February 2022, Vol. 249, No. 2

Global News

Global News February 2022

EIA Updates Oil Price Forecasts Through 2023

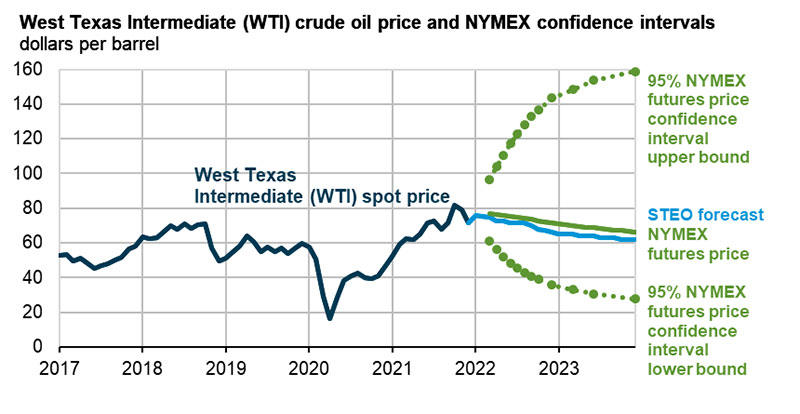

The U.S. Energy Information Administration (EIA) has updated its short-term energy outlook to forecast an average Brent crude oil price of $75 per barrel in 2022 and $68 per barrel in 2023, compared with its average daily spot price of $71 per barrel in 2021.

The agency warned, however, that its forecast continues to reflect heightened levels of uncertainty because of the ongoing COVID-19 pandemic. “Notably, the Omicron variant of COVID-19 raises questions about global energy consumption,” it said.

U.S. real GDP declined by 3.4% in 2020 from 2019 levels. Based on forecasts that use the IHS Markit macroeconomic model, EIA estimates U.S. gross domestic product (GDP) increased 5.7% in 2021 and that it will rise by 4.3% in 2022 and by 2.8% in 2023. In addition to macroeconomic factors, supply uncertainty in the forecast stems from uncertainty about OPEC+ production decisions and the rate at which U.S. oil and natural gas producers will increase drilling.

“We estimate global liquid fuels inventories fell by an average of 1.4 million barrels per day (MMbpd) in 2021 compared with inventory growth of 2.1 MMbpd in 2020,” the EIA wrote in its January Short-Term Energy Outlook. Global oil inventories rise in the forecast, increasing at a rate of 500,000 bpd in 2022 and 600,000 bpd in 2023.”

Global consumption of petroleum and liquid fuels averaged 96.9 MMbpd in 2021, up by 5.0 MMbpd from 2020, when consumption fell significantly because of the pandemic. The EIA expects global liquid fuels consumption will grow by 3.6 MMbpd 2022 and 1.8 MMbpd in 2023.

Crude oil production from OPEC member countries averaged 26.3 MMbpd in 2021, up from 25.6 MMbpd in 2020. Average OPEC crude oil production is projected to increase by 2.5 MMbpd to average 28.8 MMbpd in 2022 and 28.9 MMbpd in 2023.

U.S. crude oil production averaged 11.2 MMbpd in 2021, according to the EIA, which expects production to average 11.8 MMbpd in 2022 and to rise to 12.4 MMbpd in 2023, which would be the highest annual average U.S. crude oil production on record. The current record is 12.3 million b/d, set in 2019.

Indian Oil Investing $944 Million on Gas Sales in New Areas

Indian Oil Corp, the country’s top refiner and fuel retailer, said it aims to invest $944.02 million (70 billion rupees) to build gas sales network infrastructure, including pipelines, in new areas.

IOC said it has obtained nine licenses to sell gas to households, automobiles and small industries, representing about a third of the demand potential in 61 geographical areas in various states that were recently auctioned by the Petroleum and Natural Gas Board. IOC is already working on gas sales projects worth $2.69 billion (200 billion rupees), it said.

Prime Minister Narendra Modi is aiming to raise the share of natural gas in India’s energy mix to 15% by 2030 from the current 6.2%. Natural gas, while still a fossil fuel, emits less CO2 than coal.

India, the world’s third biggest emitter of greenhouse gases, has set a 2070 goal for net zero carbon emissions.

Cruz’s Nord Stream 2 Sanctions Bill Fails to Pass in US Senate

The U.S. Senate failed to pass a bill to slap sanctions on Russia’s Nord Stream 2 natural gas pipeline sponsored by Republican Sen. Ted Cruz, a day after Democrats unveiled their own legislation.

Sen. Robert Menendez has won the support of many of his fellow Democrats, including President Joe Biden, for an alternative bill he introduced. It would impose sweeping sanctions on top Russian government and military officials and banking institutions if Moscow engages in hostilities against Ukraine.

Sen. Jeanne Shahen, a Democrat who had originally co-sponsored Nord Stream 2 sanctions legislation with Cruz, opposed his bill, saying it risked breaking unity in Washington and in Europe over Russian aggression against Ukraine.

The United States, as well as some European countries including Ukraine and Poland, oppose the pipeline, which would deprive Kyiv of transit fees as well as increase Moscow’s leverage over Europe, where gas prices have been soaring.

Brazilian Courts Suspend Petrobras Natural Gas Price Hikes

Courts in four Brazilian states have suspended a 50% hike in natural gas prices planned by state-run oil company Petrobras, likely kicking off an intense legal battle between the firm, the distributors that buy its fuel and various political authorities.

Petrobras, formally Petroleo Brasileiro SA, said courts in four states had issued injunctions at the request of natural gas distributors, while a fifth injunction request had been denied. The company did not identify the states where the injunctions were granted, but Rio de Janeiro’s state legislature said on Twitter that a judge there had halted the price hike. National newspaper O Globo identified the other three states as Sergipe, Cearra and Alagoas, all in the country’s northeast.

Petrobras said it would appeal the injunctions, adding that nearly half of the natural gas it sells in 2022 will be via long-term contracts, the terms of which are being respected. Some clients, however, have opted for short-term contracts. Petrobras imports natural gas from Bolivia and prices have risen “nearly 500%” in 2021, the company added.

Archaea Energy Starts Up Assai Renewable Natural Gas Facility

Archaea Energy announced the successful start-up of Project Assai, an RNG facility located at the Keystone Sanitary Landfill in Dunmore, Pennsylvania.

Assai has an inlet capacity of 22,500 cf/m and combines landfill gas flows from the Keystone Sanitary Landfill and the Waste Management Alliance Landfill. Assai is expected to reduce CO2 emissions by over 200,000 metric tons annually and significantly reduce air pollutants, many by over 90%.

Assai is expected to deliver over 4 MMBtu of RNG annually at projected flows, methane recovery and uptime, resulting in over $40 million of annual projected EBITDA. The project stands to benefit from long-term gas rights agreements at landfills with decades of capacity and strategically located within growing waste markets. Apbout 80% of the total RNG volumes expected to be produced at Assai have been contracted on a long-term, fixed fee basis with FortisBC Energy Inc., Energid, L.P., and The Regents of the University of California, for periods of up to 20 years.

Iran Expected to Top Middle East Midstream Project Starts by 2025

Iran is likely to set to start operations at 27 midstream oil and gas projects between 2021 and 2025, accounting for 22% of upcoming midstream projects in the Middle East, according to GlobalData, a data and analytics company.

Its January report, “Middle East Midstream New-Build and Expansion Projects Outlook, 2021-2025,” notes that transmission projects make up 15 (56%) of the 27 projects expected to commence operations in Iran, while six are gas processing projects (22%) and four are underground gas storage projects (15%).

“Despite ongoing international sanctions led by the US, Iran is announcing massive investment plans across the oil & gas value chain, including the midstream sector,” said Sudarshan Ennelli, oil and gas analyst at GlobalData. “The investments focus on building greater transport and storage to meet the growing demand for oil and gas, as well as for exports.”

Enterprise Boosts Gas Pipeline Network via Navitas Acquisition

Houston-based Enterprise Products Partners LP said it would buy Warburg Pincus-owned Navitas Midstream for $3.25 billion in cash, entering the active Midland basin to tap into increased demand for natural gas infrastructure.

Navitas owns a network of about 1,750 miles of natural gas pipelines in the Midland portion of the Permian basin, the region of Texas and New Mexico considered the heart of the U.S. shale industry. Enterprise owns only some downstream pipelines in the Midland basin, Chief Executive Officer Jim Teague said in a statement.

Navitas is expected to reach one billion cubic feet per day of cryogenic natural gas processing capacity once it completes its Leaker plant in Texas in the first quarter of 2022, during which Enterprise also plans to close the deal.

UGI Acquiring Stonehenge Appalachia Gathering System

UGI Corporation announced that its UGI Energy Services subsidiary has agreed to acquire Stonehenge Appalachia from Stonehenge Energy Holdings for approximately $190 million.

The Stonehenge system, located in Butler County, Pennsylvania, includes more than 47 miles of pipeline and associated compression assets, and has gathering capacity of 130 MMcf/d.

The Stonehenge acquisition follows UGI’s recent purchase of an ownership stake in the Appalachian Basin’s Pine Run gathering system, which averaged 31.9 Bcf/d of production in the first half of 2021, the highest for a six-month period since production began in 2008, UGI said.

The transaction is expected to close by Jan. 31, pending regulatory approval.

Harvest Midstream Agrees to Buy to Arrowhead ST Holdings

Harvest Midstream announced the signing of a purchase and sale agreement to acquire the remaining interest in Arrowhead ST Holdings, LLC from its joint venture partner. Harvest is already the operator of ASTH and a 25% owner of the joint venture.

ASTH, a fully integrated Eagle Ford midstream business, spans the most active areas of the Eagle Ford. The system delivers to numerous crude export docks and into Flint Hills Corpus Christi and Valero Three Rivers refineries. Harvest said the deal is part of an ongoing effort to expand crude oil transportation and logistics services for upstream and downstream customers.

The ASTH system includes about 515 miles of pipeline with a total throughput capacity of 380 MMbpd. The system is a key link between the Eagle Ford Basin producers and Corpus Christi, the leading crude export market in the United States.

Pending regulatory approval, the sale is expected to close in the first quarter of 2022.

Williams Transco System Delivers Record Gas Volumes

Williams announced that it recently delivered a record amount of natural gas on its Transco interstate pipeline, providing essential and reliable service to natural gas distribution companies, electric power generators, LNG exporters and other customers located along the Eastern Seaboard and Gulf Coast.

Transco, the United State’s largest-volume natural gas transmission system, delivered a record-breaking 17.15 million dekatherms (MMt) on Jan. 3, 2022. The new peak-day mark surpasses the previous high that was set on Feb. 20, 2020. While extreme winter weather usually coincides with peak-day deliveries, the volume record was due to continued expansions on the Transco.

Williams has nearly tripled contracted capacity on Transco to approximately 18.7 MMt/d in 2021 (from 6.6 MMt/d in 2008) primarily through incremental growth projects along Transco’s existing footprint. Leidy South was the most recently completed expansion project to maximize the use of Transco’s existing corridor and minimize environmental impacts.

“The value of safe, dependable natural gas infrastructure becomes abundantly clear when millions of homes, businesses and manufacturing facilities across the United States need reliable, low-cost energy more than ever,” said Alan Armstrong, president and chief executive officer of Williams. “We are proud to deliver this critical service all year long and especially during winter periods of peak demand when it is most appreciated.”

Transco delivers natural gas to customers through a 10,000-mile pipeline network whose mainline extends approximately 1,800 miles between South Texas and New York City. The system serves markets in 12 U.S. Southeast and Atlantic Seaboard states, including major metropolitan areas in New York, New Jersey and Pennsylvania.

Comments