November 2021, Vol. 248, No. 11

Projects

Projects November 2021

Canada Formally Invokes 1977 Pipeline Treaty with US Over Line 5 Dispute

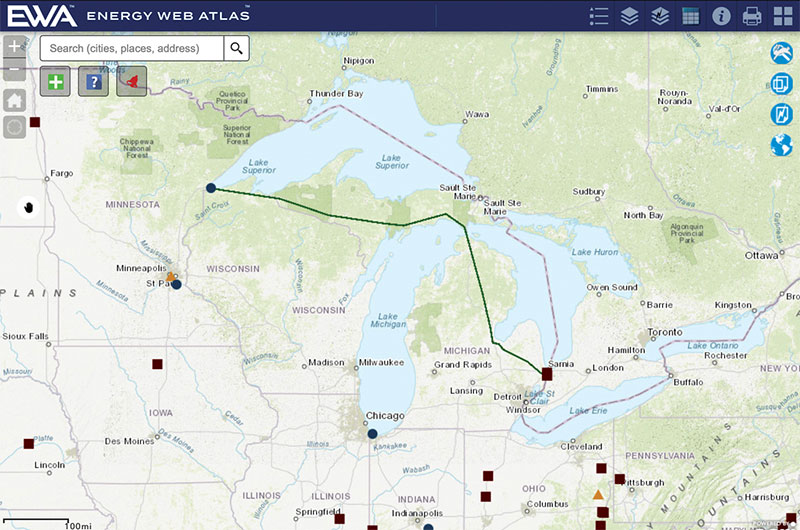

Canada has formally invoked a 1977 treaty with the United States to request negotiations over Enbridge’s Line 5 pipeline.

The 540,000-bpd pipeline currently ships crude and refined products from Superior, Wisconsin, to Sarnia, Ontario. However, concerns over potential leaks beneath the Straits of Mackinaw has led Michigan to try to shut down a 4-mile (6-km) section of the pipe.

In a letter to the federal judge presiding over the case, Gordon Giff, legal counsel for the Canadian government, said Canada had formally invoked Article Six of the 1977 Transit Pipelines Treaty.

The treaty, designed to stop U.S. or Canadian public officials from impeding the flow of oil in transit, has never been invoked.

Gazprom Begins Shipping Gas on TurkStream, Awaits Approvals

Gazprom said it has started transporting gas to Hungary and Croatia via the TurkStream pipeline.

Russian gas supplies via the pipeline to Hungary have angered Ukrainian officials, due to the loss of some of that country’s transit revenues. Additionally, Hungary and can no longer acquire reverse-flow gas from Hungary.

Gazprom said Germany was continuing to work on the certification of the Nord Stream 2 natural gas pipeline to Germany, but the CEO of German utility Uniper stated earlier that licensing for the undersea pipeline is not expected soon.

Hungary Receives Gas Shipments from Ukraine, Operator Says

Hungary started receiving gas from Ukraine, Hungarian pipeline operator FGSZ said, but the company did not name the trader delivering the gas.

Russian gas producer Gazprom, under a long-term supply deal with Budapest, plans to supply Hungary with gas via Serbia and Austria instead of through Ukraine.

FGSZ confirmed that it had launched the new interconnector pipeline from Serbia on Oct. 1 in a reply to questions from Reuters.

“If a [trading] company gets hold of gas via Ukraine, it can continue to use the pipeline that comes from Ukraine, and current shipments data show that there is a similar amount of gas coming from Ukraine today as via the new pipeline from Serbia,” FGSZ said.

FGSZ said dozens of trading firms have been shipping gas to Hungary besides Gazprom on various routes, one of which was the Ukrainian pipeline.

California Oil Spill Cause Probed, Storm Threatens Cleanup

Federal and state investigators focused on the San Pedro Bay Pipeline as the source of an oil spill along the coast of southern California, while officials pointed to the possibility that the infrastructure had been damaged by a vessel’s anchor.

The incident caused an estimated 3,000 barrels of crude oil to spill into the Pacific Ocean. The 41-year-old pipeline connects an offshore oil platform to a site in Eureka, California.

In Huntington Beach, about 40 miles (65 km) south of Los Angeles, cleanup crews in white coveralls worked along a beach and wetlands running inland from the ocean on the eastern side of the coastal highway.

Officials identified the platform and pipeline operator as Beta Offshore, a California subsidiary of Houston-based offshore crude oil producer Amplify Energy Corp., according to Reuters.

Officials deployed 2,050 feet (625 meters) of protective booms, which help contain and slow the oil flows, and about 3,150 gallons have been recovered, the U.S. Coast Guard said.

Lithuania Expects Polish Gas Link Construction Completion in 2021

A pipeline designed to connect the gas grids of Lithuania, Estonia, Latvia and Finland to continental Europe will begin operating in the second half of 2022 after a delay of almost a year, the Lithuanian energy minister told Reuters.

Construction of the pipeline linking Lithuania and Poland will be completed by the end of 2021 as previously forecast, but licensing it will take several more months, Dainius Kreivys said in an interview.

The four countries are currently supplied by a pipeline gas from Gazprom and from liquefied natural gas (LNG) from a terminal in the Lithuanian port of Klaipeda, but it will get access to the Central European gas grid once the pipeline to Poland starts operating.

Poland and Lithuania will likely introduce discounted tariffs for pumping gas through the pipeline and discuss a common tariff area.

Poland is expected to cut Russian supplies next year, while a pipeline connecting Norwegian gas fields via the Baltic Sea and Denmark is expected to come online at the end of next year.

Sentinel Midstream, ExxonMobil Form Enercoast Midstream

Sentinel Midstream Texas formed a joint venture with ExxonMobil Pipeline Company that owns crude oil pipelines and related transportation infrastructure in the Houston area.

The joint venture, Enercoast Midstream, provides the critical last-mile link for Permian, Gulf of Mexico and other barrels in the Houston crude oil market.

For the joint venture, ExxonMobil will contribute two existing crude oil pipelines into Enercoast: a 16-inch pipeline originating at Webster Terminal with delivery points at ExxonMobil’s Baytown Refinery and Seabrook export terminal and a 20-inch crude pipeline with access to Moore Road station. Sentinel contributed cash for a majority equity position and will be the operator for the joint venture.

As operator, Sentinel brings an experienced, results-oriented management team with a proven track record of maximizing value while maintaining its core values of safe, reliable operations and environmental stewardship.

Sentinel will undertake efforts to commercialize capacity on Enercoast’s system while pursuing opportunities to grow its operating footprint by building or acquiring new pipelines.

Tallgrass to Track, Measure Emissions on US Interstate Pipeline

Tallgrass Energy Partners will monitor methane and other emissions on its Rockies Express Pipeline to certify its effect on the environment.

Tallgrass and carbon-measurement firm Project Canary plan to begin installing monitoring devices at compressor stations along the 1,700-mile (2,736-km) pipeline to rate the environmental impact of its operations in 2021. The devices will help provide real-time measurements of fugitive methane emissions, among other things.

Natural gas certification has been picking up steam in the past year among producers and utilities. Project Canary said natural gas certification has had increasing interest among producers and utilities in recent months.

The company lists EQT Corp. and liquefied natural gas (LNG) project developer NextDecade among its customers.

Trapil Adapting French Pipeline for Low-Carbon Fuel Transport

Trapil, a French refined product pipeline transport company, is strengthening its commitment to the energy transition by adapting one of its pipelines to facilitate transport of low-carbon liquid fuels such as bioethanol.

The pipeline is between the Basse-Seine and Paris regions. Bioethanol is the most widely used biofuel in the world, and France is the leading European producer.

Produced from plant biomass, bioethanol incorporated into gasoline emits CO2 during combustion in engines, but CO2 is captured by plants during their growth.

Driven by SP95-E10, the most sold gasoline in France, as well as by Superethanol-E85, bioethanol consumption is growing strongly. The increase will continue to rise due to the absence of particle emissions during combustion and to its contribution to the reduction of CO2 emissions (1 million tons saved each year thanks to bioethanol produced in France).

The growth will lead to a significant increase in tank-trucks traffic between the production plants and the depots in the Paris region where fuel transporters come to refuel to supply service stations. This additional traffic increases the risks associated with the transport of hazardous materials, increases traffic congestion and worsens the carbon footprint of bioethanol.

To overcome these drawbacks, Trapil is studying the adaptation of one of its pipelines between Normandy – a bioethanol production or import area – and the main depots in the Paris suburb. Trapil will be able to transport this type of cargo safely, economically and with low CO2 emissions to allow it to be incorporated into the gasoline blend stock for oxygenate blending in the depots it supplies.

YPFB Transporte to Boost Gas Pipelines Capacity

YPFB Transporte S.A. said it plans to increase natural gas production to meet the growing demands of the domestic market and service ongoing contracts with Brazil and Argentina.

The new investment plan of the state-owned company also contemplates restructuring YPFB to modernize management and optimize technology.

Among the projects expected to enter operations between December 2021 and mid-July 2022 is the Tarabuco-Sucre Gas Pipeline (GTS) expansion, which will increase capacity through the construction of a 10-inch, 14-mile (22-km) gas pipeline on the Tarabuco-to-Yamparaez section (Chuquisaca region), to increase capacity from 29.9 to 45.2 MMcf/d (0.85 to 1.28 MMcm/d). The construction phase of the project is currently underway.

Also, the Sucre-Potosí Gas Pipeline (GSP) expansion Phase II, which includes construction of a 10-inch, 8.6-mile (14-km) loop in the Río Pilcomayo Mariaca section (Potosí region) will be completed, YPFB said.

The president of YPFB, Wilson Zelaya, recently confirmed that $400 million of the $800 million investment plan for 2021 will include provisions for projects to be executed directly by the state company.

An additional $140 million has been earmarked for the most important projects, which will allow operational continuity and improve capacity in pipelines, multi-pipelines and gas pipelines.

Exploration and development will receive $150 million to recover an average of 50 MMcf/d (1.4 MMcm/d), after the company registered its lowest production in the last five years, with 43.17 MMcf/d (1.223 MMcm/d).

YPFB Transporte also will increase the transportation capacity in its hydrocarbon transportation system through pipelines.

Morocco, Spain Considers Reversing Gas Pipeline Flow

Morocco and Spain are looking into the possibility of reversing the flow of a gas pipeline if Algeria decides against renewing a transportation contract set to expire shortly.

Algeria suggested it would abandon the deal, which involves the shipment of 13.5 Bcm on the pipeline that crosses Morocco in favor of expanding the Mediterranean Medgaz pipeline, which does not cross the country.

A senior Moroccan official told Reuters that “for Morocco, the pipeline is more of a tool for regional cooperation ... we will not let it rust.”

Algerian President Abelmadjid Tebboune said, however, that no final decision has been made concerning the Maghreb-Europe pipeline. Algeria ended diplomatic links to Morocco in late summer, claiming “hostile actions” were taken against it and closed its air corridors to Moroccan planes.

Morocco officials have been having discussions with Spain in an effort to use the country’s LNG terminals to channel gas to Morocco using the same pipeline.

“This LNG will not compete with Spanish gas supplies,” the senior Moroccan official said. “It will be an additional purchase ordered by Morocco which will pay the cost of the transit through Spanish terminals and the pipeline.”

Additionally, in preparation for the pipeline contract with Algeria not being renewed, Morocco has issued permits to gas importers.

Comments