January 2024, Vol. 251, No. 1

Features

Spotlight on Germany: Nation’s Pipelines Nearing Major Changes

By Eugene Gerden, P&GJ International Correspondent

(P&GJ) – The pipelines’ sector of Germany is on the verge of major changes, due to the ongoing conversion to hydrogen and the rapid development of H2 and gas pipelines’ infrastructure throughout the country.

Germany has big hopes for hydrogen, considering it a future energy source that can cut greenhouse emissions for some heavily polluting industrial sectors that cannot be electrified, such as steel and chemicals. That will allow the country to reduce its dependence on hydrocarbons.

As for hydrogen, transporting hydrogen is a challenge because it requires either high pressure or cryogenic temperatures. So far, hydrogen has been transported in Germany and most of EU states almost exclusively as compressed gas in special pressure containers on trucks – the pressure in these cases is usually 200 or 300 bar. However, it is obvious that such transportation is rather limited, and alternative options are needed.

In general, Germany has taken a major step since the beginning of the current year in order to have an efficient H2 infrastructure in place by 2032.

These plans have recently been confirmed by Barbara Fischer, managing director of the industry association, Association of Transmission System Operators Gas e.V. FNB Gas.

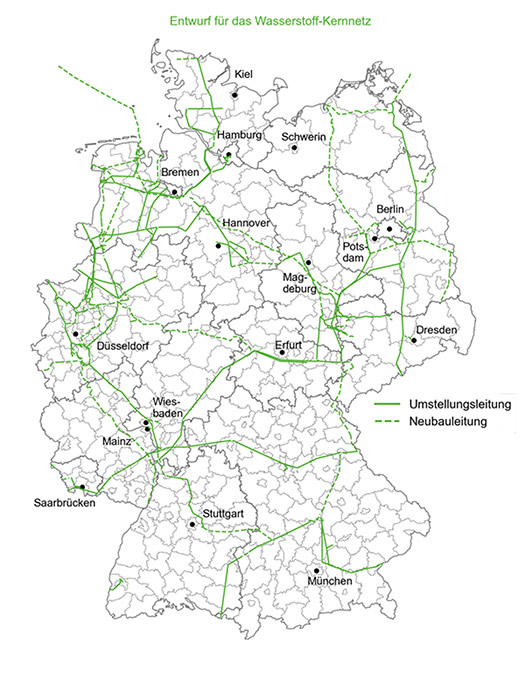

Fischer told P&GJ that the German Gas TSOs have recently published the draft of the German Hydrogen Core Network, with a length of about 6,025 miles (9,700 km). According to her, in addition to hydrogen, a further expansion of the existing pipelines’ network is also planned for the gas sector of the country.

“It is planned that 60% of these pipelines will be newly built pipelines and 40% pipelines will be repurposed gas pipelines,” she said. “The German regulator [BNetzA] will now consult and verify the planning of the TSOs and in second quarter of 2024.”

After approval, the TSOs can start on the realization of the hydrogen infrastructure up to 2032. In the gas sector, expansion of the grid expansion is necessary, mainly to accommodate new import routes.

As for hydrogen network, the volume of investments in the implementation of these plans is estimated at $21.58 billion (19.8 billion euros). The federal government will initially advance this, but the costs should be recouped through network fees by 2055 at the latest, Fischer said. The first hydrogen is expected to flow through the core network as early as 2025.

‘Have to Roll’

“We know that we have no time to lose,” said FNB Gas Chairman Thomas Gößmann, when presenting the optimized plans in November 2023. “The excavators have to roll next year.”

The network should primarily reach large industrial centers, storage facilities, power plants and import corridors. The total feed-in capacity for hydrogen through the network should amount to 101 GW. According to FNB, a total of 309 hydrogen projects were taken into account in the first scenario, according to the Federal Ministry of Economics, which should go into operation by 2032.

The starting signal for a nationwide network could be given in northwest Germany. The H2 Start Network 2030, with a length of 745 miles (1,200 km) could be built in North Rhine-Westphalia and Lower Saxony by 2030. That will be steel pipelines mainly. In the long term (by 2050), the overall length of the German H2 pipelines’ network is expected to reach 8,265 miles (13,300 km).

According to the German Chemie Technik chemical publication, the conditions are particularly favorable because the pipes for natural gas with a low-calorific value – so-called L-gas – are currently being switched off or converted. According to FNB, the starting plan is already based on 31 specific hydrogen projects in the region, including projects from large industrial customers and projects at refinery locations.

In general, the latest market surveys from the transmission system operators show a huge need for the rapid development of a hydrogen network for Germany. They developed a model showing where existing gas pipelines could be converted and where new ones would have to be built to meet the increasing demand for hydrogen.

Experts have agreed that the demand for hydrogen will sharply increase since the federal government’s national hydrogen strategy was adopted in the summer of 2020. This assumes a demand of 90 to 110 terawatt hours (TWh) by 2030. A large part of this could reach customers through pipelines directly from production sites.

According to FNB Gas, natural gas pipelines can generally be converted to hydrogen relatively inexpensively. And large quantities of hydrogen can be continuously provided using pipes. It still needs to be examined in detail which changes need to be made in individual cases, for example to fittings and seals. This is because H2 is transported under higher pressure than natural gas.

According to the experts, retrofitting is significantly cheaper than building a new one. And according to the last amendment to the Energy Industry Act (EnWG), the German law on electricity and gas supply, the permits and rights-of-way for gas pipelines also apply to hydrogen.

According to the experts, industrial sites in the steel, chemical and refinery sectors will particularly need a pipeline connection. Most of these production facilities are located in the North Rhine-Westphalia, Lower Saxony and Schleswig-Holstein as well as in Bavaria, Thuringia, Saxony and Saxony-Anhalt, where building of H2 will take place at first.

The required amounts of hydrogen could flow into the pipelines’ network from electrolyzers that are connected to the offshore wind farms off the coasts of Lower Saxony and Schleswig-Holstein. In addition, imports from Denmark, the Netherlands, Spain, Portugal or Norway could be also distributed in the German network.

Future Development

So far, leading German pipelines’ operators have announced plans to participate in future hydrogen transportation. One of them, GASCADE Gastransport GmbH (GASCADE), has confirmed planned implementation of at least two major projects as part of the German hydrogen core network.

Both, the offshore project AquaDuctus, which GASCADE intends to implement in the North Sea, and the large-scale onshore project, Flow – Making Hydrogen Happen, which would transport hydrogen from the Baltic Sea coast to southern Germany, have been included in the hydrogen core network.

AquaDuctus will be a newly build hydrogen pipeline that the first production sites for green hydrogen in the German North Sea by 2032. It will become the backbone of a European interconnected system, according to spokesman Arne Kupetz.

In the meantime, in addition to hydrogen, there are plans for the further development of the traditional gas pipelines’ network of Germany.

German Federal Ministry for Economic Affairs and Climate Action experts say that until German energy consumption is completely converted to renewable energies and the use of hydrogen, Germany will continue to be highly dependent on natural gas imports in the future due to its extremely low domestic production.

Natural gas provided almost 24% of the energy consumed in Germany in 2022, and those figures will likely be about the same this year.

As for domestic output, almost 95% of Germany’s natural gas requirements are imported. In 2022, a total of 1,441 terawatt hours (TWh) of natural gas were imported into Germany. The largest delivery volume came from Norway at 33%, followed by Russia at 22%. This year the share of Russia will be significantly lower.

The German gas network consists of the long-distance pipeline network with a of 24,854 miles(40,000 km) and the distribution network with a length of approximately 344,860 miles (555,000 km).

10-Year Forecast

The expansion of the German gas pipeline network is based on the Gas Network Development Plan (NEP Gas). The NEP Gas is a plan drawn up by the German transmission system operators (TSOs) that foresees the development of the gas network in Germany for the next 10 years. The NEP Gas is updated every two years.

There are currently 16 natural gas transmission system operators operating on the German gas market at present. Twelve of these companies are members of FNB Gas. Other players include distribution network operators, storage operators and trading companies.

In general, Fischer and other interviewed German pipelines’ operators expect a growth in the pipeline sector in the middle-term. Particular hopes are also put on the support in the implementation of these plans from the state.

According to Fischer, while for the TSOs there is no financial support from the state (only a sort of insurance in case of a failure of some projects), the government could provide a major assistance to the sector by approving related legislative bases and reliable regulation in the shortest possible time.

Moreover, according to operators, state measures to speed up approval procedures would also be helpful for more active growth.

Frank Dietzsch, head of Regulatory Framework Gas Technologies and Energy Systems at DVGW, German Association for Gas and Water told P&GJ that he remains optimistic, regarding with future prospects of the German pipelines’ sector.

According to him, the German gas transport network is being developed continuously, which is confirmed by the existing national Network Development Plan one of the major public and legal acts, regulating the industry.

In addition to new H2 network, Germany plans to continue planned general replacements of its pipelines’ network in months to come.

“In the gas distribution grid about 1% of the pipelines are replace per year (new for old),” said Frank Dietzsch. “Although there will be an increase in demand in the context of the hydrogen transformation, I don’t expect much new construction in the classical gas distribution network.”

In 2024, particular attention will be paid for better protection of the entire pipelines’ network in Germany, largely in response to the 2022 Nord Stream pipeline sabotage and the ever growing threats of attacks on critical infrastructure of the country, including gas pipelines.

Comments