May 2022, Vol. 249, No. 5

Features

Marcellus, Utica Operators Post Victories, Recalibrate

By Michael Reed, Editor-in-Chief

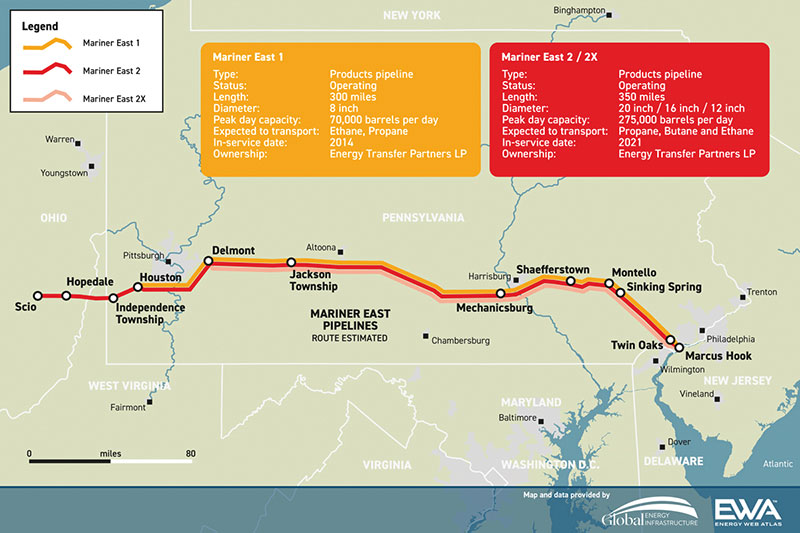

To be sure, it has not been an easy road, but of all the projects that have been completed this year, the Mariner East system may be midstream’s most satisfying – it certainly has been for those in the Marcellus and Utica shale plays of Pennsylvania, West Virginia and Ohio.

“Energy Transfer’s Mariner East franchise will now include multiple pipelines across Pennsylvania connecting the prolific Marcellus/Utica Basins in the west to markets throughout the state and the broader region, including Energy Transfer’s Marcus Hook terminal on the East Coast,” Energy Transfer’s Co-Chief Executive Officer Tom Long said of the completed project.

After a myriad of setbacks – and five years after construction began – the 350-mile (563 km), 20-inch pipeline brings the system’s capacity to about 300,000 bpd. The full system now comprises about 670 miles (1,078 km) of a natural gas liquid (NGL) transmission pipeline.

And, contrary to the picture painted in some of the legal challenges the pipeline has faced along the way, many people in the region are glad to see a project offering such an economic boost to the local workforce and businesses.

“This is the news our members have been waiting for,” Jim Snell, business manager of the Steamfitters Local 420, told the Delaware Valley (Pennsylvania) Journal. “They’ve been laboring for years on this pipeline because they know even greater opportunities are possible at the Marcus Hook Industrial Complex and beyond once everything is up and running. The economic benefits of this project have been irrefutable, but the economic promise is even greater.”

Other post-COVID-19 inroads have also been in the region. Among those, both UGI and the Valley Energy companies have announced gas pipeline expansion efforts in the Marcellus Shale region of Pennsylvania.

In the case of UGI, the company announced it would pay Energy Services $190 million for the 47-mile (76-km) Stonehenge Appalachia in west-central Pennsylvania. The pipeline transports natural gas from local wells to interstate pipelines.

As recently as 2019, UGI paid $1.3 billion for a 240-mile (386-km) system not far from that location that included the Big Pine pipeline. The company also holds 49% interest in the Pine Run Midstream system, which connects with the Big Pine system.

Emphasizing UGI’s commitment to the area, Robert F. Beard, executive vice president of Natural Gas, said, the acquisitions “demonstrate our commitment to the Appalachian basin, which averaged a record 31.9 billion cubic feet per day of production in the first half of 2021, the highest for a six-month period since production began in 2008.”

Additionally, the consensus appears to be that the majority of shale drillers are expected to return to moderate growth mode during 2022.

“We strongly believe there is need for more pipeline capacity coming out of the Marcellus,” Charles Crews, president and CEO, Northeast Gas Association, told P&GJ. “We’ve had some project setbacks and cancellations in the last couple of years, which is disappointing, but we’ve also had some new incremental capacity additions which have proven helpful to the market.”

The Marcellus play remains the highest-producing shale gas play in the United States, producing an average 31.7 Bcf/d (898 MMcm/d) of natural gas during 2021. The oil-dominant Permian Basin, a major source of associated gas, averaged 12.4 Bcf/d (351 MMcm/d) for all of 2021, making it the second-highest producing play. The Haynesville averaged 11.2 Bcf/d (317 MMcm/d) in 2021.

“We have seen some constraints on takeaway capacity emerging in the region and that remains a concern,” Crews said. “More pipeline capacity will help meet market need not only here in the Northeast but in other parts of the country as well.

With the fortunes of Marcellus and Utica so closely tied to liquefied natural gas (LNG) exportation, it seems likely the outlook will only improve over the next few years. The U.S., according to the Energy Information Administration (EIA), currently has an export capacity of 9.17 Bcf/d (260 MMcm/d), but planned and under construction projects should increase that level to 11.97 Bcf/d (339 MMcm/d).

Under the agreement, President Biden said the U.S. will work with partners to ensure an additional 592.7 Bcf/d (16.79 Bcf/d) of LNG for the European Union in 2022.

Challenges Remain

Unfortunately for the industry, the Mariner East’s story and other successes fail to paint a complete picture of the Marcellus-Utica. There are still many transportation issues to be overcome.

On the good news, bad news front, Equitrans Midstream recently said it had filed with the Federal Energy Regulatory Commission (FERC) for a pipeline expansion project to be called the Ohio Valley Connector Expansion Project (OVCX).

While the 350-MMcf/d (9-MMcm/d) expansion would add compression along the Equitrans pipelines in Pennsylvania, Ohio and West Virginia, it can also be viewed as a move to navigate its way around the fallout of the Mountain Valley Pipeline (MVP) possibly not being completed.

However, the road forward for MVP did significantly improve on April 12, when a request to bore under about 180 streams and wetlands received unanimous approval from FERC.

The approval allows what is essentially the one piece of construction remaining unfinished due to court rulings.

FERC amended its 2017 certificate — perhaps the most important approval among more than a dozen federal and state permits – to allow MVP to tunnel below some water bodies, rather than digging a trench along their bottoms to bury a 42-inch pipeline.

MVP, which is 303 miles (488 km) in length, is the largest natural gas pipeline being constructed in the region and 94% complete, did gain FERC authorization to complete part of its remaining construction for the 94% complete. The order allows for the use of horizontal directional drilling (HDD) to install the pipeline below wetlands and streams.

“This is another important step forward in MVP’s project completion and, as a critical infrastructure project, is essential for our nation’s energy security, reliability and ability to transition to a lower-carbon future,” Natalie Cox, an MVP spokesperson said in an email.

Another major sticking point has been regulatory changes from the new administration, despite the Marcellus-Utica region’s tendency to back the fossil fuel industry. In past years, major interstate pipeline projects in the region, such as the 713-mile (1147-km) Rover or the 256-mile (412-km) NEXUS, but that is no longer the case.

In Ohio, the Department of Natural Resources (ODNR) makes permitting less complicated as far as intrastate projects are concerned by having “sole and exclusive” authority over all aspects of oil and gas.

As Mike Chadsey, Ohio Oil and Gas Association (OOGA) director of Public Relations, told P&GJ in 2021, “There are other agencies that have small bits and parts, but it’s really with the ODNR. And so, that’s good. You’ve got a one-stop shop for everything that you’re working on.”

Although, based on EIA data, natural gas pipeline capacity out of the northeast has grown every year since 2014, the rate of increase has slowed and recently failed to keep pace with growth in regional production.

The Appalachian Basin as a lone entity would have been the third-largest natural gas producer in the world during the first half of 2021, behind Russia and the rest of the U.S. Meanwhile, crude oil production in the Marcellus shale is expected to reach pre-pandemic levels in 2022 and increase further to 2025, while crude oil production in the Utica shale is unlikely to recover by 2025.

However, in the wake of major interstate pipelines, such as the Atlantic Coast and PennEast pipelines, being canceled, midstream operators in the region have turned increasingly toward more efficient, smaller projects and moderate upgrades.

Still, there is a basic necessity for connecting oil and gas with energy generation, and the importance of pipelines in the transportation of these commodities cannot be denied.

“The U.S. (and global) energy market continues to experience elevated commodity prices for all products, including natural gas,” Crews said. “Getting more production to market will help mitigate commodity price volatility. Developing U.S. resources also would strengthen our energy security and position us better to support our allies in Europe and elsewhere.”

Comments