October 2021, Vol. 248, No. 10

Global News

Global News October 2021

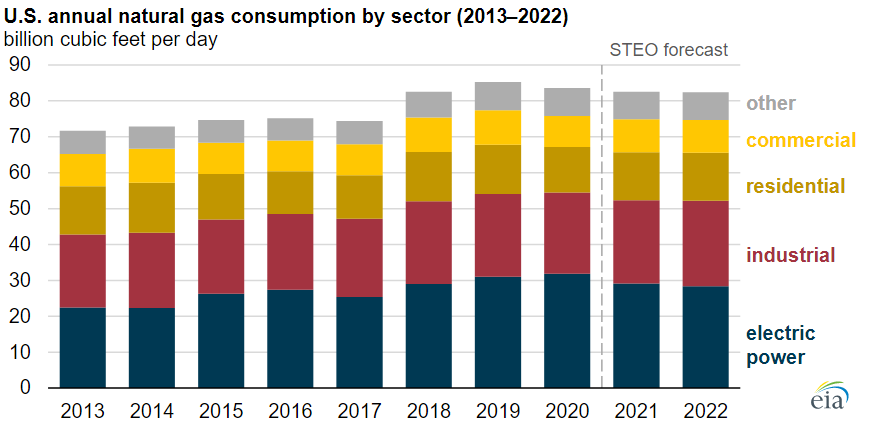

EIA Expects U.S. Natural Gas Consumption to Decline Through 2022

U.S. consumption of natural gas is projected to decline in 2021 and 2022 from 2020 levels, according to the latest forecast by the U.S. Energy Information Administration (EIA).

Consumption of natural gas will decline in all end-use sectors in the United States except in the industrial sector and for other non-sector-specific uses (lease and plant fuel, pipeline and distribution use and vehicle use).

The largest decline will occur in the electric power sector, where the EIA expects total U.S. consumption of natural gas to average 82.5 Bcf/d (2.34 Bcm/d) in 2021, down 0.7 Bcf/d from 2020. U.S. natural gas consumption in 2022 is projected to increase slightly from 2021 as increasing consumption in the industrial sector offsets declining consumption in the electric power sector, but remains lower than the 2020 level, the outlook indicates.

In the United States, natural gas prices influence natural gas consumption in the electric power sector. When natural gas prices are high, generators typically switch from natural gas to lower-cost coal as the source for power generation. Higher prices at Henry Hub, the U.S. natural gas benchmark, resulted in less natural gas consumption in the electric power sector during the first half of 2021 than during the first half of 2020.

EIA expects the Henry Hub price to average $3.63 per MMBtu in 2021, or $1.60/MMBtu more than the 2020 average. Therefore, the agency expects 2.7 Bcf/d (76 MMcm/d), or 8.3%, less consumption of natural gas in the U.S. electric power sector in 2021. It foresees another small, 700-MMcf/d (19.8-MMcm/d) decline in electric power sector consumption of natural gas in 2022 as forecast Henry Hub prices remain elevated at a projected $3.47/MMBtu and as natural gas faces more competition from renewable sources of electricity generation.

Brazil Seeks Natural Gas Pipeline from Argentina’s Vaca Muerta

Brazil is negotiating with Argentina on the construction of a billion-dollar pipeline from the Vaca Muerta shale gas reserves, Brazilian President Jair Bolsonaro said.

Speaking to supporters on social media, he said the gas pipeline from Argentina is one of the options his government is looking at to reduce the price of gas in Brazil.

“We are in negotiations with Argentina — gas from Vaca Muerta — It will happen one day, because it is not easy to start importing gas; you need pipelines,” Bolsonaro said in his weekly live broadcast.

Argentina’s ambassador in Brasilia, Daniel Scioli, in meetings with Bolsonaro and his Mines and Energy Minister Bento Albuquerque, last year proposed building the pipeline.

Argentina is proposing an 888-mile (1,430-km) pipeline running from the shale gas reserves in the Neuquen province to the border with Brazil at Uruguaiana and 373 miles (600 km) from there to the city of Porto Alegre, connecting to Southern Brazil’s gas distribution network.

Project costs have been estimated at $3.7 billion for Argentina and another $1.2 billion for the Brazilian section.

Papua New Guinea Resumes Talks with Exxon on Gas Field Agreement

The Papua New Guinea government and U.S. oil major Exxon Mobil Corp. plan to resume talks on the P’nyang natural gas project, nearly two years after their negotiations halted, Exxon confirmed.

In November 2019, talks tied to a $13 billion expansion of the country’s liquefied natural gas (LNG) exports fell apart with the government saying Exxon was unwilling to negotiate on the country’s terms.

Papua New Guinea has been pressing for better returns for the impoverished country than it obtained in the original Papua New Guinea LNG agreement in 2008.

“We look forward to further discussions with the government to align on a gas agreement that ensures fair benefits for project stakeholders and the people of PNG,” Exxon said in a comment emailed to Reuters, declining to elaborate on details of the discussions.

Kinder Morgan to Retrofit Louisiana Tank and Piping for Finland’s Neste

Pipeline operator Kinder Morgan Inc. plans to convert some Louisiana tank and piping infrastructure to hold used cooking oil and other feedstocks for Finnish renewable-fuels giant Neste, the companies told Reuters.

Houston-based Kinder Morgan has entered a long-term contract with Neste to make rail, trucking and marine enhancements as part of the expansion of the Harvey, Louisiana, facility, the companies said.

Neste initially will use 30 converted tanks as its primary U.S. hub to store feedstocks used to produce renewable diesel, sustainable aviation fuel and renewable plastics. The tanks will be able to hold more than 650,000 barrels of oils, about one-fifth of the farm’s current capacity, the companies said.

“The U.S. has all the infrastructure in place,” said Jeremy Baines, president of Neste U.S.

The companies did not disclose terms of the deal, but Kinder Morgan said its terminal division plans to finance the project internally. The first stage of the project is due to be complete in the first quarter of 2023.

Brazil’s Logum Makes 1st Ethanol Export to US Using Pipeline to Port

Brazilian transportation company Logum Logistica said it has carried out its first ethanol export deal to California using pipelines to move the biofuel from the producing region to the port.

Logum, a company that has been investing in pipelines to transport fuel in Brazil, said it moved 10 million gallons (40 million liters) of ethanol from a terminal in Ribeirao Preto, in the main sugar and ethanol belt, to the Ilha D’Agua port in Rio de Janeiro using a combination of short truck trips and its pipeline system for a total route of 463 miles (745 km).

The firm said the transport of the ethanol by pipelines, beyond the smaller cost and economies of scale, prevented the use of more than 700 trucks, estimating the operation avoided 2,000 tons of carbon emissions.

Logum said the deal was possible because the California government gives a price premium to cane-based ethanol as well as for biofuel that is transported through lower-emissions infrastructure.

US Offshore Oil Production Losses Felt Around the Globe

U.S. offshore production losses spiraled in September with contract cancellations as prolonged outages due to damages from Hurricane Ida were felt around the globe.

Three-quarters of U.S. Gulf of Mexico oil production remained offline two weeks after the hurricane struck the Louisiana coast, according to government data, as repair efforts dragged on. Power outages at onshore processing and pipeline facilities prevented some oil production from reaching shore.

Royal Dutch Shell Plc, the largest oil producer in the Gulf of Mexico, declared force majeure on oil deliveries to Asia due to damage from Ida. It said 80% of its Gulf production remained offline.

A total of 71 platforms of the 288 evacuated ahead of the August storm remained unoccupied in mid-September.

Biden to Nominate Democrat Willie Phillips to FERC

The White House announced in September that President Joe Biden plans to nominate regulatory lawyer Willie Phillips to serve as a commissioner on the Federal Energy Regulatory Commission (FERC), a panel that could play an increasingly important role in his effort to fight climate change.

Phillips, a Democrat and chair of the Public Service Commission of the District of Columbia, has “extensive background in the areas of public utility regulation, bulk power system reliability, and corporate governance,” the White House said in a statement.

Phillips would bring FERC to a 3-2 Democratic majority for the first time in Biden’s administration, a change that could help the president in his push to put the country on a path to decarbonize the power grid by 2035 and the wider economy by 2050. The role requires confirmation in the Senate, which is considered likely, with Democrats having a thin majority in the chamber.

Phillips would replace Neil Chatterjee, a Republican who once worked for Senator Mitch McConnell of coal-producing Kentucky. Late in his term Chatterjee supported putting a price on carbon emissions. Chatterjee left FERC on Aug. 30.

US Treasury to Oppose Bank Financing for Fossil Fuel Projects

The U.S. Treasury Department has issued new energy financing guidance to multilateral development banks, saying the United States would oppose their involvement in fossil fuel projects except for some downstream natural gas facilities in poor countries.

The new guidance from the Treasury, the largest shareholder in major development banks, including the World Bank Group and the African Development Bank, prioritizes financing for renewable energy options and “to only consider fossil fuels if less carbon-intensive options (are) unfeasible.”

The Treasury said it would oppose “upstream” natural gas projects, such as exploration, but could support midstream and downstream natural gas projects in poor countries that meet the World Bank’s International Development Association targets if they meet certain other criteria.

These include a credible analysis that there is not an economically or technically feasible renewable energy alternative and that the project has significant positive impact on energy security or development.

Australia Faces ‘Precarious’ Gas Supply in 2022, Watchdog Warns

Australia’s southern states could face a gas shortfall in 2022 unless liquefied natural gas (LNG) exporters offer more gas into the domestic market, the Australian Competition and Consumer Commission (ACCC) said.

The report paints a more dire picture than the Australian Energy Market Operator (AEMO) gave in March, when it said plans by billionaire Andrew Forrest to have an LNG import terminal ready by 2022 would stave off any gas shortfall until 2026. ACCC said proposed LNG import terminals would not be ready until 2023 at the earliest.

“The precarious supply situation for next year highlights the importance of the new Heads of Agreement that the Australian government signed with LNG exporters in January 2021,” ACCC Chair Rod Sims said in a statement.

Australia’s three east coast LNG exporters – Australia Pacific LNG, Queensland Curtis LNG and Gladstone LNG – earlier this year agreed with the federal government to offer uncontracted gas to the local market before it is exported.

Protesters Briefly Halt Equinor Exports from Norway Terminal

Crude oil loading at Equinor’s Sture export terminal on Norway’s west coast was interrupted after activists from the Extinction Rebellion group breached the facility’s safety zone, the company said.

Equinor halted the loading of the TS Bergen aframax vessel, but other operations were not affected, a company spokesperson said.

Sture is a major export facility for crude, which arrives by pipeline from several offshore fields, including Equinor’s Oseberg, Lundin Energy’s Edvard Grieg and Aker BP’s Ivar Aasen, according to Equinor’s website.

Activists entered the terminal’s safety zone with a boat and blocked a road leading to the terminal.

“We decided to interrupt the loading, but the terminal operates as normal,” Equinor spokesperson Eskil Eriksen said.

Algeria Hints at End for Contract for Gas Pipeline Crossing Morocco

Algeria hinted at the possibility of ending gas supplies to Morocco in October, two days after cutting diplomatic ties with the Kingdom.

Morocco currently is provided with natural gas through the Maghreb-Europe pipeline that links Algeria to Spain and runs across the Kingdom. The contract for the pipeline expires this month.

Algeri’s Medgaz pipeline does not cross Morocco, and Energy Minister Mohamed Arkab said it would supply all of Spain’s gas supplies.

Medgaz directly links its facilities in the western town of Beni Saf to Almeria, in southeastern Spain, with an annual capacity of 8 Bcm (282 Bcf), and Arkab said that volume is due to increase.

EIG Submits Offer for Petrobras Pipelines in Brazil

U.S. private equity firm EIG Global Energy Partners submitted a binding offer worth several hundred million dollars for Petrobras’ TBG and TSB natural gas pipelines in Brazil, a source with direct knowledge of the matter told Reuters.

Petroleo Brasileiro SA, as Brazil’s state-run oil company is formally known, put the 1,611-mile (2,593-km) TBG pipeline – carrying natural gas from Bolivia – and the far southern TSB pipeline up for sale in December.

The TBG/TSB sale would mark a significant step forward in the ongoing drive at Petrobras to divest non-core assets to reduce its debt load and sharpen its focus on deep-water oil production.

Petrobras has already sold its stake in the TAG and NTS gas pipeline units to consortia led by Engie SA and Brookfield Asset Management Inc., respectively.

Comments