August 2024, Vol. 251, No. 8

Features

New Haynesville Pipeline Projects Near Completion Amid LNG Demand Surge

Editor’s note: North America is continuing to develop as a major global supplier of LNG, but pipeline construction to support future LNG expansions has been limited by a variety of factors.

Unfortunately, natural gas production in the Marcellus and Utica shale continues to be restricted from the region, due to pipeline bottlenecks — and as pipelines delivering Permian Basin and Haynesville gas to the Gulf Coast are catching up with near-term demand.

About 20 Bcfd of natural gas pipeline capacity is under construction, partly completed, or approved to deliver natural gas to five U.S. LNG export terminals that are under construction along the Gulf Coast.

By Pipeline & Gas Journal Staff

(P&GJ) — The Haynesville’s proximity to LNG export facilities along the Gulf Coast is driving pipeline expansions to meet anticipated rising LNG export demand — especially as more terminals are set to come online in 2024-2025.

Several major natural gas pipeline projects are under construction or planned in the basin this year and next. These include:

- Louisiana Energy Access Pipeline (LEAP) Expansion by DT Midstream, which involves three phases to increase capacity by 900 MMcfd, with the expansions expected to be completed in stages by the end of 2024. The first stage of the expansion — adding 300 MMcfd of capacity — went into service earlier than expected in August. Stage 2 will add 400 MMcfd and is expected to be online this quarter.

The existing LEAP Gathering Lateral is a 155-mile, 1 Bcf/d line, stretching from the Haynesville to the Gulf Coast region. DT Midstream plans to increase LEAP capacity by 90% through compression and construction expansions.

- DT Midstream’s Louisiana Energy Access Pipeline (LEAP) expansion will increase capacity from 1 Bcf/d to 1.9 Bcf/d through three stages, with the final 200 MMcf/d expansion due in Q3 2024.

- Momentum Midstream’s New Generation Gas Gathering (NG3) project will add 275 miles of 2.2 Bcf/d capacity pipelines from the Haynesville to coastal Louisiana LNG markets, expected to be completed in 2024.

- Enterprise Products Partners’ Acadian Haynesville Extension, a project that recently expanded to add 400 MMcf/d of capacity, this extension serves LNG export facilities and industrial consumers along the Gulf Coast.

- Williams’ Louisiana Energy Gateway (LEG) project, sanctioned in 2022, will move 1.8 Bcf/d of Haynesville gas to Gulf Coast markets with startup during the second half of 2025.

Several natural gas pipeline projects are also in-development to connect Haynesville gas producers to Gulf Coast LNG exporters.

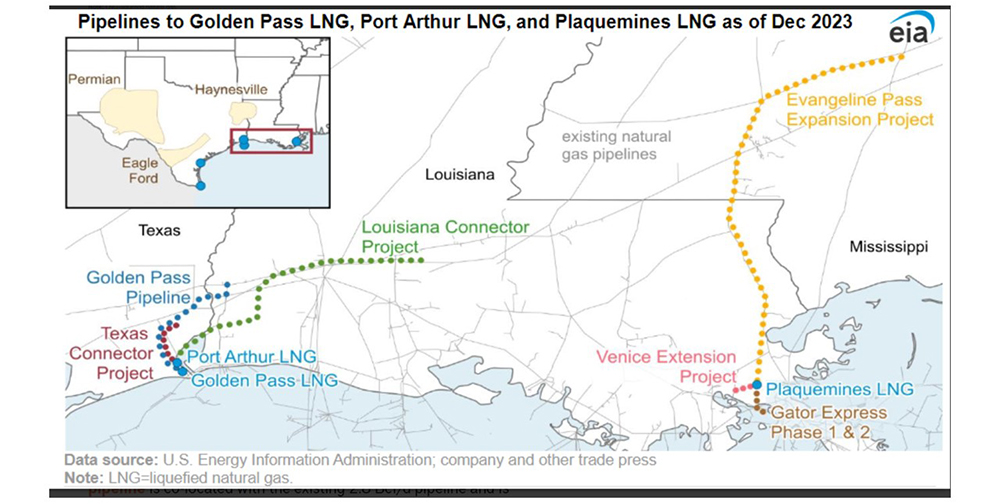

Additionally, on the Louisiana side, there is the Gator Express Pipeline project, which entails two 42-inch pipelines — each with about 2 Bcfd of capacity. It is designed to deliver natural gas from interconnections to the Plaquemines [Plaq-uh-min] LNG export terminal, 20 miles south of New Orleans. Phase 1 of the project will include 15-mile and 12-mile pipelines.

Plus, Tennessee Gas Pipeline Company expects to deliver natural gas through its Evangeline Pass Expansion Project. When completed, it will feature 13 miles of 36-inch pipeline, with a capacity of 1.1 Bcf/d. It will also ship to the Plaquemines terminal.

Energy Transfer, for example, has already finished construction of the 1.65 Bcf/d Gulf Run pipeline to move gas from north Louisiana to the coast.

That project, which the company gained through its acquisition of Enable Midstream, is backed by a 20-year agreement with the $10 billion Golden Pass LNG export plant, which is now under construction. Texas Golden Pass is expected to be online by early 2025.

Complementing these efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger, while embedding them more deeply in both production and demand markets.

Some of those deals involve expansions of gathering-and-processing footprints to support the existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, which requires that operators move ahead of the demand.

The Haynesville’s 14 Bcf/d is a plentiful source of natural gas, ranking only behind the Marcellus and the Permian in the continental United States.

The region had done a good job of bouncing back from the Covid shutdown of 2020, improving by 36% by May 2023. Recently, however, with gas prices hovering below the break-even point at about $2.35/MMcf for the first half of the year, flattening at just over 15 Bcf/d.

Full-year Haynesville production is expected to average just shy of 1.2 Bcf/d, down about 400 MMcf/d from its 2023 in-basin average, according to S&P Global.

Comments