March 2024, Vol. 251, No. 3

Features

Takeaway on Upswing in Permian, Haynesville

(P&GJ) — According to Pipeline & Gas Journal’s recent construction report a total figure of 19,832 miles of pipeline either planned or under construction in North America.

Among that total, according to new EIA data more than 20 Bcf/d of natural gas pipeline capacity is under construction, partly completed, or approved to deliver natural gas to five U.S. LNG export terminals that are currently under construction.

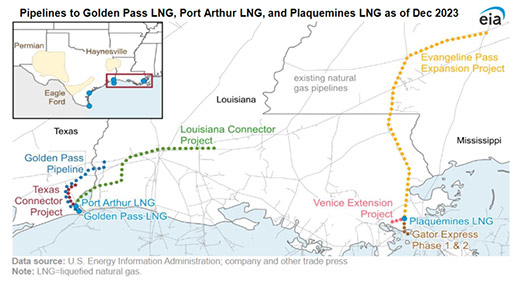

Each of those – the Plaquemines in Louisiana and Golden Pass, Port Arthur, Corpus Christi Stage III, and Rio Grande in Texas – currently has one or more pipelines currently being developed:

In South Texas, related to the capacity increases, there are:

Rio Bravo Pipeline: Rio Bravo Pipeline Company is constructing two 138-mile pipelines with a combined capacity of 4.5 Bcf/d to deliver natural gas from the Agua Dulce supply area to the Rio Grande LNG terminal in Brownsville, Texas.

ADCC Pipeline: WhiteWater Midstream is constructing this 39-mile pipeline with capacity of 1.7 Bcf/d. It is scheduled to deliver natural gas to the Corpus Christi Stage III project and originates at the end of the Whistler Pipeline near the Agua Dulce hub in Nueces County, Texas, in the Eagle Ford region.

Corpus Christi Stage III Pipeline: Cheniere Corpus Christi Pipeline is constructing this 21-mile pipeline with 1.5 Bcf/d capacity. The pipeline is co-located with the existing 2.8 Bcf/d pipeline and will deliver from pipeline interconnections to the Corpus Christi Stage III project.

Also in Texas, to the southeast is the Golden Pass Pipeline, which is expanding its existing 69-mile pipeline that originates northeast of Starks, Louisiana, to enable deliveries of 2.5 Bcf/d of natural gas to the Golden Pass LNG terminal in Jefferson County, Texas.

Golden Pass Pipeline is changing the primary flow of the pipeline to flow south and adding connections to nearby natural gas supply sources.

Additionally, the Louisiana Connector Project and Texas Connector Project: Port Arthur Pipeline Company plans to construct two pipelines, each with a capacity of 2 Bcf/d, to deliver natural gas to the Port Arthur LNG export terminal in Jefferson County, Texas.

The 72-mile Louisiana Connector Project will deliver through pipeline interconnections in Louisiana and Texas, and the 34-mile Texas Connector Project will extend from interconnections in Texas to the export terminal.

Louisiana

On the Louisiana side, there is East Texas Transmission Venice Extension Project, which will extend 3 miles and boost capacity 1.3 Bcf/d. This one replaces an older segment and deliveries will deliver gas to the Plaquemines LNG export terminal.

Also, the Gator Express Pipeline project, which entails two pipelines, each with about 2 Bcf/d capacity, to deliver natural gas from pipeline interconnections to the Plaquemines LNG export terminal located about 20 miles south of New Orleans, Louisiana. Phase 1 of the project includes a 15-mile and 12-mile pipeline.

Additionally, Tennessee Gas Pipeline Company expects to deliver natural gas through its Evangeline Pass Expansion Project. When completed it will feature 13-mile pipeline with capacity of 1.1 Bcf/d and ship to the Plaquemines LNG export terminal from a Southern Natural Gas Company interconnection in Mississippi, as well as to the interconnection with the Gator Express Pipeline in Louisiana.

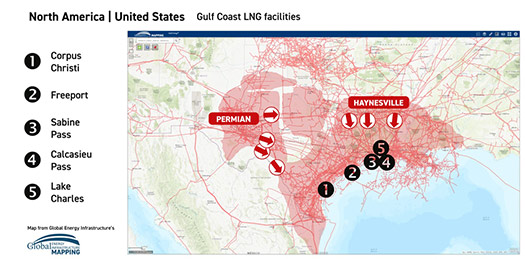

In the United States, more than 8 Bcf/d of pipeline capacity is either planned or under construction from the Permian and Haynesville basins as pipeline operators jockey for position around LNG growth markets on the Texas and Louisiana Gulf coasts.

Complementing these efforts, an ongoing wave of acquisitions is making some of the biggest midstream players even bigger, while embedding them more deeply in both production and demand markets.

Some of those acquisitions are expansions of gathering and processing footprints to support the existing long-haul business. Others are aimed at positioning companies to capitalize on LNG demand growth, which requires that operators move ahead of the demand.

While much of the new capacity is a couple of years from becoming reality, the demand is there, and it will need to be supported by new natural gas pipeline projects.

These projects range from new and expanded gathering systems, long-haul pipe construction, compression expansions and so-called “last mile” pipe connecting large transmission systems to specific areas and facilities.

Comments