December 2022, Vol. 249, No. 12

Features

Exporting LNG: Support Infrastructure Grows with Transition

By Richard Nemec, P&GJ Contributing Editor, North America

(P&GJ) — Shattering the usual August silence in Washington, D.C., when Congress was in its summer recess, lawmakers this year found a way to pass their self-described Inflation Reduction Act, which includes parts that will bolster the prospect for added U.S. LNG exports.

Meanwhile, added exports require further expansion of natural gas infrastructure projects, such as the Mountain Valley gas pipeline, adding 2.5 Bcf/d (71 MMcm/d) of takeaway capacity next year from the Marcellus Shale play.

On a second-quarter earnings conference call, ExxonMobil CEO Darren Woods called the new legislation “encouraging and a step in the right direction,” noting that it recognizes the need for catalysts to spark a diversity of approaches. For ExxonMobil’s part, Woods told analysts that the company has “stepped up its efforts to reduce the use of natural gas in its operations,” cutting up to 65% so far. He pledged to reduce more if it can be done economically.

Also on a quarterly earnings call, Cheniere Energy’s CEO Jack Fusco reiterated how global demand for liquefied natural gas (LNG) is robust, and 70% of his company’s exports at mid-year had supplied LNG cargoes to Europe, up from 40% last year. Fusco sees Cheniere’s Corpus Christi and Sabine Pass liquefaction sites as excellent candidates for more brownfield expansion beyond what is currently taking place.

In Texas/New Mexico at the resource-rich Permian Basin, over the next 24 to 30 months, there are pipeline projects underway to add more than 3 Bcf/d (85 MMcm/d) of gas supply capacity. Trying to forecast beyond that timeframe is challenging, according to midstream officials tracking the situation.

“Storage development is less of an issue these days because a large amount of natural gas is produced and sent to LNG plants without much delay,” said Joel Moxley, president of the GPA Midstream Association. “LNG exports haven’t been seasonal, so storage is less necessary, other than operational storage to smooth out short-term flows. Gas storage is still vital to support seasonal demand changes for U.S. markets. Infrastructure permitting issues outside of Texas are likely the biggest impediments to getting more pipelines and LNG facilities built — not capital to install compression, pipes and storage.”

During the first half of 2022, the U.S. Energy Information Administration (EIA) noted four projects proposed and one under construction for adding pipeline takeaway capacity from the Permian.

Collectively, the projects could boost takeaway capacity from the basin by 4.18 Bcf/d (118 MMcm/d) over 2023 to 2024. In May and June alone, three of the new projects were introduced, collectively adding about 1.5 Bcf/d (42 MMcm/d), with additions to Gulf Coast Express, Permian Highway and Whistler pipelines.

EIA also noted that there is a new joint venture project, the Matterhorn Express Pipeline, which should add 2.5 Bcf/d of capacity from the Permian by third-quarter 2024. Sponsored jointly by WhiteWater Midstream LLC, EnLink Midstream, Devon Energy Corp. and MPLX, the 490-mile (790-km) gas pipeline will run from the Waha Hub in West Texas to Katy, Texas, near Houston. “The pipeline will receive natural gas from upstream Permian connections and from direct connections at processing facilities in the Midland Basin before connecting to the Agua Blanca Pipeline,” EIA officials note.

With the dampening effect of the COVID-19 pandemic now in the rearview mirror, industry and economic forecasts are more bullish for stepped up growth in demand, production and corresponding infrastructure. In its July Short-Term Energy Outlook, EIA projected Permian Basin production increases of up to 2.3 Bcf/d (65 MMcm/d) in 2022 and another 1.4 Bcf/d (40 MMcm/d) in 2023.

With the advent of the Freeport LNG export facility returning to service in fourth-quarter 2022, officials at the Natural Gas Supply Association (NGSA) and its affiliated Center for LNG (CLNG) indicated that total U.S. LNG exports may climb to nearly 13 Bcf/d (368 MMcm/d).

In its January 2021 updated foundation report, “North American Midstream Infrastructure – A Near-Term Update Through 2025,” the Interstate Natural Gas Association of America (INGAA) was projecting U.S. LNG exports at about 11.7 Bcf/d (331 MMcm/d) in 2025, and now that should be exceeded two years early given sufficient supporting infrastructure.

Writing in the midst of the pandemic in late 2020, the analysts at ICF Consulting still predicted that potential for infrastructure development was “significant,” despite recent events. They anticipated nearly 33 Bcf/d (935 MMcm/d) of added capacity in the 2020–2025 period.

“New gas infrastructure is needed in many different geographic locations, particularly in Texas and Louisiana, to support continued supply development and continued growth of both domestic gas use and exports (via both pipeline and LNG),” the INGAA report notes. “LNG exports are a major driver of future demand for U.S. natural gas markets.”

After dropping significantly in the first eight months of the pandemic, gas deliveries for LNG exports have risen steadily since, according to INGAA’s analysis.

On a micro-economic basis, a review of ongoing and proposed projects at San Diego-based Sempra Infrastructure provides a clear snapshot of continuing growth prospects. Sempra’s corporate goal as reiterated in August by CEO Jeff Martin is “to build the energy network of the future.” On a second-quarter 2022 earnings conference call, Martin touted his company’s relative lower risk in focusing on infrastructure compared to others who are tied to the commodity markets.

“We’re growing this business for utility shareholders, so we have a defined view about our strategy for investing in transmission/distribution [infrastructure] assets that have low risk,” Martin told analysts during his quarterly earnings call in August. “There are a lot of other opportunities in the LNG space for people who want to be commodity-exposed or take construction risks. Our job is to make sure we risk-adjust these projects and put those cash flows in a box that looks substantially similar to our utility cash flows.”

Over the past 15 years, Sempra has moved from a large energy company model with an international commodity trading desk shared with the Royal Bank of Scotland to focusing on being a North American infrastructure and utility holding company exclusively during the past five years.

“We have a decided view that infrastructure, namely continued investment in the power grid and energy network, will be a key way in which we support North America’s continued economic expansion,” Martin said.

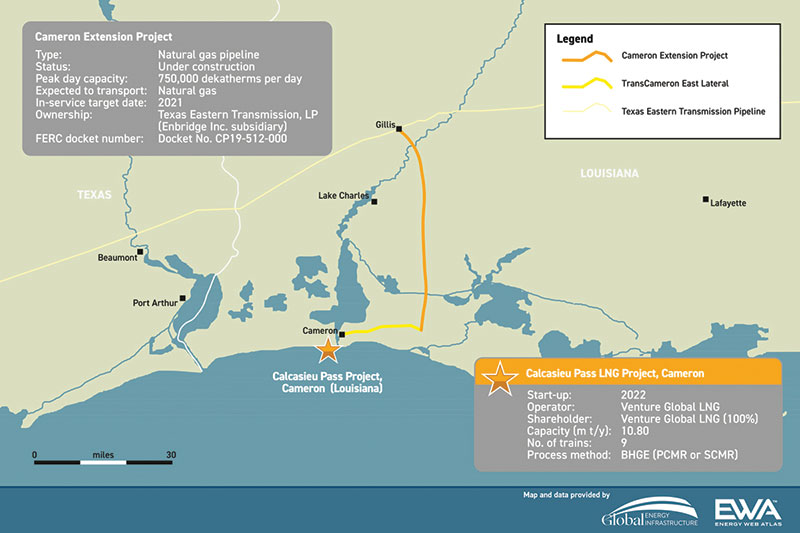

Thus, in 2022, Sempra has existing and proposed pipelines, storage and LNG terminals on both sides of the U.S.–Mexico border. In the United States, there are existing and expansion LNG facilities at Cameron, Louisiana, and proposed facilities at Port Arthur, Texas, along the Gulf of Mexico. In Mexico there is an existing receiving terminal slated to have an export terminal along Mexico’s West Coast of Baja California and two or three other proposed LNG terminals south of the border.

Sempra’s 40-mile (64-km), 2.35 Bcf/d (67 MMcm/d) Cameron Interstate Pipeline is in operation in south Louisiana, linking the LNG terminal in Cameron Parish to five interstate pipelines. It also has a Louisiana Storage Pipeline spanning 23.3 miles (37 km) near Sulphur, Louisiana, in Calcasieu and Beauregard Parishes, that interconnects with six major pipelines throughout the Gulf region. Meanwhile, in development in Cameron Parish is a 25.5-Bcf (722-MMcm/d) capacity storage facility in Hackberry, Louisiana, along with related pipelines in the area.

Also in development in 2022 is Sempra’s Louisiana and Texas Port Arthur pipeline connector. A 131-mile (211-km), 42-inch, 2-Bcf/d (57-MMcm/d) line is planned to link up to six counties in Louisiana and two in far east Texas. The pipeline will supply feed gas to the eventual Port Arthur LNG liquefaction project.

A Sempra LNG subsidiary, LA Storage, seeks to build and operate a high-deliverability gas storage facility in Hackberry, Louisiana, along with associated pipelines as a means of meeting what Sempra officials call “growing operational needs” for LNG facilities in the Gulf region.

The project dates back more than a decade and more recently market conditions caused Sempra to upgrade its design with added amenities in a new application filed with Federal Energy Regulatory Commission (FERC) in 2021.

Facilities for this storage project include four caverns (three existing) located on a Sempra-owned parcel in Cameron Parish, a compressor station and ancillary facilities, four saltwater disposal wells, six freshwater wells, and another 22 miles (34 km) of three separate pipelines from brine disposal, gas connections to the Port Arthur–Louisiana connector, and a connector to the Cameron Interstate Pipeline.

“We believe our proposed midstream projects, along with our existing Cameron Interstate Pipeline, are sufficient to meet Sempra Infrastructure’s LNG needs,” said Sempra Infrastructure’s Paty Ortega Mitchell, noting also that Sempra does not disclose the investment amounts for each project. “Port Arthur pipeline and LA Storage are both in the development stage. Permit applications have been filed for LA Storage and we are encouraged by the progress made to date.”

In direct support of the LNG export operations is the sizable Port Arthur Pipeline Louisiana Connector (PAPLC) with its proposed 2-Bcf/d capacity. It will require a compressor station in Beauregard Parish, multiple interconnects and various above- and below-ground equipment, including valves and launchers/receivers. Sempra engineers say the project will follow a route that is mostly co-located with existing pipelines through the six Louisiana and two Texas counties.

Justin Bird, CEO for Sempra Infrastructure, notes that the PAPLC and the liquefaction facility projects are “contingent upon completing the required commercial agreements, securing all necessary permits and approvals, obtaining financing and incentives, achieving other customary conditions, reaching a final investment decision, and other factors associated with the investments.” So, there is still a lot of work to do for Sempra’s LNG team.

Since the Russian invasion of the Ukraine in February, the global spotlight has been turned up on U.S. LNG exports and the infrastructure to support them. Industry advocates have turned up the volume on FERC and the Department of Energy (DOE), urging more regulatory certainty for policies allowing U.S. LNG to play a critical role in stabilizing Europe’s natural gas supplies.

In mid-2022 among the 180 U.S. LNG shipments, 122 went to Europe. Seventy percent of the 2022 U.S. LNG cargoes have gone across the Atlantic. The United States led the global growth in LNG year-over-year in 2021 with a 24-million-ton increase.

The latest reports from the CLNG note that the week ending Feb. 20, 2022, U.S. LNG terminals operated at near peak capacity, nearly 12% above full utilization levels, while EIA was predicting 50% increased global LNG use over the next 30 years. Current demand globally is expected to grow 90% by 2040. In this context, CLNG officials express a lot of concern about alleged inaction at DOE on permits for exports to non-Free Trade Agreement (FTA) nations.

In mid-2022, there were six applications for non-FTA permits under review at DOE. All six already had received FERC approvals, according to CLNG. They collectively represent more than 2.1 Bcf/d (59 MMcm/d) of exports, including Cheniere Sabine Pass (Louisiana) and Corpus Christi (Texas); the Golden Pass Texas facility under construction; privately held Glenfarne Group LLC’s Magnolia plant under development in Texas; and two Sempra Mexican projects – Energia Costa Azul, along the Baja Pacific Coast, and Vista Pacifico LNG.

In total, CLNG indicates there are up to 20 applications for long-term exports to non-FTA nations pending with DOE, another 14 projects awaiting FERC action, adding up to 4.27 Bcf/d (121 MMcm/d) of capacity waiting for regulatory approvals. “DOE has not approved a non-FTA permit application since January 2021,” CLNG notes on its website.

Another aspect of future and existing LNG infrastructure is the interest in electrifying operations to reduce carbon footprints. This is particularly interesting to European buyers these days.

“If we continue to electrify the grid and move to a green molecule on the gas side, we will be in a unique position to be a leader in the clean energy transition,” Sempra’s Martin said. “When you think about how we approach Europeans for LNG, this is right in our sweet spot.”

Sempra is planning its Cameron terminal expansion to be made based on electric drives, according to Martin.

“Over a long period of time, I think the United States will be a competitive leader in being able to source and deliver LNG on both a more cost-competitive basis and on the basis of a reduced emissions profile.”

Since 2014, Freeport LNG hooked up with GE Oil & Gas to provide technology and financing for its 2.2-Bcf/d (62-MMcm/d) LNG export facility on Quintana Island, Texas. Calling it the first world-scale electric LNG (eLNG) plant in North America, Freeport officials say that “using electric motor-driven technology has enabled us to comply with strict local emissions standards and support our ambitious production and export targets.”

Similarly, with a vision to be the premier LNG export company in North America, the $10 billion Golden Pass LNG export project will add natural gas liquefaction and export capabilities to the existing terminal in Sabine Pass, Texas. With an anticipated startup in 2024 through 2026, this investment by subsidiaries of state-owned Qatar Petroleum and ExxonMobil will include the construction of three liquefaction process trains, each with a nominal output of approximately 5.2 million metric tons per annum (MTPA). A 6.8-MW electric motor will drive each of the compressor packages.

ExxonMobil CEO Woods reiterates that Golden Pass is a way for the United States to increase exports to Europe in the wake of the energy disruptions caused by Russia’s invasion of the Ukraine. And he expresses support for the industry, cutting emissions from all its operations that are aimed at bringing supply back in line with a growing post-pandemic increase in demand. In his second-quarter earnings presentation, Woods cited a first-quarter 25% increase in Permian production by ExxonMobil, and an overall 17% increase in the Gulf region.

However, in August, U.S. Environmental Protection Agency (EPA) officials criticized the nation’s largest LNG exporter, Cheniere Energy, for using what they describe as “higher-polluting” natural gas-fired turbines at its Sabine Island Gulf Coast facility.

According to EPA, Cheniere is facing the possibility of reduced or slowed gas shipments to make expensive upgrades the federal environmental regulators contend could have been made a decade ago. Separately, Cheniere has reportedly requested an exemption from the current tougher emissions restrictions.

“It will be extremely difficult for us to defend eliminating electric drive compressors for LNG liquefaction when that is what is proposed by Freeport,” an EPA official was quoted as saying in a Reuters report in mid-August.

In August, Fusco was optimistic that Cheniere can successfully negotiate the EPA appeal processes. “We have a clear line of sight to get Corpus over 30 million tons of LNG annually,” Fusco noted. “In terms of growth plans, we think this is the lowest hanging fruit.” He calls the expansions at existing sites “essentially seamless.”

Part of the puzzle of reaching net-zero carbon footprints involves carbon capture and storage (CCS), and LNG terminals like Sempra’s Cameron facility are looking to integrate it with the liquefaction operations.

In 2021, Sempra applied to the U.S. EPA for a permit to operate a carbon sequestration well at its Hackberry site. “In May of this year we signed a participation agreement with Cameron LNG Partners to jointly develop the [sequestration well] opportunity,” Sempra’s Bird said. “We’re doing all we can to make our projects less emissive and to promote the energy transition.”

Bird notes that electric drives, carbon capture, responsibly sourced gas (RSG), and other design changes are part of the mix. Operators like Sempra insist that natural gas has a key role to play in the long-term U.S. energy transition. It is a matter applying innovation, new technology, and improvement in operational processes.

“There won’t be an energy transition without energy security, so fuels like natural gas are important,” Sempra’s Martin said, making the need to reduce methane emissions essential.

Richard Nemec is P&GJ’S Los Angeles-based correspondent and contributing editor. He can be reached at rnemec@ca.rr.com.

Comments