April 2024, Vol. 251, No. 4

Features

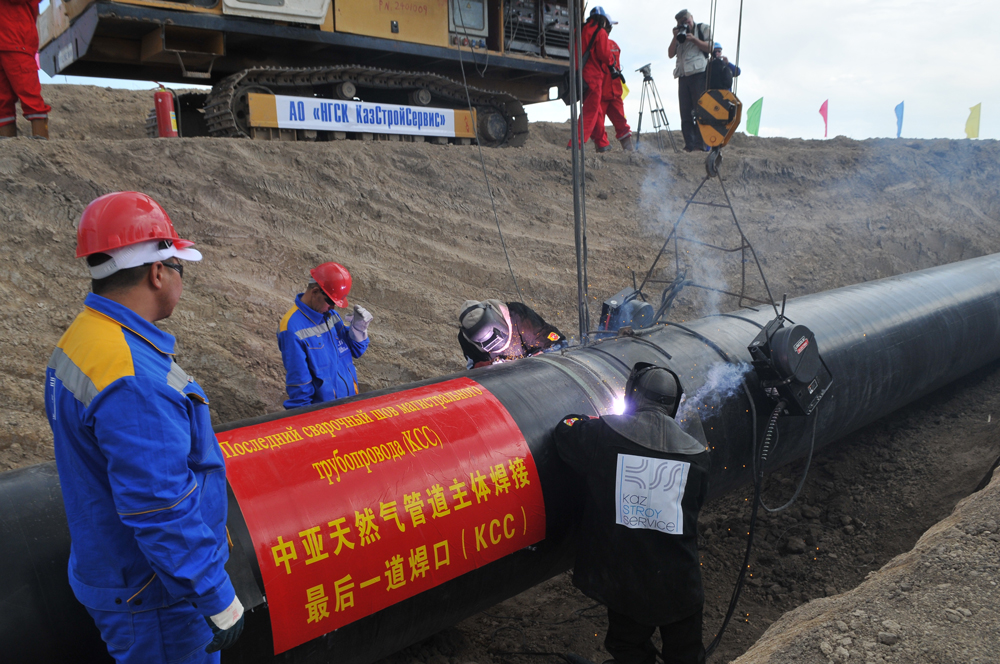

Pipeline Projects Seen as Unlikely to Involve Western-Based Companies

By Gordon Feller, P&GJ Eurasia Correspondent

(P&GJ) – Inside China, there are numerous large-scale oil and gas pipeline projects that are being built, are currently in the planning stages or have been proposed. Some of these have huge potential significance, and the situation has certainly caught the attention of Western-based companies, which hope to supply equipment, technology or services to one or more of the projects.

Below is a status update provided primarily through a director of the China National Energy Commission, which coordinates overall energy polices for the People’s Republic of China. Its 23-member body includes representatives from agencies responsible for initiatives concerning environment, finance, the Central Bank, national development and the Reform Commission.

Central Asia-China Gas Pipeline (Line D):

- Status: Construction is expected to resume in 2024.

- Details: This would expand the existing network by adding a new line from Turkmenistan through Uzbekistan, Tajikistan and Kyrgyzstan to China’s Xinjiang region.

- Significance: It could increase gas import capacity by 30 Bcm/a, further strengthening China’s reliance on Central Asian gas.

West-East Gas Pipeline Expansion Projects:

- Status: Several ongoing expansion projects are planned or underway.

- Details: These projects aim to increase the capacity and reach of the West-East Gas Pipeline network, which transports natural gas from western China to eastern provinces.

- Significance: Could improve energy security and access to natural gas for eastern China, supporting economic growth and development.

Xinjiang-Guangdong-Zhejiang SNG Pipeline:

- Status: Under construction, expected to be operational in 2026.

- Details: This 5,575-mile (8,972-km) pipeline will transport synthetic natural gas (SNG) produced from coal in Xinjiang to high-demand regions in eastern China.

- Significance: The project will address gas demand in eastern China, but it also raises concerns about air quality and carbon emissions.

Myanmar-China Oil and Gas Pipelines:

- Status: Several existing pipelines already operate; expansion and new pipeline projects are proposed.

- Details: These pipelines transport oil and gas from Myanmar to China, enhancing China’s energy security and Myanmar’s export revenue.

- Significance: Geopolitical complexities surround these pipelines, including concerns about environmental impact and human rights abuses in Myanmar.

Russia-China Power of Siberia 2 Pipeline:

- Status: Negotiations are ongoing, with construction potential in the coming years.

- Details: This proposed pipeline would double the capacity of the existing Power of Siberia pipeline, further increasing Russian gas exports to China.

- Significance: Could significantly deepen energy interdependence between Russia and China, with geopolitical implications for global energy markets.

Kazakhstan-China Gas Pipelines:

- Status: Existing pipelines operate, with proposals for expansion and new routes.

- Details: These pipelines transport natural gas from Kazakhstan to China, diversifying Chinese gas sources and boosting Kazakhstan’s export revenue.

- Significance: Contribute to regional energy security, but concerns exist about economic viability and competition with other Central Asian gas pipelines.

Pipeline Connecting to the Fuman Oilfield Development Project:

- Status: Major gas and oil processing station completed in November 2023, marking a significant milestone.

- Details: This project involves developing the Fuman oilfield, China’s largest ultra-deep oilfield with estimated resources exceeding 1 billion tonnes.

- Significance: This could significantly increase China’s domestic oil and gas production, potentially reducing reliance on imports.

Hydrogen Pipelines:

- Status: This project is in the early stage of development, but it is gaining attention.

- Details: This project involves several proposals for hydrogen pipelines, both ones within China and ones connecting China to neighboring countries like Russia and Kazakhstan.

- Significance: It could support China’s ambitious clean energy goals by transporting hydrogen produced from renewable sources.

The most recent survey conducted by the American Chamber of Commerce in China (AmCham China) on business leader attitudes towards doing business in Mainland China is actually a flash survey, released in October 2023, which provides a quick snapshot of sentiment following the release of the full 2023 Business Climate Survey.

It is clear from the key findings of the AmCham China Flash Survey that the China-facing executives of U.S. companies have become pessimistic about the prospects going forward.

A summary of the survey’s findings:

Overall Sentiment:

- Deteriorating: 83% of respondents reported a decline in their sentiment toward China compared to the previous year.

- Uncertainty: Only 50% expressed optimism about the business environment in the next five years, the lowest recorded in the survey’s history.

Top Concerns:

- U.S.-China Relations: 87% of respondents were pessimistic about the bilateral relationship, highlighting its impact on their business outlook.

- Slowing Economy: Concerns about China’s economic slowdown were also significant, with 43% indicating it had negatively impacted their operations.

- Regulatory and Policy Climate: Inconsistent regulations and unclear enforcement remained top challenges for many businesses.

Investment Trends:

- Mixed Signals: While 31% of respondents planned to increase investment in China compared to 2022, the rate was lower than previous years.

- Diversification: Many companies reported strengthening their resiliency by diversifying supply chains outside China.

Positive Notes:

- Market Potential: 59% of respondents held positive views on China’s domestic market growth, suggesting continued opportunities for some sectors.

- Resilience: Despite challenges, the majority of companies still see value in the Chinese market and are exploring ways to adapt and operate successfully.

The 2023 Business Climate Survey (BCS) by AmCham China paints a complex picture of American companies’ experiences in China. While the report acknowledges continued commitment to the Chinese market, several key concerns and challenges are highlighted:

Top Challenges:

- U.S.-China Relations: For the third year in a row, this issue was cited as the biggest business challenge, with nearly all respondents emphasizing its importance for growth. Deteriorating relations negatively impact business sentiment and create uncertainty.

- COVID-19 Era Restrictions: While restrictions eased by the time of the survey, their lingering effects and concerns about future policy fluctuations create instability for businesses.

- Regulatory and Policy Climate: Unclear, inconsistent and rapidly changing regulations were seen as significant hurdles, hampering predictability and planning for many companies.

- Macroeconomic Environment: Concerns about China’s economic slowdown and its impact on market demand emerged as a prominent factor.

Business Performance:

- Financial Rebound: After pandemic difficulties, financial performance showed signs of improvement, with nearly half of companies forecasting profitability. However, cautious optimism prevailed.

- Investment Trends: Although China remains a priority market, willingness to invest and increase strategic priority declined compared to previous years. Many opted for focusing on core businesses and limiting new investments.

- Supply Chain Diversification: Companies increasingly explored diversifying supply chains outside China to mitigate risks and build resilience.

Outlook:

- Uncertainty: The overall sentiment was one of cautiousness and uncertainty about the future business environment in China, with significant concerns about geopolitical tensions, policy shifts, and economic prospects.

- Long-Term Commitment: Despite the challenges, most companies still see value in the Chinese market and expressed a desire to remain engaged. However, their strategies are likely to adapt towards increased risk mitigation and a wait-and-see approach.

The survey results varied based on industry and company size, with some sectors feeling the challenges more acutely than others.

One conclusion has been widely commented upon: open communication and constructive dialogue between the U.S. and Chinese governments were seen as crucial for improving the business environment and restoring confidence. The most recent Biden-Xi summit, which convened in November of 2023 in Silicon Valley, was seen as a good first step.

Overall, the 2023 AmCham China BCS reveals a cautious and adaptable approach by American companies operating in China. While the long-term commitment remains, navigating the complex challenges requires careful risk management and strategic adjustments.

U.S. business leaders are not the only ones who’ve become quite worried. The influential E.U. Chamber of Commerce in China published its own survey, the E.U.-China Business Climate Survey, in 2023. Here are some of the key findings from that survey:

Overall Sentiment:

- Deterioration: Similar to the AmCham China survey, the European Union Chamber of Commerce in China (EUCCC) reported a significant decline in business sentiment among European companies in China. 67% expressed a less positive outlook compared to the previous year.

- Uncertainty: Rising uncertainty and volatility topped concerns, due to factors like:

- U.S.-China relations

- Regulatory environment changes

- Geopolitical tensions

- Economic slowdown in China

Top Challenges:

- Policy and Regulatory Environment: Inconsistency, unpredictability and lack of transparency in regulations were major concerns, negatively impacting business planning and confidence.

- Market Access and Fair Competition: Concerns persisted about uneven playing fields and discriminatory practices favoring domestic Chinese companies.

- Intellectual Property Protection: Inadequate protection and enforcement of intellectual property rights remained a significant concern for many European companies.

Business Performance:

- Mixed Bag: While revenue and profitability saw slight improvements compared to the pandemic years, growth projections remained subdued.

- Investment Trends: Similar to the AmCham China survey, there was a decline in willingness to increase investment and strategic priority in China. Companies adopted a wait-and-see approach, focusing on core businesses and risk mitigation.

Outlook:

- Cautious Optimism: Despite the challenges, European companies still see long-term potential in the Chinese market. However, their strategies are shifting toward greater risk management, diversification and flexibility.

- Emphasis on Dialogue and Engagement: The survey underscores the importance of constructive dialogue and cooperation between the E.U. and China to address concerns and create a more predictable and level playing field for European businesses.

In the pages of the E.U.-China Business Climate Survey 2023, E.U. business leaders exhibit complex and cautious attitudes toward the risks of investing in China. While recognizing the market’s long-term potential, they highlight significant concerns and a shift in investment strategies:

Key Concerns:

- Rising Risk Perception: Compared to previous years, E.U. leaders perceive investing in China as riskier. This stems from factors like:

- Uncertain and Volatile Business Environment: Geopolitical tensions, changing regulations, and economic slowdown contribute to this perception.

- Lack of Transparency and Predictability: Inconsistent and opaque regulations make planning and risk assessment challenging.

- Uneven Playing Field: Concerns about discriminatory practices favoring Chinese companies raise anxieties about fair competition.

- Intellectual Property (IP) Protection Deficiencies: Inadequate IP protection and enforcement remain a source of concern.

All of this is having a tangible impact on the investment strategies. A cautious approach now prevails. The overall sentiment detected in the E.U. survey translates into a more cautious investment approach. While some sectors still see opportunities, there’s a general decline in the willingness to increase investments and strategic priority in China.

Risk mitigation has certainly become a key concern in the boardroom, as companies now prioritize managing risks. Companies are focused on reducing risks by using strategies such as these four:

- Diversification: Moving outside China to spread the risk and build resilience.

- Strengthening Compliance: Focusing on understanding and adhering to evolving regulations.

- Focus on Core Business: Limiting new investments and concentrating on existing core activities.

- Wait-and-see Approach: Delaying major decisions until the business environment becomes more predictable.

Despite these concerns, the EUCCC found two somewhat hopeful indicators:

- Long-Term Potential Recognized: Many E.U. leaders still acknowledge the long-term potential of the Chinese market. However, they are adapting their strategies to cope with the current challenges.

- Constructive Dialogue: The survey emphasizes the importance of constructive dialogue and cooperation between the E.U. and China, to address concerns and create a more stable and fair investment environment.

Both U.S. and E.U. business leaders are wary of the risks associated with investing in China, but they haven’t abandoned the market entirely. They are adopting a cautious approach, prioritizing risk mitigation and strategically adjusting their investments, while seeking greater dialogue and engagement with Chinese authorities for a more predictable and equitable environment.

Comments