June 2022, Vol. 249, No. 6

EIA Update

Demand for US Exports to Drive More Natural Gas Production

By U.S. Energy Information Association (EIA)

The reference case in the U.S. Energy Information Association’s (EIA’s) Annual Energy Outlook (AEO2022) projects U.S. natural gas production to continue to increase through 2050. The reference case is the baseline in AEO2022, and it projects energy trends based on current laws, regulations, and market conditions.

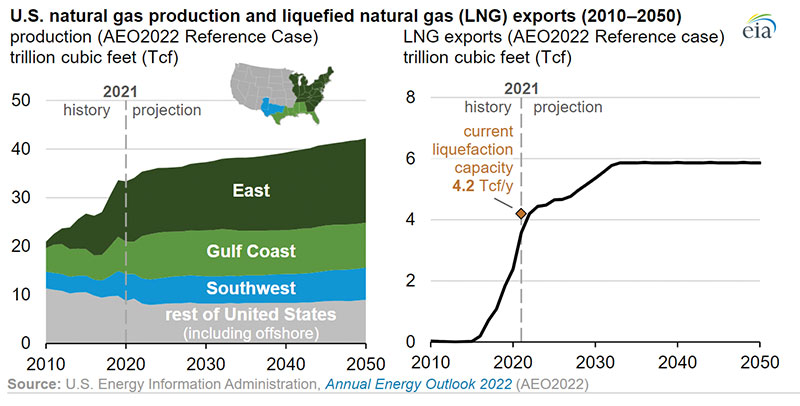

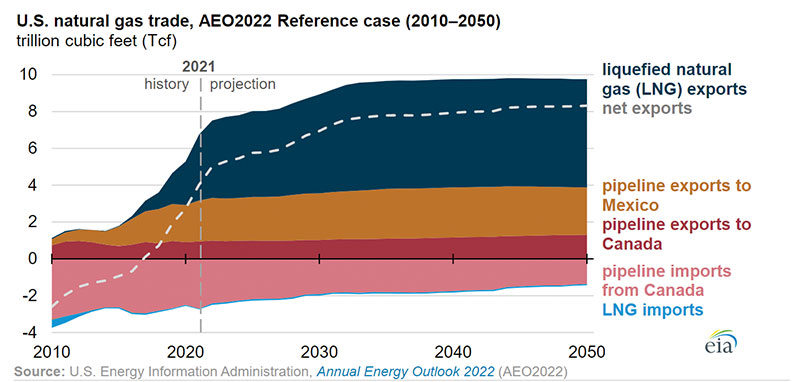

Much of the modeled growth in natural gas production results from rising demand for U.S. natural gas exports, especially for liquefied natural gas (LNG). EIA projects natural gas exports to continue to rise through the early 2030s before leveling off.

EIA projects that annual U.S. natural gas production will grow by almost 25% through 2050. Much of this growth comes from the Appalachia Basin (East region) and the Mississippi–Louisiana salt basins (Gulf Coast region). However, more than half of this growth comes from natural gas production in oil formations, known as associated gas.

The most significant increase in production of associated natural gas is in the Wolfcamp formation of the Permian Basin in the U.S. Southwest. The Wolfcamp and Haynesville formations’ proximity to LNG export terminals on the Gulf Coast in Texas and Louisiana has facilitated production growth in these regions.

“Natural gas from the Appalachia Basin also reaches export markets,” the analysts said. “However, we project that the majority of new production from this region will be directed toward domestic markets because access from Appalachia to export terminals is constrained by pipeline infrastructure.”

As a result, the region’s relatively low production costs are predominately driving the growth in Appalachia’s natural gas production.

In 2021, U.S. natural gas exports set a record high for the seventh consecutive year and are projected to increase further. After 2033, natural gas exports is expected to stay relatively flat for the remainder of the projection period. Most natural gas export growth comes from LNG, but exports of natural gas by pipelines to Mexico and Canada also increase.

EIA projects that continued growth in natural gas exports through 2025 will be driven by increases in LNG capacity at facilities that are currently under construction.

Additional LNG trains at Sabine Pass and Calcasieu Pass in Louisiana and at Golden Pass in Texas are now expected to enter service much earlier than anticipated in the AEO2021, increasing the amount of infrastructure available for converting natural gas to LNG for export. Recent completions of additional natural gas pipeline infrastructure have also increased capacity into Mexico.

After 2025, U.S. natural gas production should increase to meet growing LNG export demand. The projected global demand for natural gas will continue to be high, making it more economical to build additional LNG export facilities in the United States.

These LNG capacity expansions, coupled with increasing demand for natural gas abroad, result in an increased forecast of LNG exports to 5.86 Tcf (16.1 Bcf) by 2033 in the reference case, up 65% from current levels.

Comments