August 2024, Vol. 251, No. 8

Features

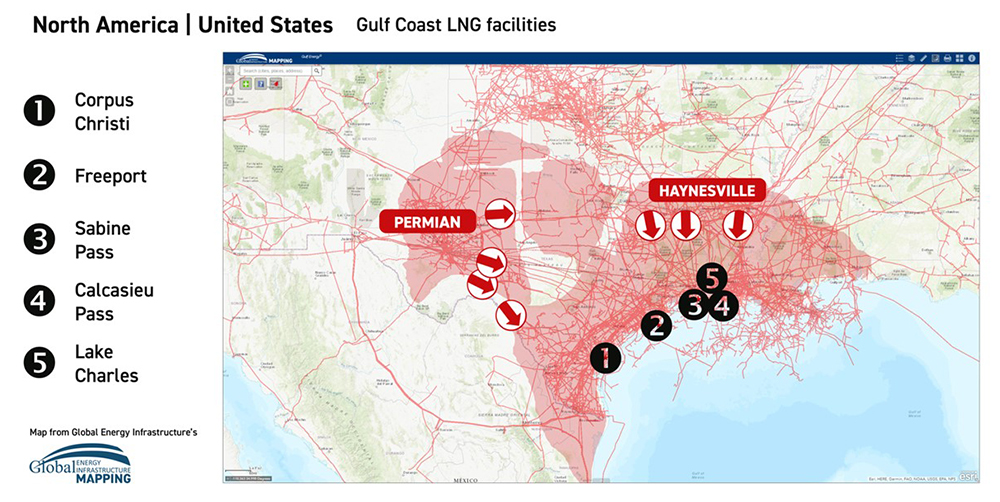

Spotlight on Permian: Pipeline Activity Still Pushing Toward Texas-Louisiana Border

[To explore the full digital edition, including the Page Raft version of this article, click here.]

By Pipeline & Gas Journal Staff

(P&GJ) — While most of the Permian Basin natural gas pipelines built in recent years have targeted LNG export markets south of the Houston area, two proposed intrastate projects have emerged within the last couple of years that will deliver Permian Basin gas to the Texas-Louisiana border region.

The larger of the two, Targa’s 562-mile Apex Pipeline, was approved by the Texas Railroad Commission in late March. It would originate in West Texas and run along the Louisiana border, near Sabine Pass.

Another, WhiteWater Midstream’s proposed 190-mile Blackfin Pipeline, which filed for state regulatory approval a year ago, takes a different approach.

Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mile Matterhorn Express Pipeline that was sanctioned in May of 2022.

The Matterhorn Express is scheduled to be in-service in the third-quarter of 2024 and will provide up to 2.5 Bcf/d of Permian takeaway capacity to the Katy area west of Houston.

These Permian “connectivity” projects will be getting pipes closer to liquefaction projects than some others, such as Gulf Coast Express, Permian Highway and Whistler.

An example of a capacity increase brought about by using compression technology. In December (cq), Kinder Morgan added 550 MMcf/d to the Permian Highway natural gas pipeline.

The enhanced capacity now stands at 2.65 Bcf/d for the pipeline, which extends from the Waha Hub in West Texas to the Houston area.

Additionally, there is Enbridge’s Rio Bravo Pipeline, which involves the construction of two 138-mile pipelines with 48- and 42-inch diameters and a combined capacity of 4.5 Bcf/d.

The pipelines will run from the Agua Dulce supply area to the Rio Grande LNG terminal in Brownsville, Texas. If all goes well, construction is expected to begin next year. The latest in-service date we have on the terminal is 2026.

Separately, WhiteWater Midstream is building the ADCC – a 43-mile, 42-inch pipeline with a capacity of 1.7 Bcf/d. The project will deliver natural gas to the Corpus Christi Stage III project. The ADCC originates at the end of the Whistler Pipeline, near the Agua Dulce hub, in the Eagle Ford region.

Additionally, Cheniere Corpus Christi Pipeline is building the Corpus Christi Stage III, which will involve 22 miles of 48-inch pipeline, with a capacity of 1.5 Bcf/d. The pipeline is co-located with an existing 2.8 Bcf/d pipeline and will deliver from interconnections to the Corpus Christi Stage III project.

LNG Expansion

North America is continuing to develop as a major global supplier of LNG. But pipeline construction to support future LNG expansions has been limited by a variety of factors.

Unfortunately, natural gas production in the Marcellus and Utica shale continues to be restricted from the region due to pipeline bottlenecks – and as pipelines delivering Permian Basin and Haynesville gas to the Gulf Coast are catching up with near-term demand.

There is a total of 19,832 miles of pipeline, either planned or under construction in North America, according to P&GJ’s most recent data. Of that total, 8,689 miles are currently under construction with planned project mileage reaching 11,143. Both represent increases over the previous year.

Interestingly enough, of that, about 20 Bcf/d of natural gas pipeline capacity is under construction, partly completed, or approved to deliver natural gas to five U.S. LNG export terminals that are under construction along the Gulf Coast.

In South Texas and related to these capacity increases are, among others:

- The Rio Bravo Pipeline Company’s construction of two 138-mile pipelines, with a combined capacity of 4.5 Bcf/d, running from the Agua Dulce supply area to the Rio Grande LNG terminal in Brownsville, Texas. The latest in-service date is 2026.

- WhiteWater Midstream is building the ADCC Pipeline – a 43-mile pipeline with capacity of 1.7 Bcf/d. The project will deliver natural gas to the Corpus Christi Stage III project. The ADCC originates at the end of the Whistler Pipeline, near the Agua Dulce hub, in the Eagle Ford region.

- Cheniere Corpus Christi Pipeline is constructing the Corpus Christi Stage III Pipeline, a 22-mile pipeline with a capacity of 1.5 Bcf/d. The pipeline is co-located with the existing 2.8 Bcf/d pipeline and will deliver from interconnections to the Corpus Christi Stage III project.

Comments