July 2024, Vol. 251, No. 7

Features

Mid-Year Global Forecast: Midstream Responding to Demand from LNG Projects

By Michael Reed, Editor-in-Chief

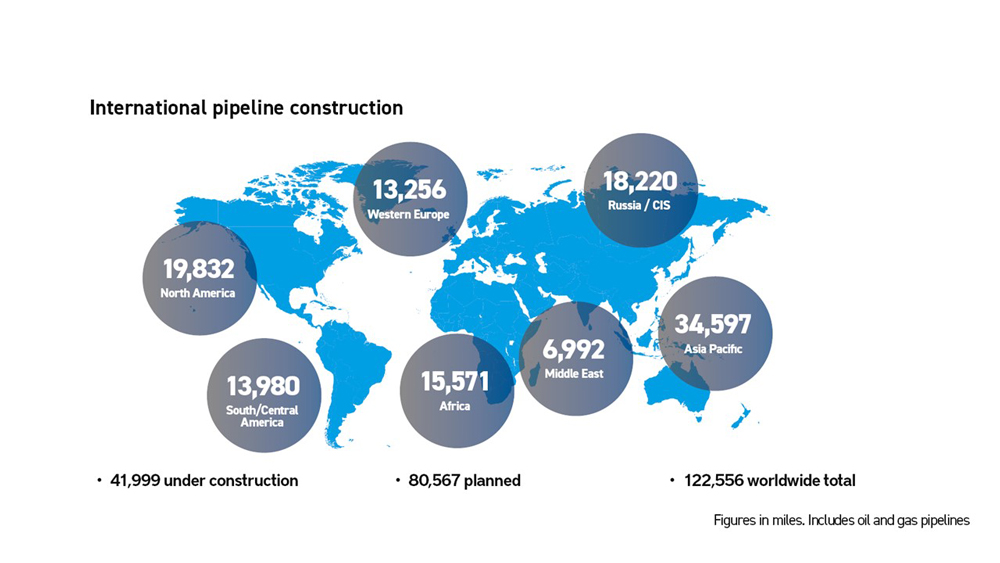

(P&GJ) – In our latest count, Pipeline & Gas Journal reported almost 42,000 miles of pipeline under construction worldwide as we reach the midpoint of 2024, while another 80,500-plus miles of pipeline are in the planning stages. Overall, this represented a 9.3% increase over the previous year – which is significant.

It will probably come as little surprise to you when I say that during the past six months LNG has been in the headlines more often than pipelines. However, it is important to remember that new terminal construction drives new gas pipeline construction.

And while such construction projects are obviously increasingly common in Europe – where new pipelines are being developed to support new entry-points for gas – it is also true in the United States, where new pipelines are needed to supply liquefaction plants on the other side of the supply chain.

As LNG infrastructure continues to develop, pipeline construction will, out-of-necessity, grow with it.

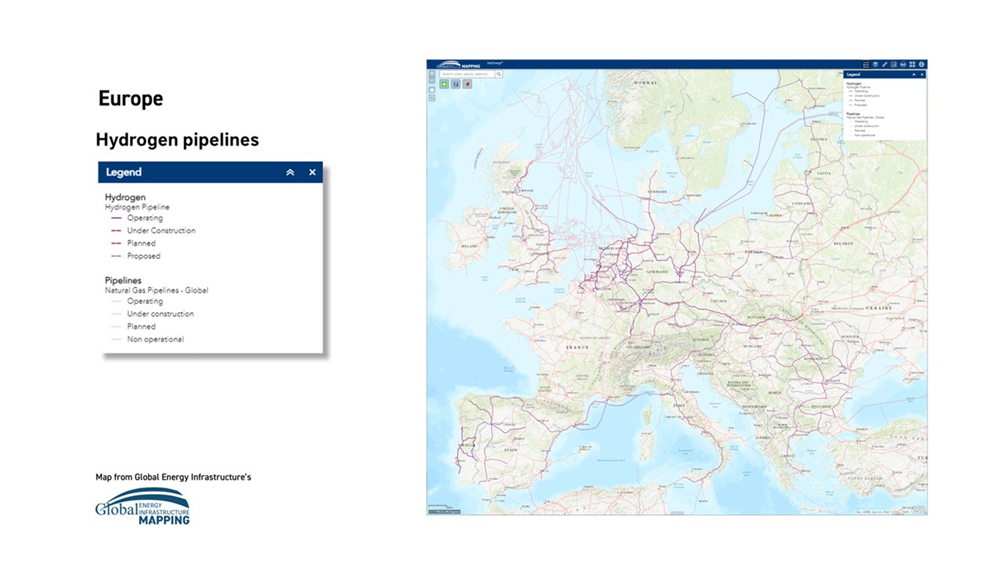

Additionally, thousands of miles of hydrogen pipelines are in development already, particularly in Europe, as the world continues the transition to net-zero, and hydrogen finds its role in the energy mix. This, too, in our view, will bring new opportunities for pipeline development and construction.

North America

To start things off regionally, let’s move to North America, where I plan on spending most of my time tonight. Overall, the continent showed a 9.5% increase in activity over last year, though bear in mind much of that activity is still in the planning stages.

It’s no secret that North America is continuing to develop as a major global supplier of LNG. But, unfortunately, pipeline construction to support future LNG expansions has been limited by a variety of factors.

Among those, natural gas supply from the Marcellus and Utica shale continues to be limited due to pipeline bottlenecks.

As you can see from the slide, our data indicate a total of 19,832 miles of pipeline, either planned or under construction in North America.

Of that total, 8,689 miles are currently under construction with planned project mileage reaching 11,143. Both represent increases over the previous year.

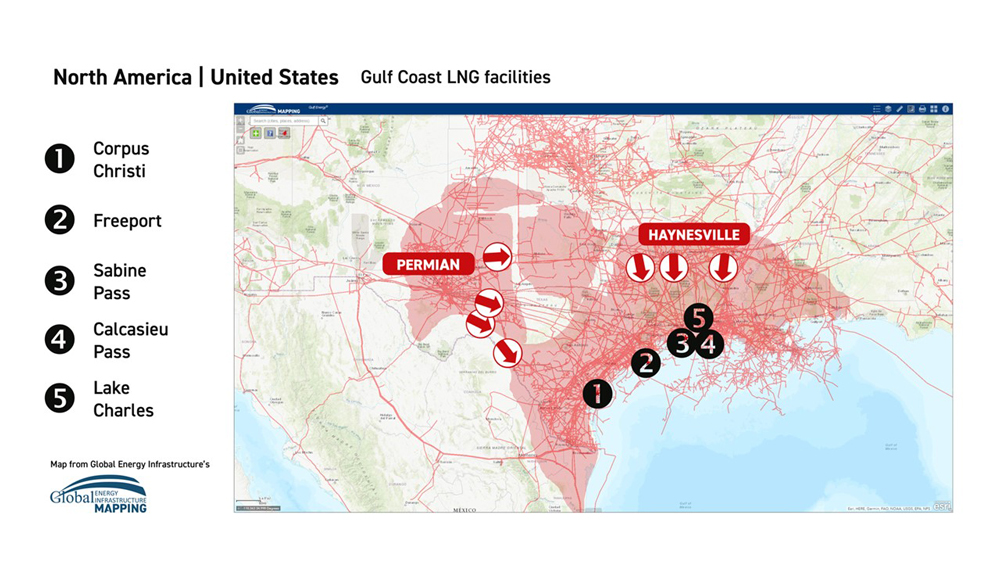

Interestingly enough of those projects, about 20 Bcf/d of pipeline capacity is under construction, partly completed, or approved to deliver natural gas to five U.S. LNG export terminals that are being built along the Gulf Coast.

And each of those terminals currently has one or more pipelines being developed to supply it. In South Texas and related to these capacity increases there are:

Enbridge’s Rio Bravo Pipeline involves the construction of two 138-mile pipelines with 48- and 42-inch diameters and a combined capacity of 4.5 Bcf/d. They will run from the Agua Dulce supply area to the Rio Grande LNG terminal in Brownsville, Texas. If all goes well, construction is expected to begin next year. The latest in-service date we have on the terminal is 2026.

Separately, WhiteWater Midstream is building the ADCC – a 43-mile, 42-inch pipeline with a capacity of 1.7 Bcf/d. The project will deliver natural gas to the Corpus Christi Stage III project. The ADCC originates at the end of the Whistler Pipeline, near the Agua Dulce hub, in the Eagle Ford region.

Additionally, Cheniere Corpus Christi Pipeline is constructing the Corpus Christi Stage III, which will involve 22 miles of 48-inch pipeline, with a capacity of 1.5 Bcf/d. The pipeline is co-located with an existing 2.8 Bcf/d pipeline and will deliver from interconnections to the Corpus Christi Stage III project.

On the Louisiana side, we have The Gator Express Pipeline project, which entails two 42-inch pipelines – each with about 2 Bcf/d of capacity. It is designed to deliver natural gas from interconnections to the Plaquemines [Plaq-uh-min] LNG export terminal, 20 miles south of New Orleans. Phase 1 of the project will include 15-mile and 12-mile pipelines.

Additionally, Tennessee Gas Pipeline Company expects to deliver natural gas through its Evangeline Pass Expansion Project. When completed it will feature 13 miles of 36-inch pipeline, with a capacity of 1.1 Bcf/d. It will also ship to the Plaquemines terminal.

One potential snag along the way is the Biden administration’s decision to pause pending and future approvals to export LNG from new projects.

P&GJ’s take is that this is a purely political move and regardless of who wins the presidency, approvals will go forward not long after Election Day. Still, uncertainty and potential delays are costly, and this could be especially bad for Venture Global’s CP2, which is a pending LNG project in Louisiana. Climate activists have loudly targeted the CP2.

A sidenote to this is that the administration’s move will not stop exports from the seven LNG terminals currently shipping from the U.S., nor the 16 projects that have already been authorized or are under construction – these include 12 new terminals and four major expansions at existing plants.

Wave of Acquisitions

Complementing the Gulf Coast efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger, while embedding them more deeply in both production and demand markets.

Some of those deals involve expansions of gathering-and-processing footprints to support the existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, which requires that operators move ahead of the demand.

Granted much of the new capacity is a couple of years from becoming reality, but the demand is there, and it will need to be supported by new natural gas pipeline projects.

While the timelines for LNG expansion can be fickle, with underutilization of new pipelines being common, the impact of such gaps will vary.

Energy Transfer, for example, went into service well ahead of schedule with its 134-mile, 42-inch Gulf Run pipeline, designed to move gas from north Louisiana to the coast.

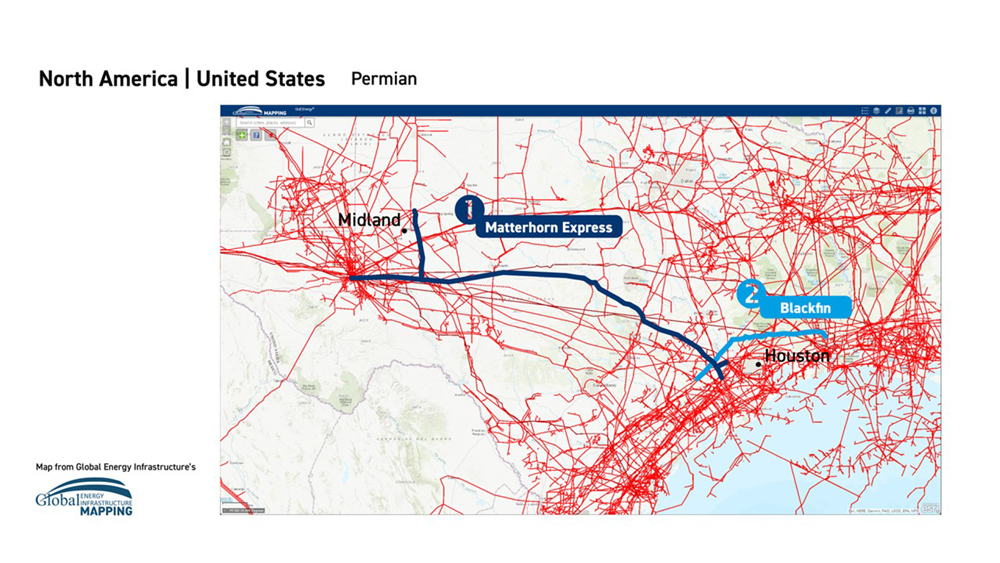

While most of the Permian Basin natural gas pipelines built in recent years have targeted LNG export markets south of the Houston area, two proposed intrastate projects have emerged within the last couple of years that will deliver Permian Basin gas to the Texas-Louisiana border region.

The larger of the two, Targa’s 562-mile Apex Pipeline, was approved by the Railroad Commission of Texas about a year ago. It would originate in West Texas and run along the Louisiana border, near Sabine Pass.

The other, WhiteWater Midstream’s proposed 190-mile Blackfin Pipeline, which filed for state regulatory approval a year ago, takes a different approach.

Although Blackfin would originate at the eastern edge of the Eagle Ford shale, it would primarily serve as an extension of the 580-mile Matterhorn Express Pipeline, which was sanctioned in May 2022.

The Matterhorn Express, itself, is scheduled to be in-service in the third-quarter of this year and will provide up to 2.5 Bcf/d of Permian takeaway capacity to the Katy area west of Houston.

Also, in a recent development, DeLa Express, an affiliate of Moss Lake Partners, has asked FERC to begin the pre-filing review process for its proposed DeLa Express Project.

If completed the 42-inch, 690-mile pipeline would transport Delaware Basin natural gas to markets in and around Lake Charles, Louisiana. The plan includes five laterals, eight compressor stations and several meter stations.

The DeLa pipeline, according to the plans, would provide 2 Bcf/d of capacity from the Permian Basin to Port Arthur, Texas and Cameron Parish, Louisiana. Moss Lake hopes to have the project certified by April 2026 and in-service in the second quarter of 2028.

While I’m talking about Permian, I wanted to cite a fairly recent example of a capacity increase brought about by using compression technology. In December, Kinder Morgan added 550 million cubic feet a day to the Permian Highway natural gas pipeline.

The enhanced capacity now stands at 2.65 Bcf/d for the pipeline, which extends from the Waha Hub in West Texas to Katy, near Houston.

Several natural gas pipeline projects are in-development to connect Haynesville gas producers to Gulf Coast LNG exporters.

One major project is DT Midstream’s three stage Louisiana Energy Access Pipeline (LEAP) expansion. The existing LEAP Gathering Lateral is a 155-mile, 1 Bcf/d line, stretching from the Haynesville to the Gulf Coast region. DT Midstream plans to increase LEAP capacity through compression and construction expansions.

The first stage of the expansion – adding 300 MMcf/d of capacity – went into service earlier than expected. Stage 2, which has achieved mechanical completion, will add 400 MMcf/d and is expected online this quarter.

Also, Momentum Midstream is developing the New Generation Gas Gathering project. Dubbed NG3, it extends from the Haynesville to coastal Louisiana LNG markets, with 275 miles of additional natural gas gathering pipelines, representing 2.2 Bcf/d of capacity. It is expected online by the end of the year.

Interestingly, the system will be complemented by a Carbon Capture and Sequestration (CCS) solution to offer producers a net negative in CO2 emissions. NG3 is expecting a start-up date this year.

Additionally, Williams’ Louisiana Energy Gateway (LEG) project was expected to start up this year but has been delayed until the second half of 2025 due to a legal dispute with Energy Transfer. It is designed to move 1.8 Bcf/d of Haynesville natural gas to several Gulf Coast markets.

Permitting, Bottlenecks

In the Marcellus, where bottlenecks and permitting problems have been the rule in recent years, there was a midstream victory of note in mid-2023. This occurred when the 303-mile Mountain Valley Pipeline was initially cleared for all construction and operation activities.

True, this – literally – took an act of Congress, but a win is still a win.

MVP also achieved significant milestones recently, securing two FERC approvals. The first allows for increased transportation rates on natural gas moving through the pipeline. The second grants additional time for the construction of a North Carolina extension, known as the Southgate Project.

In a reshuffling in the region, EQT is selling 40% interest in its non-operated natural gas assets in northeast Pennsylvania to Equinor USA in exchange for Equinor's onshore asset in the Appalachian basin and $500 million in cash.

Non-operating positions give holders a cut from the hydrocarbons sold without taking charge of drilling or other operations, although they must contribute their share of costs. This is part of EQT’s plan to exit the position to cut debt.

In March, EQT acquired Equitrans Midstream in an all-stock deal valued at $4 billion. The key to that acquisition being the addition of over 2,000 miles of pipelines, which will enhance EQT's capacity to produce and transport natural gas.

Elsewhere, in the Williston Basin, in recent years, gas-to-oil ratios have flipped while drilling activity in the Bakken shale is nearly four times higher than it was three years ago.

Nonetheless, oil production in the Bakken is expected to grow following Chevron’s acquisition of Hess. However, we do not expect to see a return to the record levels of 2020.

A big update for the region is that Williams Pipeline has applied for an expansion project that would increase capacity to the Opal Hub in Wyoming, to meet growing regional and West Coast demand.

The MountainWest Overthrust pipeline project is an expansion of the existing pipeline system. The project could add about 325,000 Dth/d and is expected to be in service in late 2025.

Also, there was an interesting development in the DJ Basin region, as Tallgrass Energy’s Trailblazer Pipeline Company announced considerable progress in its transportation plans.

The company received a FERC permit granting it permission to convert its 400-mile Trailblazer natural gas pipeline to CO2.

Plans now are for the pipeline to ship CO2 from a corn-processing plant in Nebraska – through Colorado – to Tallgrass’ permanent underground storage hub in Wyoming. The project is expected to begin CO2-service this year and have a transportation capacity of over 10 mtpa.

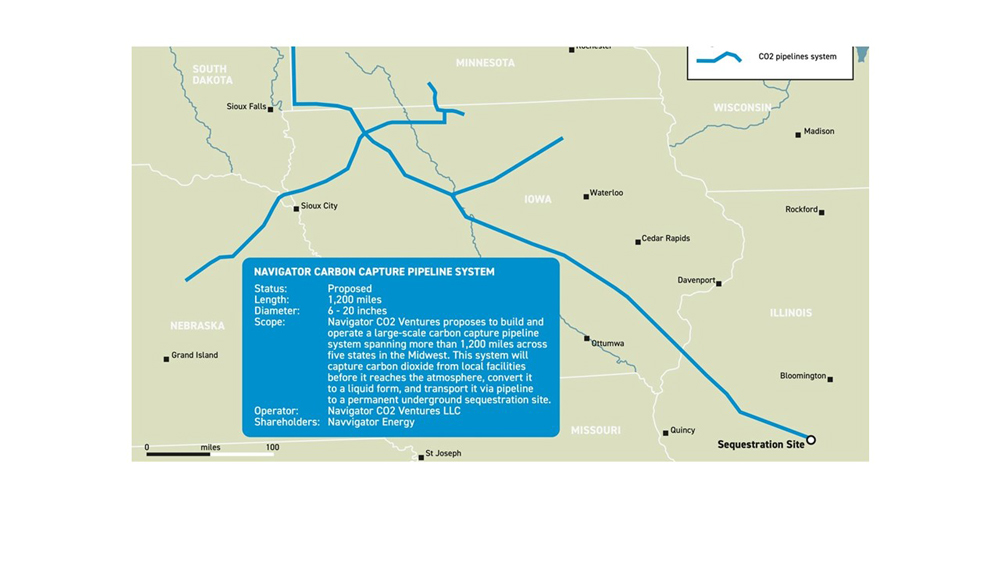

However, in the Midwest, plans to build major greenfield CO2 pipelines have not fared as well as this conversion effort. Navigator CO2 Ventures threw in the towel on its 1,200-mile project, which would have crossed five states and was projected to capture 15 mtpa of carbon dioxide from ethanol plants.

Separately, Iowa-based Summit Carbon Solutions says it is still planning to build about 2,000 miles of CO2 pipeline across five states, with Wolf Carbon Solutions U.S. developing a 350-mile network in coordination with Archer-Daniels-Midland.

However, this project has faced setbacks, including permitting denials and opposition from landowners. Not to be dissuaded, the company – which has already pursued eminent domain orders – said it expects its pipeline to be in operation in 2026, which would be two years later than its initial timeline.

Midwest Struggle

Navigator CO2 Ventures threw in the towel on its 1,300-mile project, which would have crossed five states and was projected to capture 15 mtpa of carbon dioxide from ethanol plants.

Separately, Iowa-based Summit Carbon Solutions says it is still planning to build about 2,000 miles of CO2 pipeline across five states, with Wolf Carbon Solutions U.S. developing a 350-mile network in coordination with Archer-Daniels-Midland.

However, this project has faced setbacks, including permitting denials and opposition from landowners. Not to be dissuaded, the company – which has already pursued eminent domain orders – said it expects its pipeline to be in operation in 2026, which would be two years later than its initial timeline.

Mexico

Much farther to the south, Mexico is developing 31 mtpa of LNG export capacity on its west coast. And – in an unusual move for an LNG exporter – these projects are planning to import most of their feed gas.

Most of the planned terminals will make use of spare capacity on existing pipelines, including the Sonora pipeline, the Topolobampo and the Samalayuca Sasabe, with gas originating at the Waha gas hub being transported either through the El Paso Pipeline System – or the Comanche Trail and Roadrunner Gas Transmission Pipelines.

The biggest potential new project in the region is the 155-mile Saguaro Connector Pipeline, which awaits the full sanctioning of a proposed LNG export terminal. The pipeline would deliver natural gas to Mexico Pacific’s, in-development, 14.1 mtpa Saguaro LNG export facility on the Gulf of California coast.

In December 2022, a division of Tulsa-based ONEOK filed an application with FERC to construct the pipeline, which would run from the Permian Basin to Mexico.

Additionally, Gasoducto Centauro del Norte has signed an agreement with Mexico’s Federal Electricity Commission to develop, build and operate a 258-mile gas pipeline in the north of the country.

In Canada, one of the biggest positive developments for energy infrastructure developers in recent years has been that the country’s First Nations are beginning to embrace the economic opportunities that pipeline and export projects can offer.

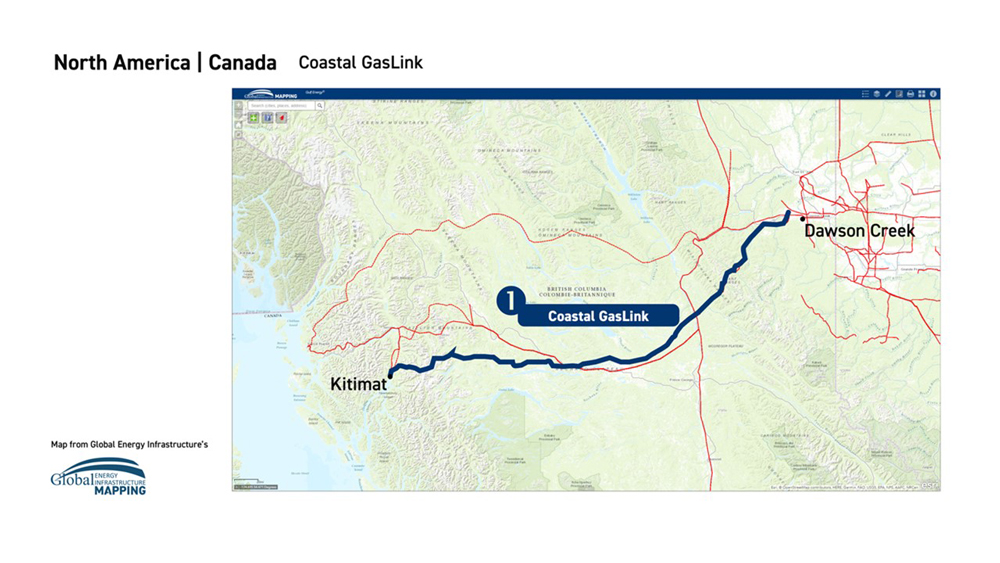

An early indication of this has been that First Nation members reached an agreement to take a 10% ownership stake in TC Energy’s Coastal GasLink pipeline project, which TC Energy said completed construction on Oct. 30.

The Coastal GasLink project involved the construction and operation of a 48-inch, 416-mile pipeline from northeastern British Columbia to the Shell-led LNG Canada Export Terminal, which is scheduled for completion this year, near Kitimat.

In another sign of growing First Nations involvement, Indigenous groups are contenders for an ownership stake in Canada’s other major pipeline project expected to be online shortly – that being the Trans Mountain oil pipeline expansion and related export facilities.

The Canada Energy Regulator, only recently, approved a request for a change in construction for the final stretch of the expansion project, clearing the path for its completion, with commercial operations beginning in May.

This did not happen before things got a little dicey, though. The CER earlier rejected the change, which Trans Mountain said at the time could result in a two-year delay.

The 590,000-bpd expansion will nearly triple the flow of crude on Trans Mountain from Alberta to Canada’s Pacific Coast.

Also in Canada, Keyera Corp. completed the Key Access Pipeline System (KAPS), a 357-mile NGLs and condensate pipeline. It will transport 350,000 bpd of NGL and condensate from the Montney and Duvernay basins to Keyera’s processing hub in Fort Saskatchewan.

The pipeline will consist of a 16-inch pipeline for condensate and a 12-inch pipeline for NGL mix.

Europe’s Buildout

OK, in Europe, as mentioned earlier, pipelines have not been the main midstream story this year, per se. Instead, the continent is continuing its massive LNG build-out as it continues to look for ways to replace Russian pipeline gas.

Between 2022 and 2023, Europe added about 77 mtpa of new LNG regasification capacity, representing a 44% increase over 2021. Nearly 37 mtpa of this capacity has started or will begin operations by the end of the year.

Additionally, Europe is expanding its gas pipeline networks to support gas flows from these new LNG terminals. Germany, for instance, is planning to add 355 miles of pipeline over the next few years to accommodate new LNG imports, almost all of which will be high-capacity pipe, with diameters of 39 inches or greater.

Also, in Germany, where hydrogen has been transported – as is the case with most EU states – almost exclusively as compressed gas in special pressure containers on trucks – a major step has been taken toward having an efficient H2 infrastructure system in place by 2032.

The gas industry’s Association of Transmission System Operators, told PGJ that the German Gas TSOs recently published a draft for the German Hydrogen Core Network, which would include about 6,025 miles (or 9,700 km) of pipelines.

This would entail 60% of these pipelines being newly built, while 40% of pipelines will be repurposed gas pipelines.

South America

South America will continue to be an active region for pipeline development with more than 13,980 miles (22,498 km) of pipeline planned or under construction. The biggest milestone for South American pipelines within the past year was the completion of the first stage of the Nestor Kirchner Pipeline in Argentina.

The pipeline will bring to market Argentina’s Vaca Muerta shale gas. Located in the west of Argentina, the Vaca Muerta reservoir is estimated to hold 300 Tcf of recoverable gas reserves. Argentina is currently a net importer of gas, but development of the reservoir promises to satisfy the country’s domestic demand and leave a large surplus available for export.

The Nestor Kirchner pipeline began development in 2018 and the first phase of the project, a 290-mile section of 36-inch pipe, was opened this last summer. While the pipeline will eventually operate at a capacity of 6.6 Bcf/d until October of this year capacity will be limited to 3.5 Bcf/d.

This first section links Vaca Muerta production to the Buenos Aires province, where most of Argentina’s domestic gas demand is located. The second section of the project will carry gas farther north to the Santa Fe province, where it can supply customers in northern Argentina.

As part of the project, Argentina is also reversing the flow of the Gasoducto Norte (Northern Pipeline), currently set up to receive gas from Bolivia. Bolivian gas production is falling, and Bolivia and Brazil are both potential markets for Argentina’s gas.

Combined with the flow reversal, a 93-mile interconnector between the Northern Pipeline and the Central East Pipeline will ensure additional Vaca Muerta gas has a route north to Argentina’s neighbors.

Construction on the second phase of the pipeline has yet to begin. State-owned Energia Argentina is expected to launch tenders for its construction soon, and it is hoped the second phase will be completed before the end of 2024.

Africa has been a quiet region for actual pipeline construction again this year. Within the continent, major projects continue to languish in the early stages of planning, with relatively few projects entering the construction stage or having begun operations. Planned pipelines in Africa total 15,571 miles, but only 2,829 miles of pipeline are under construction.

However, in Uganda, Tilenga and Kingfisher petroleum projects – as well as a pipeline to carry oil to Tanzania for export – are on track for first production by 2025, according to Uganda National Oil’s chief executive.

The 898-mile (1,445-km) East African Crude Oil Pipeline (EACOP), which will transport crude from Tilenga and Kingfisher, is scheduled to come online in 2025.

EACOP is co-owned by the government of Uganda, France’s TotalEnergies, China’s CNOOC and Tanzania’s Tanzania Petroleum Development Corp (TPDC).

Russia’s Mega-Projects

As you may have guessed, mega-projects make up most of new pipeline activity in Russia, but much of that remains in the planning stages. Of the 18,220 miles of pipeline planned and under construction in Russia, nearly 25% of the total is associated with a few mega-projects.

The most watched pipeline projects in the region are the three Power of Siberia pipelines, which aim to increase Russia’s gas exports to China. Power of Siberia 1, which opened in 2019, continues to ramp up this year.

Flows through the pipeline rose 47% year-over-year and reached 776 Bcf at the end of 2023, according to Global Energy Information, closing in on the pipeline’s maximum capacity of 3.8 Bcf/d.

The Power of Siberia 3 project has also progressed this year. The pipeline would connect far-eastern Russian to the Chinese city of Harbin, allowing gas to flow from fields on and around the island of Sakhalin.

The 56-inch Power of Siberia 2 would provide an alternative export route, connecting the West Siberian Basin to China with a 55-inch, 5 Bcf/d pipeline. The pipeline would cost tens of billions of US dollars and would likely take at least a decade to build.

Additionally, Novatek, the Russian energy giant, has officially announced its project to construct an extensive 808-mile (1,300-km) gas pipeline reaching Murmansk, Russia.

The Asia Pacific remains the region with most new pipeline activity. This is in large part due to the fast-growing infrastructure of the world’s two largest countries, China and India.

Globally, Indian and Chinese pipeline development continues to drive growth, with those countries accounting for about a quarter of the planned and under-construction projects.

In particular, India is seeing an enormous pipeline infrastructure build-out as its economy takes off. GDP growth for the country is forecast to be between 6% and 7% over the next 12 months, and the nation is hopeful that gas will have a 15% share in the total energy mix by 2030, up from about 6% in 2022.

More than 13,300 miles of pipelines are currently planned or under construction in the region, with major gasification efforts taking place in India’s northeast and northwest. Pipelines are also increasingly reaching out from the coasts to central India.

India’s New Markets

However, some projects in India continue to be plagued by delays. GAIL’s Mumbai-Jharsuguda Pipeline is a case in point. The project planners had hoped to avoid delays by choosing a route adjacent to a government highway, thereby removing the need to obtain permission to build from private landowners. Despite that, commissioning has been pushed back from May of 2023 to October 2024.

In February, GAIL claimed the 451-mile Mumbai-to-Nagpur section was about 80% complete, with GAIL citing technical issues for the delay. The 874-mile, 32-inch pipeline would deliver 580 MMcf/d of gas to new markets in central India.

Hundreds of millions of people stand to benefit from access to new energy sources. India has about 10% of global under construction pipeline mileage.

Comments