March 2022, Vol. 249, No. 3

EIA Reports

US Natural Gas Inventories Near 5-Year Average

By U.S. Energy Information Administration (EIA)

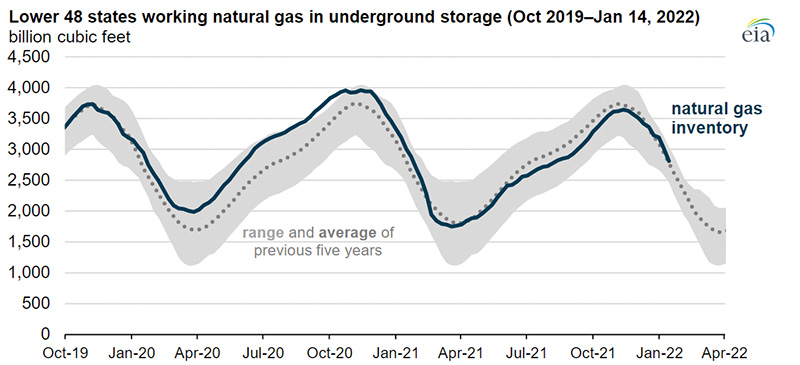

After starting the winter heating season (November–March) below its previous five-year average, the Lower 48 working natural gas in storage surpassed its five-year average in mid-December during one of the warmest Decembers on record.

However, colder-than-normal temperatures in early January, along with increased liquefied natural gas (LNG) exports and increased power demand compared with last year, have lessened these gains, and working natural gas is again less than the five-year average.

Working natural gas stored in the Lower 48 states totaled 2,591 Bcf (73 Bcm) as of Jan. 21, based on data from its Weekly Natural Gas Storage Report. As of Jan. 21, natural gas in storage was 25 Bcf (708 MMcm), or 1%, less than its previous five-year (2017–2021) average for the week. At the beginning of the heating season on Nov. 5, natural gas in storage was 3,618 Bcf (102 Bcm), or 3%, less than its previous five-year average.

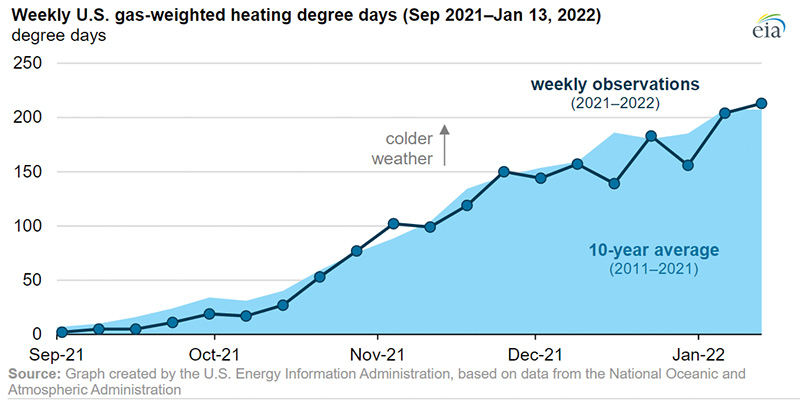

Significantly warmer-than-normal temperatures during the early weeks of the heating season lessened space heating demand for natural gas and withdrawals from U.S. natural gas inventories. Heating degree days measure the relative coldness of winter seasons.

The National Oceanic and Atmospheric Administration (NOAA) reported 635 cumulative gas-weighted heating degree days for the Lower 48 states from Dec. 3 to Dec. 30, or 12% less than (that is, warmer than) the previous 10-year average.

Natural gas demand in the U.S. residential and commercial sectors averaged 34.5 Bcf/d (977 MMcm/d) in December, which is 15% less than the previous five-year average, according to data from IHS Markit. The decreased demand for natural gas in these sectors resulted in lower withdrawals of natural gas from storage compared with the five-year average.

Record-high LNG exports limited increases in U.S. natural gas inventories, despite a much warmer-than-normal December and high natural gas production in the Lower 48 states. EIA’s Short-Term Energy Outlook (STEO) estimated U.S. LNG exports averaged 11 Bcf/d (312 MMcm/d) from November through January in response to high prices in both Asia and Europe. In particular, inventories in Europe remain much lower than their five-year averages and contributed to increased demand for LNG.

Starting in early January, colder-than-normal temperatures in the Midwest and Northeast United States have led to more natural gas demand for space heating, while LNG exports have remained at elevated levels. Net withdrawals from storage exceeded the five-year average in the first three weeks of January by 25%, bringing storage inventories to within 1% of the five-year average.

In the STEO, EIA forecasts working natural gas inventories in the Lower 48 states will total 1,795 Bcf (51 Bcm) at the end of March, which would be 128 Bcf ([4 Bcm] 7%) more than the five-year (2017–2021) average.

Comments