January 2024, Vol. 251, No. 1

Features

Solving Sulfide Stress Cracking in Sour Service

By Gary Whelan, Materials Design Engineer, QuesTek Innovations, LLC

Nearly every oil country tubular goods (OCTG) manufacturer and producer is looking for solutions to sour service. It’s a perpetual issue that’s been hampering the oil and gas industry for as long as pipes have been underground.

High-strength, low-alloy carbon steels are the backbone of most oil and gas casing and tubing projects. However, these alloys are not necessarily equipped to operate for extended periods of time in sour environments that are prone to sulfide stress cracking. This is the type of cracking that occurs when hydrogen sulfide accelerates the absorption of hydrogen into the steel, which embrittles grain boundaries.

The oil and gas industry has traditionally handled sulfide stress cracking in one of two ways: Rely on significantly more expensive corrosion-resistant alloys (CRA) or replace the lower-grade OCTG when sour conditions emerge in the operating environment.

While completely eradicating corrosion and cracking remains a pipe dream, advances in materials engineering provide opportunities for the oil and gas industry to increase the lifespan of the OCTG by developing better alloys. With the help of computational modeling and design, manufacturers can create casing and tubing materials that transport oil and gas over a longer service life and create cost savings.

Better Alloys

The oil and gas industry needs material innovations that not only lengthen the life of OCTG but are also cost-effective. To this end, manufacturers have tried coatings on the OCTG, adding inhibitors to the reservoir, and trial-and-error experimentation with different materials to create new alloys or modify and improve existing ones.

Each of these options has its drawbacks. Coatings are expensive, difficult to apply, and increase the risk level as a chip in the coating could result in catastrophic failure. Inhibitors, while useful, come with some environmental concerns and don’t always work for the entire lifespan of an oil field. Once the reservoir sours, all of the lower-grade OCTG needs to be replaced at great cost.

Lastly, the traditional trial-and-error approach to new alloy development has been the best way to deal with sour service. Over time, new alloys are developed this way. But it is a slow and costly process. With a mature industry like OCTG, much of the low-hanging fruit has been picked when it comes to empirical alloy design. New innovations are few and far between and can take decades to materialize. Clearly, all of these options have proven to be either ineffective, limited or too expensive.

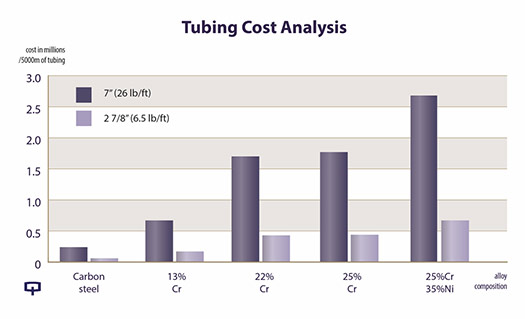

While a few different material grades are used for OCTG, cheap carbon steel is generally ideal for most wells. For more corrosive environments ranging from mild to medium sour service, stainless steels with higher chromium content are a better option, while severe sour service environments typically require corrosion-resistant alloys containing high quantities of nickel and chromium. Integrated computational materials engineering can be used to find optimal alloy solutions that are both more durable and cheaper to produce.

Materials engineers can optimize the cheap carbon steel as much as possible, but the performance will still be lacking. The upper-tier 25% chromium/35% nickel alloy delivers on performance but can be cost-prohibitive.

Computational modeling offers the potential to enhance the performance of middle-tier chromium alloys – 13%, 22% and 25% – to a level that reaches a similar performance to 25Cr35Ni.

Chromium Nickel

Typically, CRA like 25Cr35Ni have higher density and lower specific strength than lower-grade steels, resulting in a snowball effect in cost. Not only are the alloys more expensive per pound, but for the same well, more of the alloy is needed. Manufacturing cheaper, high-strength OCTG with similar corrosion resistance has value for everyone in the industry.

Major steel manufacturers are interested in this technology for a simple reason: Selling cheaper, effective OCTG that other companies don't have in stock means more business. The sale prices may be lower, but the quantities will rise substantially if buyers aren’t shelling out for 25Cr35Ni from competitors. The lower price point can also make more wells feasible for producers, resulting in new business for manufacturers.

Another downside of 25Cr35Ni is that, while it is corrosion resistant for sour service, it is quite susceptible to other types of corrosion, particularly in warm, salty air. Sometimes pipes will be delivered with severe pitting because they’ve been sitting in hot temperatures in the cargo hold of a ship anchored in a canal halfway around the world.

Micro-Elements Effect

Another process that helps prevent sulfide stress cracking in pipes is the addition of micro-alloying elements. These elements don't show up in the typical spec range as major alloying elements because their quantities are less than 1%. As part of the alloy solution, they migrate through the microstructure and preferentially saturate grain boundaries, improving cohesiveness and preventing cracking.

In typical materials, sulfide stress cracking occurs when the concentration of hydrogen increases and grain boundaries become brittle. However, by improving the cohesion of these grain boundaries with micro-alloying additions, alloys can be designed with just small additions of the right elements to not break down and become brittle in the presence of hydrogen.

Computational modeling makes it easier to efficiently screen the almost endless combination of alloy compositions when considering the addition of micro-alloying elements – in addition to the traditional bulk alloying elements like iron, nickel and chromium. It is generally understood that elements like molybdenum can have positive effects on corrosion performance.

However, alloys can contain upwards of 10 to 15 or more alloying elements in small quantities, each playing complicated roles both independently and in relation to each other.

Approaching this with traditional design-of-experiments methodology and producing prototype heats to do an exhaustive search to discover new alloys with improved properties quickly becomes unfeasible. This is especially the case for micro-alloying elements added in low quantities, because it is challenging to control precision in small prototype batches of material, and it is not feasible to produce large, production-scale tonnage of material for the countless variants of a potential alloy.

These elements can have a big effect with a small quantity, and the only practical way to explore the design space is with efficient methods like computational modeling.

In a somewhat related example, QuesTek has applied a specific model to design the chemistry around grain boundaries, establishing which alloy additions are better for cohesion and keeping the grain boundary together under conditions of stress. It’s also possible to model which additives have a higher tendency to migrate to the grain boundaries depending both on the thermodynamic driving forces and the kinetics of the diffusion rate of the elements in a solid solution.

This technology enabled the design of a new landing gear steel, which replaced an incumbent steel composition, which was strong but required a coating that contained toxic elements to operate in corrosion environments due to its high susceptibility to stress corrosion cracking. The design achieved the same strength requirements while having a high enough stress-corrosion cracking resistance that it could be used safely with no coatings. This model, vetted in aerospace, has found a range of applications in OCTG.

Ingenuity, technology and novel approaches like this are leading to the creation of novel materials that extend longevity and reduce costs. Now manufacturers can get mid-tier alloys to perform like premium materials at a fraction of the price, and producers are able to create longer-lasting OCTG for their customers.

Author: Gary Whelan is a senior materials design engineer at QuesTek Innovations, LLC, who specializes in the oil and gas industry.

Comments