November 2023, Vol. 250, No. 11

Features

Paradigm Shifts in Natural Gas Measurement, Maintenance

By Ernest Hauser, President, C-SMART Analytics

(P&GJ) — What drives paradigm shifts? Are paradigm shifts in industry the result of changes in behavior which lead to technology innovation, or does technology innovation precede paradigm shifts in behavior? This existential “what came first, the chicken or the egg” question may not have a universal answer, but in mature, risk averse, and regulated industries, the answer is almost universally the latter.

Increased performance is required. Headcount increases to achieve results if performance is not forthcoming. Pressures to reduce headcount further are a reality and skilled resources are scarce. Despite these drivers for change, jumping off a cliff in the absence of historical data is not something that a risk-averse corporation or investor is accustomed to do.

Fortunately, data is not scarce in today’s information rich environment, yet actionable insights are all too often stranded or hidden among the noise. No where is this principle better illustrated than in natural gas measurement.

Smart Stations

The adoption of smart measurement equipment for natural gas custody transfer measurement picked up steam in 2000 in the transmission and storage segment of the natural gas value chain, where high throughput formed the economic sweet spot for smart ultrasonic meters.

In the next decade, advances and innovation from ultrasonic meter manufacturers have stretched their offerings and expanded the viable market sweet spot both upstream and downstream, to include the tailgates of processing plants and larger power and industrial users.

The capital cost of these stations was higher than the older, mature technologies, but the industry bought in to the promise that improvements in measurement performance would be achieved.

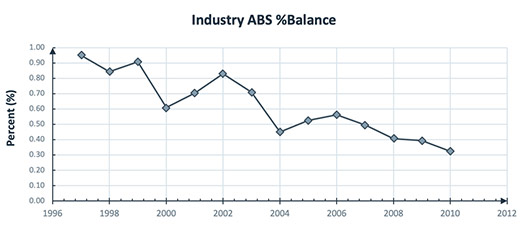

The promise was realized. Widespread introduction and use of advanced smart measurement stations led to 60% improvements in measurement performance over the 00’s decade, as evidenced by the Energy Information Administration (EIA) (Figure 1).

Improvement Stagnation

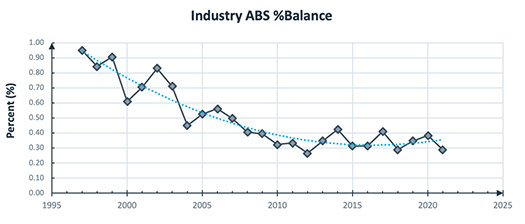

While new technology was introduced and the promised improvement in performance was achieved, fundamental practices for periodic maintenance and testing remained unchanged, with slight adaptations, from traditional practices for older stations without “smart IIoT” capabilities. Performance and accuracy improvements leveled off at a new steady state value, as evidenced by the EIA data from 2010 through 2021 (Figure 2).

Potential of Diagnostics

The 2010’s brought an explosion of automation and AI to process huge amounts of data, and cloud-based services to provide it. The players in the natural gas value chain have talked a great deal about using the data from these new smart measurement stations to affect a paradigm shift from traditional periodic maintenance regimes to condition based maintenance regimes.

Slowly, some forward thinking, early adopters began the process of collecting stranded data within existing or expanded SCADA system throughput, believing that somehow the data might be profitable to operations and measurement teams and that performance and accuracy improvements would result.

A smaller percentage of gas measurement teams have made use of information systems and software platforms to internally create dashboards and alert thresholds to assist measurement teams in their manual analysis and improve efficiency. Some success has been achieved, but the promised paradigm shift and transformation has not yet occurred even with these developments (Figure 2).

The pressure for change has never been more acute and real for the natural gas value chain.

Return on Data Deployed – Profit motives and investor pressures for ever higher returns are nothing new. But today’s information driven economy and the hyper value creation possible when mining IIoT technology has driven the point home with an exclamation point. Investors want to see results from information technology adoption across a broad spectrum of industries and respond to the sex appeal of “data driven decision making.”

Unstoppable Commodity Price Volatility – Boom and bust cycles are an integral part of the industry. Along with the profit motive inherent in capitalism, it has accentuated the need for creative destruction in the natural gas value chain. Each boom-and-bust cycle leads to innovation and the adoption of new technologies necessary for corporate sustainability.

Climate Action and Wall Street Sentiment – Politics and Regulation are another key driver in the natural gas value chain. Additional regulatory burden in the era of climate change action is a fact of life.

These forces increase the overhead burden of the organization, demanding change, and innovation in the operational end of the business. In the present case, pressure to reduce emissions and opportunities presented by new carbon credit exchange markets exponentially increase pressure on measurement performance improvements and accurate data to track these results.

Big Crew Drain – Corporate sustainability is obviously important to investors, and the creative-destruction gale represents both risk and opportunity. Current times present a perfect storm of risk to sustainability for the Oil & Gas industry in the way of workforce availability where the “big crew change” has nearly passed, leading to more of a “big crew drain.”

Our measurement workforce talent is aging out, and the younger generation of talent required to backfill those positions and replace that experience is thinning rapidly, as the message that fossil fuels are evil permeates our social discord. Doing more with less is a mandate of the three pressures above, but a necessity in the face of tomorrow’s severely limited resources.

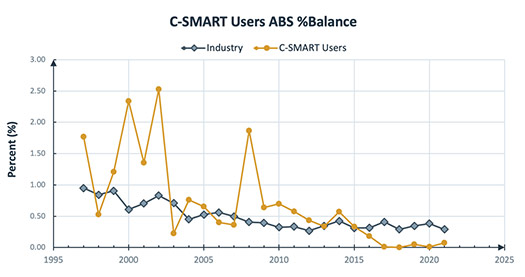

Triple Bottom Line – Cloud-based continuous monitoring services are available and have been demonstrated to increase measurement performance and significantly reduce measurement error. Figure 3 shows the improvement results which have been achieved over the last decade for those that have employed these services.

Even these forward-thinking users have not yet realized the full potential of the coming paradigm shift to condition-based maintenance. But they are banking the performance improvement while collecting the data to justify the coming transformation.

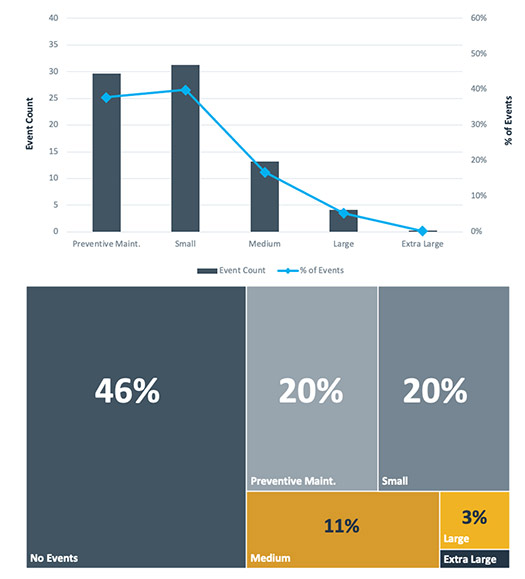

Figure 4 demonstrates clearly that manpower can be leveraged by a factor of three with the transition from the periodic to condition based maintenance regime in natural gas measurement. This is not a surprise given the demonstrated performance improvements in general industry, but this data proves the point directly.

There is an obvious financial benefit for continuous gas measurement station analysis. By driving error rates down to the technical limits of equipment, we de-risk over- or under-reporting lost and unaccounted for gas. This drops revenue to a pipeline operator’s bottom line that they had written off to LAUF.

In today’s ESG focused industry, ensuring volume throughput accuracy also delivers tangible benefits for establishing a true emissions baseline. This, in turn, can eliminate phantom emissions and correctly document the extent of fugitive emissions, reducing carbon intensity liability and assisting in the certification of responsibly sourced gas (RSG).

Beyond moving and measuring natural gas, our industry is accelerating into an era of full scale decarbonization as climate change spurs net zero policy and massive government incentives.

Pipelines are crucial conduits to deliver the sustainable sources of natural gas needed in the foreseeable future and at the same time supporting carbon capture, transportation, and storage projects and even hydrogen transmission.

Here, continuous gas measurement monitoring and analysis is equally as important to a company’s triple bottom line where environmental, social, and financial metrics are now the measure of corporate performance whether pipelines transport methane or CO2.

Conclusion

The status quo of measurement performance is not acceptable and urgent change is required. Increased manpower to drive the required performance improvement is unavailable, or increasingly unaffordable. Given these two contradictions, a paradigm shift is inevitable.

The technology exists today for cloud-based measurement analytical services to achieve the paradigm shift from a periodic maintenance regime to a condition-based maintenance regime and has been shown to satisfy all of the apparently competing pressures for increased profitability and sustainability in the face of market volatility and increased regulatory pressures.

The investment in capital over the past two decades paid off with a 60% performance improvement. Next, cloud-based services for automated and continuous measurement data analytics will pay off with 80% improvements in performance. These Services will also enable a paradigm shift from traditional periodic maintenance regimes to condition-based maintenance regimes for pipeline measurement assets.

The early and later adopters have blazed the trail for the industry by collecting the data that shows that the promised improvement is real and most certainly will be realized. There is now clear evidence and defensible data to support investment in continuous gas measurement diagnostics monitoring with clearly delineated financial and environmental value.

The pressures to achieve better performance and results while at the same time reducing overheads have never been greater. The combination of urgent drivers for change and the overwhelming data provided by automated cloud-based analytical services will fuel the paradigm shift in the approach to measurement maintenance. And progress will be made.

Author: Ernie Hauser is president of C-SMART Analytics where he brings more than 30 years of experience in the design, sales and manufacture of ultrasonic flowmeters. He has been a significant contributor to innovations in measurement, including contributions to numerous USM patents, the introduction of the 8-path meter to oil and gas applications, and the creation of the Measurement Uncertainty Recapture (MUR) Uprate market for nuclear power plants worldwide. Prior to C-SMART Analytics. He holds a bachelor’s degree in mechanical engineering from Pennsylvania State University.

Comments