to fund its expenditure, which is well above the current price of $60 to $62 a barrel.

One thing is clear, if Aramco’s capital raising exercise proves successful, it is likely to be only the first step in a series to raise capital by either selling leasing rights and/or non-core assets.

The future strategy was outlined by Amin Nasser, Aramco’s chief executive officer, in an interview in which he explained that the company is now looking to optimize its portfolio and “squeeze” more value out of it, including potentially selling assets.

In this case, Aramco is following the lead of Abu Dhabi National Oil Company (ADNOC), which raised money by selling leasing rights and stakes in non-core assets to foreign investors, including New York banks JP Morgan Chase and Morellis. Industry pundits have suggested that potential investors in Aramco could include U.S. investment funds, such as Apollo, Brookfield, CIC and KKR.

Saudi Aramco, the national oil and gas company, also known as the Saudi Arabian Oil Company, is based in the Gulf port of Dhahran. During 2020, it was the world’s sixth largest company, ranking behind Royal Dutch Shell, but ahead of the German car manufacturer, Volkswagen.

Reserves of 270 billion barrels and the world’s largest daily output of 13 million barrels during August 2020, as reported by Reuters, were sustained by annual capital expenditure of between $40 and $45 billion a year on operations and infrastructure, ensuring its world leadership in fossil fuels.

Oil Pipeline Networks

But, in line with its peers, Aramco’s capital expenditure has fallen in recent times. The changing fortune of oil companies is reflected in their share price. Aramco’s shares opened at $9.24 (34.65 Saudi riyals) on the Tadawul stock exchange in December 2019, then crashed in parallel with the collapse in crude prices to $7.03 (26.36 Saudi riyals) in March 2020 and has since climbed slowly to reach $9.29 (34.85 Saudi riyal) in February 2021, reflecting rising demand from China, India and Southeast Asia, and crude prices rising from $40 a barrel in July last year to $62 in February this year.

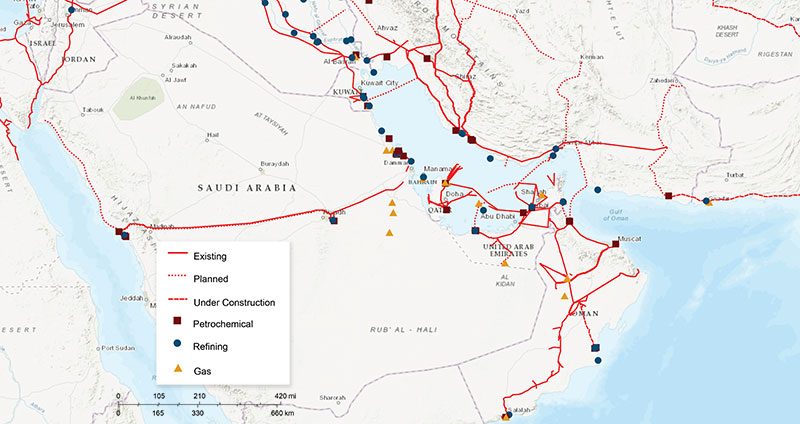

Aramco owns and operates 90 crude oil and petroleum products pipelines, totaling 12,000 miles (19,000 km), which link producing fields to processing plants, export terminals and consumption hubs. The major operational pipelines are the Petroline or East-West crude and the Abqaiq-Yanbu carrying natural gas liquids (NGL) products.

The Petroline Pipeline is a strategically important 750-mile (1,200-km) oil pipeline that links production and processing facilities in the eastern part of the country to export terminals, such as Yanbu and Rabigh on the Red Sea.

It is a crucial lifeline allowing Aramco to export oil if the Straits of Hormuz are blocked.

The Petroline network comprises two parallel pipelines with capacity to carry 4.8 MMbpd. The larger pipeline of 56 inches (1,422 mm) can carry 3 MMbpd. The second and smaller pipeline is 48 inches (1,219 mm) and can carry up to 1.8 MMbpd. This smaller pipeline has been used as a natural gas pipeline in the past.

The last decade has witnessed several proposals to increase the capacity of the Petroline line network to about 7 MMbpd, but little progress has been made.

Running parallel to the Petroline system is the 741-mile (1,193-km) Abqaiq-Yanbu NGL pipeline, which can carry 290,000 bpd of NGL. This NGL pipeline serves the petrochemical plants at Yanbu on the Red Sea coast of Western Saudi Arabia.

Surprisingly, given the country’s geographic position and nearness to energy-hungry countries, Aramco does not operate major functioning international pipelines.

The Trans-Arabian Pipeline (TAPLINE), built in 1947 to transport crude oil from Qaisumah through Jordan to Sidon, Lebanon, has been partially closed since 1984. The portion of the pipeline that runs to Jordan was closed in 1990, due to terrorist incidents.

The 1.65-MMbpd, 48-inch IPSA-1 pipeline was built in 1989 to carry crude oil from Iran to the Red Sea and was closed a year later during the 1990 invasion of Kuwait. The pipeline was deemed unusable by Saudi officials who inspected it in October 2013.

This is the country’s only cross-border oil pipeline still in operation. For more than 60 years, it has carried Arab light crude from Saudi Arabia’s Abu Safah field to Bahrain. A new replacement pipeline with a capacity of 350,000 bpd is under construction.

Operational Gas Pipelines

At the start of the 1970s, Aramco began to build a network of gas-gathering pipelines to reduce wasteful flaring from oil production as well as to monetize its natural gas resources.

The result is a ready network of pipelines linking oil fields producing associated gas and gas fields with gas processing plants, water desalination plants, petrochemical factories and power stations throughout the country.

Aramco operates the world’s largest single hydrocarbon network, the Master Gas System. Production from the Jafurah field is expected to start in 2024 and should reach 2.2 Bcf of gas sales by 2036.

Nonetheless, burgeoning populations, an expanding petrochemical industry and demand for air conditioning and water desalination means that demand will exceed supply. Aramco is expected to import natural gas from the United States in the not-too-distant future.

In recent years, Aramco’s infrastructure, including its pipeline networks, has been under attack from both domestic and foreign terrorist groups, such as al-Qaeda, the Houthi and possibly Iran.

As recently as Sept. 14, 2020, the Khurtas and Abqaiq facilities were attacked, as was Aramco’s Jeddah plant last November. Due to spare capacity, these terrorist attacks had only a small impact on Aramco’s operations but nevertheless provided a vivid display of Aramco’s vulnerability to hostile action.

Despite such attacks, Saudi Arabia will continue to be a major producer of oil and gas not only for export but also to supply feedstock for the increasing production of plastics, fertilizers and chemicals. This will require well-maintained and enough protected pipeline capacity to transport oil and gas to demand hubs for many years to come.

Comments